Autodesk 4Q'FY23 Update

Disclosure: I am long shares of Autodesk

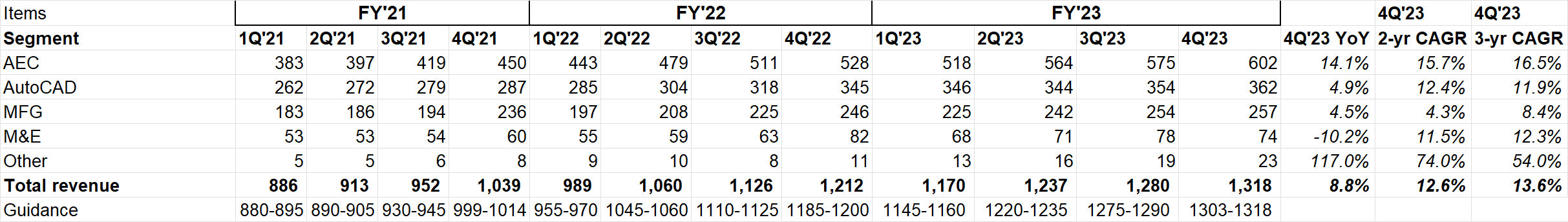

Autodesk met their high end of the topline guidance. While topline grew at High Single Digit (HSD) rate YoY, it was +12% FXN. Subscription revenue, which is ~92% of revenue, was +14% FXN.

While Media &Entertainment (M&E) segment was down 10%, it won the largest ever EBA in 4Q last year which included significant upfront revenue. Excluding upfront revenue, M&E grew 4%.

Net revenue retention remains at 100-110% (FXN).

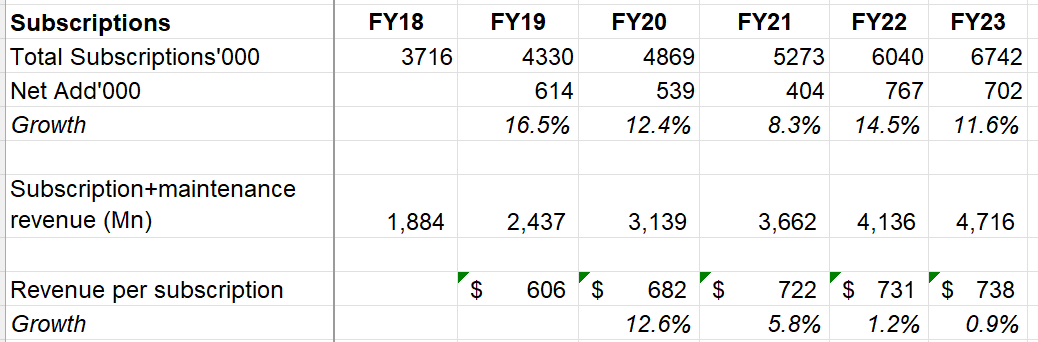

Autodesk typically discloses their subscriber numbers in 4Q. Volume remains the primary driver as it continues to grow at solid double digit rate. Price has been a muted factor over last couple of years, but I suspect it's more due to mix shift.

Autodesk management mentioned that over time they want to drive 10-15% topline growth from largely equal contribution from volume, price mix, and ASP.

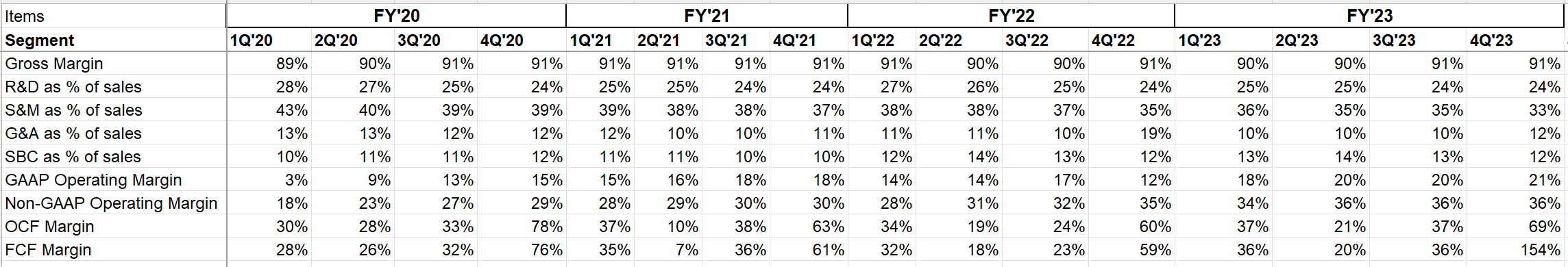

GAAP operating margin increased by 1 percentage point, but Autodesk management continues to have an unhealthy obsession with non-GAAP margins as well as Rule of 40/45. As a shareholder, it does concern me that the management team keeps touting metrics that have no real meaning. CFO thinks this rule of 40 is "hallmark of the most valuable companies in the world". Nope.

While Rule of 40/45 (sum of Non-GAAP operating margin+ Topline) can have relevance for cash burning companies, it essentially has zero relevance for mature public market software companies.

Thankfully for minority shareholders, management did mention that they expect SBC as % of revenue to come down to 10% over time.

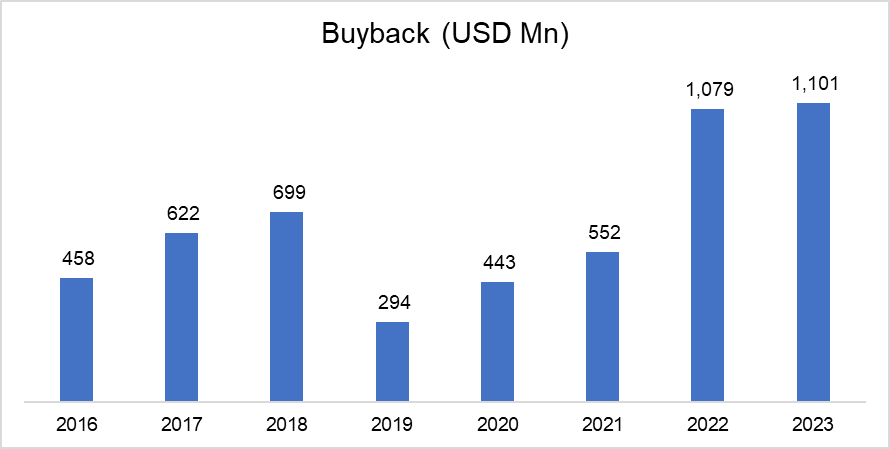

Autodesk repurchased 5.5 mn shares for $1.1. Bn at an average price of $198/share in 2022 which reduced shares outstanding by 4 mn (-2% YoY). Buyback was 54% of FCF. They also spent $350 Mn to retire debt in 2022.

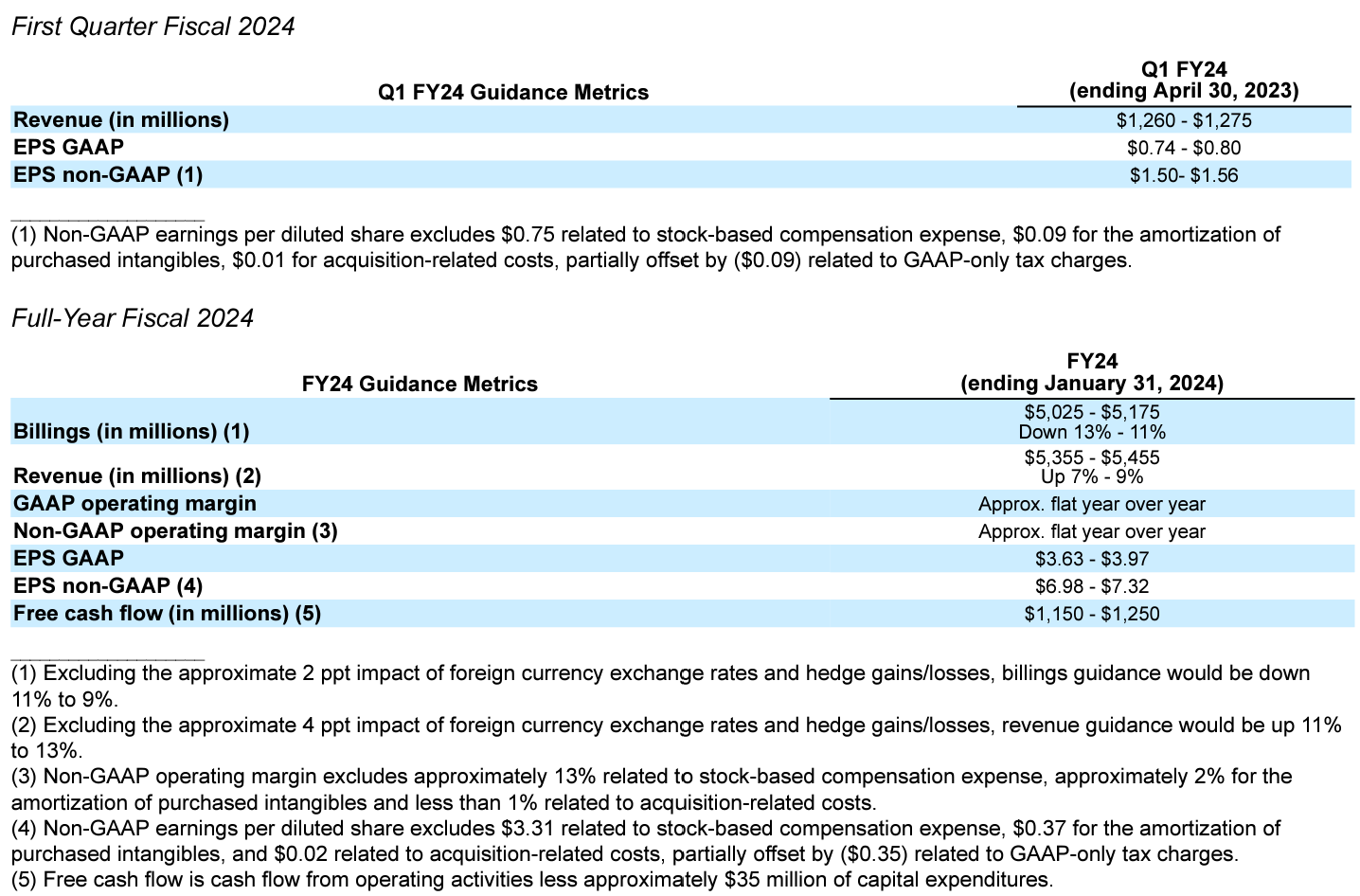

FY'24 topline guidance assumes 7-9% growth, but +12% on constant currency and excluding Russia impact.

Management mentioned 3Q and 4Q activity was consistent across quarters. Analysts seem a bit skeptical about the guide because it's essentially not incorporating much of a slowdown in business despite the macro environment.

Back in 2009, Autodesk's revenue went down by 26%. One could perhaps infer a couple of things: a) this recession, if it comes to fruition, may just be a very benign one; and b) Autodesk's business, following the switch to subscription in 2017, may be somewhat immune from the general cyclicality of the economy.

Management seems to think the trends in 4Q would basically continue throughout this year. If that doesn't happen, the topline guide, in fact, may prove to be optimistic.

Non-GAAP operating margin guide is similar to this year which may be impressive given FX headwind. Long term (FY'26) Non-GAAP operating margin targets are 38-40% (~2-5 percentage points higher than FY'23).

Cash tax rate will be 31% in FY'24 vs 25% this year:

Our cash tax rate will return to a more normalized level of approximately 31% in fiscal '24, up from 25% in fiscal '23. We accrued significant tax assets as a result of the operating losses we generated during our business model transition. Growing profitability and more recently, rising effective tax rates across the globe, have accelerated the consumption of those tax attributes. Absent changes in tax policy, we expect our cash tax rate to remain in a range around 31% for the foreseeable future.

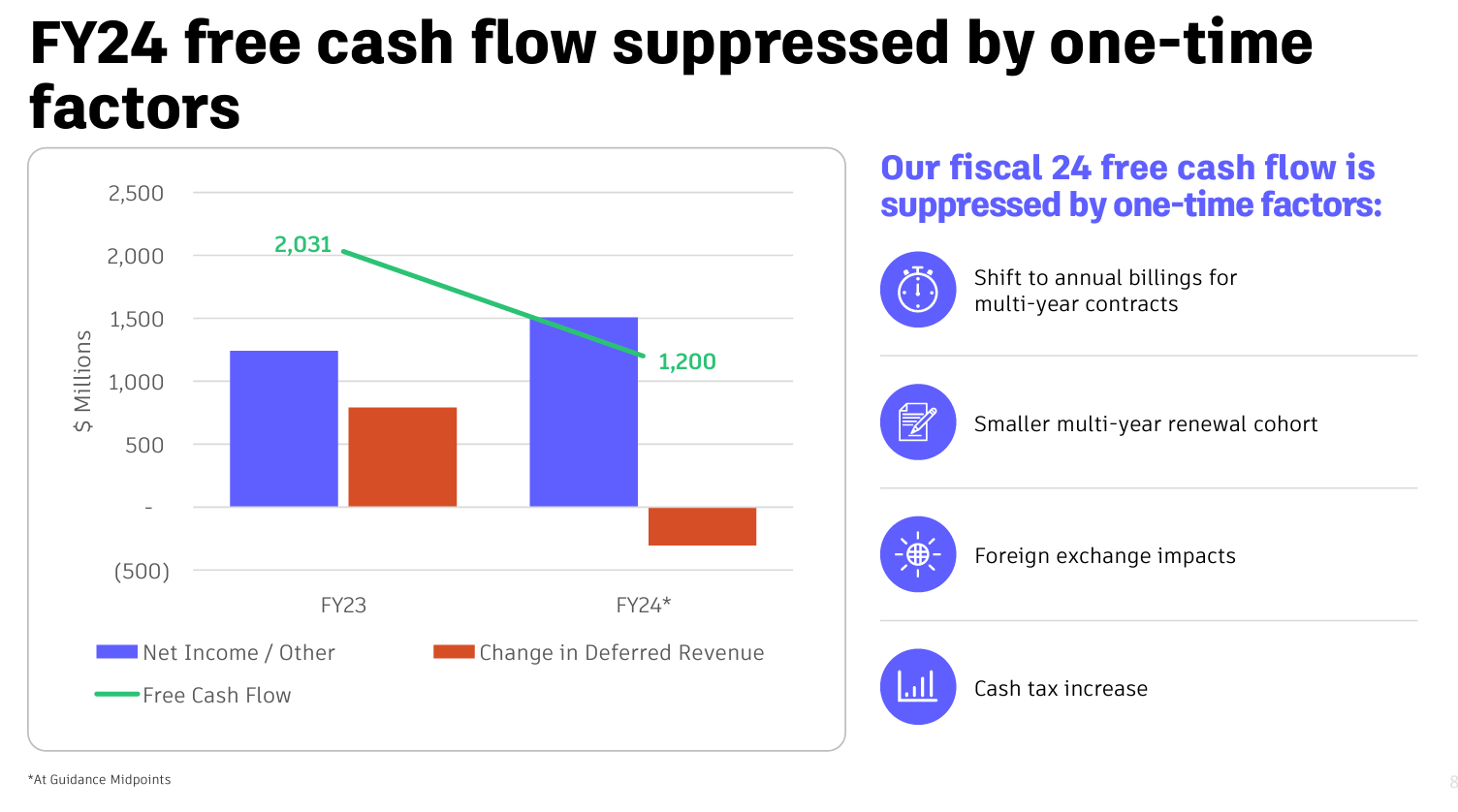

Why is FY'24 FCF guide only $1.2 Bn (Mid-point) vs $2 Bn in FY'23?

Change in deferred revenue increased fiscal '23 free cash flow by $790 million, but will reduce fiscal '24 free cash flow by approximately $300 million. The switch to annual billings for multiyear customers and a smaller multiyear renewal cohort are the key drivers of this $1.1 billion swing.

Thank you for reading. I will publish my valuation update on Meta Platforms later next week.