Fastenal: Compounding Nuts and Bolts

You can listen to this Deep Dive here

On "Invest Like The Best", Charlie Songhurst mentioned an interesting framework which I think is quite apt as a starting point for Fastenal Deep Dive (emphasis mine):

if you pick two axes, one co-axis is boredom and the other is complexity. You want highly boring and highly complex. Because everything in the universe is a supply and demand curve, and you just get insufficient supply of entrepreneurs in the highly boring but highly complex space. And therefore you get elevated return.

So if you go to the quadrants, you've sort of got the whole simple side, boring and simple, and complex and simple. It's just too hard to get differentiation without enough complexity. That's when you get commoditization. If you go for interesting and complex, you get brilliant entrepreneurs. This is the problem say with Space Tech as an area of innovation. Every single person involved with space is basically a brilliant genius who's passionate about their work and loves it.

On the other hand, if you hang out in audit software, accounting software, just sitting in an area that's complex, but no one wants to boast they do it at a dinner party. And what might call the sort of spiritual reward of the industry are lower, and therefore you just get less entrepreneurs. Therefore, the chance of having entrepreneurs succeeding is significantly higher.

"Highly boring and highly complex": that's exactly how I would characterize Fastenal's business. For the uninitiated, while after being founded in 1967 Fastenal primarily used to sell just Fasteners, over time they expanded their product offerings to cutting tools, hydraulics, janitorial supplies, electrical supplies, welding supplies, safety supplies etc.

Watching this product catalogue, you may wonder "okay, I get the boring part, but how or why is it a complex business?"

To answer that question, I will have to go back to the 2022 annual shareholder meeting in which Terry Owen, who runs sales operations at Fastenal, said the following:

"our customers today are asking us to create more value for their business. And they're asking us to create that value through managing their supply chain. So I'm going to talk about really what does that mean.

So I brought a prop with me today. And this is a Zinc-plated Grade 5 Hex Cap Screw. It's one of the fastest moving parts we sell in Fastenal. Last year, we sold 16 million pieces of this bolt. If you go on our website today, the bolt sells for $0.43. Thousands of our customers use this bolt and they use it for thousands of applications, and they do use it for production and assembly and their finished goods.

The challenge today with supply chain is managing -- or even before today, managing the supply chain for this $0.43 bolt is complex, surprisingly complex. It's not a core competency for our customers. It is a core competency for Fastenal. So more and more, our customers are asking us to create value for their business by managing this bolt along with tens of thousands of other SKUs.

What do they expect when they ask us to manage this bolt? They expect us to have it at their facility on time when they need it. They expect us to deliver a bolt that meets their quality standards. Those are just table stakes. They expect a lot more than that. They expect us to free up their working capital. They expect us to lower their expenses. They expect us to improve their P&L, increase their quality, increase their production, impact their capacity and lead times and to improve their worker and end-user satisfaction. Those are a lot of expectations for a $0.43 bolt."

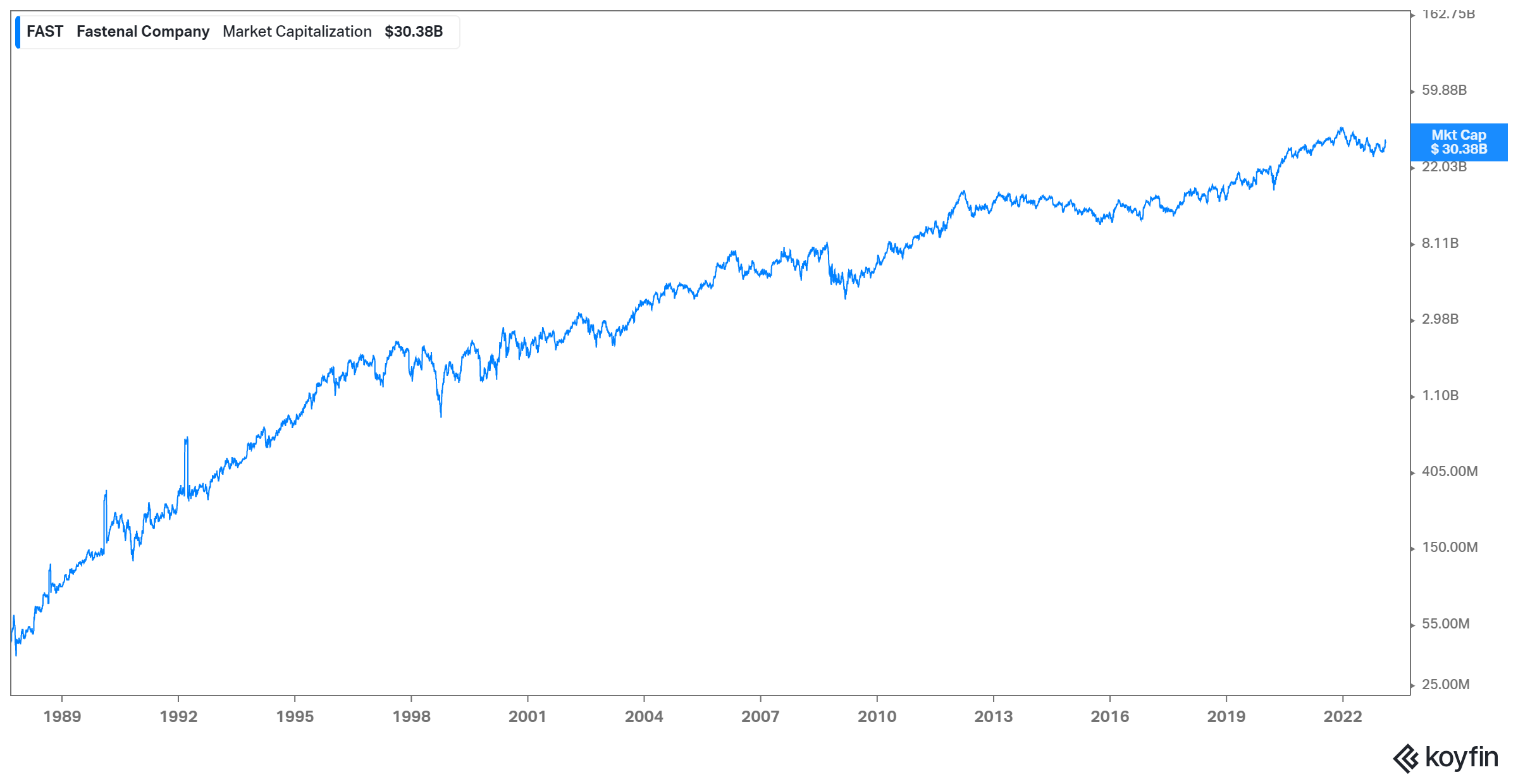

When my wife asked which company I was working on this month, I said Fastenal and briefly mentioned what they do. She wondered whether it is a relatively small company; I nodded and said its valuation is probably $5-10 Bn. To my surprise, I later found out Fastenal's market cap is ~$30 Bn. It really reminded me what a great privilege it is to be born or to be based in the US for an industrious and ambitious entrepreneur. Coming from Bangladesh, it is a bit shocking to me that you could build a ~$30 Bn company by distributing such mundane products as nuts and bolts.

Of course, building a durable company by selling commodity products such as nuts and bolts in a thriving capitalistic society is anything but luck. Interestingly, Bob Kierlin, the founder of Fastenal, wasn't afraid of selling commodity products as he believes the secret to Fastenal's success and durability is not quite tied to what they sell and it is rather hinged on something much more simple and basic fundamentals:

"Just believe in people, give them a chance to make decisions, take risks, and work hard. We could have made this work selling cabbages."

