Why I may have underestimated the potential for Airbnb Experiences

Brian Chesky has made quite the uproar in re-launching Airbnb Experiences in the last 6 months. As far as I can tell, almost none of the investors shares remotely the same enthusiasm about experiences as Chesky appears to do. I too was more on the “unenthusiastic” or “indifferent” camp when it comes to Airbnb’s potential in experiences, but after studying this market a bit, especially after 3Q’25 earnings, I am starting to appreciate Chesky’s enthusiasm.

The data point that really woke me up here is when Chesky mentioned the following:

“in Q3, almost half of the people who booked an experience did not have an Airbnb stay. So we’re giving people another reason to use Airbnb.”

If you asked me to guess this number, I would probably say somewhere close to ~10-20%. I think it’s a pretty big deal that Airbnb seems to be able to find customers only for “Experiences” which makes experiences not just a mere services that you cross-sell when someone books a Stay on Airbnb, rather a new market or use case that can deepen the relationship.

Moreover, even though Chesky used to have a somewhat condescending tone when it comes to the typical tourist experiences and activities and why Airbnb’s “differentiated” supply would stand out, he seems to have a change of heart here. I liked how he segmented the experiences market in three categories and Airbnb’s willingness to participate in all of them. From the call:

“one of the lessons we learned in Paris for experiences, for example, is that there are really 3 types of travel people. There’s people where it’s their first time to a city like Paris. There are people who’ve been to Paris repeatedly and then there’s local. And that each of them want totally different types of supply. So for people for whom it’s the first time to a city, they really want to go to landmark. They want see Eifel Tower…And this is really what you see when you see other platforms where they’re really focused on traditional tourist experiences. So we’ve been adding a lot of landmark experiences. We think we provide some of the very best high-quality experiences. They’re very local in nature, but they’re very much appealing to first-time visitors to a city. And this has been very, very popular. Then you’ve got people who’ve been to the city already. This is nearly as big and in many cities, it’s a bigger market.

A lot of people that go to Paris, they have been there before. If it’s your second or third time to Paris, you’re not going to see Eifel Tower. You want to see something different. So now you want more local experiences. You might want to do a cooking class. Now you might do some other type of activity. And then locals want to do something really unique...They want to book originals. And so we see these 3 audiences, and that’s been really interesting. And the year-over-year growth in Paris has been very encouraging.

In Paris, 70% of Airbnb originals are booked by locals. And so we think with Airbnb Originals, we’ve figured out a product that is appealing to people in their own city.”

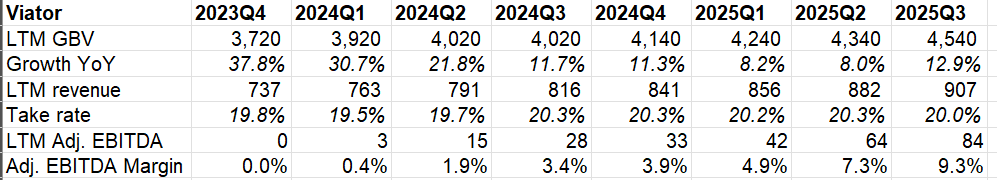

It is also worth noting that Viator, one of the leaders in Experiences market, has seen their growth accelerate to low double digit in the recent quarter. However, I was always a bit underwhelmed when I looked at Viator’s numbers. If one of the leading players only generate ~$4.5 Billion Gross Booking Value (GBV), it doesn’t seem that exciting to enter such market, especially given Airbnb’s ~$90 Billion LTM GBV today.

Nonetheless, one of the things that really prompted me to update my thinking about experiences potential is when I went through Klook’s IPO filing.

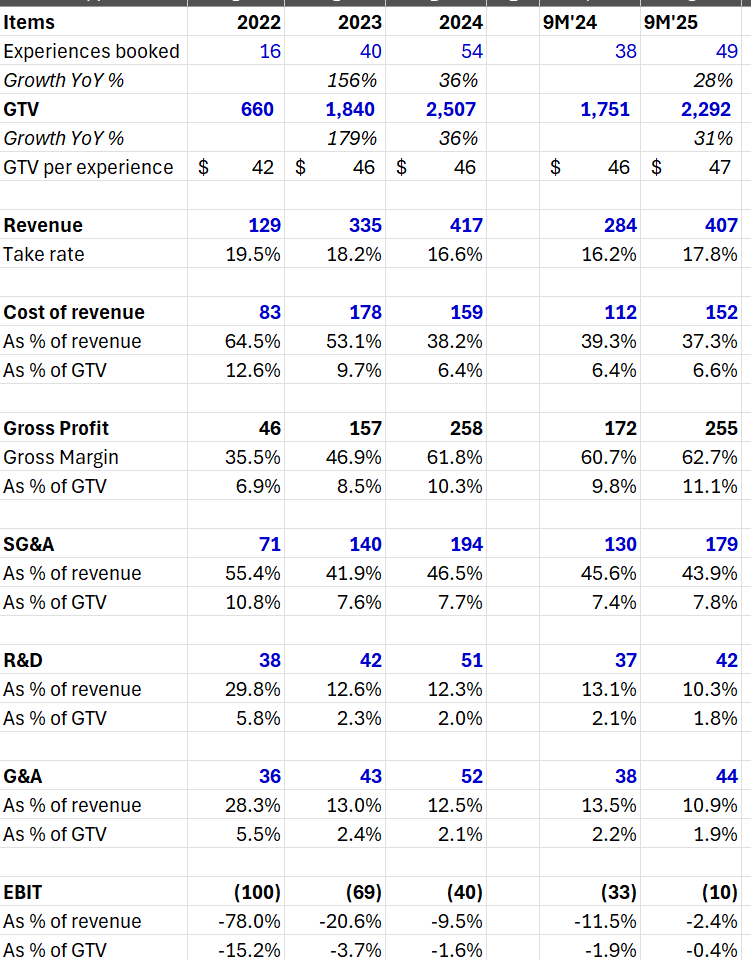

Most of you may not have heard about the company, but Klook is one of the leading players in the Asia-Pacific (APAC) region aggregating attractions, tours, transport etc. ~80-90% of their revenue came from APAC region in the last three years. Despite such a narrow regional focus, their Gross Transaction Value (GTV) actually increased from $660 Million in 2022 to ~$3 Billion in 2025. Their GTV grew ~179% in 2023, but this primarily reflects the post-pandemic pent up travel demand; please note that APAC region generally lagged most of the world in terms of opening up post-pandemic and relaxing travel restrictions. In any case, given they are still growing at ~30-35% in 2024 and 2025, you can see even the normalized growth rates is pretty healthy for Klook.

SoftBank-backed Klook raised more than ~$1 Billion to get to $3 Billion GTV. However, I’m not sure the company used to be quite well run. The crazy thing is they mentioned they had 3% more employees in 2019 than they do today. For context, their GTV back in 2019 was $918 Million which means their GTV became ~3x despite reducing headcount in the last 6 years. The decoupling of labor and capital is increasingly more global!

Klook’s current take rate is hovering around high teen (for context, Airbnb’s experiences take rate is 20%); I suspect things such as transportation may have lower take rates than attractions. GTV per experience was almost $50 for Klook which is admittedly higher than I would imagine. While only ~25% of Airbnb’s gross profit is spent on S&M, Klook spends ~70-75% of their gross profit in marketing. Interestingly, they mention ~70% of their traffic comes organically and they seem to have more focus on leveraging social media (e.g. Klook Kreator program).

Thanks to their more prudent approach to headcount, the company is now profitable in adjusted EBITDA level and almost breakeven this year in GAAP EBIT basis.

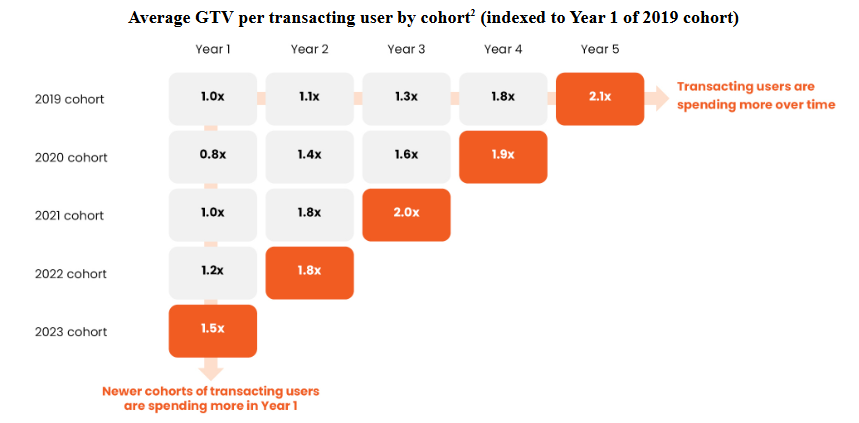

While the overall number itself can clearly show the impressive growth in recent years, I was more encouraged to see their cohort level data. Not only transacting users are spending more over time, the newer cohorts are also spending more compared to earlier cohorts. As of 2024, they had 10.7 million annual transacting users from 200 geographic markets. Given the total experiences booked in 2024 was 54 million, it implies the average transacting users are using the app at least five times a year or once every two months. If Airbnb can get to such engagement level in the next 5 years, you can sense why it can become a needle mover for them. More importantly, I think if Airbnb can graduate from an app that you open a couple of times a year to a couple of times a month, it can also open up the opportunity to cross-sell other products/services than they are going to launch.

Of course, in a marketplace, you need both demand and supply. Again, I was surprised to see Klook had only 310k offerings in their platform (which itself has grown ~30% YoY). For context, Airbnb mentioned they received 110k applications from Experiences hosts just in 3Q’25 (although they haven’t disclosed how many of them were accepted). Given Klook’s number of offerings, it implies an average merchant hosted ~176 experiences per year. This number tells me Klook is likely much more focused on scaling the first category of experiences that Chesky highlighted. Klook also mentioned “merchants who made a sale on our platform in 2023 generated 127% of their 2023 GTV in 2024”.

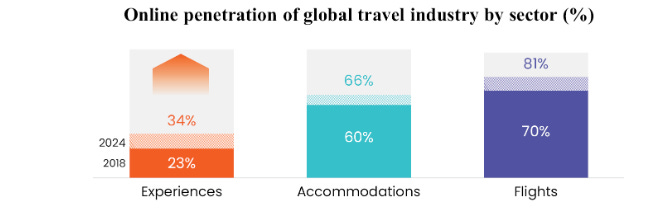

Klook highlighted that experiences lagged in terms of online penetration compared to accommodations and flights. However, given the pace of increase in penetration from 23% in 2018 to 34% in 2024, it seems rather safe to assume that this penetration is pretty much one way street and has ample headroom for future growth.

Overall, it is quite telling that even just an APAC focused experiences platform managed to build a $3 Billion GTV business. Given Airbnb’s global marketplace, I would actually be disappointed now if they don’t generate $5 Billion GBV from experiences in 2030. If they do get there, Airbnb may generate $1 Billion revenue from Experiences in 2030 (assuming ~20% take rate) which is ~10% of their current revenue. They should have a structural CAC advantage compared to almost any other region specific marketplace. As alluded earlier, if Airbnb can make experiences successful, there may be additional benefits that can accrue to the marketplace even beyond Experiences revenue or profit contribution. If they can graduate to become an app that you want to use on a monthly basis, it may lead to much more compelling opportunities that Airbnb can pursue in the coming years!

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 64 Deep Dives here.

Current Portfolio:

Please note that these are NOT my recommendation to buy/sell these securities, but just disclosure from my end so that you can assess potential biases that I may have because of my own personal portfolio holdings. Always consider my write-up my personal investing journal and never forget my objectives, risk tolerance, and constraints may have no resemblance to yours.

My current portfolio is disclosed below: