Airbnb's Evolution

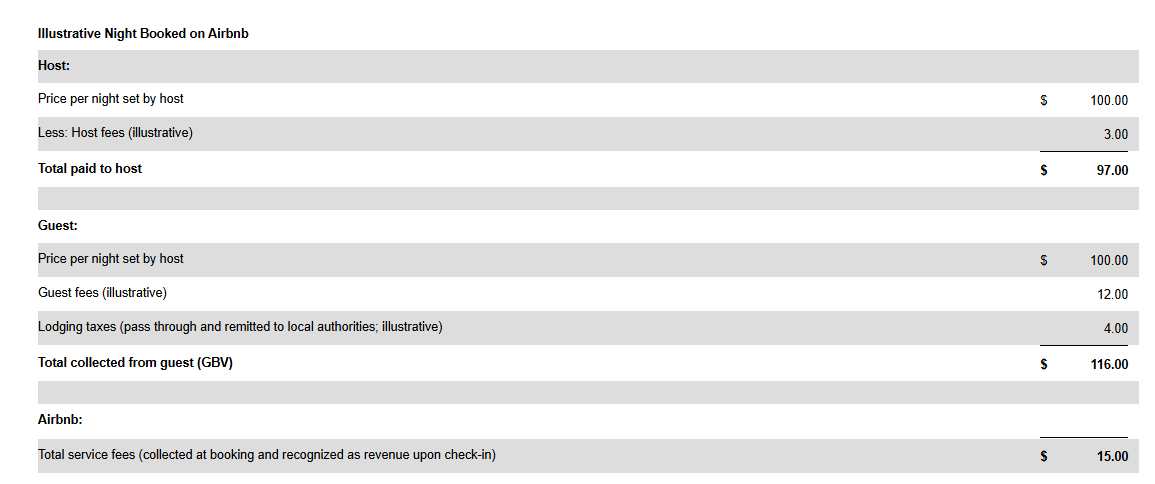

How does Airbnb make money? Let’s go through an illustrative example first assuming an individual host lists their home at $100 per night.

If a host lists their home at $100/night, Airbnb charges the host ~$3 to cover the payment processing costs; hence, the host receives $97 for a night's booking. Essentially, Airbnb doesn't make money from the individual hosts; it's the guests who, on that illustrative $100 booking, will pay ~$12 to Airbnb, $4 in lodging taxes, and therefore, $116 to book for a night.

To recap, guests pay $116, hosts receive $97, local authorities/govt. receive $4, and $15 goes to Airbnb (implied take rate ~13% of the gross booking paid by the Guest).

As we all know, marketplaces are bit of a chicken and egg problem. In the initial years, both supply and demand are critically important. But at scale, it is aggregating demand that increasingly becomes the dominant force over time. The incremental supply to the marketplace may be less valuable (still valuable, but incrementally less so) in year 15 than it was in year 3, and once the overall marketplace infrastructure is in place, it is usually the supplier that pay for the privilege to be able to sell their products/services on the marketplace. That is exactly the case if you look at OTAs such as Booking or Expedia.