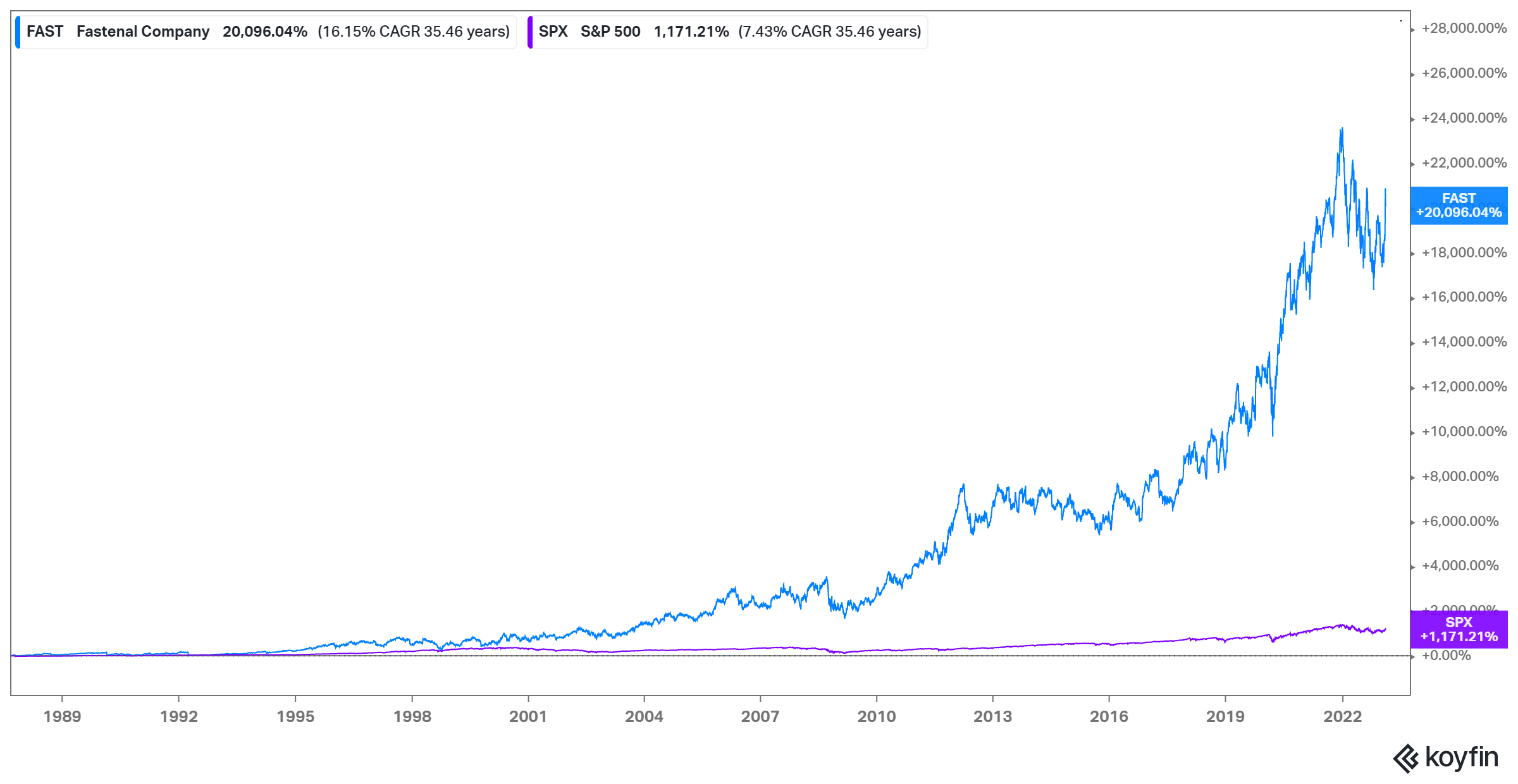

After 20 years of operations, Fastenal became a public company in 1987. Over the last ~35 years, Fastenal compounded at ~16.2% CAGR compared to S&P 500's 7.4% CAGR. To say it differently, while S&P 500 Index became 12x over this period, Fastenal's stock became a whopping ~200-bagger during the same time. Although Fastenal may sell rather boring products, there is clearly nothing monotonous about the money it made for its long-term shareholders.

Here's the outline for this month's Deep Dive:

Section 1 The History and Economics of Fastenal: I first discussed Fastenal's history and the unit economics of the old branch model, and then I elaborated on Fastenal's current business model as well as how the economics of the business evolved over the years.

Section 2 Competitive Dynamics: While industrial supplies distribution market is extremely fragmented, I primarily focused on Grainger, the market leader in this industry. I also explored how/whether Amazon threat would potentially affect both Fastenal and Grainger in the long run.

Section 3 Management and Incentives: Fastenal's management, culture, and incentive structure is discussed in this section.

Section 4 Capital Allocation: I compared and contrasted capital allocation of Grainger and Fastenal. I also explained why I slightly prefer Grainger's capital allocation.

Section 5 Valuation and Model Assumptions: Model/implied expectations are discussed here.

Section 6 Final Words: Concluding remarks on Fastenal, and disclosure of my overall portfolio