Amazon 2Q'25, Portfolio Change

A programming note: For my next Deep Dive, I am currently working on Union Pacific which I will publish sometime later this month. After Union Pacific, I will do a Deep Dive on ASML in September. You can find all the past 61 Deep Dives here.

Amazon 2Q’25 Update

Amazon stock is down ~7% post-earnings. What happened?

In 1Q’25 call, Amazon guided revenue and EBIT for Q2 to be $159-164 Bn and 13-17.5 Bn respectively. They actually reported $167.7 Bn revenue and $19.2 Bn EBIT.

Perhaps consensus estimates was higher than guide? Going into the call, consensus estimates for revenue and EBIT were $162.1 Bn and $16.8 Bn respectively.

Maybe Q3 guide was poor?

3Q’25 revenue and EBIT consensus estimates before the call were $173.2 Bn and $19.5 Billion respectively. Amazon guided revenue and EBIT for Q3 to be $174-179.5 Bn and $15.5-20.5 Bn respectively. Amazon usually beats the high end of the guide.

So, why is the stock down so much today? I can invent reasons if you like, but the closer to the truth explanation is: nobody quite ever knows!

Here are my highlights from yesterday’s call.

Revenue

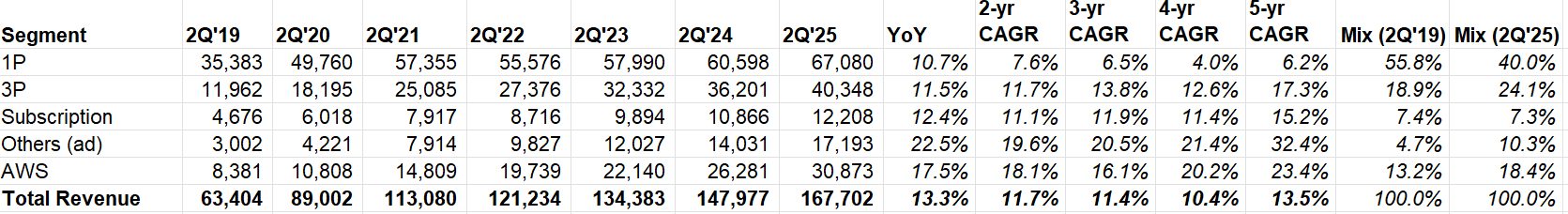

Overall revenue grew by ~13% (~12% FXN).

I’m quite encouraged to see that both 1P and 3P revenue accelerated to double digit growth in 2Q’25 compared to MSD growth in 1Q’25. In fact, every single revenue segment grew at double digit rate; AWS at high-teen and Ads grew at 22%.

I’ll discuss more about AWS later, but let’s talk more about Amazon ex-AWS first.

Amazon ex-AWS

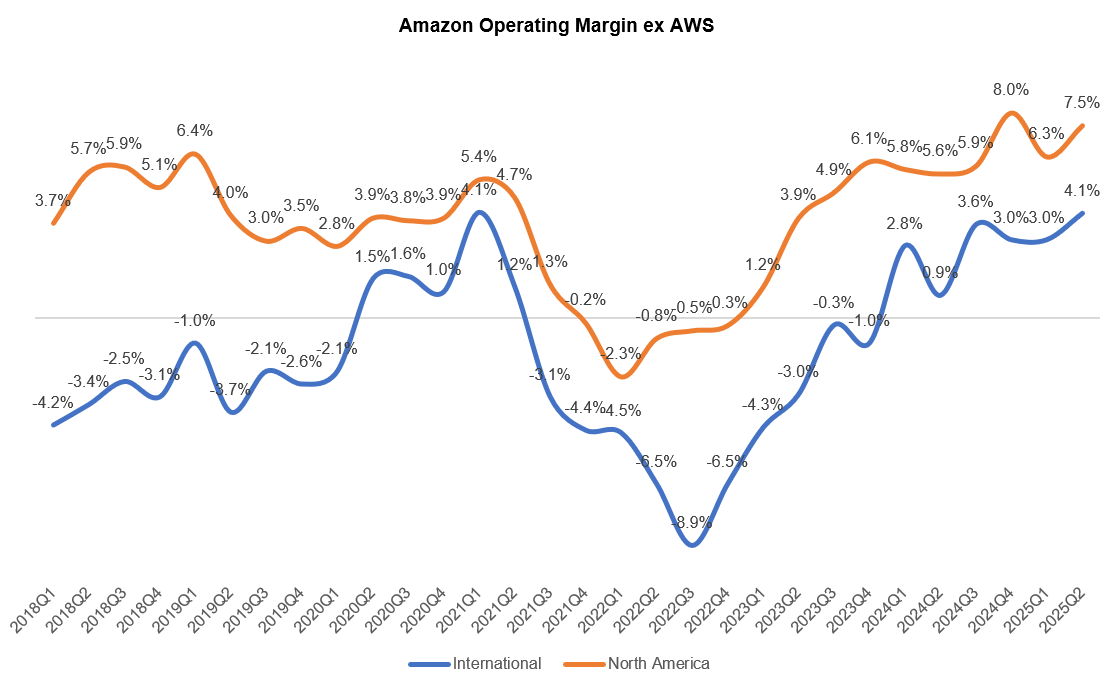

North America and International segment’s margin expansion theme remains very much in tact. In 2Q’25, operating margin in North America was +7.5% (vs +5.6% in 2Q’24) and in international was +4.1% (vs +0.9%). It’s quite remarkable to see how consistently they have been able to expand the margins and all indications are there that there is more room to go (to be discussed shortly)!

Tariff remains a black box and a source of ongoing uncertainty for the retail business. From Andy Jassy in the call:

“It's hard to know where the tariffs are going to settle, particularly in China. It's hard to know what will happen when we deplete some of the prebuys that we did on our own first-party retail and then some of the forward deploying that we saw of our third-party selling partners. And if costs go up over time, we're unsure at this point who's going to end up absorbing those higher costs. What we can tell you is what we've seen so far in the first half of the year, in the first half, we just haven't seen diminished demand. And we haven't seen any kind of broad scale ASP increases. And so that could change in the second half.”

Fulfillment+ Shipping

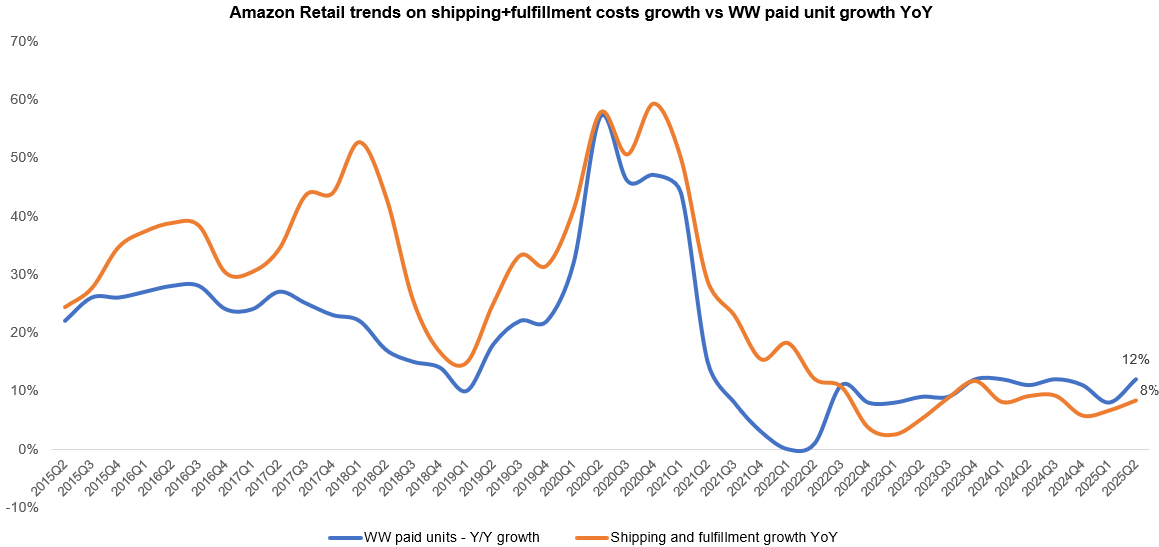

If you look at worldwide paid unit growth vs shipping+ fulfillment cost growth, you would notice that the latter used to consistently outpace the former pretty much all the time since 2015 until 3Q'22. Since then, unit growth has largely been faster than shipping+ fulfillment costs, indicating operating leverage in their logistics footprint.