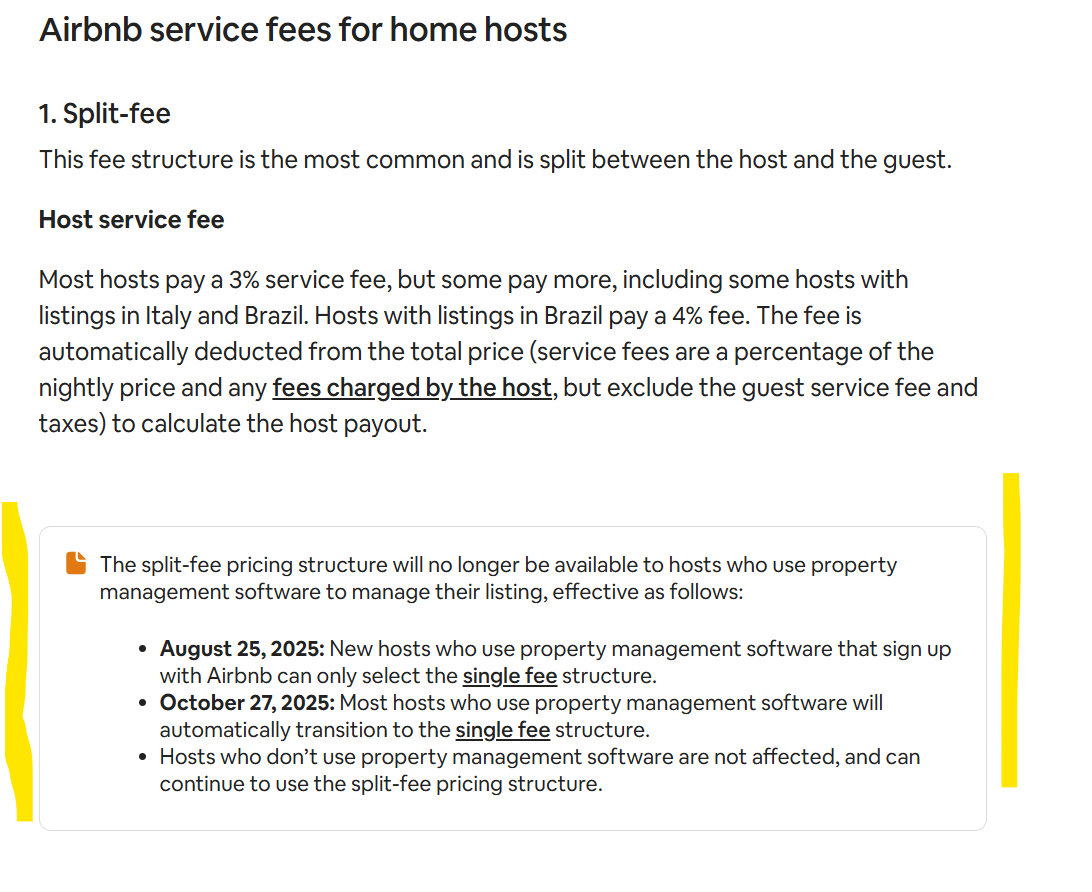

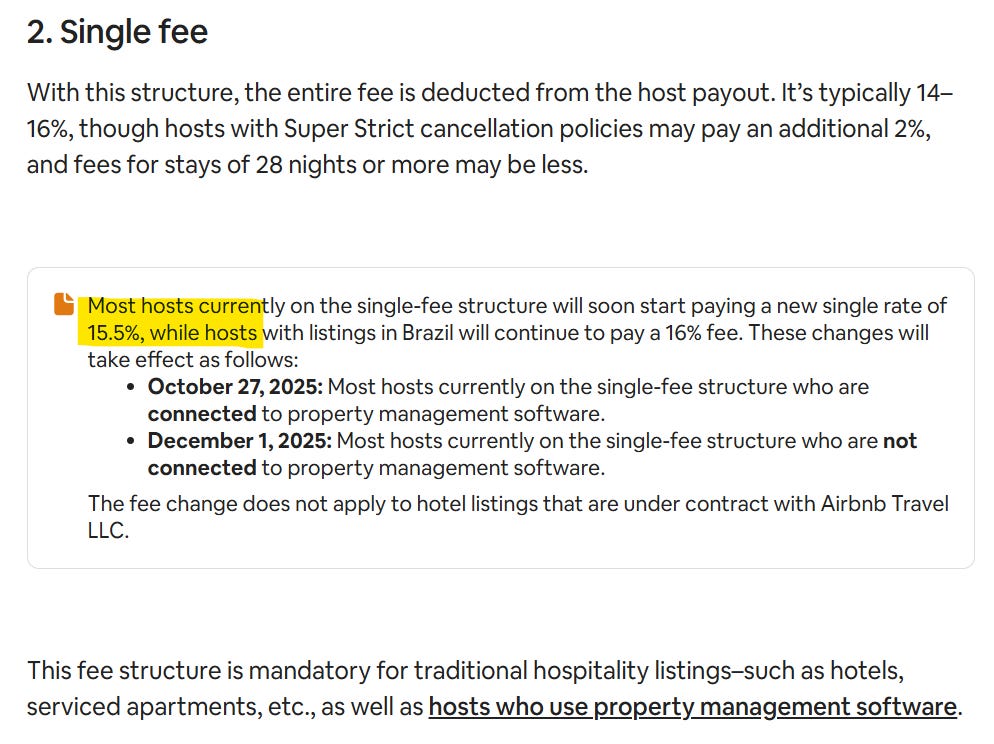

So why does Airbnb have such a strange commission structure after all these years? I used to think that it is indicative of Airbnb’s assessment that unique supply is still of paramount importance for them and that’s why individual hosts don’t pay much to Airbnb. I’m not sure why but I was also under the impression that if you are connected to Airbnb via Property Management System (PMS), the hosts pay ~15% of the booking to Airbnb. That has indeed been the case in Europe and other non-US markets since 2020-21, but apparently that hasn’t been implemented in the US until this year.

Booking.com and Expedia have long used a host‑only commission model. Airbnb’s shift makes cross‑listing price parity simpler for property managers and removes the “Airbnb looks ~12-15% higher” problem that came from layering a guest fee on top.

Brian Chesky in a recent interview with Skift provided more context how Airbnb came up with the original pricing model and why they are shifting now:

“Let’s just back up. How do we—why do we—have this kind of weird commission structure? Because when I was like 26 years old and I didn’t know anything—I went to art school—Joe, Nate, and I realized, like, we need to have a business model. We handled money; no vacation app handled money. And we said, ‘Let’s have a 5% commission,’ and it was a guest fee. Then eventually we realized, ‘Oh, credit‑card processors are taking 3% from us,’ and that’s how we came up with 3% on the host fee. And eventually the 5% on the guest fee we, over time, increased to about 12%, and we ended up with this legacy of 12 + 3, or 12 1/2 + 3.

It was purely organic. I would never have designed it that way. But once you have this inertia, it’s like a major switch. Once we were designing service experiences, we’re like, ‘Let’s just do it right from the first time.’ A lot of guests complain about: there’s taxes, there’s cleaning fees, there’s service fees—there’s a lot of drip pricing—and, ‘Let’s just have one price.’ Like, you go to a coffee shop, there’s a price of coffee and there’s tax. So that’s what we did, and we did it for service experience.

And we said, if we’re going to do it for that, why don’t we make the switch to homes? That was for two reasons. Number one, for ease of use. People were confused; they were frustrated—why is the price changing? But the other thing—and this is related to a competitive issue—a lot of API host cross list, property managers were charging more on Airbnb because they charge $200 a night on Airbnb and then we mark the price up, and they charge $200 on a competitive site, but they didn’t mark the price up. So now our prices are 12% higher.

And so this was—you know, we were trying to educate them—but we started realizing people were just being really confused. And so that’s partly why we went to just one one host fee, and this is how the hotel industry does it. So we think it’s going to be much simpler.”

Given that this simple pricing only applies to PMS-connected hosts, will this give some sort of advantage to individual hosts? Any “advantage” for individual hosts is mostly optical and small. Guests now see total price by default, so what matters is the all-in number, not how Airbnb slices its fee between guest and host. PMS-connected hosts can (and will) reprice to keep their owner payout whole, which erases most of the gap. It will, however, stop the confusion from consumers end who used to think prices may be higher on Airbnb for the same property compared to other OTA websites.

While this pricing shift itself won’t be a material tailwind for Airbnb in the near term, I do think they are setting themselves up for potentially consequential changes in monetization which may prove to be significant tailwind for their topline in the next ~3-5 years. I will discuss this point as well as some portfolio changes behind the paywall.

In addition to "Daily Dose" (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 62 Deep Dives here.