Amazon 1Q'25 Update

Disclosure: I own shares of Amazon

Amazon has another pretty decent quarter.

Here are my highlights from today’s call.

Revenue

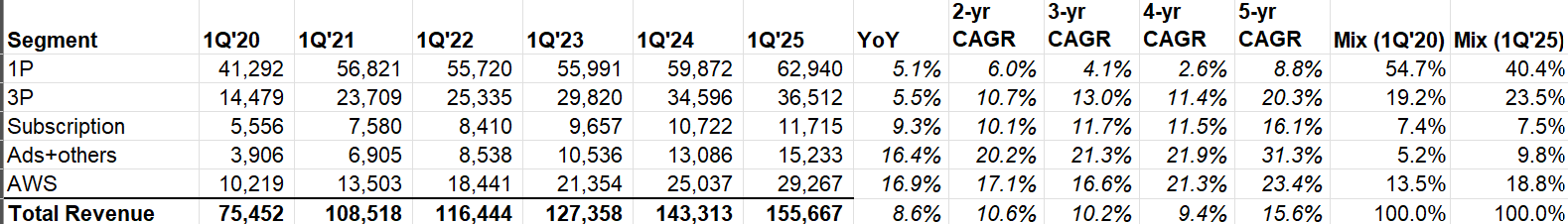

Overall revenue grew by 10% (FX neutral).

While Amazon’s 3P business usually grows faster than 1P, both 1P and 3P retail business grew at similar rate in 1Q’25. Ads revenue continued its momentum at 19% growth YoY which was higher than both Google and Meta.

After growing at ~19% YoY for the last three consecutive quarters, AWS growth decelerated this quarter to 17%.

I’ll discuss more about AWS later, but let’s talk more about Amazon ex-AWS first.

Amazon ex-AWS

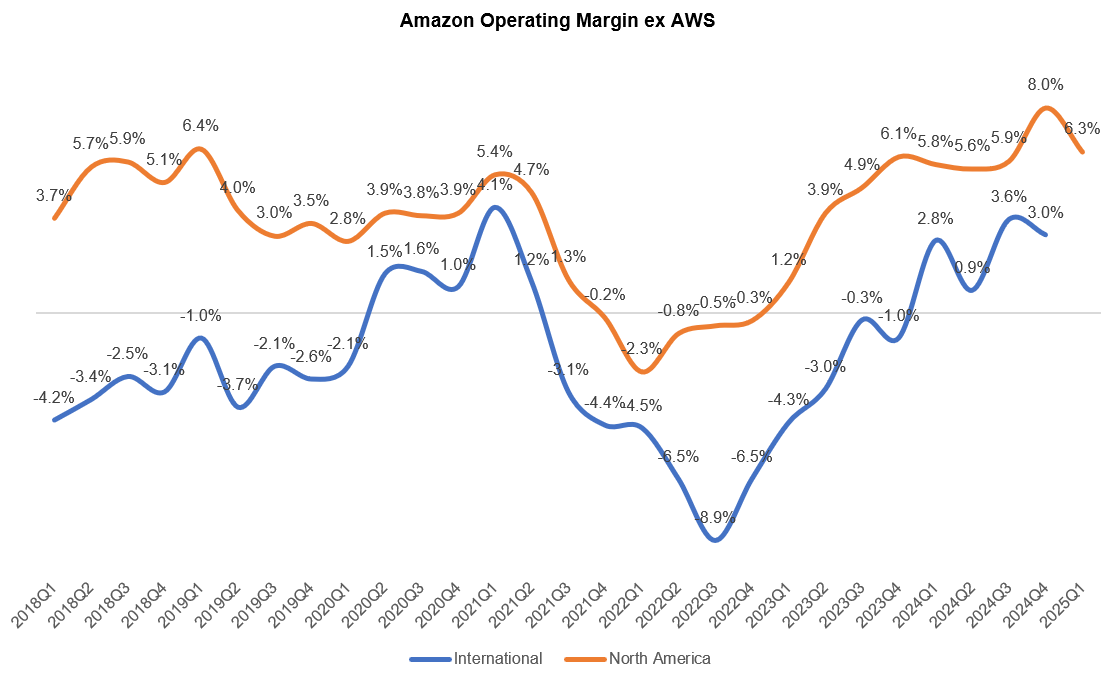

Amazon recorded “one time charges related to some historical customer returns has not yet been resolved and some costs to receive inventory that was pulled forward into Q1 ahead of anticipated tariffs”

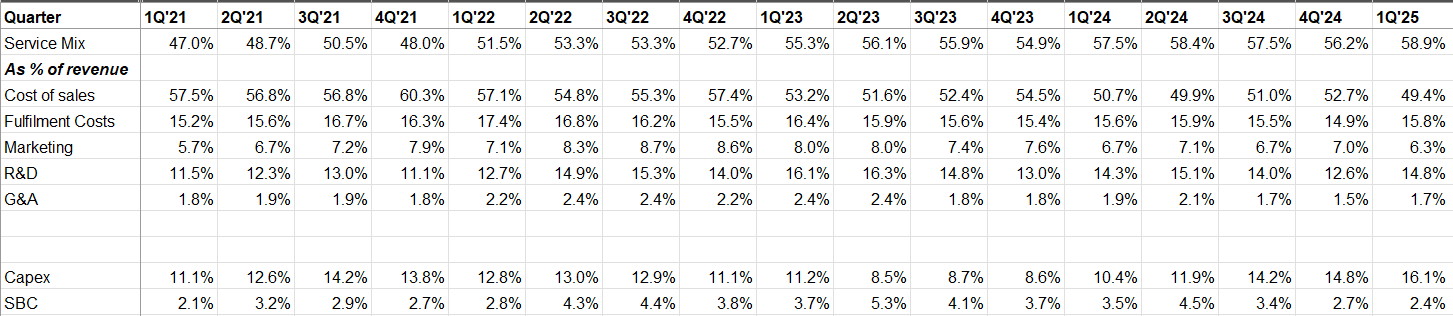

Excluding this impact, North America and international segment’s margin would be 7.2% and 3.7% respectively. Given that 1Q’24 operating margins for North America and international segment were 5.8% and 2.8% respectively, the margin expansion continues to be an ongoing theme.

Of course, tariffs were a big talking point in the call. I thought it was interesting that Amazon was somewhat forceful in reminding investors that the value proposition that Amazon retail provides to customers and how they may be much more resilient than they’re given credit for (perhaps compared to other retailers such as Walmart or Costco):

…We haven't seen any attenuation of demand yet, To some extent, we've seen some heightened buying in certain categories that may indicate stocking up in advance of any potential tariff impact. We also have not seen the average selling price of retail items appreciably go up yet. Some of this reflects some forward buying we did in our first party selling, and some of that reflects some advanced inbounding our third party sellers have done But a fair amount of this is that most sellers just haven't changed pricing yet. Again, this could change depending on where tariffs settle. Amazon is not uniquely susceptible to tariffs.

As it relates to China, retailers who aren't buying directly from China are typically buying from companies who themselves are buying from China. Marking these items up, rebranding, and selling to US consumers. These retailers are buying the product at a higher price than Chinese sellers selling directly to US consumers in our marketplace. So the total tariff will be higher for these retailers than for China direct sellers. It's also sometimes easy to forget what Amazon sells. We're not mostly selling high average selling price items, though we certainly sell a bunch. In the first quarter, our everyday essentials grew more than twice as fast as the rest of our business, and represented one out of every three units sold in the US on Amazon. Even if you exclude Whole Foods Market and Amazon Fresh, Amazon is one of the largest grocers in the US with over 100 billion dollars in gross sales last year. People are buying a lot of their everyday essentials at Amazon. We also have extremely large selection.

…Finally, when there are uncertain environments, customers tend to choose the provider they trust most. Given our really broad selection, low pricing, and speedy delivery, we have emerged from these uncertain areas with more relative market segment share than we started and better set up for the future. I'm optimistic this could happen again.

Fulfillment+ Shipping

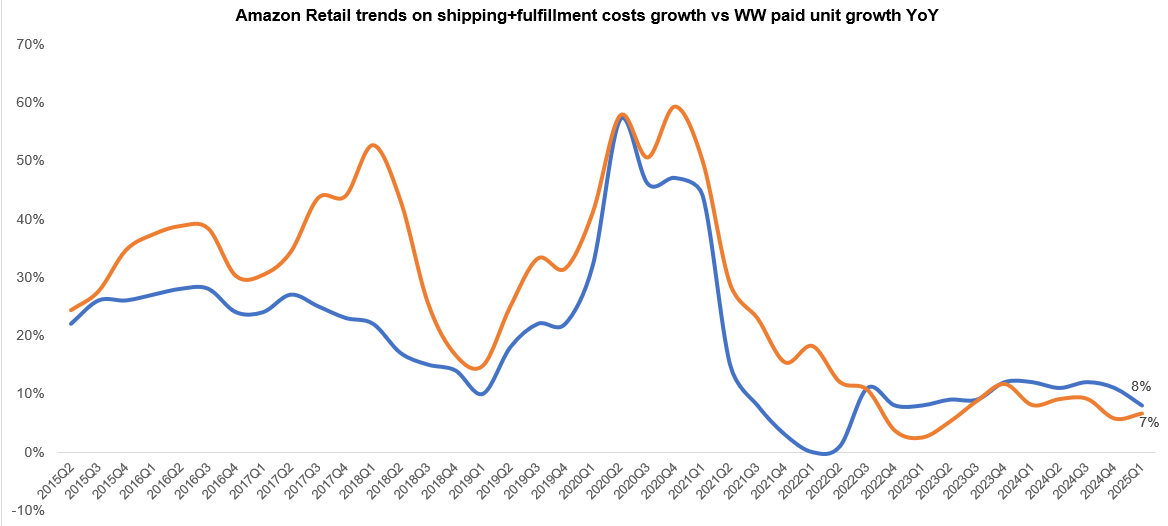

If you look at worldwide paid unit growth vs shipping+ fulfillment cost growth, you would notice that the latter used to consistently outpace the former pretty much all the time since 2015 until 3Q'22. Since then, unit growth has largely been faster than shipping+ fulfillment costs, indicating operating leverage in their logistics footprint.

Advertising

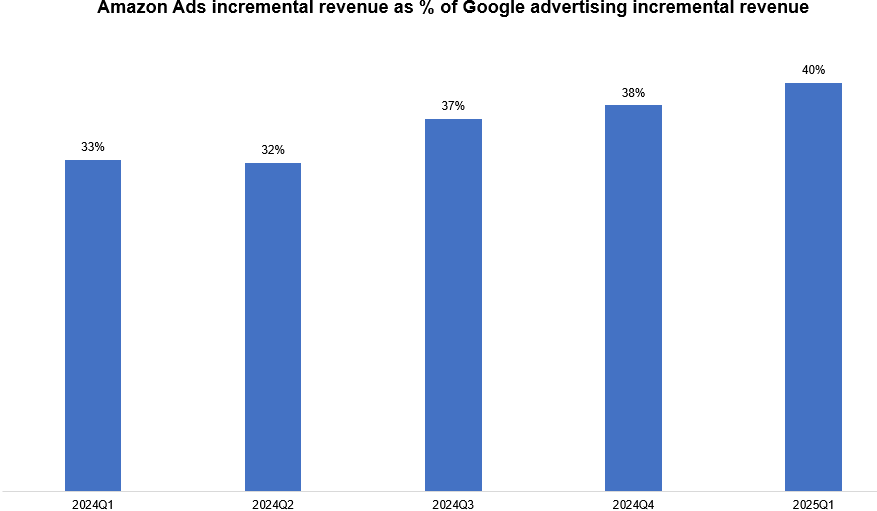

As mentioned before, Amazon ads grew the fastest among the top three digital advertising players. Given Amazon ads are perhaps more of a competitor to Google than Meta, I think it’s interesting to track how Amazon is gaining share here.

Amazon ads incremental revenue as a percentage of Google advertising incremental revenue increased from 33% in 1Q’24 to 40% in 1Q’25.

AWS

Okay, now let’s talk about AWS.

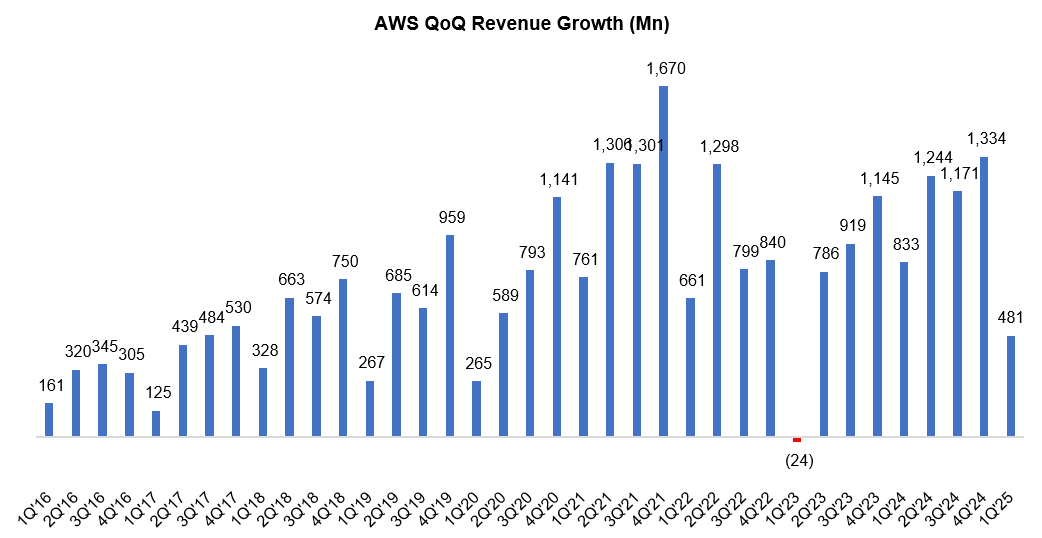

AWS added $481 Mn incremental revenue QoQ which was slightly disappointing to me. Current backlog stands at $189 Bn, which is +20% YoY. Weighted average remaining life of this backlog is 4.1 years.

Azure vs Google Cloud vs AWS

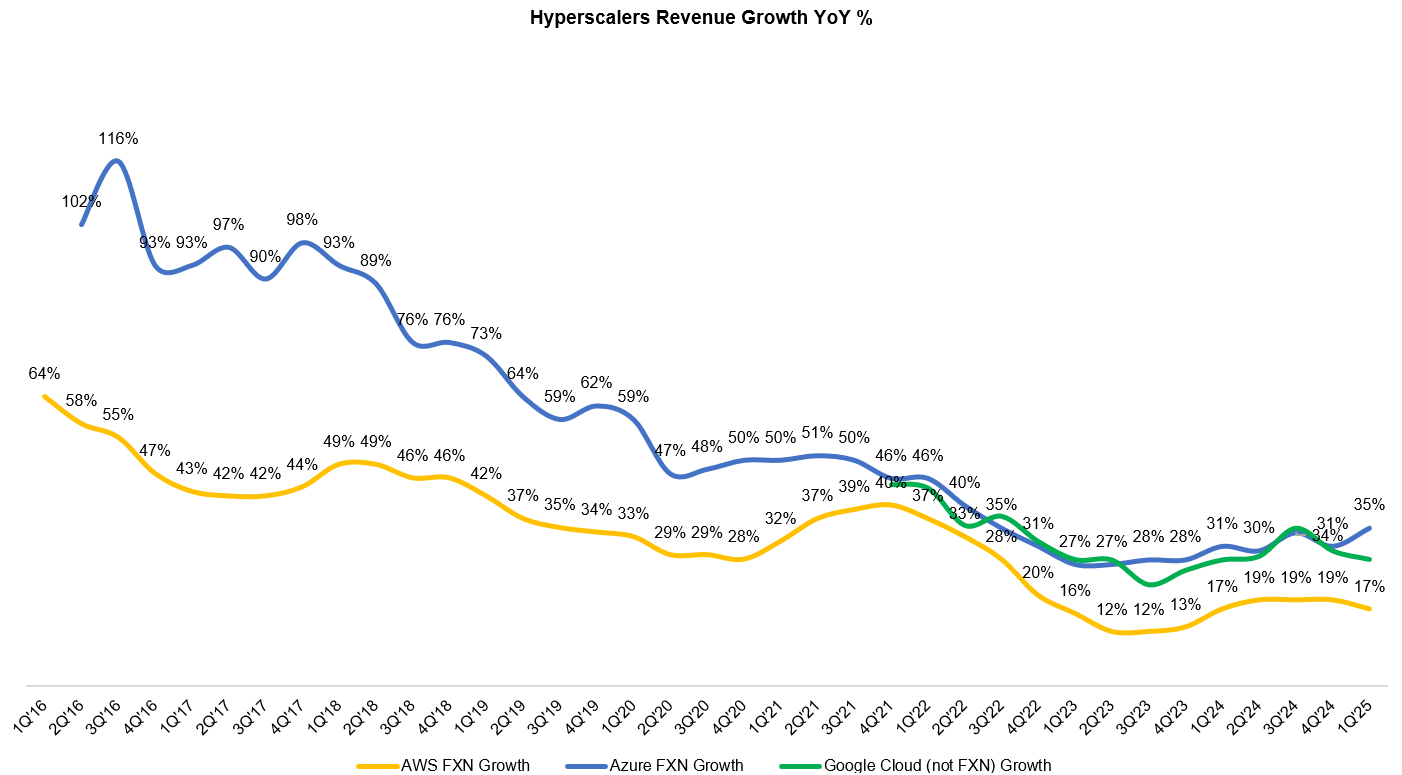

Let’s take a quick look at hyperscalers growth. Azure, Google Cloud, and AWS revenue grew by 35%, 28%, and 17% respectively. OpenAI clearly is adding bit of a torque to Azure’s growth here.

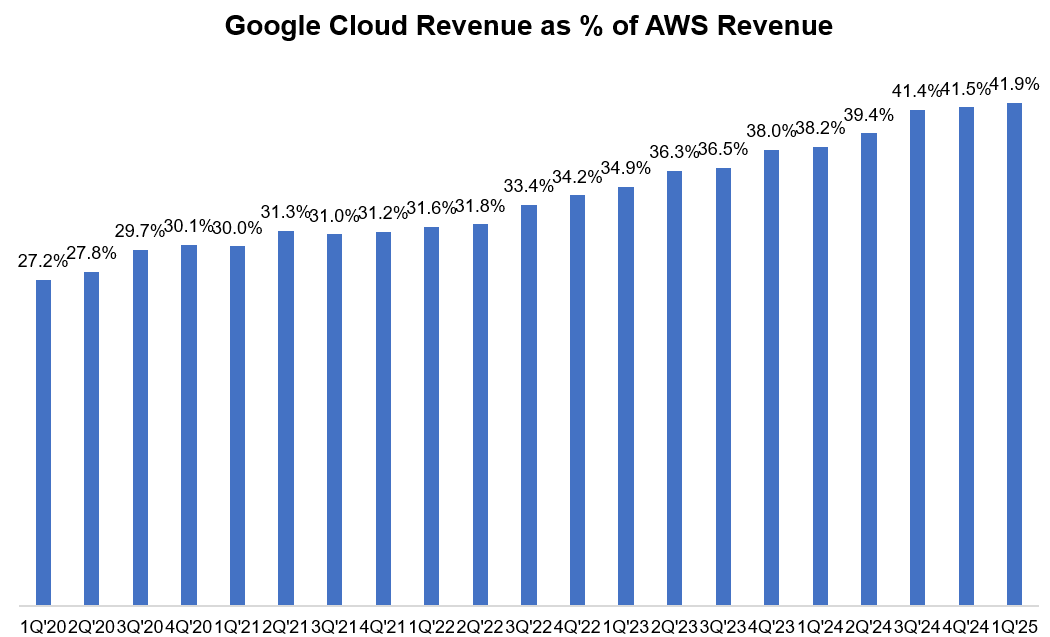

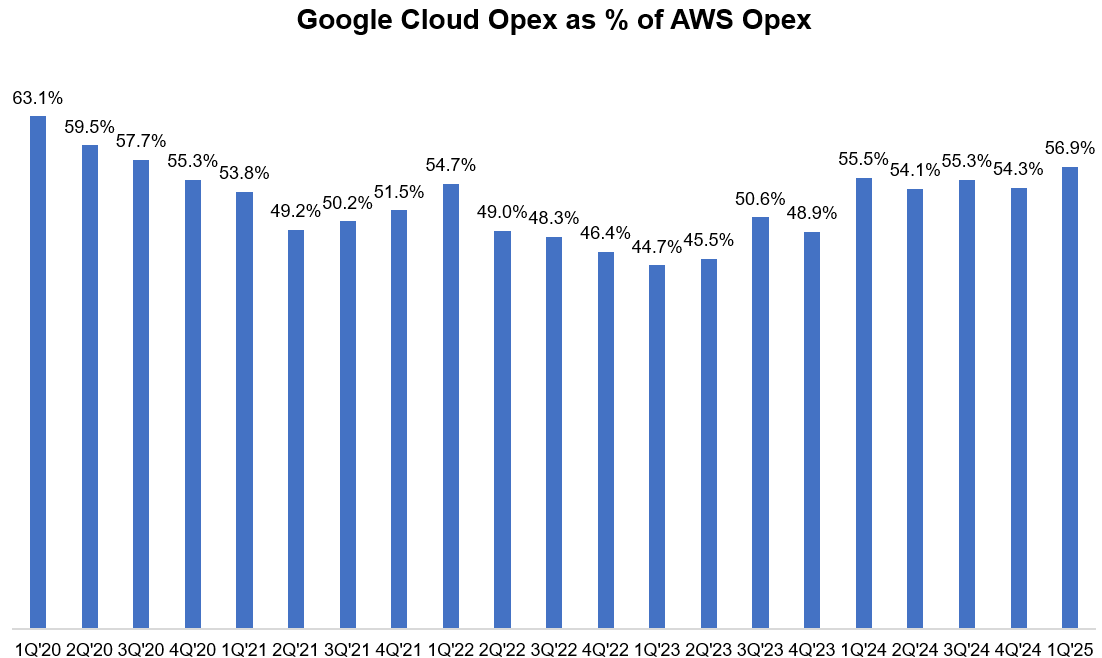

One thing I would like to track is Google Cloud’s operating performance trajectory against AWS. Back in 2020, Google Cloud was only about a quarter of the size of AWS, but now it’s two-fifth of AWS revenue. We don’t know exactly how much of this is GCP, but we can be pretty confident that GCP is leading this catch-up with AWS.

Google Cloud hasn’t made much progress this quarter relative to AWS. While revenue as a percentage of AWS increased by 36 bps QoQ, opex as a percentage of AWS actually increased by 258 bps which isn’t quite indicative of efficiency from Google’s perspective. However, Google tends to look worse in this comparison in Q1 and gradually improves over the course of the year. I will be curious to track if that continues to be the case in 2025.

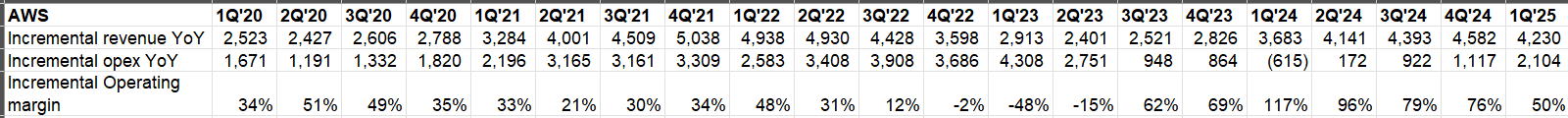

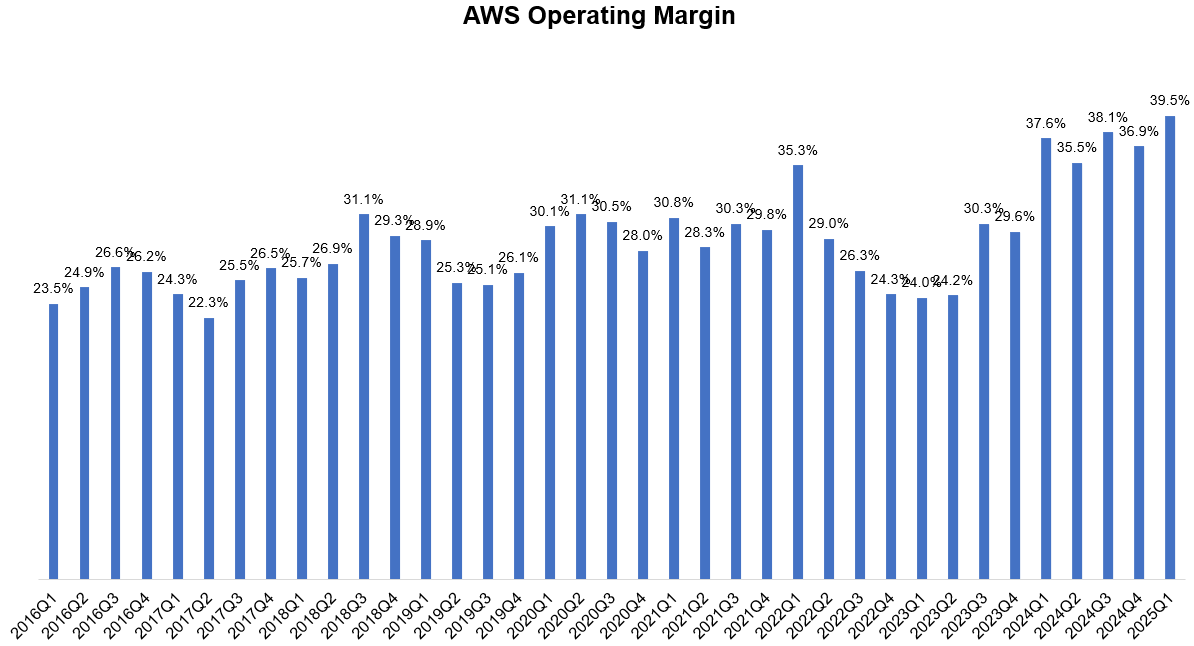

While AWS topline growth was slightly disappointing, they did post their highest ever operating margin of ~40% this quarter. I am mostly used to seeing AWS operating margins hovering around ~25-30%, but for the last five consecutive quarters, AWS is posting 35%+ operating margin. What’s interesting about such margins this quarter is AWS actually decreased useful life of servers last quarter which was a headwind this quarter. Moreover, when you consider their “multi-billion” AI revenue run-rate growing at triple digit which is presumably lower margin segment today, it is mighty impressive that they are posting ~40% operating margins!

Couple of quotes on AWS from the call:

Our AI business has a multibillion dollar annual revenue run rate, continues to grow triple digit YoY, and is still in its very early days. While there is good reason for the high optimism about AI, I conclude my AWS comments with a reminder that there is still so much on premises infrastructure yet to be moved to the cloud. Infrastructure modernization is much less sexy to talk about than AI but fundamental to any company's technology and invention capabilities, developer productivity, speed, and cost structure. And for companies to realize the full potential of AI, they're going to need their infrastructure and data in the cloud.

…as fast as we actually put the capacity in, it's being consumed. So, you know, I think we could be helping more customers and driving more revenue for the business if we had more capacity…I expect that, you know, there are other parts of the supply chain that that are a little bit jammed up as well, you know, motherboards and some other componentry, some of that is just because there is so much demand right now. But I do believe that the supply chain issues and the capacity issues will continue get better as the year proceeds.

Opex+Capex

Just like other big tech, Amazon’s capital intensity continues to increase as well. Capex as a percentage of revenue was ~16% in 1Q’25 (vs ~10% in 1Q’24).

Outlook

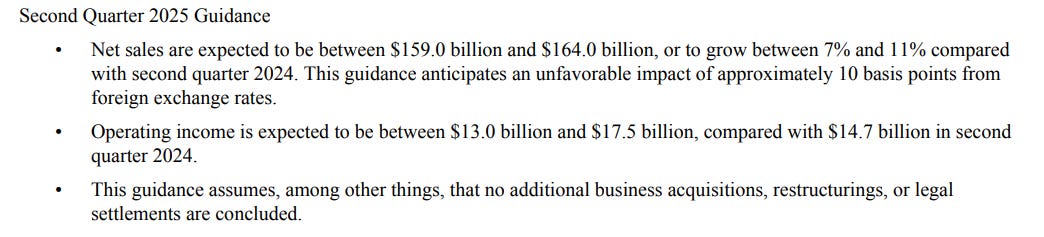

Amazon’s guidance for 2Q’25 is below. Please note consensus 2Q’25 revenue and EBIT before the call were $161 Bn and $17.7 Billion respectively.

Closing Words

I agree with Jassy’s characterization that even in a deteriorating tariff scenario, my best guess would be Amazon retail would fare okay and may even gain share. Of course, they can still be hurt if consumer spending goes down in a recession scenario, but I feel comfortable about Amazon retail’s competitive position which is more important to me as a long-term shareholder than guessing how tariff will affect this year’s EPS. On AWS side, while the margins are quite eye popping, I expected to see them grow faster, especially in light of the increasing capex spending. These things can be lumpy and as Jassy mentioned in the call, it isn’t a question about demand.

I intend to stay invested, and if I decide to deploy some capital over the next month, Amazon would be on top of my list.

Disclaimer: All posts on “MBI Deep Dives” are for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.