Every time I read about what Amazon has been doing in their fulfillment and logistics, it makes me more comfortable about their moats in retail. Some key quotes from the call:

“In Q2, we increased the share of orders moving through direct lanes where packages go straight from fulfillment to delivery without extra stops by over 40% year-over-year. We've also reduced the average distance packages traveled by 12% and lowered handling touches per unit by nearly 15%. We've made progress on order consolidation with more products positioned locally, we're able to pack more items into each box and send fewer packages per order. That has helped drive higher units per box and improved overall cost to serve. Taken together, these improvements are making the network faster and structurally more efficient.

In the U.S., we delivered 30% more items same day or next day than during the same period of last year.

we're working to further improve delivery speeds no matter where customers live, we've recently announced plans to expand our same-day and next-day delivery to tens of millions of U.S. customers and more than 4,000 smaller cities, towns and rural communities by the end of the year. Today, it's already available in more than 1,000 of these communities across the U.S. The early response from customers in these areas have been very positive. They're shopping more frequently and purchasing household essentials and meaningfully higher rates. Automation and robotics are also important contributors to improving cost efficiencies and driving better customer experiences over time. We deployed our 1 millionth robot across our global fulfillment network and unveiled innovations in our last-mile innovation center, such as automated package sorting and a transformative technology that brings packages directly to employees in an ergonomic height. We rolled out DeepFleet, our AI improves robot travel efficiency by 10%.”

I continue to think Amazon retail is underestimated; while Amazon is never going to be a monopoly in retail, it’s hard to imagine why they won’t be a headwind to most physical retailers over the next few decades as the convenience of ordering something which magically appear on your doorstep in a couple of hours is a timeless value proposition.

Advertising

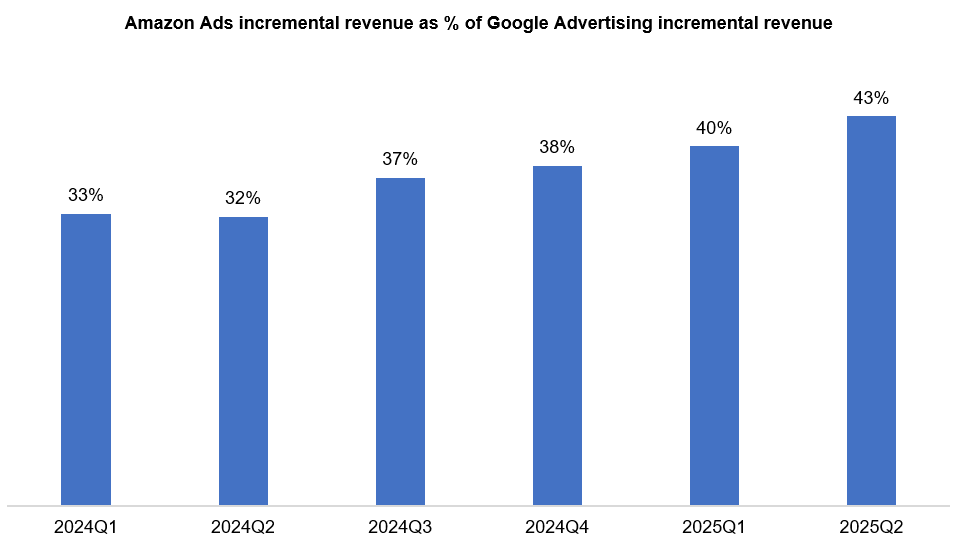

A big driver for retail profitability is advertising. For the second consecutive quarters, Amazon ads grew the fastest among the top three digital advertising players. Given Amazon ads are perhaps more of a competitor to Google than Meta, I think it’s interesting to track how Amazon is gaining share here.

While Amazon ads is still just ~20% the size of Google Advertising revenue, Amazon ads incremental revenue as a percentage of Google advertising incremental revenue increased from 33% in 1Q’24 to 43% in 2Q’25.

I will discuss AWS and the rest of this update behind the paywall.