Amazon's "unfair" advantage in advertising

Amazon started disclosing their advertising revenue from 4Q’21. Before 4Q’21, their ad revenue was “hidden” in “other” segment. Everyone, of course, knew ads was ~80-90% of “other” revenue. Amazon’s other segment grew from quarterly revenue of $1.1 Billion in 3Q’17 to a whopping $8.1 Billion in 3Q’21 after which they disclosed ad revenues separately.

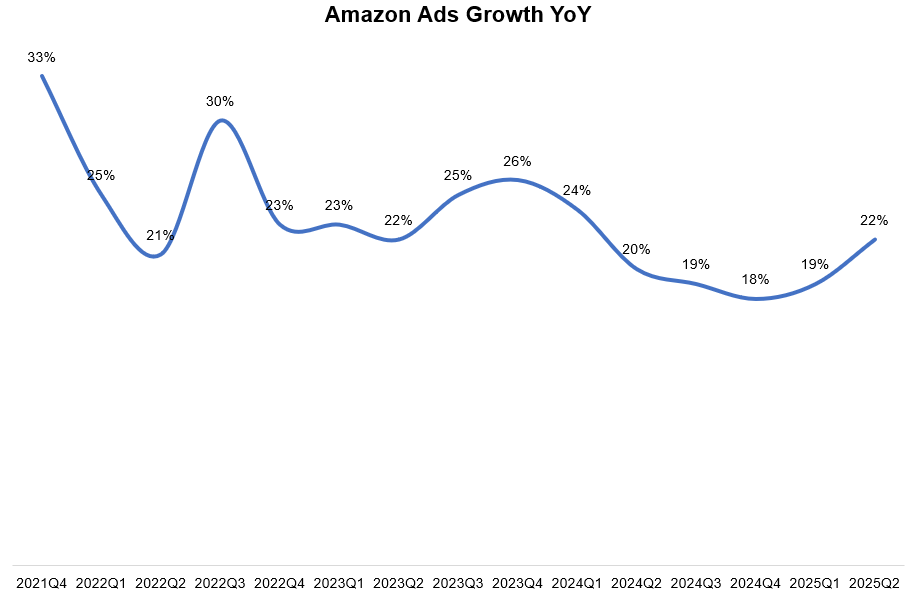

While modeling Amazon’s ad revenue, I consistently underestimated its potential in the past. For example, in early 2024, I modeled Amazon’s ad revenue to be ~$62 Billion in 2025. Given their LTM ad revenue is already ~$61 Billion, it is highly likely that they will end up generating ad revenue ~10% higher than what I was modeling for 2025 early last year.

It took me a while to appreciate Amazon’s “unfair” advantage in advertising (something that may cause some headaches for Trade Desk) which I will discuss behind the paywall.

In addition to "Daily Dose" (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 62 Deep Dives here.