Walmart and Target Earnings

Walmart and Target announced their earnings this week and while I don’t follow these businesses rigorously, going through their earnings simultaneously was an interesting exercise.

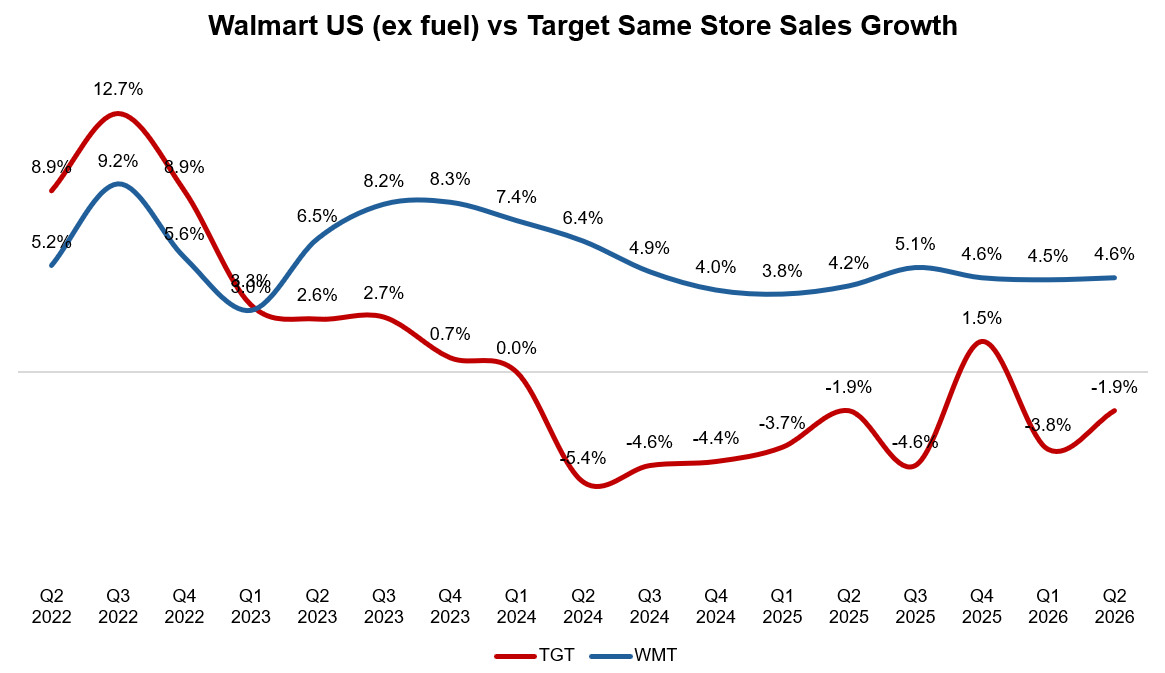

If you looked at Walmart and Target’s same store sales growth trajectory in the last eight quarters, you might be tempted to think they must be operating in two different industries! In eight out of the last nine quarters, Target posted negative same store sales comp whereas Walmart’s worst comp during this period was +3.8% (FY 1Q’25).

Perhaps it’s not a surprise that Target has chosen a new CEO.

I have been saying for the last few quarters that the secular rise of same day (or increasingly two-hour) shipping will have profound impact on most physical retailers. It’s difficult to compete against the likes of Amazon if the key competitive vector shifts to changing consumer behavior and an execution muscle requiring technological expertise. The new CEO tried to reassure that they have identified the challenges but frankly speaking, there are few things easier in business world than a retail turnaround. From the call:

"We've identified the biggest challenges that slow us down, legacy technology that doesn't meet today's needs, manual work that can be automated, unclear accountabilities, slow decision-making, siloed goals and a lack of access to quality data."

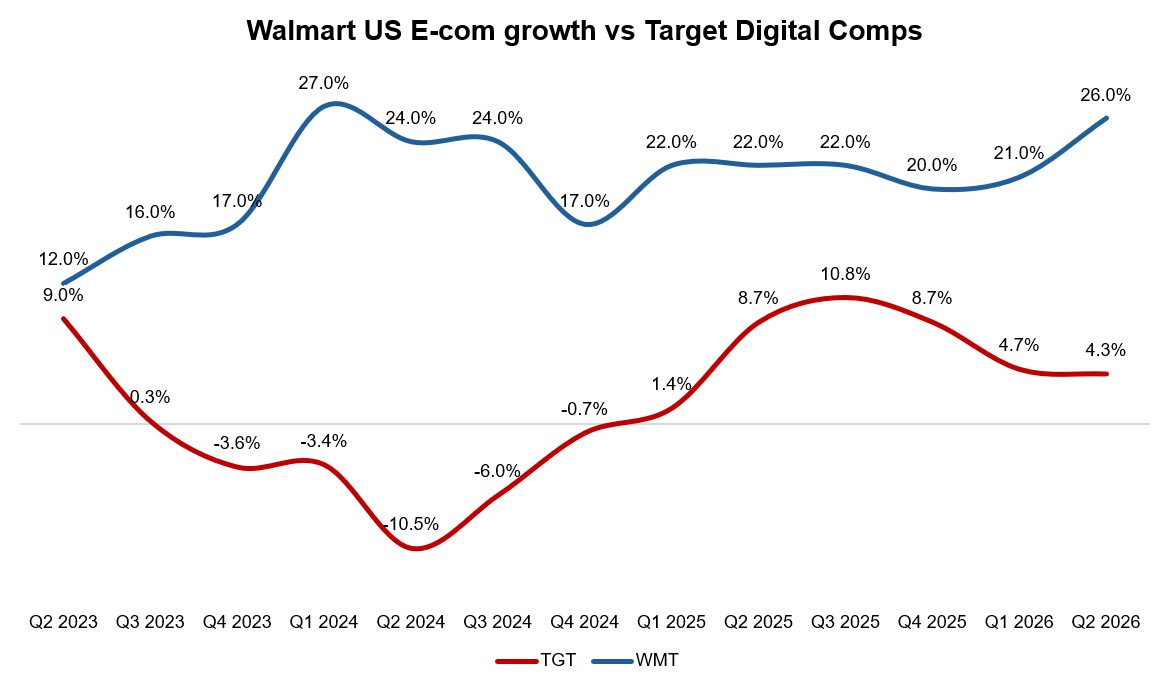

It’s not just same store sales growth that’s under pressure, even Target’s digital comps appear increasingly lethargic, especially when you peek at Walmart. My admiration for Walmart only grows when you see how much they have transitioned to the new reality of retail. E-commerce used to be just 12.7% of their US sales just two years ago, but it reached 17% in FY’25 and the growth has continued so far in FY’26.

I do want to highlight that the below chart is not quite apple to apple comparison (Walmart defines eCommerce sales as “omnichannel sales where a customer initiates an order digitally and the order is fulfilled through a store or club, as well as net sales from other business offerings that are part of the Company's ecosystem such as certain advertising arrangements, fulfillment services, and data insights” whereas Target Digital comparable sales include “all merchandise sales initiated through Target’s digital channels (apps/websites, fulfilled by stores or other means”), but still probably much closer to the truth than otherwise.

Walmart's incredible logistical advantage, using its store footprint to compete effectively on speed in the convenience-driven digital marketplace was on full display during the call. It really does sound like they got the memo of where retail is heading. From the call:

"Walmart U.S. e-commerce sales grew 26%, stepping up from the low 20% growth range we delivered over the prior 4 quarters. All fulfillment channels increased, led by delivery from store, which was up almost 50%.

Speed of delivery is important to customers, and we're continuing to get faster. Approximately 1/3 of deliveries from store in recent weeks were fast delivery in 3 hours or less, reinforcing the value of our store network and driving speed and 20% of those deliveries arrived to our customers in 30 minutes or less.”

Retail is too large a market to make it either/or winner between Amazon and Walmart, and given the most retailers will find it excruciatingly hard to adapt to new retail environment, both Amazon and Walmart will likely keep snatching market share from more feeble operators. Frankly speaking, Walmart increasingly sounds more like Amazon…I almost had to double check if I’m reading the right transcript:

With strong growth in e-commerce, our advertising business globally increased nearly 50%, including VIZIO. Walmart Connect in the U.S., ex VIZIO grew more than 30%

…50% of our incremental profit, excluding claims, was related to advertising, membership and marketplace.

…it's pretty rare to find a company of our size with a roughly $700 billion revenue base that is growing organically 5% to 6% each period. We're really pleased with what we're seeing there. And if you look at the contribution to that growth, it's primarily e-commerce…We are more than just a standard brick-and-mortar retail business. We have a much more diversified set of profit streams now that are both higher growing as well as higher margin.”

While Walmart does have a reputation of serving more lower income households, they did mention their comp was driven by “all income cohorts with upper income households contributing the largest gains."

How about tariff? Walmart has hinted that we may not be out of the woods from tariff related impact yet, and in fact, the more difficult days may be ahead of us unless tariffs are changed materially downward in the coming months. From the call:

With regards to our U.S. pricing decisions, given tariff-related cost pressures, we're doing what we said we would do. We're keeping our prices as low as we can for as long as we can. Our merchants have been creative and acted with urgency to avoid what would have been additional pressure for our customers and members. They've done a terrific job managing pricing and mix across merchandise categories. They managed to generate rollbacks. They've made good quantity and flow decisions, and they've set us up well as we start the back half of the year.

As it relates to what we're experiencing with customers and members here in the U.S., their behavior has been generally consistent. We aren't seeing dramatic shifts. The way things have played out so far, the impact of tariffs has been gradual enough that any behavioral adjustments by the customer have been somewhat muted. But as we replenish inventory at post tariff price levels, we've continued to see our costs increase each week, which we expect will continue into the third and fourth quarters.

Not surprisingly, we see more adjustments in middle and lower-income households than we do with higher-income households. In discretionary categories where item prices have gone up, we see a corresponding moderation in units at the item level as customers switch to other items or in some cases, categories. As always, our customers are aware, smart and value conscious. We have approximately 7,400 price rollbacks across our assortment, which is about 2,000 more than last quarter.

While I don’t follow the stock closely, I have been quite impressed with Walmart and I intend to do a Deep Dive on the company sometime next year to hone my understanding of their business (and the stock) a bit more.

In addition to "Daily Dose" (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 62 Deep Dives here.

Current Portfolio:

Please note that these are NOT my recommendation to buy/sell these securities, but just disclosure from my end so that you can assess potential biases that I may have because of my own personal portfolio holdings. Always consider my write-up my personal investing journal and never forget my objectives, risk tolerance, and constraints may have no resemblance to yours.

My current portfolio is disclosed below: