What if there's an overinvestment in AI?

A programming note: In case you missed it, I published my Deep Dive on ASML yesterday which you can read here.

Without the benefit of hindsight while it can be hard to figure out where we are in the AI capex cycle, it is extremely likely that we will at one point end up overinvesting in AI. Both Alphabet (see 2Q’24 call) and Meta (see Zuck’s recent comments) pretty much explicitly expressed their desire to err on the side of overinvestment than under-investment. The inevitability of overinvestment was eloquently explained by Byrne Hobart a couple of months ago:

“The only way for the GPU industry never to have a down cycle, even if the face of growth, is some combination of:

- Every single person who can make big capital spending decisions chronically underestimates long-term AI demand. (If even one of them doesn’t, that person is a larger share of the next round of capital allocation decisions.)

- It’s a straight shot from here to the Singularity.

In any other case, there will still be an air pocket or two; even if spending rises 30% annualized, there will be times when it’s closer to 25% and the capex for that period supports something more like 35% growth.

And a good working explanation for why cyclicality won’t go away is that Mag7 executive who had read the above description of cyclical dynamics in AI capex a few years ago, taken it to heart, and decided to spend less than planned would have ended up regretting that choice.

Many cyclical industries were born as growth industries. Airlines had great returns in the 1960s, automakers did similarly well in the 1920s (in the aggregate, with many failures made up for by a few huge success stories), and in the chip industry the slowest growth from 1950-60 was just over 40%, in 1960. (The next year, the industry shrank year-over-year for the first time, and settled into a cycle thereafter)”

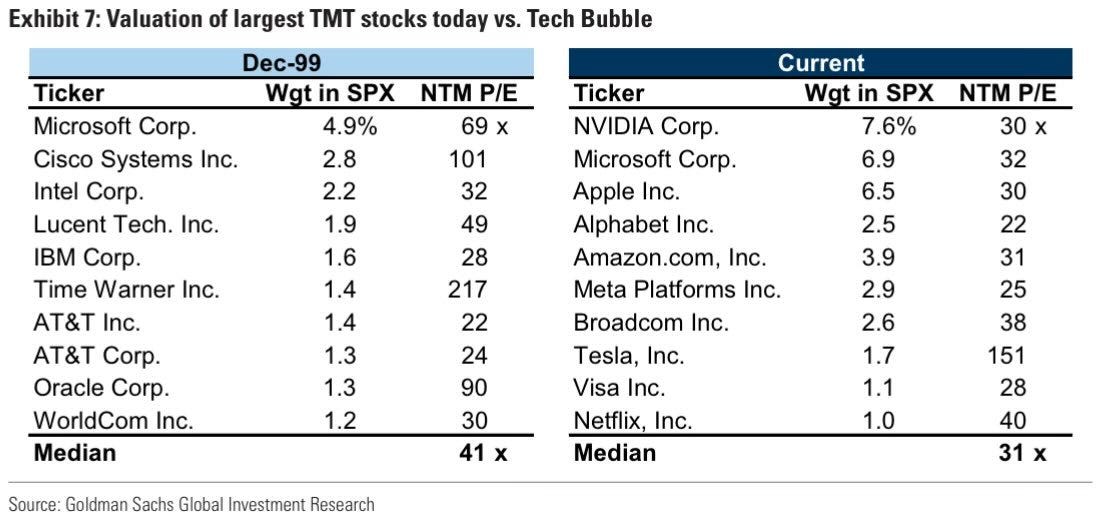

Since overinvestment is all but inevitable, does that mean stocks are bound to crash on the other side of the cycle? I have seen the below chart from Goldman Sachs being shared on twitter. While some pointed out how today’s mag7 valuation pales in comparison with stocks at bubble peak back in 2000, one stock particularly caught my attention: AT&T. The stock was trading at valuation level below all of mag7 currently trades at. So, what happened to AT&T during the internet crash?

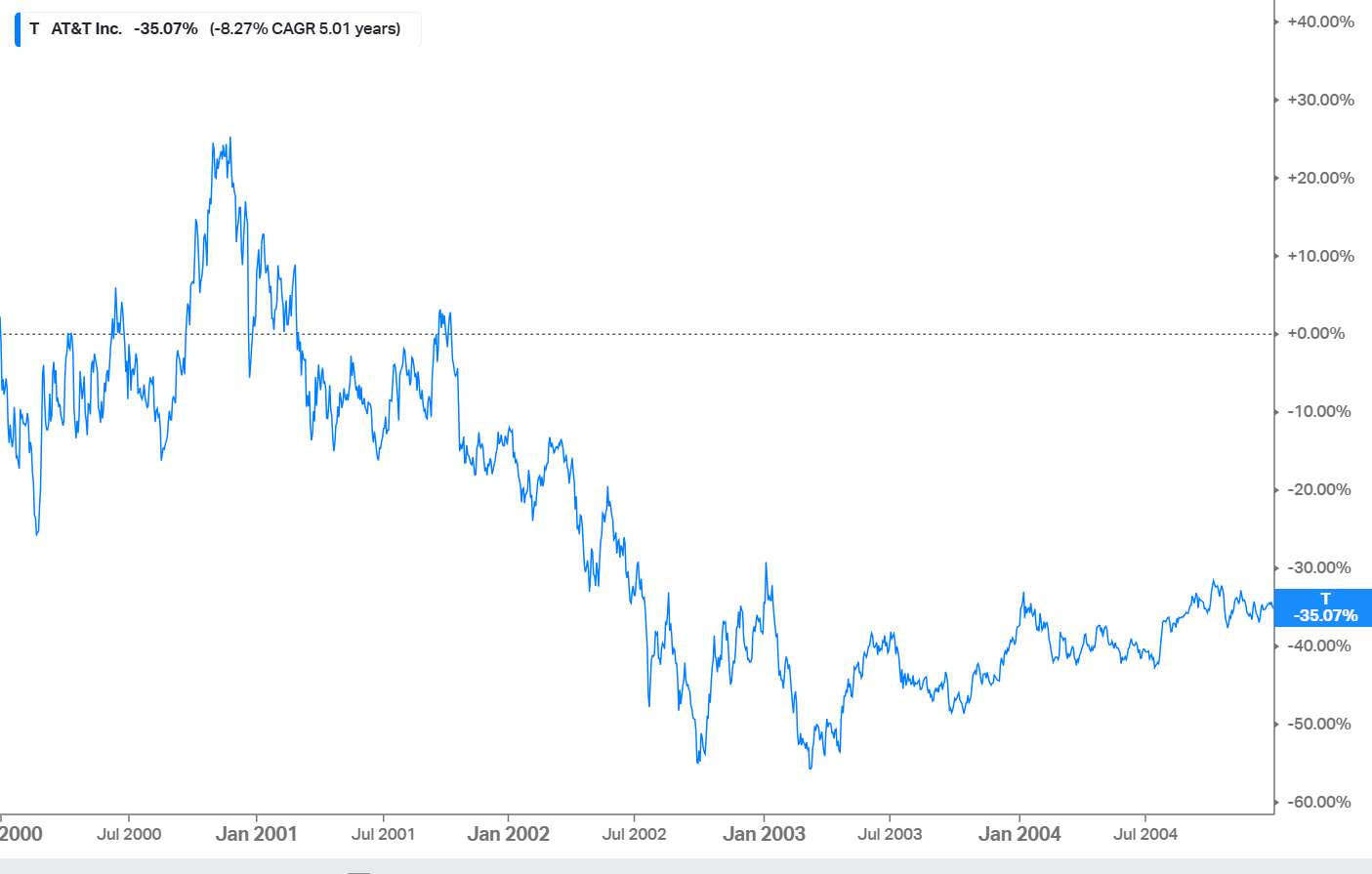

Of course, it wasn’t just internet bubble, early 2000s was also very much about telecom capex bubble. Despite appearing to trade at somewhat reasonable multiple, AT&T wasn’t spared from the carnage. It experienced a ~65% drawdown from the peak and had a negative 35% return during 2000 to 20004 period.

The “reasonable” P/E didn’t save AT&T shareholders from a painful experience as it went from ~24x P/E to bottom at ~9x P/E. It’s a good reminder that just because some of today’s mag7 aren’t trading at nose bleeding multiples doesn’t mean the shareholders will be immune from a traumatic aftermath if it turns out the eyewatering investments in AI yields sub-par return.

The trillion dollar question now is whether we are already in the overinvestment phase and if we are, how much drawdown might we face once the realization of overinvestment sets in? I don’t know the answer to the former, but I will make an attempt to answer the second question in this piece. Of course, different companies will face varying degree of impact within big tech land. Companies such as Nvidia is likely to be hit particularly hard, but what about the overall market? I’m not presumptuous enough to have any strong opinion on the overall market in this scenario, but I would like to focus on Meta Platforms to gauge the potential impact of overinvestment in AI.

Before talking about potential overinvestment in AI, let me give you some context on Meta so that I can provide some guesstimate of Meta’s investments in AI.

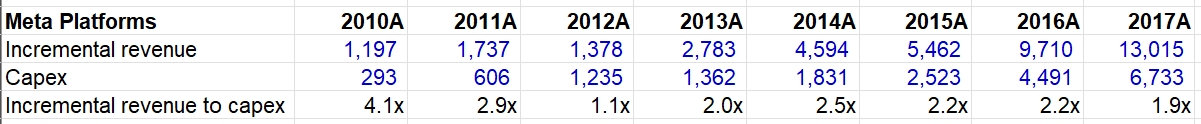

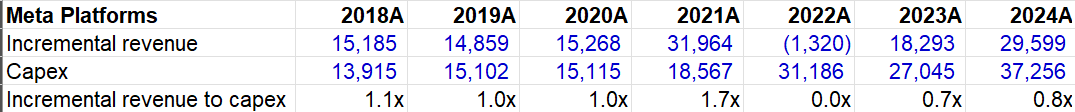

When I think of Meta’s capital intensity, I can sense three distinct phases. In the first phase (2010-2017 period), Meta’s Family of Apps (FOA) business is mostly about texts and photos. Every dollar of capex added $2 to $2.5 of incremental revenue to Meta’s topline.

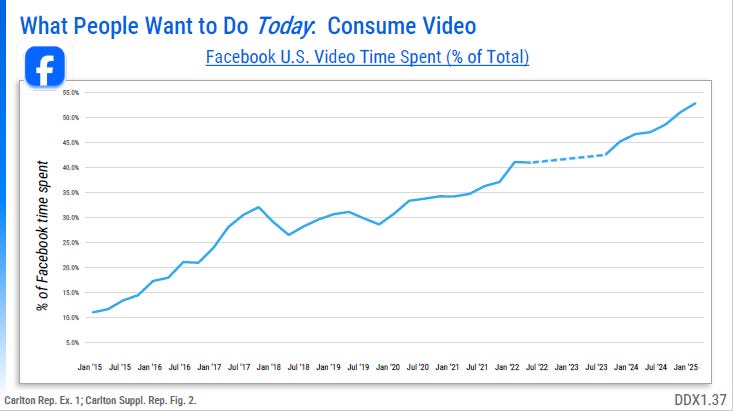

Then video consumption took off on Meta. While video used to be just ~15-20% of overall time spent on Meta’s platform in 2015-17 period, it has steadily crept upward to be half of all time spent on Facebook (likely even more on IG).

Video consumption is obviously much more capex intensive and every dollar of capex added just $1 of incremental revenue during 2018-20 period. During ZIRP era, it temporarily shot up to 1.7x, but then ATT happened. To regain the lost signal, Meta had to amp it up in capex and while the attribution infrastructure is never going to be as perfect as it was pre-ATT, Meta has largely regained the signal (especially relative to other competitors ex Google) and the company returned to its enviable growth trajectory. Moreover, given Meta has shifted more and more to recommended content to fill your feed, the core FOA product is also much more compute intensive than the earlier versions of newsfeed. During 2022-24 period, Meta spent a cumulative ~$95 Billion of capex and added ~$47 Billion of incremental revenue. Given the ever increasing compute intensity, let’s assume Meta’s “normalized” incremental revenue to capex ratio would be 0.6x during this 2022-24 period which implies the incremental $47 Billion of incremental revenue would require $78 Billion of capex. That means Meta spent a cumulative ~$15-20 Billion on “AI” during 2022-24 period.

Please note Reality Labs related investments largely flow through income statement through opex, so Reality Labs is likely to be quite capex light. That’s why I think these $15-20 Billion was spent on AI that didn’t generate any revenue yet.

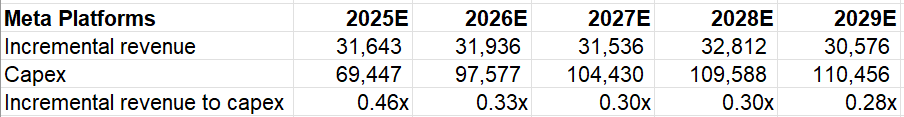

Phase 3 is next 5 years when Meta’s core business is expected to even more capital intensive. If you look at consensus estimates, you can see analysts are modeling consistently $30 Billion incremental revenue in the next 5 years for Meta even though capital intensity just creeps up over time. As a result, incremental revenue to capex ratio is expected to go from ~2-2.5x during phase 1 (2010-17 period) to ~1x during phase 2 (2018-24 period) to only 0.3x during phase 3 (next 5 years). Of course, some of these deterioration is due to “Nvidia tax”, but I find it remarkable that the assumption of persistent capex increases going forward despite no acceleration in incremental revenue.

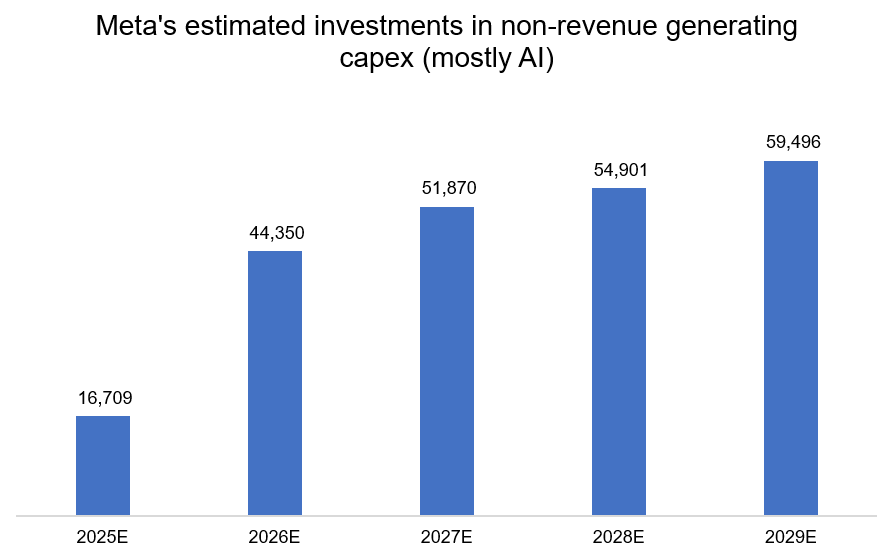

If we assume the core incremental revenue to capex ratio will hold at 0.6x (as it was likely the case during 2022-24 period), it shows my guesstimate of investments in non-revenue generating AI going forward. Just to help to you understand how I calculated this number, let me explain my estimates for 2026. I took the consensus capex and incremental revenue estimates for 2026. Since Meta is expected to grow revenue by $32 Billion next year and if we assume for every dollar of capex would lead to $0.6 incremental revenue, it implies Meta would need to spend $53 Billion in capex in 2026. However, since they actually are expected to spend ~$97 Billion, the difference between these two numbers is what I am guesstimating as Meta’s investments in non-revenue generating capex (mostly AI).

Even with these consensus estimates, incremental revenue to capex of just 0.3x is uninspiring enough, now imagine if the revenue estimates turn out to be too optimistic for some reason. Ultimately, Meta’s revenue comes from advertising and if the broader macro experiences a slowdown for some reason, Meta won’t be immune. It is highly unlikely that in any such scenario, Meta would post anywhere close to $30 Billion of incremental revenue growth.

So let me imagine a scenario and show my math to estimate how much Meta’s intrinsic value might be down if a lot of these non-revenue generating investments turn out to be largely a waste. I will discuss this behind the paywall.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 63 Deep Dives here.