Insurance Brokers, Portfolio Change

I have written about insurance brokers before (see my Brown & Brown Deep Dive, and write-up on Aon). I love insurance broker business and while they are certainly not the most exciting businesses around, the entire industry has been a reliable compounding machine for investors for decades. Hence, even though I only own Aon today, I expect myself to own multiple brokers over time. So, yesterday I listened to the recent earnings calls of the big two in this industry i.e. Marsh McLennan (MMC) and Aon (AON).

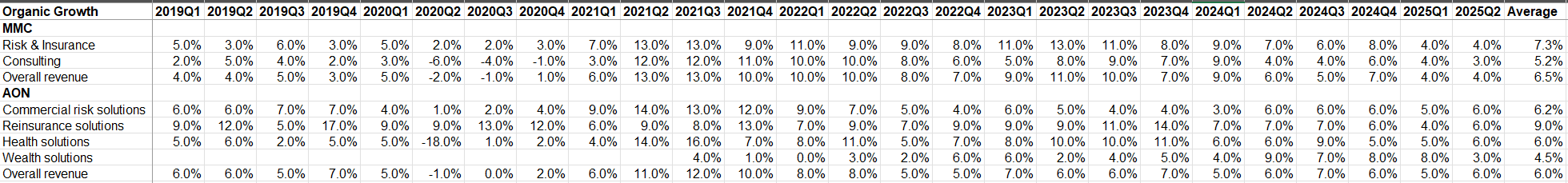

First of all, let’s look at the organic growth. Aon surprised a bit with 6% organic growth while MMC did 4%. Over the long run, I expect both of them to grow organically at MSD rate. If you average their organic growth from 1Q’19 to 2Q’25, the average organic growth during this period was 6.5% for MMC and 6% for Aon.

Some notes from MMC Call

Management mentioned lower fiduciary interest income, declining Property & Casualty (P&C) pricing and market uncertainty affecting their clients in the U.S. Here’s what they mentioned about P&C pricing:

According to the Marsh Global Insurance Market Index, commercial insurance rates decreased 4% in the second quarter, driven by property despite a surge in cat losses in the first 6 months of the year. This follows a 3% decline in the first quarter of 2025. As a reminder, our index skews to large account business. Overall, rates in the U.S. were flat. Latin America, Europe, U.K. and Asia were all down mid-single digits and Pacific was down double digits.

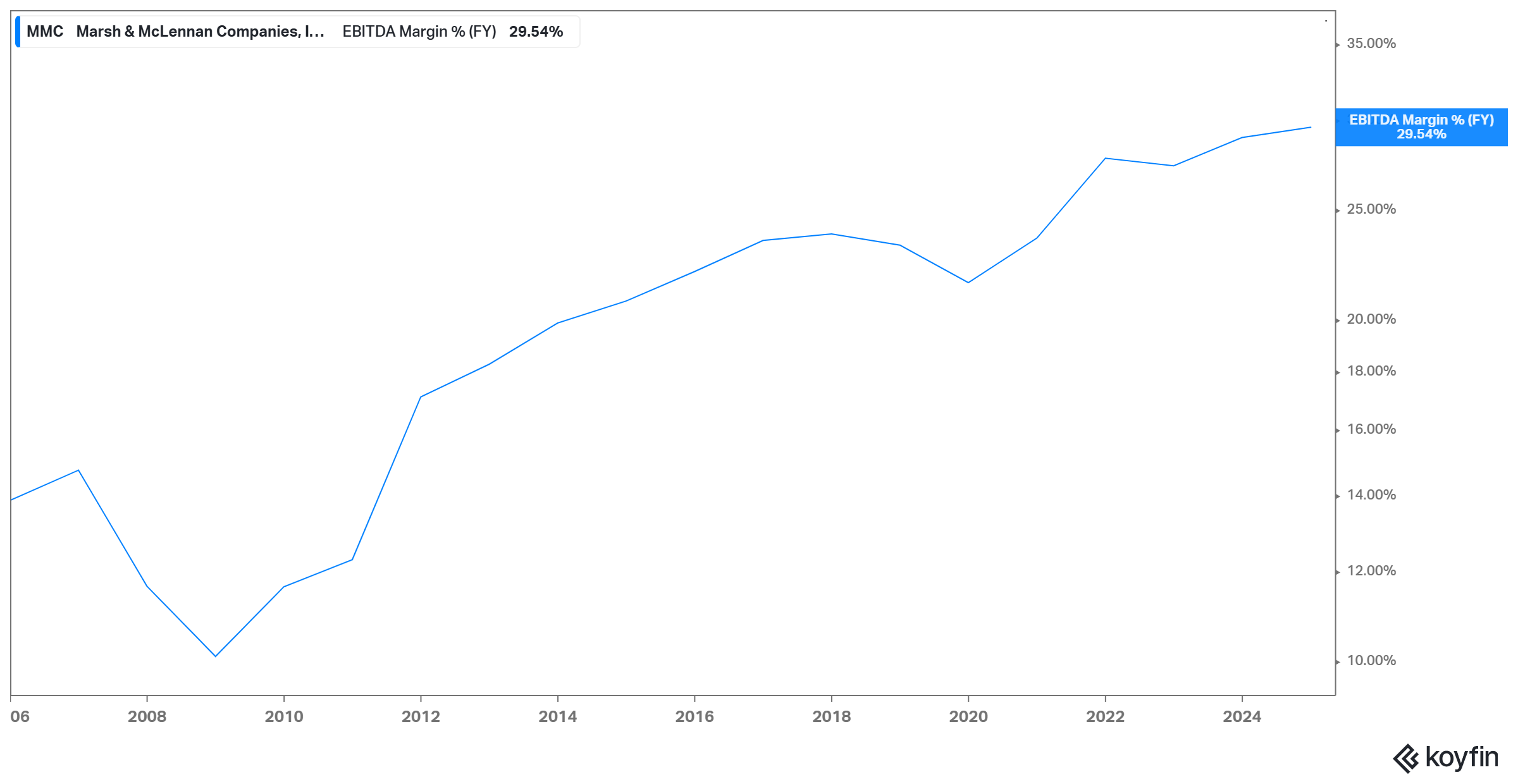

For the full year, MMC guided for MSD organic growth and margin expansion. It’s remarkable to see how much the margins have expanded here over time.

One particular comment from the call stood out about how they’re using AI to negotiate better terms for their customers:

We have $1.12 trillion of premium that we've analyzed and over $100 billion of claims are in our databases that gives us a unique insight into that. And most recently, one of the AI tools that we've done is we've laid over an agentic tool over our claims database, and so clients can interrogate that, we can track comparators between how insurance companies pay their claims over which space, which puts us in a good position to negotiate great terms for them.

Some notes from AON Call

What did Aon say about their organic growth drivers? From the call:

In the quarter, new business powered organic revenue growth and contributed 11 points, with an equal contribution from both new clients and expansion with existing clients.

Net new business contributed 5 points to organic revenue growth in the quarter. Net market impact, which captures the impact of rate and exposure, contributed approximately 1 point to organic revenue growth, consistent with our 0 to 2-point estimated range. Reinsurance was down from rate declines and higher retentions, and rate pressure in Commercial Risk was offset with limit and coverage increases across our book. Health and Wealth both benefited from positive net market impact with rising health care costs and favorable asset performance supporting growth.

Revenue-generating headcount is up 6% through the first half, and these colleagues are equipped with advanced data analytics and capabilities from ABS, enabling them to win more business. We continue to expect these investments to support sustainable organic revenue growth, with the 2024 cohort projected to contribute 30 to 35 basis points to full year organic revenue growth.

NFP acquisition seems to be going well. All the previous guide for synergy remains on track. NFP closed 8 acquisitions with aggregated $20 million EBITDA.

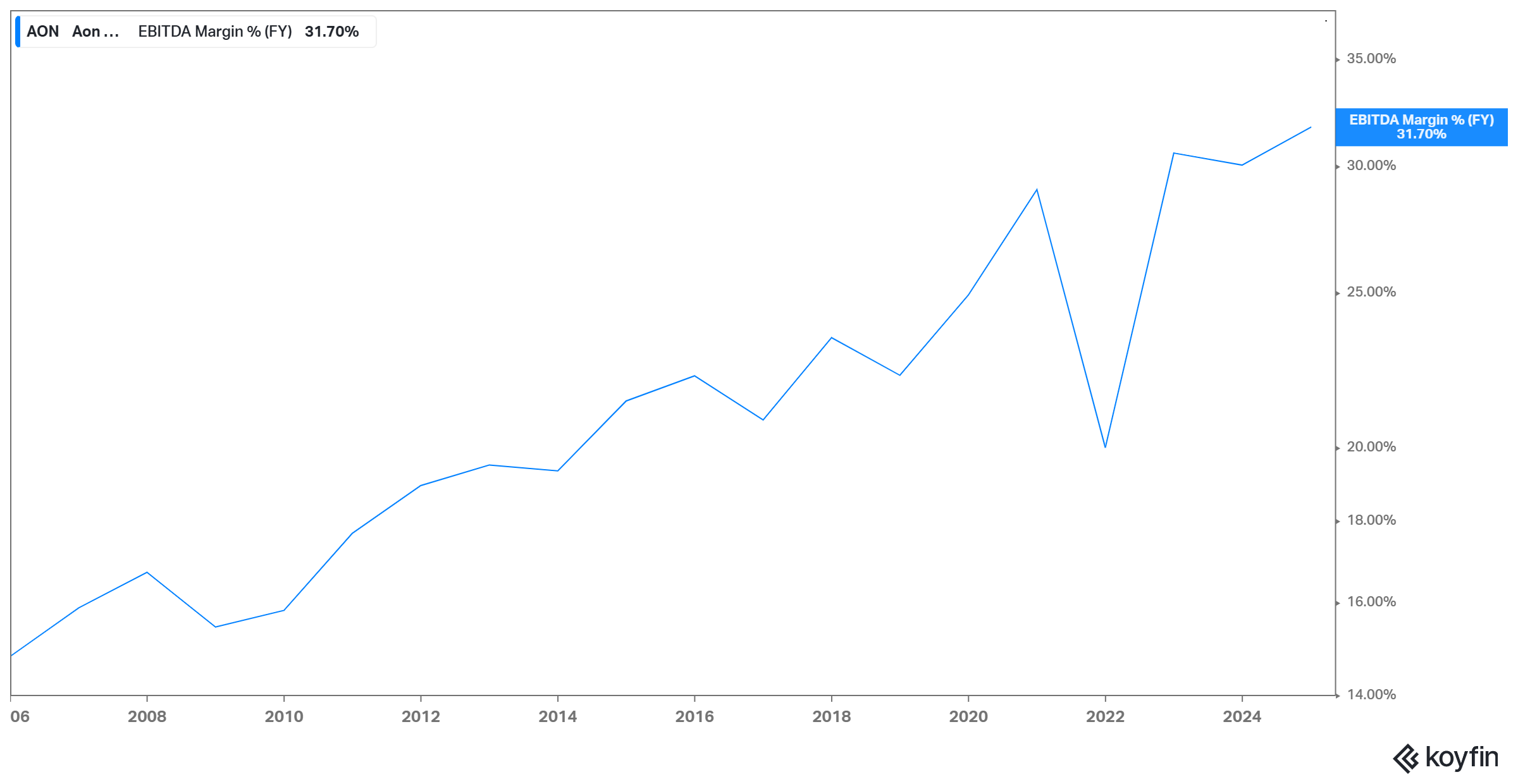

AON too reaffirmed their full year guidance of MSD (or greater) organic revenue growth, and 80-90 bps of margin expansion. Like MMC, Aon’s margin expansion history is also pretty impressive.

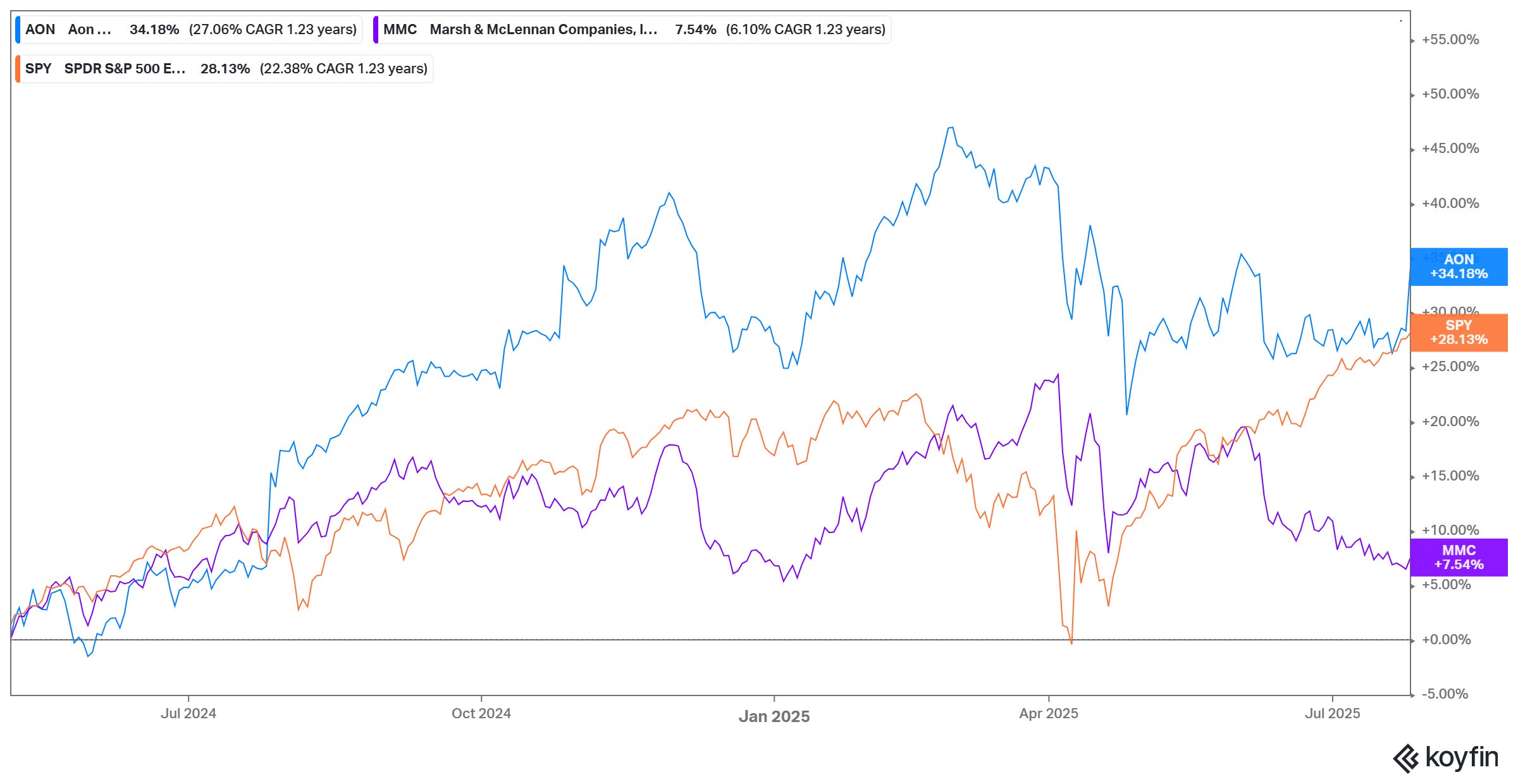

Since I bought Aon last year, they have performed noticeably better than MMC. I will share some thoughts behind the paywall what I’m thinking today about exposure in insurance brokers.

In addition to "Daily Dose" like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 61 Deep Dives here.

Prices for new subscribers will increase to $30/month or $250/year from August 01, 2025. Anyone who joins on or before July 31, 2025 will keep today’s pricing of $20/month or $200/year.