The Case for Giving Employees More Agency in Compensation

Whenever software companies take a beating in the market, their elevated stock based compensation (SBC) becomes a talking point between bulls and bears. As the stocks tumble, some atypical investors start to look at SaaS companies and often get dissuaded pretty fast after taking a look at their excessive executive compensation. Software bulls, on the other hand, are pretty insistent that whenever people start talking about SBC too much, that’s your hint to get long of SaaS companies. Bulls do not live in the fantasy land that assumes SBC is not a real expense, but their point is a bit more nuanced: SBC alone is almost never a reason for a stock’s poor return, rather it’s usually some business or industry related questions that drive the stock. So, just as SaaS stocks took a beating after the ZIRP era ended and IT budget optimizations began in 2022, AI related concerns today are the primary reason for these stocks to fare poorly. Since these stocks aren’t really faltering due to excessive SBC, it is bit of a waste of time to overthink on SBC.

If you’re looking to catch a random 50% pop on a revenue acceleration (especially more than what is implied in buy-side expectations), the arguments put forward by bulls are fine. But if you intend to be long-term shareholders of any of these SaaS companies, excessive SBC can absolutely be a huge drag for long-term compounding on these stocks. Apologies for stating something so obvious, but somehow I find this to be underappreciated among many investors.

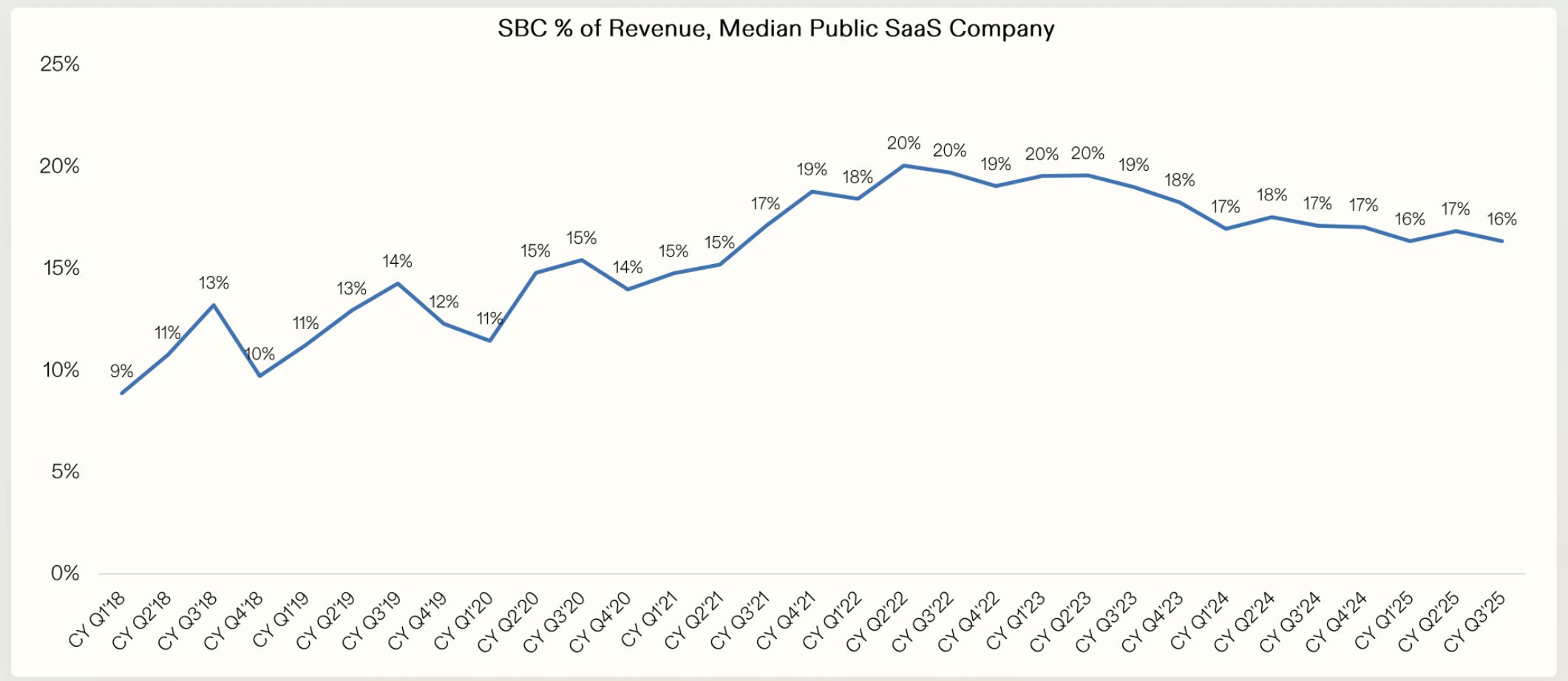

When I was going through Avenir’s excellent presentation “The Future of SaaS-A Fork in the Road”, the following SBC chart stood out. It is indeed strange that the SBC intensity has increased by ~50-60% since 2018 even though if you time travel and asked investors what they expect to see SBC intensity in 2025, they would almost certainly say the opposite. Remember, the SBC number reported in Cash Flow Statement or Income Statement considered the stock price at issuance and since stocks have generally gone up (at least until recently for these companies), the actual compensation has gone up even more.

Nothing is more unpleasant for public market investors when we observe these same companies at times get acquired by Private Equity investors and then quickly rationalize their expense base and at times re-IPO when they find enough gullible bunch to perhaps do the whole shenanigan all over again. While many investors seem to think the presence of PE bid is a good thing to protect your downside, I find it discouraging for long-term investors that PE can snatch assets from public market exactly when the stocks appear to be attractive. Given this dynamic, I have largely avoided SaaS companies led by non-founders. At least founders (especially with voting control) can keep the company public and presumably are deeply invested in making the business a success over the long-term.

I want to make it absolutely clear that I have nothing against SBC as a compensation tool. I also understand the reality of the market; when you are competing for talent against Mag7 which seemed to have more money than “God” (at least until the GPUs showed up), it is hard not to be generous in compensation although PE companies ability to rationalize expenses do make me question to what extent this itself is driving the compensation up. In any case, as investors, our job is to value the companies taking all of these into consideration. If company A is too generous whereas B is more prudent in doling out SBC, we should value B more than A and hopefully with the passage of time, company A will amend its compensation if they want to receive the valuation premium. Without rationalization of these expenses, these stocks may remain largely trading sardines that go nowhere in the long-term.

Perhaps the worst offense some of these companies can commit is the inherent “heads I win, tails you lose” strategy in SBC. If you issue RSU at $10 and the stock becomes $100 in three years, everyone is understandably too happy to ask questions. But god forbid if you issue RSU at $100 but the stock then goes to $10 in three years, sometimes the companies want to make employees “whole” for the “lost” compensation. This is, of course, quite demoralizing for the investors who don’t have such a nice cushion in the downside.

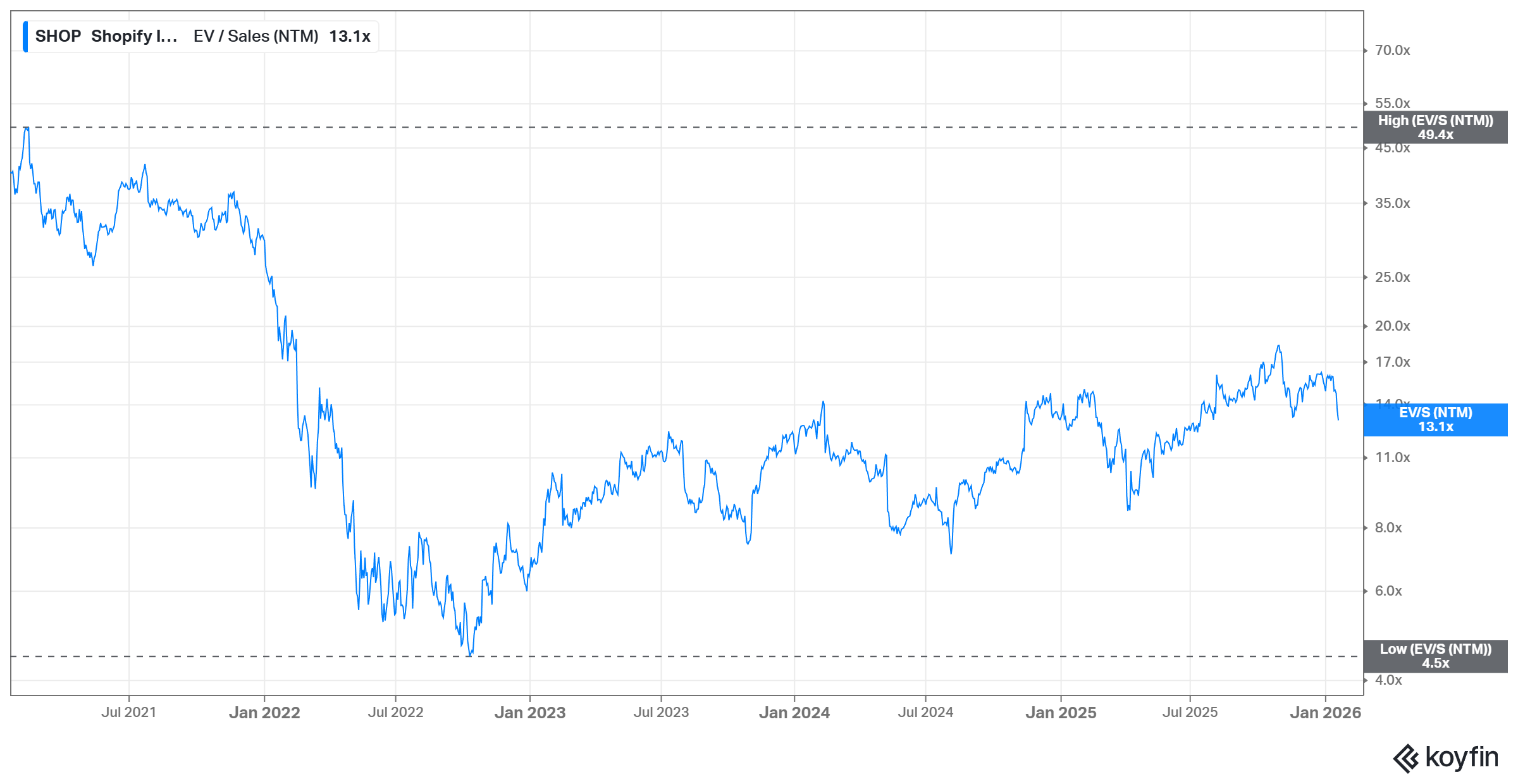

Take Shopify, for example. The stock traded at ~50x NTM revenue in the height of 2021 SaaS bubble, but then came back to earth to 4.5x NTM revenue at the bottom in 2022. It is, of course, not helpful for employees to have so little clue how much money they actually are going to make in the coming year as such volatility seems to happen every few years these days. For the average employee in most of these SaaS companies, they have almost no agency in selecting the stock and cash mix, neither do they have much of an impact on the stock’s direction on a year-to-year basis.

This isn’t some hypothetical concern; Tobi actually specifically mentioned why he decided to change Shopify’s compensation approach after experiencing the drawdown in 2022. In his recent podcast with David Senra, Tobi discussed this at length:

“one of the effects was—and this is right—people got stock options at the level up there the peak. They rightfully ask, “Well, how about it?” Even if they say, “Okay, I’m super game to get us back there,” I realized the psychological problem with everyone being so underwater. They have to spend years basically getting to the zero point where the stock options are worth even a penny again.

Of course, they felt that the company gave them those things at the time. They felt, “I received them. I was passive in this interaction. Therefore the company has some responsibility to make me whole here.”

I don’t necessarily see it this way because the risk was there. Other people voting is what causes the price; I didn’t set it. However, I do concede the point that they had no agency in the process.

So, we rebuilt our compensation system to work completely the opposite of everyone else’s. We give people their total value. You go into an internal system, look at the number, and you get sliders.

You can choose: How much do you want in stock? How much do you want in RSUs? How much do you want in cash?

You can change that every quarter. You decide how you want your money. You can even use a tool to lock in the value of the stock you receive for three years.

Sometimes “orthodoxy” can come back on the table if you get there from good principles. You can actually join Shopify and get exactly the same stock option deal that you get at other places by using the tool we give you. But you have full agency and you make this choice.

The consequence of this compensation system is beautiful. First, it’s super predictable. Second, if you choose stock and it appreciates, you make more money. If the stock goes down, you get more stock units in your next quarter. It rebalances against the actual value every quarter. It works really well.

It is very popular. It was hard to do because doing this worldwide, with people in many different countries, was a legal nightmare due to rules regarding changing salaries. We figured it all out. So we have a blueprint of how people want to do it. We’re proud of it because it’s a point of differentiation and we believe it works much better.

Again, I want people at the company to feel like this is a company that never sleepwalks into anything. We are deliberate about things.”

Giving some agency to the employees for choosing compensation feels like a basic common sense, but as they say common sense is hardly common. If I were running a SaaS company, I would probably contact Tobi or someone at Shopify to understand how to implement this in my company. At the very least, giving back the agency to employees will dissuade the employees from demanding the company make them whole when the stocks are near the bottom which, from the investors’ perspective, is clearly the worst possible time to issue too many stocks.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 65 Deep Dives here

Current Portfolio:

Please note that these are NOT my recommendation to buy/sell these securities, but just disclosure from my end so that you can assess potential biases that I may have because of my own personal portfolio holdings. Always consider my write-up my personal investing journal and never forget my objectives, risk tolerance, and constraints may have no resemblance to yours.

My current portfolio is disclosed below: