MBI Daily Dose (July 17, 2025)

Companies or topics mentioned in today's Daily Dose: Google, US innovation, Aging gracefully

“Search Engine Land” published some interesting data about the evolution of Google Search post-AI Mode launch. Some key excerpts from the piece:

The biggest shift has been from 1-2 word keywords to 3-4 word search terms.

Short queries dropped from 42% in January to just 31% in June – suggesting users are increasingly communicating in more natural language.

Shorter keywords have a CTR drop of 50%. Keywords with more than eight words are down by 26%.

Shorter keywords accounted for 76% of conversions in January, but dropped to 50% by June.

Three- and four-word queries now make up 40% of conversions, up from 20% in January.

Clearly, search behavior is changing, but instead of clinging onto to the old search model, Google seems to be evolving just as fast. In fact, Eric Seufert recently quoted a survey by Oppenheimer to point out an intriguing data point:

…of users familiar with AI Mode and who pay for ChatGPT, 82% find AI Mode more helpful than Google Search and 75% find AI Mode more helpful than ChatGPT.

Admittedly, this surprised me because of two things: a) these ChatGPT users in this survey are paying subscribers (my initial reaction was they must be comparing free version of ChatGPT vs Google’s AI mode), and b) I personally would respond differently in this survey. Having said that, sample size in this survey was only 263, so not sure how representative this is for more broader population. In any case, I do think the real fight between ChatGPT vs Google is on the free users. If Google AI mode is deemed decisively better than ChatGPT’s free version, users will have no compelling reason to shift their decade long search habits, and Google search can survive and thrive just fine.

Speaking of Google thriving, Ben Thompson wrote a piece yesterday that has profound positive implications for Google. Thompson highlighted how Cloudflare is trying to reshape the open web by forcing AI crawlers pay for content. This is potentially a bad news for model developers’ margins unless you are Google. From Ben Thompson’s piece yesterday:

Google, which has two crawlers.Googlebotcrawls the web for Google search, whileGoogle-Extendedcrawls the web to capture data for Gemini. What is critical to understand, however, is that data for Google Search AI products — including AI Overviews and AI Mode (i.e. the search funnel) — is gathered byGooglebot; that means that if you want your website to show up in Google Search you have no choice but to have that data also be used by any AI products that are under the Search umbrella.

Just to be clear, what Cloudflare is doing is not simply amendingrobots.txt; rather, they are straight-up denying access to AI crawlers — again, except forGooglebot, which a Google executive confirmed in court captured data for use in Search AI products

In short, Cloudflare is actively helping Google’s competitive position, insomuch as Google’s most important AI product is in fact Search

I am not super confident that Google can maintain these terms as I imagine Google’s SOTA model competitors will highlight these terms to the regulators and force a level playing field. If such attempts to level playing the field are not successful, this would be a decisive competitive advantage for Google. Of course, if the chatbots need to pay for content, they may try to be much more careful in crawling the number of pages before answering a query or running deep research which can hurt answer quality.

Frankly speaking, these terms do seem unfair. I can digest the argument “AI overviews” as part of the core traditional search experience, but including “AI mode” in “Googlebot” terms feels a bridge too far. AI Mode has a chat like interface too which makes it functionally no different than something like ChatGPT. If ChatGPT needs to pay for content, so should “AI Mode” in Google.

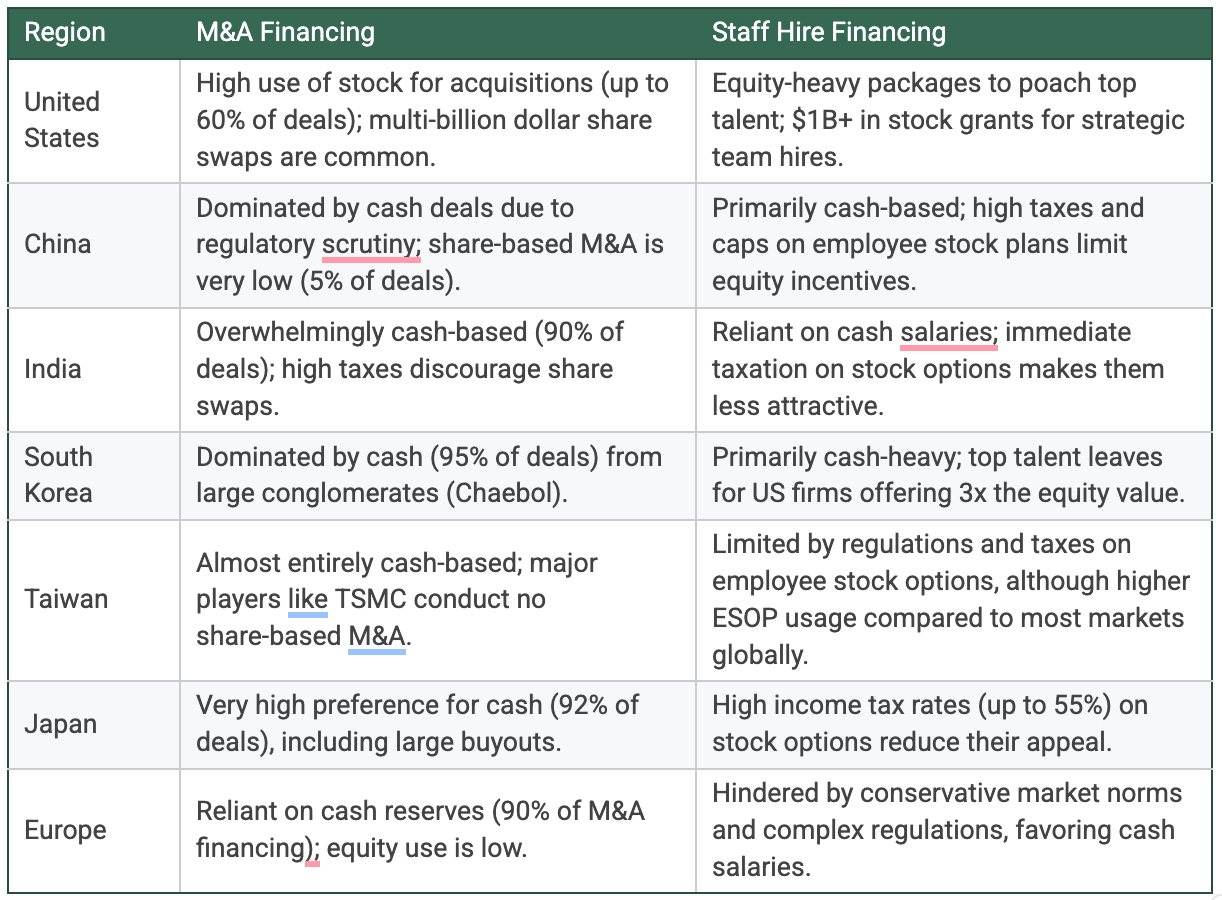

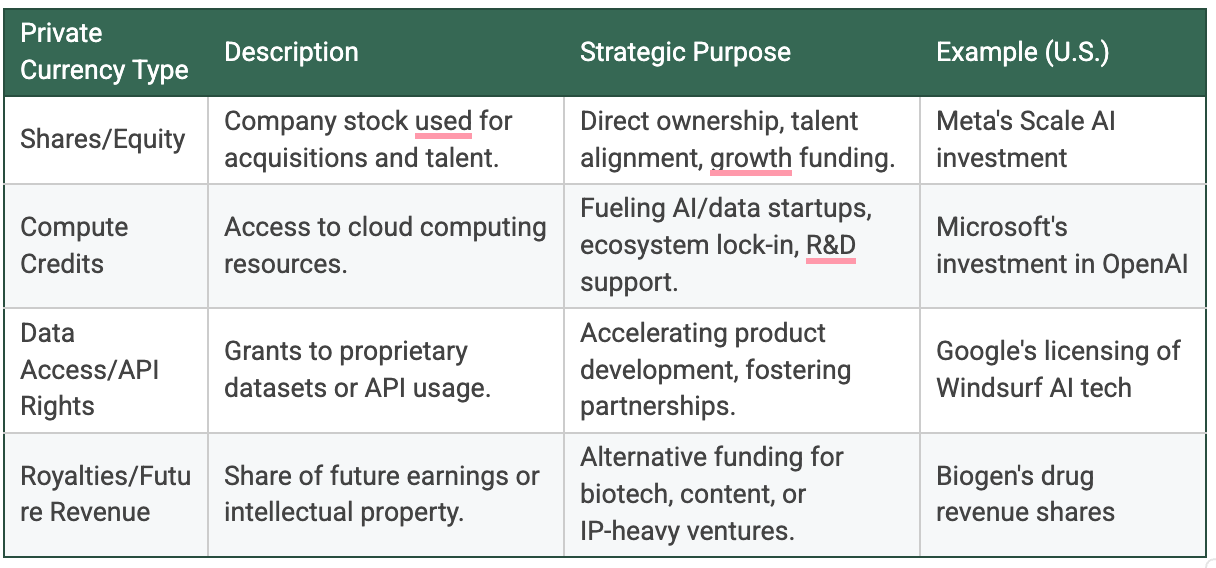

Nilesh Jasani made an interesting case that one of the true innovation edges for US is its companies’ willingness to wield highly valued shares and even cloud‑compute credits as a de facto private currency, letting them fund outsized acquisitions, poach talent and embark on decade‑long AI‑era capex at an exceptionally low cost of equity. I was a bit surprised to know how cash is the decisively dominant currency for deals everywhere else outside the US.

Regions where valuations and dilution tolerance are lower must rely on cash, limiting strategic flexibility and putting them at risk of falling irreversibly behind in the global innovation race. While many people bemoan innovations in financing, this piece points out the other side of it:

Giants like Microsoft, Amazon, and Google strategically offer cloud computing credits to startups and AI innovators, effectively investing through services rather than direct capital.

Such credits are often seen by purists, including us at times, merely as receivables or deferred revenue, but the reality is far richer. These arrangements provide critical support for cash-strapped innovators, who receive significant resources without immediate financial burden, enabling rapid scaling of ideas. Moreover, this approach locks promising startups firmly within the hyperscalers' ecosystems, ensuring a future revenue pipeline and industry alignment.

In addition to "Daily Dose" like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 60 Deep Dives here.

Prices for new subscribers will increase to $30/month or $250/year from August 01, 2025. Anyone who joins on or before July 31, 2025 will keep today’s pricing of $20/month or $200/year.

I came across a very interesting data point about aging which is worth highlighting. From a piece by Goldman Sachs:

In addition to living longer, people are also living healthier lives, in the sense that the functional capacity of older individuals is improving over time. A recent IMF study, using micro-data of individuals aged 50+ (including physical and cognitive tests) from a sample of 41 developed and emerging economies, found that “on average, a person who was 70 in 2022 had the same cognitive ability as a 53-year-old in 2000”, while the physical frailty of a 70-year-old corresponded to that of a 56-year-old in 2000. Measured in years, these improvements are larger than the reported increases in life expectancy, emphasizing the need to focus on biological rather than chronological age.

This feels like a big deal, especially given the increasing aging population across the world. If our cognitive and physical ability can be sustained for an extended period of time compared to before, perhaps we can age more gracefully than earlier generations did.

Another interesting data from the same piece:

while median expected life expectancy in developed economies has increased by 5% since 2000 (from 78 to 82 years), the median effective working life has risen by 12% (from 34 to 38 years) and the share of the total population in employment has increased from 46.0% to 48.3%.

Current Portfolio:

Please note that these are NOT my recommendation to buy/sell these securities, but just disclosure from my end so that you can assess potential biases that I may have because of my own personal portfolio holdings. Always consider my write-up my personal investing journal and never forget my objectives, risk tolerance, and constraints may have no resemblance to yours.