Why we need Intel foundry spin-off, funded by a mag7 consortium

In July 2024, I appeared on Liberty’s podcast to discuss semiconductor industry. Near the end of the podcast (43 minute), I proposed an idea that I considered to be potentially a wild but reasonable idea.

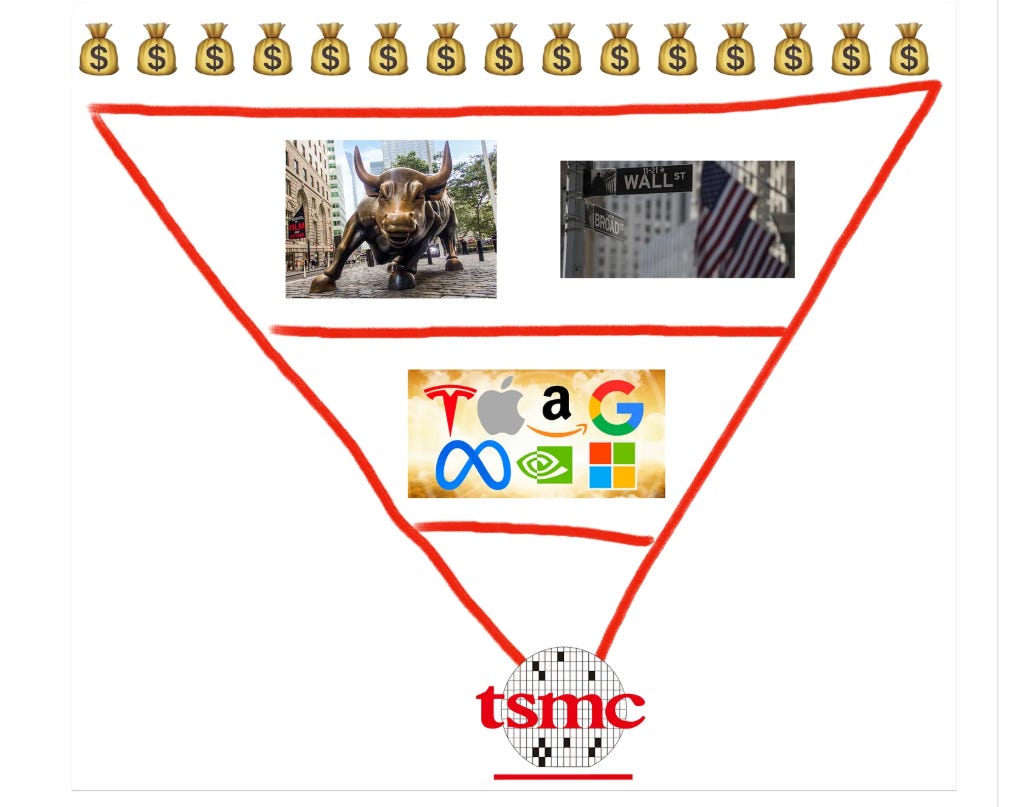

The global tech ecosystem is dangerously reliant on a single point of failure: TSMC. This concentration of advanced chip manufacturing in a geopolitical hotspot poses a profound systemic risk, visualized as an inverted pyramid where TSMC supports tens of trillions of dollars in global market capitalization, alongside critical national security infrastructure. For the visually inclined, Liberty later showed the below diagram.

A disruption in Taiwan would not merely cause a temporary shortage; it would likely trigger a severe global recession and potentially halt the trajectory of technological progress. The "Magnificent Seven" (mag7) tech giants, whose valuations and operations are almost entirely dependent on uninterrupted access to leading-edge silicon, are particularly exposed to this catastrophic tail risk.

To mitigate this vulnerability, my “wild” idea was to spin off Intel’s foundry division into an independent, dedicated manufacturing company, primarily funded by a consortium of the Mag7. While government subsidies distribute costs across the entire tax base, the primary beneficiaries of a resilient supply chain should assume a more direct financial stake.

If you asked “what keeps you up at night” to every single CEO of mag7, Taiwan risk would probably be up there for all of them. The current reliance on TSMC represents an unacceptable strategic vulnerability. By forming a consortium, they can at least give their best shot to a viable, Western-based alternative although success is, of course, far from guaranteed.

Intel has historically lacked the customer-service orientation required for a pure-play foundry. A spin-off, however, would provide the singular focus needed to excel, free from the conflicting priorities of Intel’s integrated model. Operating with a startup mentality and offering fresh equity incentives would make the entity far more attractive to top engineers as well.

If each of the mag7 contributed, for example, $10 billion (which isn’t a massive number for any of the mag7 and can be disbursed over multiple years which will make it even easier), the resulting capital would radically accelerate the foundry's development. The opportunity cost of this investment pales in comparison to the trillions in market value that would evaporate if access to TSMC were compromised. Despite potential coordination challenges among these competitors, this collaborative investment is perhaps a necessary insurance premium to secure the future of the economy itself.

Why am I writing about this today? During the weekend, I was listening to Dan Kim’s interview with Ben Thompson. Mr. Kim is the former chief economist and director of strategic planning and economic security at the U.S. Department of Commerce for its CHIPS for America program. During the interview, Mr. Kim suggested quite a similar idea as I did. It was a bit gratifying to understand that perhaps it wasn’t such a wild idea after all. Read the excerpt of the relevant section below (BT= Ben Thompson; DK=Dan Kim):

BT:I think the scale of devastation that would come from a Taiwan war is drastically understated and underappreciated, but there is a bit where we don’t have the luxury of thinking about the trailing edge if Intel goes out of business, because guess what? The trailing edge for the next 100 years is screwed, so we’ve got to get this one right first.

DK: No, you have to seed it, so we’re focusing on one particular problem, but the demand driver, so one very small solution that I thought of when I was at CHIPS was, okay—

BT: Before you move on, I want to put a pin in what you just said because I think it’s brilliant, I think it’s the answer. I’m annoyed I didn’t write this in my Article, which is — this is exactly it — Intel is saying we need a customer, the answer is not to give them a customer, it’s to give them all the customers.

DK: Every customer.

BT: That is it’s introducing economic inefficiency, but it’s socializing the harm of doing this. In this case the US has the leverage to do it. Micron was going to complain or I don’t know if it’s going to be founding, memory’s a whole different thing, but just as an example, because that’s a US competitive space where they’re competing with SK Hynix and a Samsung. In that case, you don’t want to unfairly impinge on one, you need to do it all and I just want to double down before you move on to your point to say, you nailed it. That’s exactly it. That is exactly the next step. That makes sense.

DK: I’m not actually suggesting that any of this is a good idea, I think we all recognize that these are just-

BT: They’re all horrible ideas, it’s choosing the least bad one and in that context, I’m saying that is a good idea, it’s a good one.

DK: If I were in a company situation, I would hate this. Meaning if I were in a customer situation, I would hate all of this. But in the spirit of having the least bad idea, lets at least choose an idea that’s equally terrible for everybody.

BT: Exactly.

DK: Where they share it.

BT: It’s a tax. Taxes suck for everyone, but they’re equally applied and this is the Intel Tax. What you’re proposing is the Intel Tax.

DK: And it could be that maybe the outcome in 2035 looks like in which maybe there is no Intel that we recognize it as today, but it’s like a joint venture among all the leading edge customers as an alternative to TSMC, and you call it whatever you want. Maybe it’s Intel, maybe it’s something else, but they all have a stake in the game.

BT: Here’s the thing though, don’t you have to split Intel to do this though? One of the problems is no one trusts Intel, no one has trusted Intel for decades, that’s a big problem here. And yes, they’re talking about putting up a firewall and separating all these sorts of things, but if you’re going to go all in and you’re going to break every single norm, at what point should you just say, “You know what Intel Products, you go somewhere else”? We know we need your products for volume, that’s the argument to keep Intel together is, Intel is the core customer that gives volume for these new nodes, but at the end of the day, if we’re going to mandate volume, don’t we need to cut the Intel Product organization out?

DK: Well, this is where I would think if we were to steelman your argument even further, which is the government should take a stake, but maybe all the customers should take a stake too, and then they dictate what trust looks like that’s good enough for them to be able to use them. Maybe it’s complete separation, maybe it’s some other system, but the point is that the customers then dictate instead of saying, “We don’t trust you”.

BT: If you’re going to force them to do this, they should get the financial upside too. They should have the input upside as well.

DK: Not even the financial upside. I’m not sure if any customers will look at this and look at it as a financial investment.

BT: We’re not recording video, but I was smiling cheekily because yes, I completely agree with you.

DK: Again, just also underscoring the point, I’m not suggesting any of these are good ideas or even endorsing it, but these are some creative ideas that you could be thinking about as to like, “Okay, break the glass scenario, here we are, let’s solve it”. One parallel problem that I thought about when I was at CHIPS was, “If there is a dominant foundry and there’s such a demand for the chips that TSMC would make in Arizona, then presumably they could demand the price premium for that, if there is such a demand”. In that case the government-

BT: Well, that’s what’s happening, they are getting a price premium.

DK: Well, the way that I thought about it was, is it then the government’s position to say to these customers, “You pay for that fab because it’s either you pay for it or the taxpayer pays for it”. In some ways, if I give money to this company that could demand the price premium then are not in effect giving that money to an Nvidia or an Apple from a government perspective, and that made me very uncomfortable until it became very clear that you actually did need the incentives to push them to commit further, so I made peace with that.

But then it also got me in a really uncomfortable position of then what is the government’s role then? Only fund losers that the industry doesn’t want to fund? But is that really where the best thing is, or do you actually also want to fund some winners too? These are all interesting philosophical questions about industrial policy, but the principle of having the customers having a skin in the game and having that turn into a demand driver that is enduring, I think is a principle that the government should think about for sure.

These all make sense to me. I really hope someone at the current US administration is indeed exploring such an idea. This isn’t, of course, an ideal scenario; US government shouldn’t exert pressure on companies to invest in a particular company, but given the current administration’s penchant for pursuing unusual ideas, I won't be surprised if something like this is also on the table (I hope it is)!

In addition to "Daily Dose" (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 62 Deep Dives here.

Current Portfolio:

Please note that these are NOT my recommendation to buy/sell these securities, but just disclosure from my end so that you can assess potential biases that I may have because of my own personal portfolio holdings. Always consider my write-up my personal investing journal and never forget my objectives, risk tolerance, and constraints may have no resemblance to yours.

My current portfolio is disclosed below: