Amazon marketplace trends

A programming note: We are heading towards a pretty packed earnings week. As a reminder, I will cover only one company’s earnings every day. My tentative earnings coverage schedule for the next few days is: CoStar (Wednesday), Meta (Thursday), Amazon (Friday), Alphabet (Saturday) , Microsoft (Sunday), and Insurance Brokers (Monday). All of the earnings coverage will be behind the paywall.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 64 Deep Dives here.

“Marketplace Pulse” publishes a very data driven report on Amazon marketplace trends every year. They recently released their report for this year which you can download here.

They estimate Amazon marketplace currently has $575 Billion third-party (3P) GMV. While Amazon operates its marketplace in 23 countries, ~83% of its GMV comes from just five countries: US, UK, Germany, France, and Italy.

One of the interesting points the report made is that the US market is truly a goldmine for its “micro niche viability that simply doesn’t exist elsewhere”. While I imagine a significant percentage of men in Saudi Arabia have beards, the term “beard oil” was searched only 50 times per month in Saudi Arabia whereas it received 25k monthly searches in the US. Similarly, “sourdough starter jar” received 20k searches whereas it received only 200 in Australia. US consumerism is truly off the charts, especially relative to any other country!

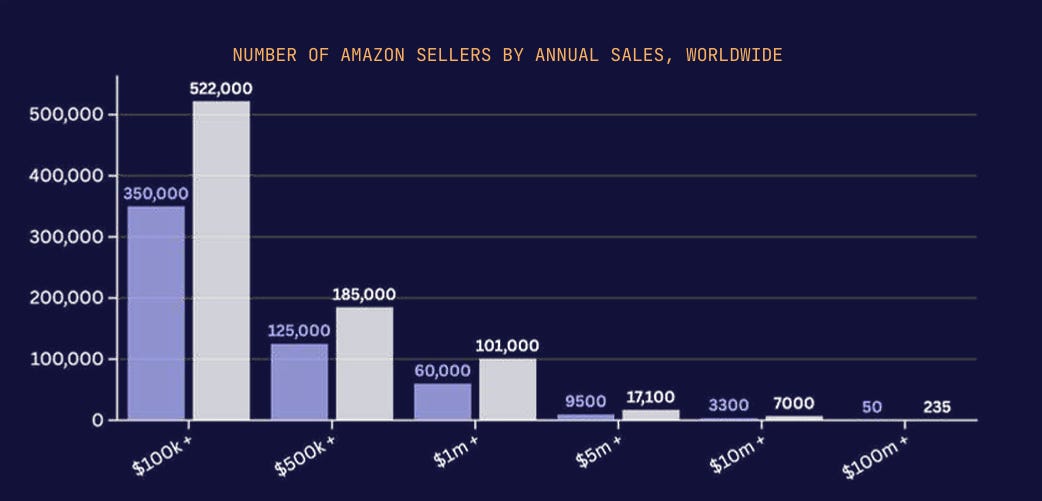

As you can expect, sellers exhibit a power laws in the marketplace. From the report:

“Amazon’s competitive paradox intensified in 2025: the number of million-dollar sellers has nearly doubled in four years, from 60,000 to over 100,000, while the total number of active sellers has declined by 25%

Even more dramatically, sellers exceeding $100 million in yearly sales surged from approximately 50 to over 230 across global marketplaces…The marketplace’s power law has intensified – in the U.S., just 2% of sellers generate over 50% of total revenue”

The dominance of Chinese sellers only seems to be increasing in Amazon’s US marketplace. Again, from the report:

“The U.S. marketplace offers the clearest path to substantial revenue, with 43% of sellers generating $100,000 or more annually, compared to a 19% global average. Among the 146 sellers achieving $100 million or more in the U.S. marketplace, 117 are based in the U.S., while 22 are Chinese companies. However, at the million-dollar threshold, Chinese sellers represent 57% of approximately 51,000 Amazon.com sellers.

Chinese sellers crossed the 50% threshold among Amazon’s top U.S. sellers in 2024, and then the global active seller base in 2025. With 47-68% of new seller registrations across international markets, Chinese merchants are systematically capturing market share through manufacturing advantages, government support, and operational sophistication that other sellers struggle to match.

US sellers account for approximately $157 billion of Amazon.com’s $305 billion in third-party GMV, compared to $132 billion for Chinese sellers. The average US seller generates $884,958 in revenue, more than double that of their Chinese counterparts at $393,557

Tariffs paradoxically worsen competitive positioning. When U.S. sellers source from Chinese manufacturers, they pay tariffs on marked-up wholesale prices. Chinese manufacturers selling directly face tariffs on manufacturing costs – a significantly lower baseline, maintaining pricing flexibility even with duties. However, revenue performance remains strong and can continue to be so with strategic moat building beyond price alone

The pattern extends beyond the U.S. - European marketplaces show Chinese seller penetration above local representation, while Canada demonstrates near-complete capture with only 4% local seller representation”

Looking at these data, it is hard not to agree with the report’s conclusion that the Amazon marketplace has “evolved from “Made in China, Sold by America” to “Made, Sold, and Marketed by China.”

Amazon marketplace, in a sense, perhaps perfectly encapsulates the two distinctive axis of power of the US and China. The exceptional consumerism exhibited by the US consumers leads the US to enjoy enormous influence and power whereas China’s manufacturing capacity and ability to serve that very demand is increasingly difficult to match. The symbiotic dance of the US and China may need to sustain for the greater good of both the countries until and unless either of them has any good alternative!

Current Portfolio:

Please note that these are NOT my recommendation to buy/sell these securities, but just disclosure from my end so that you can assess potential biases that I may have because of my own personal portfolio holdings. Always consider my write-up my personal investing journal and never forget my objectives, risk tolerance, and constraints may have no resemblance to yours.

My current portfolio is disclosed below: