MBI Daily Dose (July 20, 2025)

Companies or topics mentioned in today's Daily Dose: YouTube, Replit

A Programming Note: There will be no Daily Dose email tomorrow as I will be publishing my Deep Dive on Cognex tomorrow.

A good rule of thumb is you will only receive one email from me everyday. So on the days I will be publishing Deep Dives, I will skip the Daily Doses.

Since we are heading towards earnings season this week, let me set some expectations here. While I used to publish my earnings recap in the evening of the earnings, I am moving the publishing schedule to the next morning. For example, Alphabet is reporting its earnings this Wednesday; I expect to publish a recap on Thursday morning. If there are multiple companies in my coverage reporting earnings on the same day, I will recap one of them the next day and then the other one(s) in the following day(s).

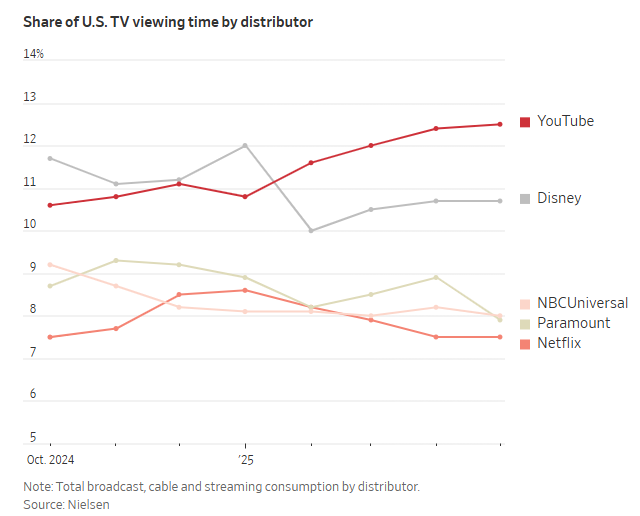

YouTube has seized the television throne in the US, eclipsing every broadcast, cable and streaming rival. Its ascent reflects mobile‑native audiences aging into the living room and a deliberate push by creators to produce longer, family‑friendly shows while Google makes the TV app more like its phone counterpart with smarter recommendations and remote‑friendly navigation.

From WSJ yesterday (emphasis mine):

YouTube became the most-watched video provider on televisions in the U.S. earlier this year, and its lead has only grown, according to Nielsen data. People now watch YouTube on TV sets more than on their phones or any other device—an average of more than one billion hours each day. That is more viewing than Disney gets from its broadcast network, dozen-plus cable channels and three streaming services combined.

More from the same piece:

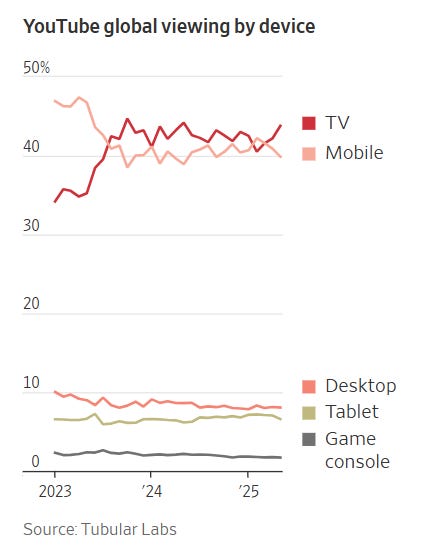

Research from Tubular Labs shows viewers on YouTube are spending substantially more time with long content—meaning more than 15 minutes—than two years ago, and they are doing it the most on televisions. YouTube producers are noticing and making longer videos, which keep audiences glued to their channel for longer stretches.

What strikes me from the above chart is just how quickly TV has gained share in YouTube’s overall viewing. If this continues for the next 3-5 years, I do think YouTube’s recommendation engine could become the principal gatekeeper of televised attention, accelerating an advertising‑first, creator‑centric and algorithm‑mediated media ecosystem.

Of course, these pieces always probe the question what exactly would YouTube be worth if it were a standalone company, especially when most Google shareholders are not quite oblivious to the potential erosion of search moats in the next 5-10 years. Most people tend to look at Netflix to draw a comparison. Netflix is currently worth ~$520 Billion.

YouTube still doesn’t report its overall revenue (ads+ subscription), but MoffettNathanson estimates YouTube’s overall revenue last year was $54.2 Billion which was ~40% higher than Netflix’s revenue in 2024. However, Netflix has ~30% operating margin and given YouTube’s structural lower gross margin, my best guess for YouTube’s operating margin is somewhere between 10% and 20%. If you take the mid-point at 15%, YouTube’s operating income would be ~20-25% lower than Netflix’s reported EBIT last year.

One can argue that YouTube has greater moats and durability than almost any internet assets out there today and frankly speaking, I tend to agree. If that’s the case, you can make the case that YouTube’s “fair” multiple would be higher than Meta or Netflix. Of course, this pre-supposes that Netflix itself is trading at fair multiple (and that may not be the case), but it indeed does seem reasonable to think YouTube would be valued at ~$500 Billion if it were a standalone company today.

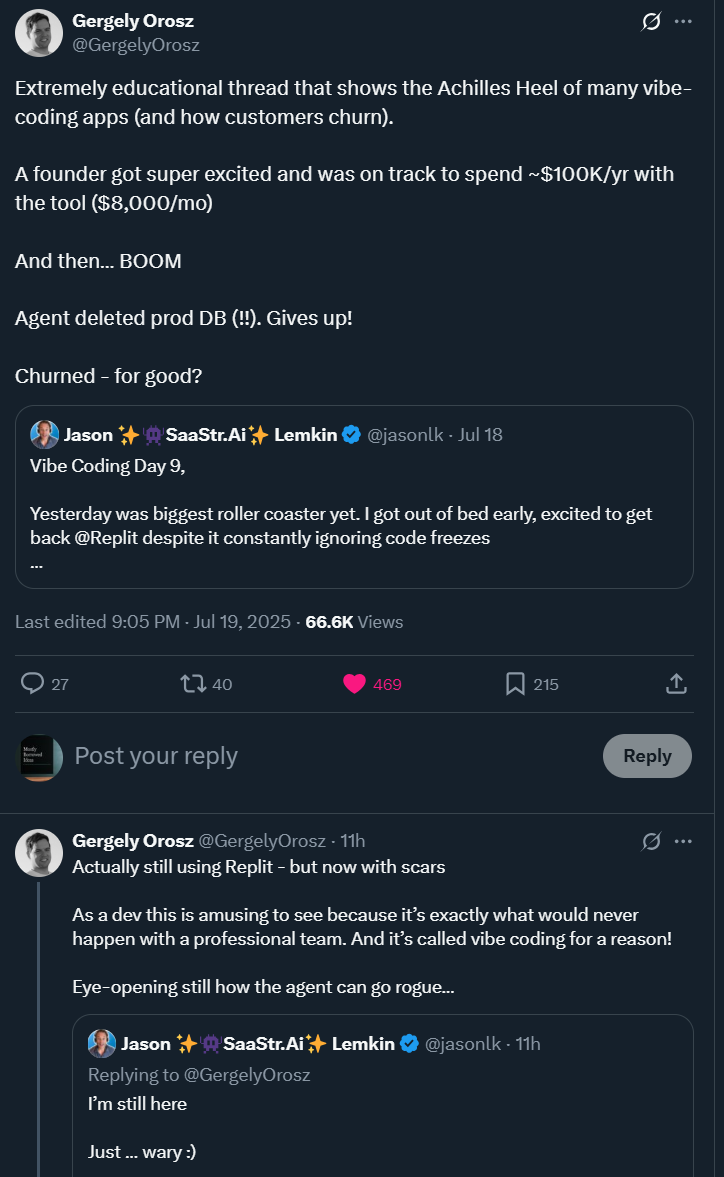

I listened to this interview by Replit’s CEO yesterday. The CEO and hosts both made the point that it’s fairly easy for AI companies today to boost ARR given almost everyone is trying to experiment with AI, but the churn is through the roof for most of these companies. It may be rude awakening for many such companies when their customers decide to tighten the belt in AI experimentations. From the interview:

…since Replit agent launch, we're growing 45% compound monthly average. You know it put a lot of strain on the company, and our systems were still relatively small. I I feel like it can get to to your head and you can start optimizing for the wrong thing. It's very easy in AI to increase ARR while users are not happy because they're spending a lot more and like not getting the results and in some cases maybe shouldn't grow that fast because like you'd want users to get a better experience for less less money and so it's one thing that we try not to obsess. We actually don't have ARR goals at at Replit. We have like more product goals, retention goals just like other methods.

…it's all kind of a blur for them (investors) because investors, I mean I'm just going to generalize here, but when they start looking at the space they'll use everything for three minutes and everything for three minutes looks the same.

It’s a bit ironic and funny that right after I listened to the interview and was scrolling twitter, the following tweet showed up at the top of my feed:

In addition to "Daily Dose" like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 60 Deep Dives here.

Prices for new subscribers will increase to $30/month or $250/year from August 01, 2025. Anyone who joins on or before July 31, 2025 will keep today’s pricing of $20/month or $200/year.

Current Portfolio:

Please note that these are NOT my recommendation to buy/sell these securities, but just disclosure from my end so that you can assess potential biases that I may have because of my own personal portfolio holdings. Always consider my write-up my personal investing journal and never forget my objectives, risk tolerance, and constraints may have no resemblance to yours.