Adobe Update

Disclosure: I own shares of Adobe

Adobe just had its Annual Creativity Conference: MAX as well as its Analyst Day. I wanted to write an update based on more data points that were disclosed on the Analyst day. If you are not up to speed on the business, I encourage you to read my Adobe Deep Dive published in August, 2022. On this update, I will mostly talk about interesting things we got to know from the Analyst day and then talk about quantitative implications for the stock.

I will break this update in four segments: a) Digital Media (Creative Cloud, Document Cloud, and Figma) b) Digital Experience, c) Capital Allocation, and d) Valuation/Model Assumptions.

Digital Media

Creative Cloud

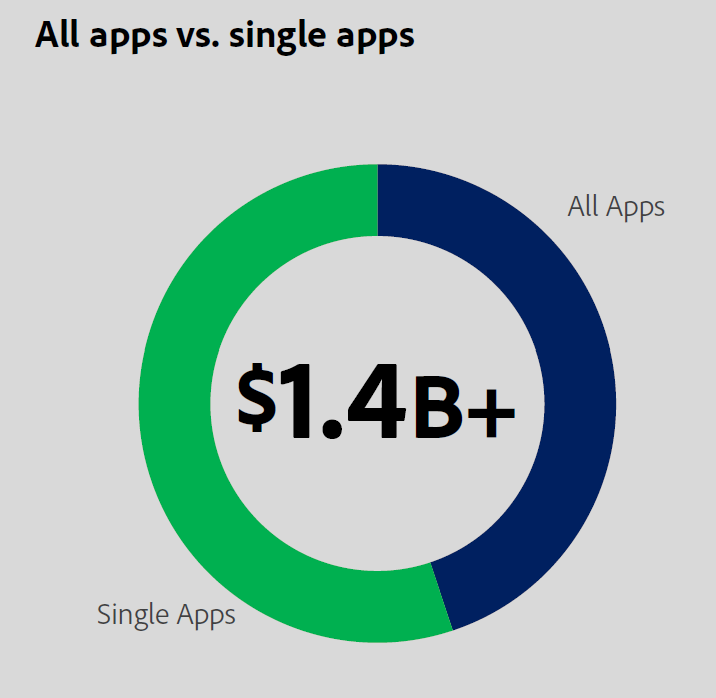

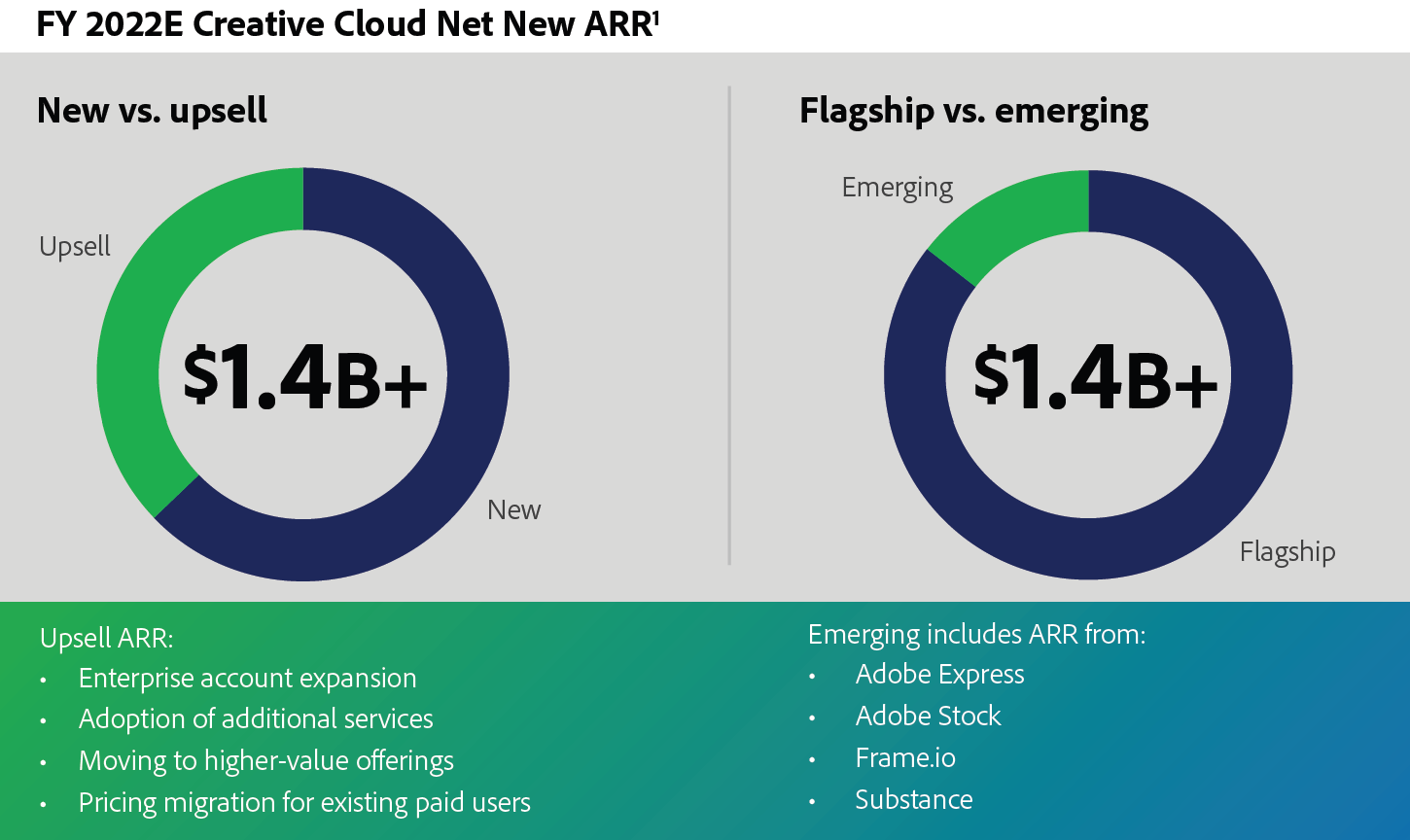

One of the interesting disclosures on the Analyst Day was the mix between single apps and all apps. Adobe expects to add $1.4 Bn net new ARR for Creative Cloud in 2022. Of this net new ARR, ~55% of it will come from single apps and the rest from all apps.

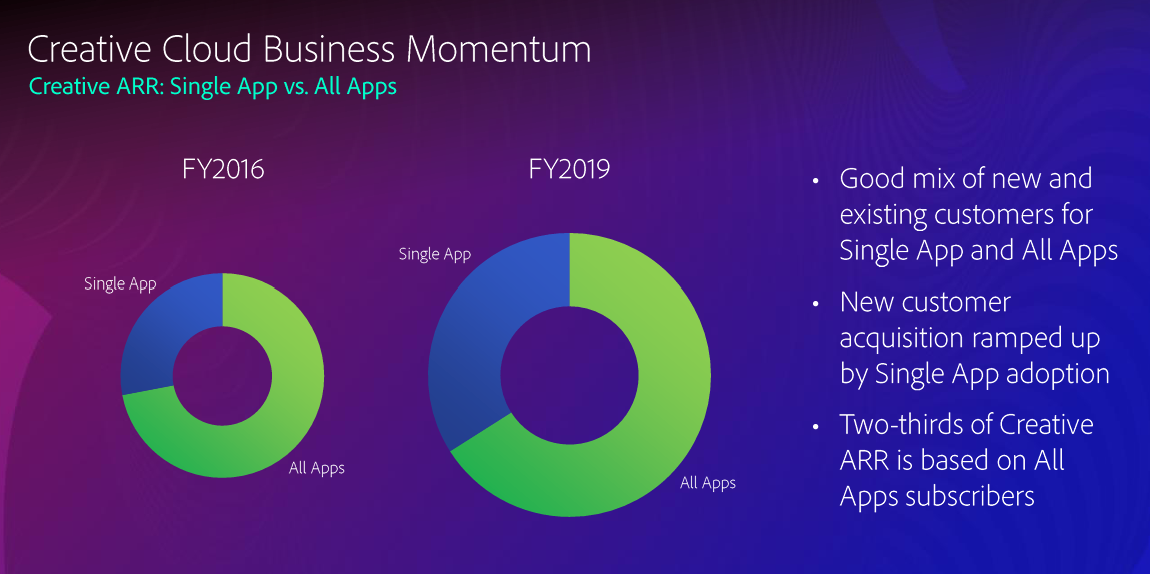

In January 2020 Analyst Day, Adobe disclosed single apps and all apps ARR mix. In 2016, all apps used to contribute ~80% of ARR and then in 2019, ~67% of Creative Cloud ARR came from all apps. Given majority of the growth is coming from single apps these days, overall revenue is likely to be more balanced between single and all apps.

Adobe's strategy is clear. They want to have as large install base as they possibly can. Even if a subscriber is in the Adobe ecosystem through a single app, over time Adobe gets ample opportunities to upsell on these subscribers:

We are prioritizing user acquisition growth and longer-term ARR over short-term maximization

New subscription explained ~65-70% of new new ARR in Creative Cloud and the rest came from upsell. Moreover, supermajority of net new ARR came from Adobe's flagship products (Photoshop, Illustrator, Lightroom, Premiere etc.). While in the short to medium term, subscription growth can continue to carry the growth momentum, Creative Cloud's long-term future growth is likely to depend on Adobe's upselling capabilities as well as success of some of its emerging products (Adobe Express, Stock, Frame.io, Substance etc.). Given the rise of single app users, future ARPU growth may primarily come from upselling and Adobe may not be under pressure to use its pricing lever anytime soon to meet its desired growth.

Speaking of Emerging products, let me talk about Adobe Express. Now that Figma is being acquired by Adobe, Canva is probably the largest threat for Adobe going forward, especially for creator/communicator segment. Founded in 2012, Canva launched its first product in 2013 and now has ~100 mn Monthly Active Users (MAU). In contrast, Adobe Express was launched in December 2021, so it is still pretty early days. It does appear they are willing to be a bit disruptive to compete effectively against Canva who has a decided lead in this segment. Adobe recently announced that Adobe Express reached over 43 million students and teachers globally for free. From the Analyst Day:

We've removed all barriers to adoption. It's free to get started. It doesn't require a desktop download. It's 100% web and mobile. It doesn't have a learning curve and sign up to publish and have your first success is a matter of minutes. So this fundamentally has changed and enabled us to bring new customers into the franchise.

And the quality of our templates, the size of our stock library, over 175 million images, the integration of our fonts, over 20,000 fonts, workflows with our flagship applications. These are the things that differentiate us. And the team has been super busy since launch. We've now had over 100 releases in the last 10 months. We have a strong NPS.

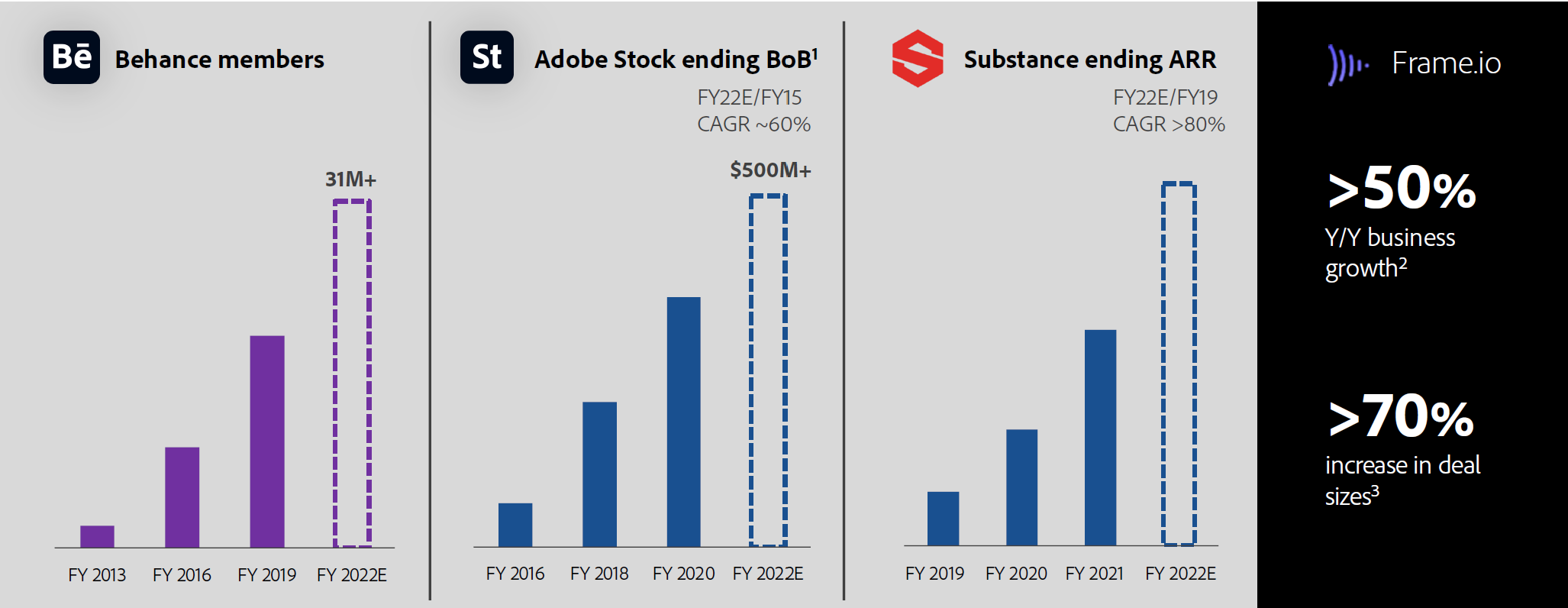

While today Emerging products don't quite drive much of the growth for Creative Cloud primarily due to low base compared to the size of its flagship products, the growth momentum in Adobe Stock, Substance, and Frame.io look quite encouraging. Adobe Stock's Book of Business (BoB), which is defined as annualized subscription value of SaaS, Managed Service, Term, and subscription services offerings, will exceed $500 Mn this year, growing at ~60% CAGR from 2015-2022. Substance's ARR grew at ~80% CAGR in 2019-2022, and Frame.io's ARR also increased by >50% YoY in September, 2022. The growth numbers shown in the below graph highlights Adobe's ability to scale these products after acquiring them (the starting time indicates when it was acquired).

A long-term potential area of concern for Adobe is the rise of Generative AI that really has captured everyone's attention in recent months. While it is perhaps too early to shut down these concerns for good, Adobe doesn't seem to be oblivious to what may turn out to be a generational trend. Adobe thinks Generative AI will make their existing products more productive. Here's an excerpt from discussions related to Generative AI:

For those of you who are not familiar with it, generative AI can conjure up an image from a simple text description. So imagine a world where you can ask Sensei in Photoshop to add an object to scene simply by describing what you want or ask Sensei to give you alternative ideas based on what you've already built.

Imagine if you can combine Gentech with Lightroom, so you can ask Sensei and Lightroom to transform night in today to alter a sunny photograph into a beautiful sunset, move shadows by moving the light or changing the weather. Imagine what you could do in Adobe Express, if you could combine generative technology with our massive font library, you'll be able to create completely new and highly stylized fonts on the fly in a way that makes you and your brand stand out.

It's not just all talk; Adobe showed its capabilities in the conference:

This is wild. Dall-E-like transformer model integrated into Photoshop. $ADBE pic.twitter.com/PEQLnGmPkB

— Marcelo P. Lima (@MarceloPLima) October 18, 2022

It is not clear to me how the technology itself is going to be differentiator for the startups focusing on Generative AI. While I don't think playing field has been decided yet, the distribution advantage that incumbents have and the ability to integrate AI capabilities to existing products may prove to be a big hurdle for the startups in the medium to long-term. A quote by Alex Rampell that I always come back to whenever I assess disruption risk faced by incumbents:

The battle between every startup and incumbent comes down to whether the startup gets distribution before the incumbent gets innovation.

Document Cloud

I will keep this section really short. Two things stood out to me for Document Cloud: a) Adobe Sign had >50% YoY growth in SMB which indicates Adobe's momentum in the lower end of the market, and b) "product-led growth motions for the Acrobat business represents over 60% of new paid Acrobat subs in this year"

Figma

Figma acquisition obviously captured much of the attention of the broader tech world as well as shareholders, and it remains a hotly debated topic among many investors. Following the acquisition announcement, one concern from Figma users I came across on Reddit/Hacker News/Twitter was whether Figma may face similar fate as Macromedia for which Adobe diluted its shareholder ~20% in 2005 but eventually most of the Macromedia assets struggled under Adobe's umbrella. Adobe made it a point to highlight its success in scaling some of the recent acquisitions (as discussed earlier). Here are a few quotes on Figma that stood out to me from the Analyst Day:

As a reminder, Figma has 2 core products. The first is FigJam for brainstorming and ideation and the second is Figma Design for interactive product design. Both products are nice adjacencies to our TAM.

2/3 of our users are non-designers and a substantial portion of those are developers. And as we think about the entire product journey of starting with ideation, brainstorming, diagramming, in FigJam and going to Figma with design, next step of that is design to code. How do designers and engineers collaborate better. As we focus more on developers, I think you'll see a lot more coming in there.

as we look at Figma, we actually see that 5% of the files created in ft are slides and presentations. And so we think there's enormous opportunity. Like you said earlier, creativity is the new productivity

Figma is this incredibly rare company that has achieved escape velocity as it relates to product design and targeting an area that was an unsolved problem

I think we will have the ability to take what Figma has with FigJam, what Adobe has with Adobe Acrobat, what we have with Express and create a brand-new platform that enables people to be both creative and productive.

Digital Experience

Adobe shared interesting data points and anecdotes on its Digital Experience segment. While I am far less enthusiastic about Digital Experience segment compared to Digital Media, I came out slightly more optimistic about this business but also managed to stumble on to new concerns as well.

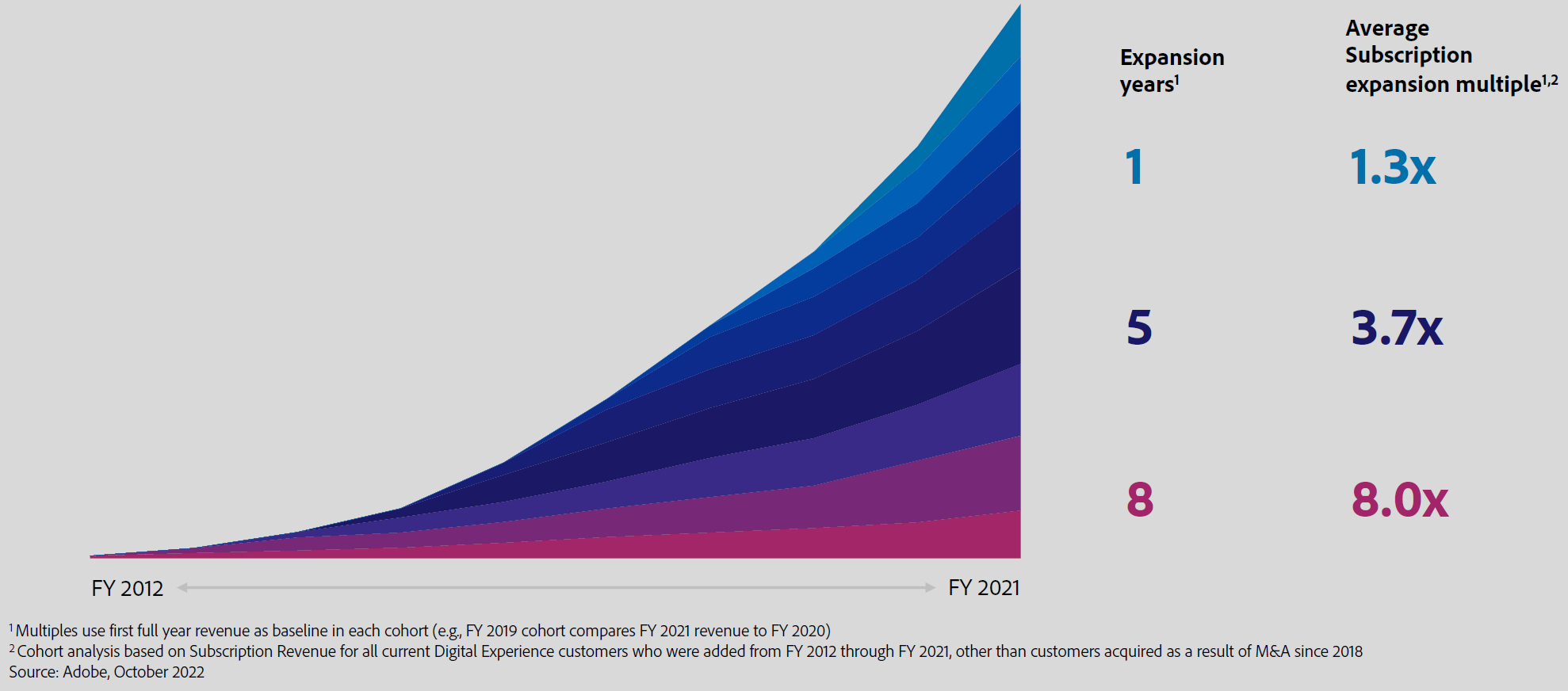

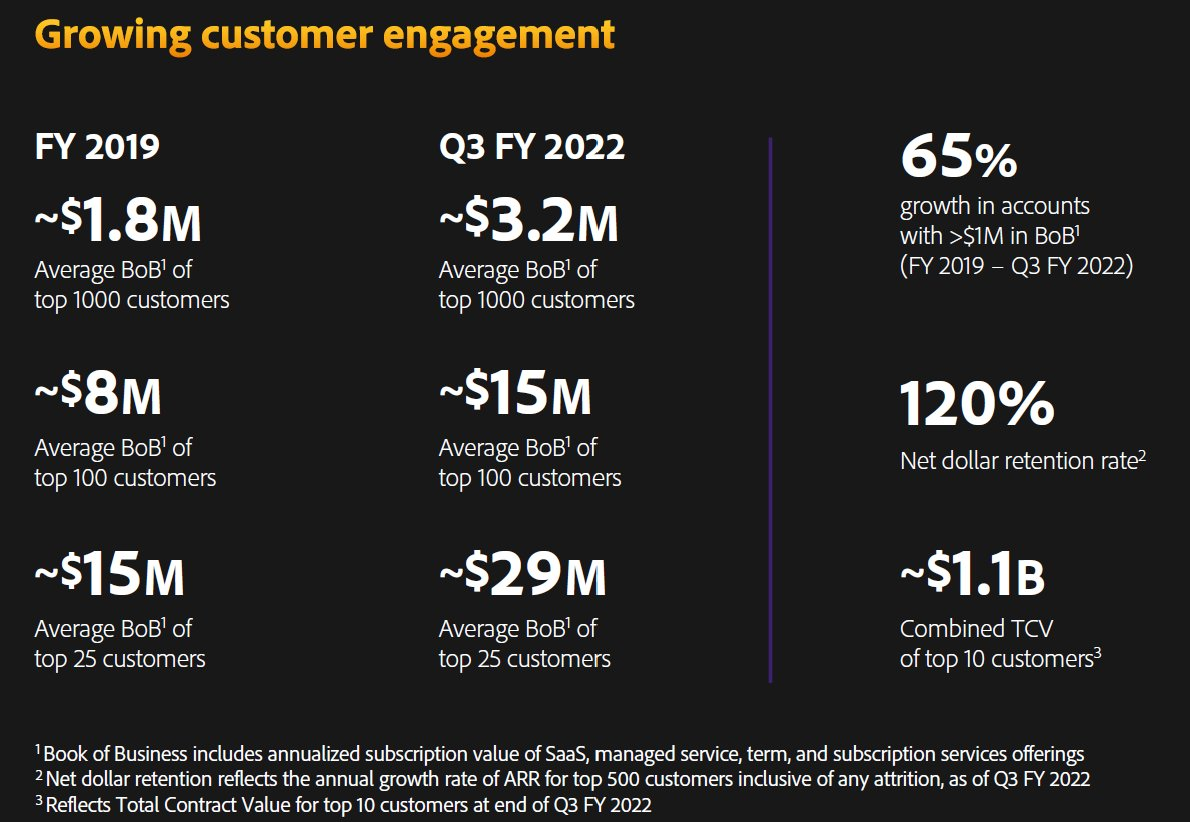

Let's start with the good stuff. Adobe mentioned two of its large customers in this segment who scaled their relationship with Adobe massively over time. One telco company grew its Book of Business (BoB) from $4.5 Mn in 2016 to $45 Mn in 2022. Even more impressively, a healthcare company scaled from $3.7 Mn of BoB in 2019 to $48 Mn in 2022. While they are obviously cherry picked, data across the customer cohort shows impressive momentum.

Total customers grew from 2,000 in 2012 to 11,500 in 2022. Only 10% of these customers have over 4 Adobe Digital Experience products (# of customers with 4+ products growing 26% YoY). Avg BoB is $2.5 Mn for customers with 4+ products. Adobe highlighted many of its enterprise customers' willingness to partner with platform solution rather than point solutions:

the other big thing that we are seeing is as they look at the multiple point providers they have had or they've been looking at in this space of customer experience, digital marketing, we have, one, it's leading to fragmentation. Two, that's just concerned about the viability of some of these providers. And so they're looking to a strategic digital partner, a partner like Adobe, who can really help them be the long-term partner of choice.

Customer Data Platform or CDP is also another bright spot for Adobe. Adobe Experience Platform (AEP)'s BoB increased from $70 Mn in 2020 to $450 Mn in 2022.

In 2020, our book of business for Adobe Experience and the 3 apps that we have constructed natively on this, which is the CDP, the real-time customer data platform, Adobe Journey Optimizer and the customer journey analytics. That AEP and apps was a $70 million book of business in 2020, and we estimate that exiting this year, it'll be at $450 million in growing.

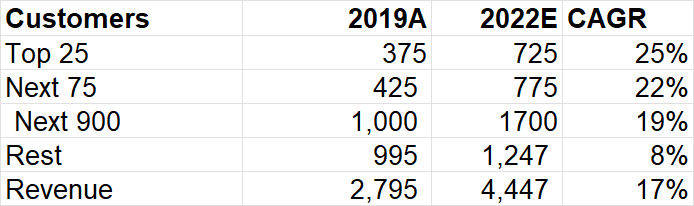

What was, however, surprising to me is how Adobe's Digital Experience BoB for its top 25 and top 100 customers almost doubled over the last three years and yet its revenue increased by only ~60% in the same period.

If we assume BoB as equivalent of revenues (for simplicity's sake; I know they are not the same), based on the data above we can figure out the performance of long tail customers for Digital Experience. As you can see below, while Adobe's top 25 customers grew its BoB by ~25% CAGR, its customers beyond the top 1000 grew its revenue by only ~8% CAGR over the last 3 years. Since number of customers itself has certainly grown over this period, actual revenue or BoB per customer in the long tail may be flat or declining. It is possible Adobe's Digital Experience platform may not be a good fit or may be lot harder to scale over time unless you are a large enterprise customer.

As usual, there wasn't much discussion on profitability of Digital Experience segment apart from the comment from management that Digital Experience segment contributed to recent margin expansion experienced by overall Adobe.

we're on pace to deliver approximately 5 points of margin expansion over the last 3 years. And that margin performance includes delivering significant improvement in the margin of our digital experience business.

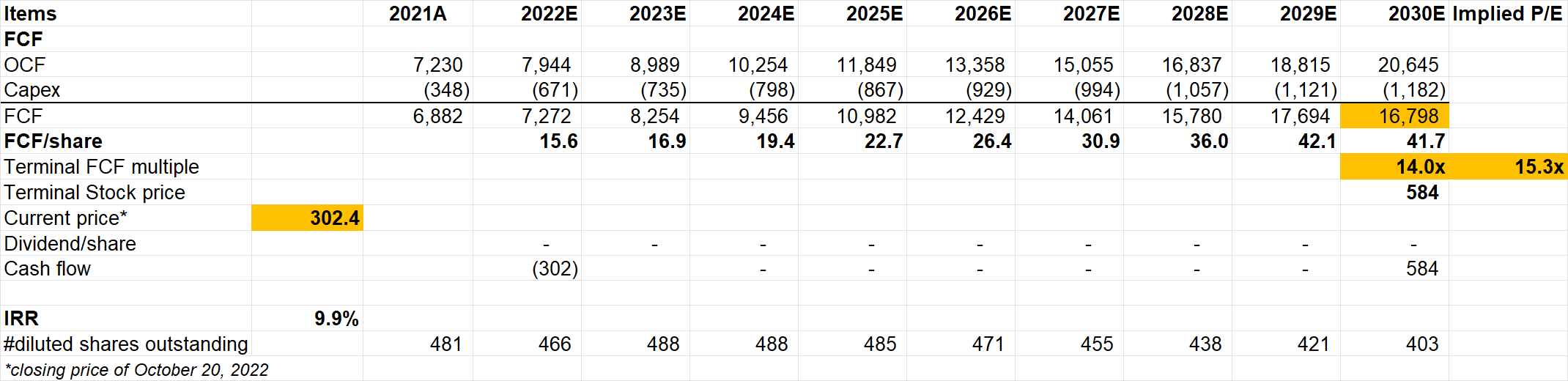

Capital Allocation

Adobe emphasized its strategy of share buybacks following its splurge on Figma:

While the transaction is pending, we will be opportunistic regarding share repurchase. And you saw that in the current quarter with our $1.75 billion share repurchase executed. And at a minimum, we'll repurchase enough shares to remain dilution-neutral, but we'll always look to be opportunistic in this environment.

As a growth company, we think the most efficient mechanism to return cash to shareholders is through share repurchase. Our goal is going to be to meaningfully reduce the share count over time following the closing of the Figma acquisition.

Although this isn't anything material, I was a bit disappointed to still see concept such as "Rule of 40" (whether your Non-GAAP operating margin+ topline growth exceeds 40%) being mentioned by Adobe CFO. While "Rule of 40" may be helpful for companies burning cash, it has almost no use or meaning for a 40-year old public software company. For example, I estimate Digital Media's GAAP operating margin to be ~50% (so non-GAAP would be even higher). For such mature margin business, if Digital Media's topline declines by 10% next year, it would still be "Rule of 40" business. Is there anyone (including management) who would be glad that Adobe remains a "Rule of 40" business in such a case? Adobe is hardly the exception here as most tech companies mention these metrics even though they don't quite make sense from first principles perspective. Ultimately, shareholders mostly care about increasing FCF per share over the long term, and most new-age metrics don't quite pass the smell test.

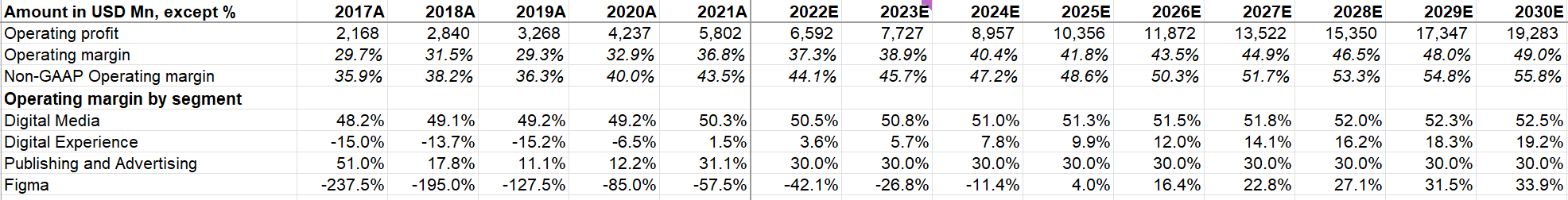

Valuation/Model assumptions

If you haven't read any of my Deep Dives before, I strongly encourage you to read my piece on “approach to valuation”. Please read it at least once so that you understand what I am trying to do here. I follow an “expectations investing” or reverse DCF approach as I try to figure out what I need to assume to generate a decent IRR from an investment which in this case is ~9-10%. Then I glance through the model and ask myself how comfortable I am with these assumptions. As always, I encourage you to download the model and build your own narrative and forecast as you see fit to come to your own conclusion. None of us have the crystal ball to forecast 5-10 years down the line, but it’s always helpful to figure out what we need to assume to generate a decent return.

Revenue Model

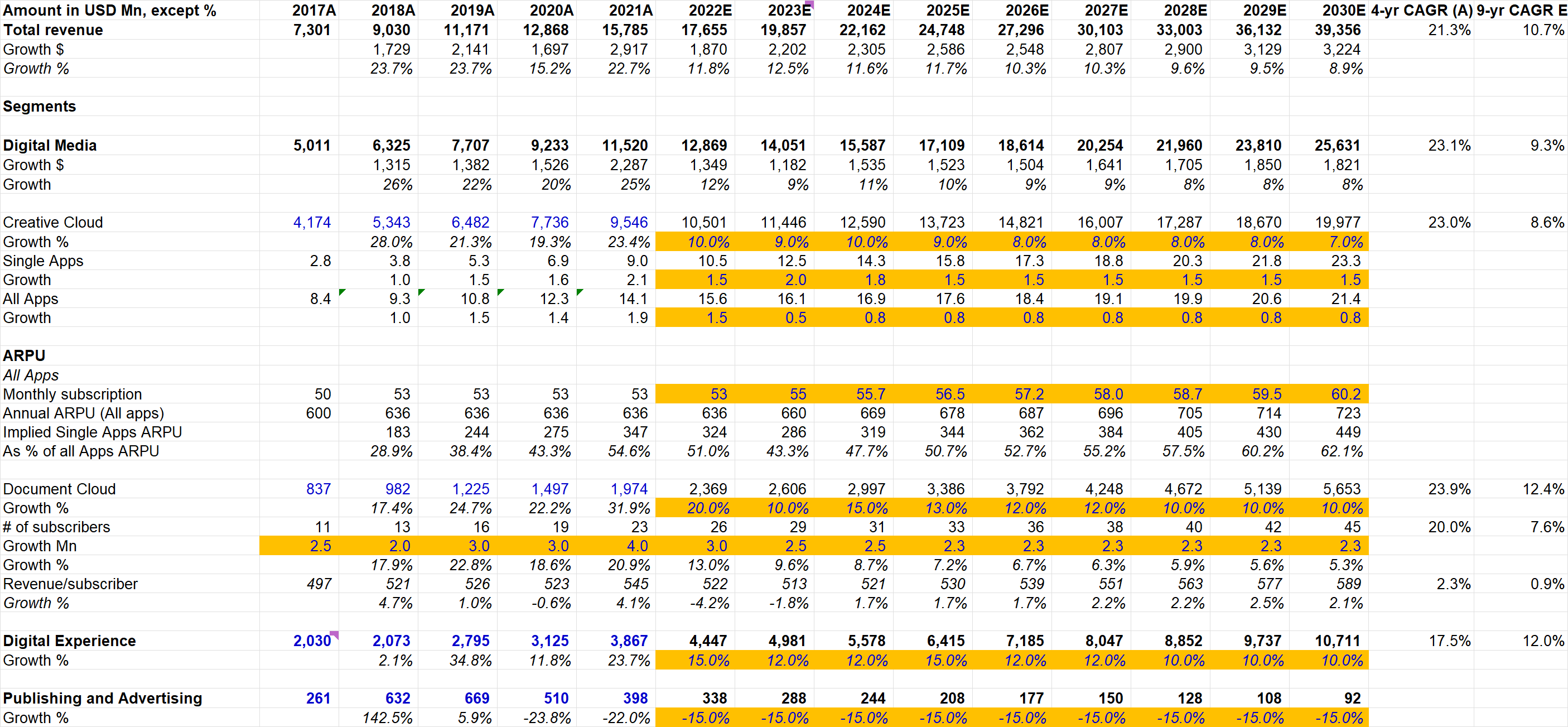

I have updated my Adobe model based on management's guidance and made few other changes which I'll explain here. I encourage you to download the updated model here and play around the assumptions to fit your narrative.

One of the variables that I kept fixed while building this model to generate ~9-10% IRR is terminal FCF multiple which I assumed to be 14-15x. Hence, these are not necessarily my estimates or forecasts, rather what I need to assume to underwrite ~9-10% IRR at 14-15x terminal FCF multiple. Even though the acquisition is pending, I have incorporated and modeled Figma into this updated model.

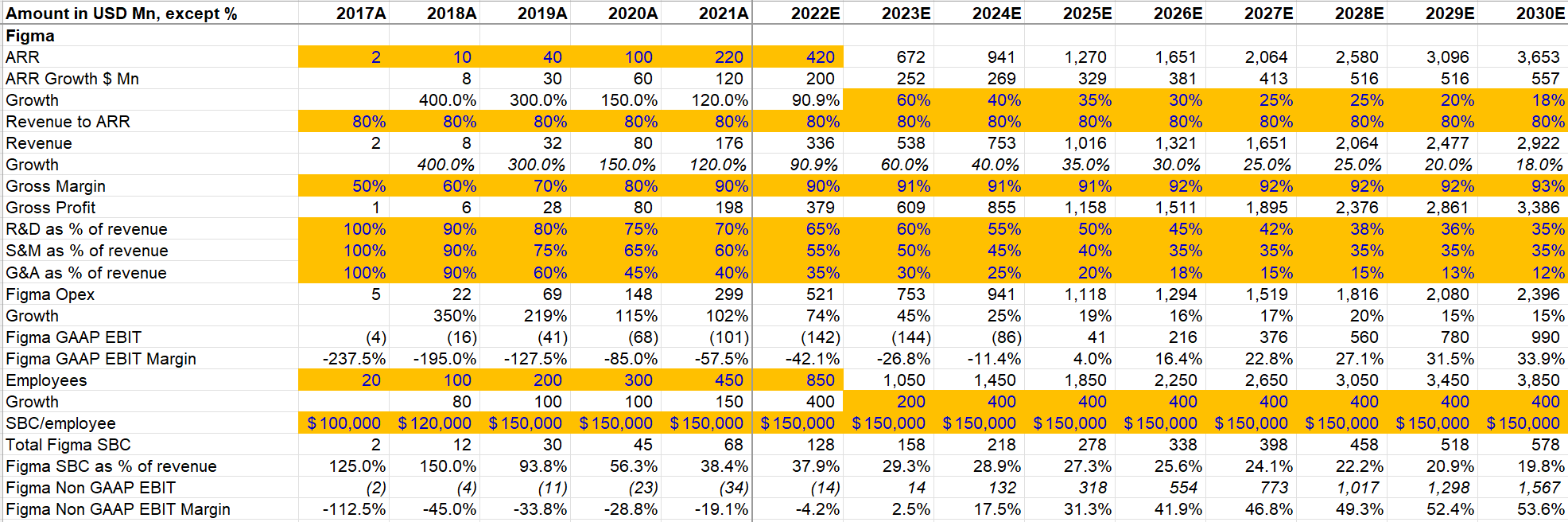

Let's start with Figma. While Figma's numbers are not publicly disclosed, Adobe management shared enough data points to allow me to build a shell model for now. Adobe mentioned Figma is expected to add ~$200 Mn ARR (Annualized Recurring Revenue) in 2022 and will exceed $400 Mn ARR this year. I assumed ARR in 2022 to be $420 Mn, $220 Mn in 2021, and made some reasonable assumptions going back to 2017 when they generated first dollar of sales. Of course, for a growing company, ARR is higher than revenue. I made an assumption that Revenue to ARR ratio to be ~80%. Adobe mentioned Figma's gross margin to be ~90% this year and Figma will be operating cash flow positive. Since a high growth subscription business such as Figma's operating cash flow is likely to have material net working capital benefit, I assumed its non-GAAP operating margin to be slightly negative (something like -5%) in 2022 and then made some assumptions in the rest of the income statement to get there. One other data point that I had was Figma currently has ~850 employees and I assumed the average Stock-Based Compensation (SBC) per employee to be $150k. My estimates assigned larger cost in R&D as Adobe mentioned Figma to be largely product led company and its sales motion is yet to be supercharged.

In terms of projections, I estimate ARR $ growth to be ~$250 Mn/year for the next two years as Figma becomes part of Adobe and gets digested to broader Adobe ecosystem in a soft macro environment. But over time, I expect ARR growth momentum to pick up from here as I expect Adobe to help Figma scale faster. Based on these assumptions, I estimate Figma's 2030 revenue to be ~$3 Bn. In the terminal year (i.e. 2030), I assumed R&D, S&M, and G&A as % of revenue to be 35%, 35%, and 12% respectively. While many startups can be product led companies in the early stage, S&M costs almost always end up being the largest cost line item if you are building anything to sell to enterprise customers. I expect Adobe to be a great help here for Figma as Figma scales the business for the rest of this decade. Overall, I estimate GAAP operating margin to be ~34% in 2030 and assuming SBC as % of revenue to be ~20%, non-GAAP operating margin to be ~54% which closely matches with Adobe's broader Digital Media margin.

As per these estimates, Figma may post ~$1 Bn operating profit in 2030. Assuming 30x multiple on that, we get to ~$30 Bn valuation for Figma in 2030, implying ~6% IRR for Adobe. While that may not be excellent use of capital from strictly financial sense, Adobe shareholders would probably be pretty worried if Figma were acquired by Microsoft (hypothetical example). Therefore, the strategic value of Figma may have played an important role in Adobe's decision to pursue Figma.

Before I discuss all the segments at Adobe, let me clarify a few things first. While Adobe management guided $19.1-$19.3 Bn revenue for 2023, my model incorporates Figma's estimated revenue of $538 Mn in 2023. Excluding Figma, I'm at the high end of management guidance. Two things need to keep in mind for the guidance: a) FX is a ~4% headwind going into 2023. Therefore, although management's mid-point guidance implies ~9% topline growth, on a constant currency basis it's ~13%; b) management did take soft macro environment into account while giving the guidance. ~13% topline growth despite macro headwinds indicates the overall resilience of Adobe's subscription model. In 2009, Adobe experienced 18% decline in topline when it still had perpetual licensing model. There may be, however, potentially a lag between the impact of macro softness and the impact on Adobe's topline, so we may still not be quite out of the woods yet.

Let's talk about Digital Media and Digital Experience now.

While Digital Media grew at 23% CAGR in the last 4 years (2017-2021), I modeled High-Single-Digit (HSD) CAGR for 2022-2030. This implies Mid-Single-Digit (MSD) CAGR for number of subscribers in 2022-2030 vs estimated ~20% CAGR in the last 4 years. Moreover, pricing power is also assumed to be muted. It is perhaps more likely that this model may turn out to be a bit conservative. While Adobe added estimated ~15 mn subscribers in 2017-2022, I am modeling another ~19 mn in the next 8 years. This growth is likely driven by single apps and by 2030, single app may become majority of the Creative Cloud subscriber mix. Given the rise of single apps subscriber, ARPU growth is likely to be relatively subdued. However, the implied all apps subscriber numbers appears to be quite conservative (vs historical) and it is possible further upside may be there on subscriber growth in this segment. While all apps subscription price was raised in 2018 and then in March this year, I assumed a more linear increase going forward (although it is more likely that it may happen in every 2-3 years but the end result may be somewhat similar).

For its Digital Experience business, I assumed Low Double Digit (LDD) CAGR going forward (vs high teens in the last 4-5 years). It is perhaps likely that Adobe will continue to do some bolt-on acquisitions in this segment. Please note I set aside $16 Bn for acquisitions in 2023-2030 (excluding Figma) which is likely to be mostly utilized to do bolt-on acquisitions in Digital Experience.

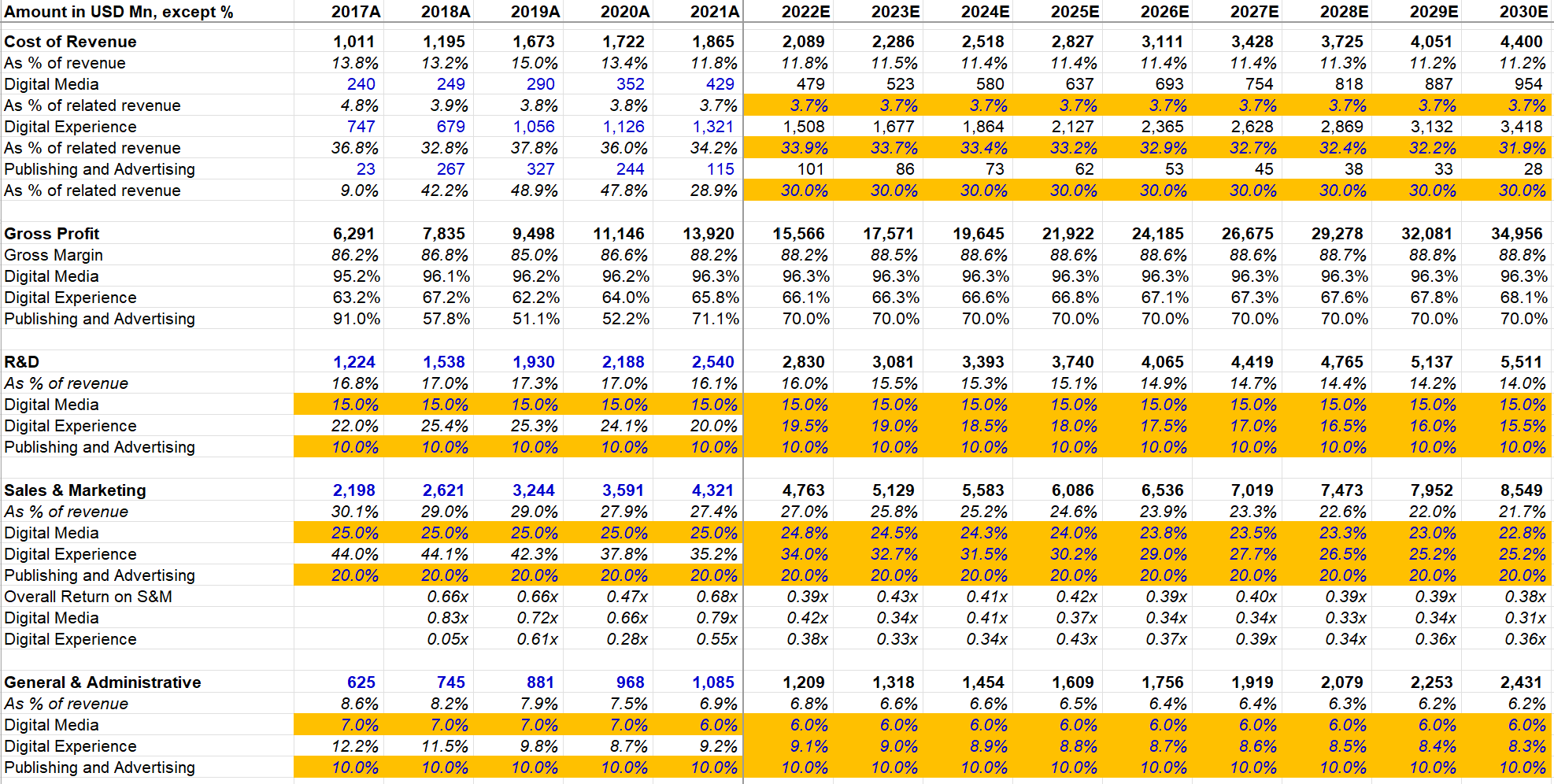

Cost structure

As discussed in my Deep Dive, while Adobe reports gross margin by segment, it does not report segment wise operating margin.

After publishing my Deep Dive, I heard from a couple of Adobe shareholders who were more sanguine about Digital Experience's profitability than I was. While I assumed Digital Experience to be operating at loss, it may be lot closer to breakeven than I assumed. Therefore, I made some changes in the model.

Digital Media is estimated to be ~50% operating margin business and margin upside is perhaps limited from here. Digital Experience, on the other hand, is expected to increase its margin from near break even in 2021 to ~20% in 2030. Even if you think such margin expansion may not materialize, it is not a significant driver of Adobe's value anyway. If you assume ~10% operating margin for Digital Experience instead of ~20% in 2030, it decreases the overall operating profit by ~5%. Ultimately, the success or failure of Adobe largely hinges on maintaining its dominance on Digital Media.

Valuation

To generate ~9-10% IRR in this model, I had to use ~14x FCF multiple which implies ~15x P/E multiple. To be clear, FCF multiple is lower compared to P/E since as a subscription business, Adobe enjoys networking capital benefit. Also note that, I have deducted SBC in the terminal year to keep it consistent with stock variable (share count) and flow variable (FCF) which is why you notice a drop in FCF in the terminal year. As you can see below in share count for 2023, the jump in share count is explained by Figma acquisition.

What's the upside case from here? If Adobe manages to grow its topline 300 bps faster (will probably need to be driven by Digital Media), keep the margins as modeled, and assume ~20-25x terminal FCF multiple, Adobe can be mid-to-high teen IRR from current prices.

I will cover earnings of Google, Amazon, Meta, Spotify, Shopify, and IAC in the next couple of weeks.

Subscribers can also access all the Deep Dives published so far: Uber, Etsy, Lululemon, Angi, Ansys, Autodesk, Copart, Shopify, Otis, CrowdStrike, Roku, Boeing, Square, Trupanion, RH, Spotify, Pinterest, Twilio, Constellation Software, Ethereum, Adyen, PayPal, Danaher, Adobe, Cloudflare, and Airbnb.

Thank you for reading!