Texas Instruments 4Q'25 Update

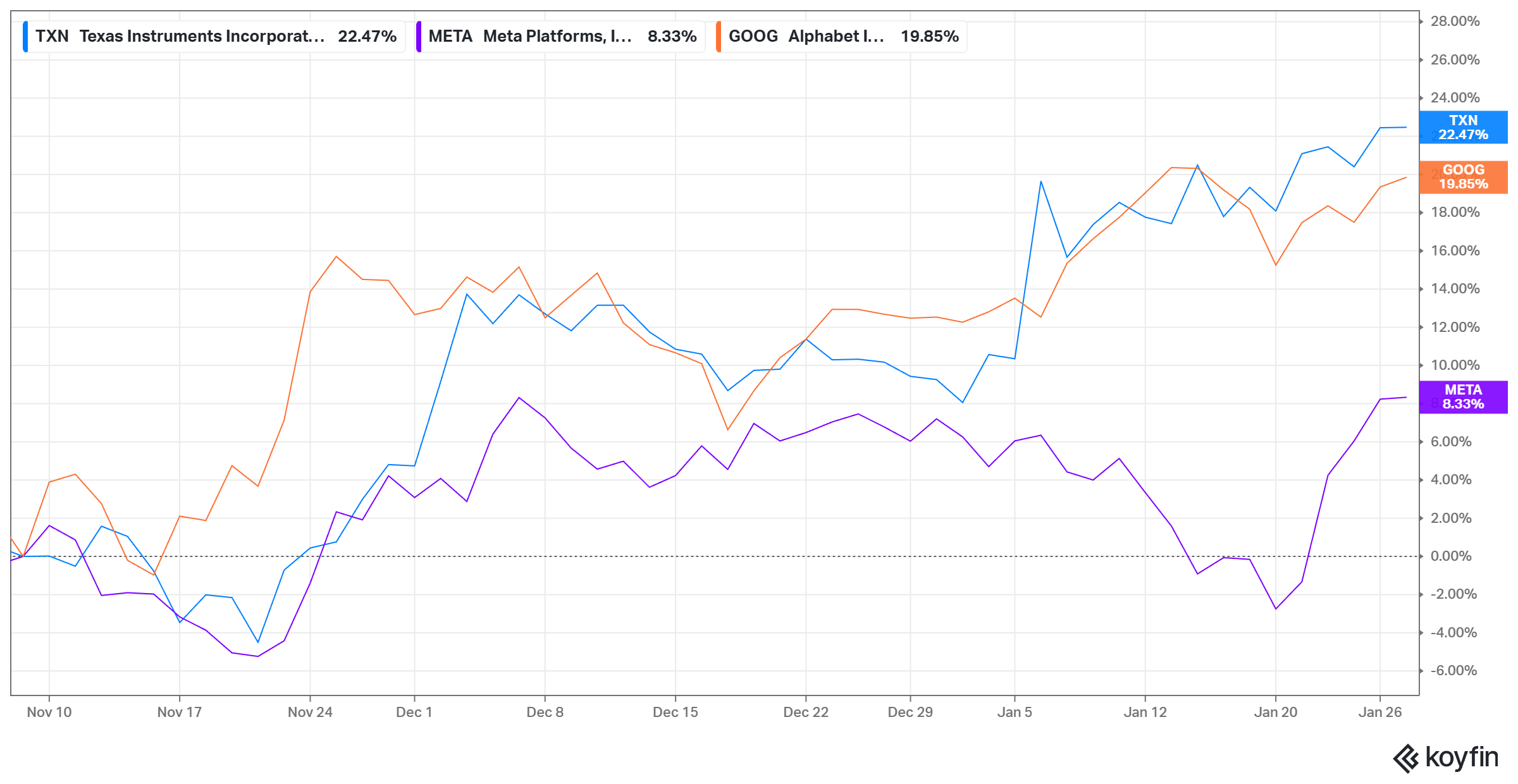

I owned Texas Instruments (TXN) for almost 18 months and then managed to sell what appears to be a local bottom in hindsight. Although I did re-allocate my proceeds from TXN sale to Alphabet and Meta equally, Texas Instruments performed better than either of those companies. The chart below doesn’t even include the earnings pop of TXN; it went up ~30% since I sold in November. As you can see, markets are a humbling machine!

Let me dig into 4Q’25 earnings of Texas Instruments (TI).

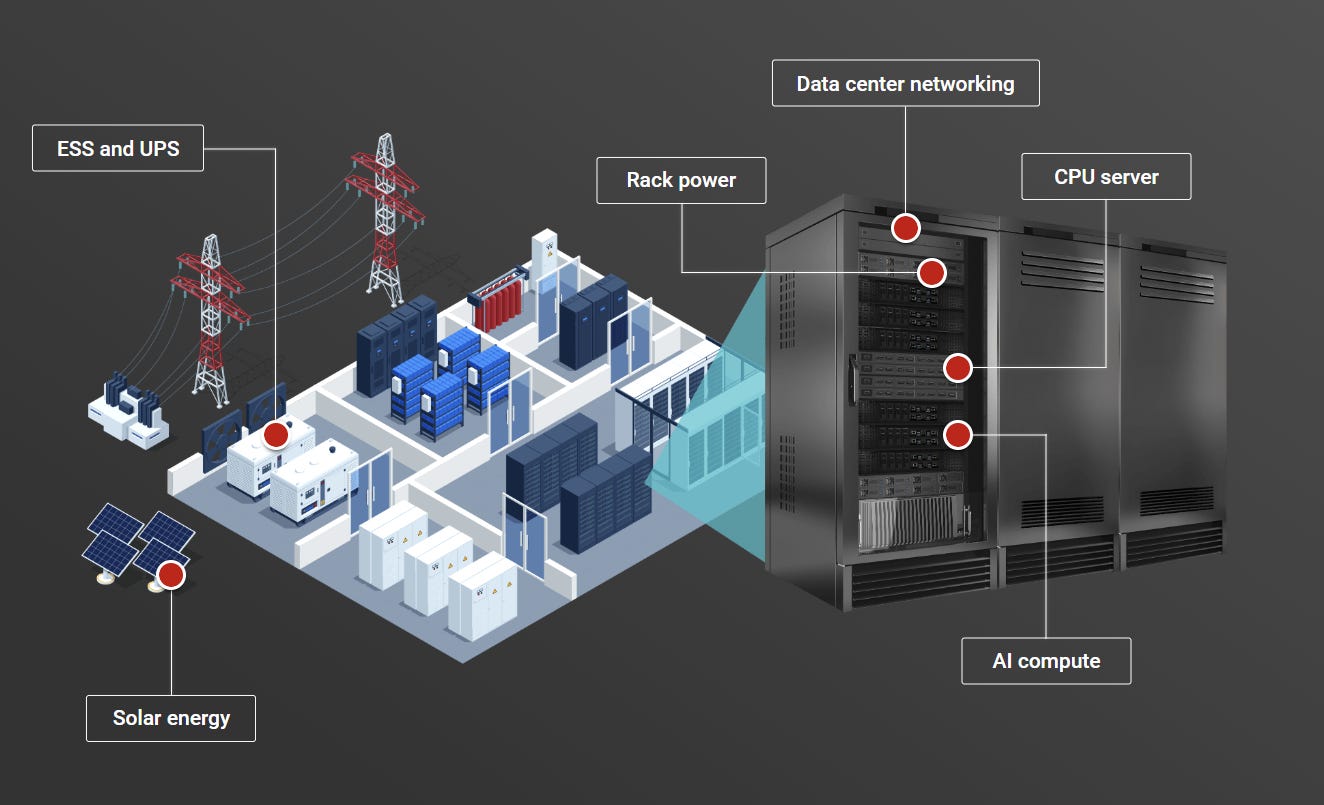

The big reveal in this call was TI’s revenue from data center which includes sectors related to data center compute, data center networking, rack power, and thermal management. TI’s website has a good interactive section to help you understand their offerings in data center.

Back in September, TI’s CEO mentioned that data center can eventually be ~20% of their business which implied ~$4-5 Billion revenue opportunity for them. They ended Q4 with $450 million run-rate which was ~10% of their 4Q’25 revenue. Data center has been growing for 7 consecutive quarters and looking at their estimate of eventual size of data center business, it is likely to continue to grow in the coming years. Management also clarified they are not chasing a single “socket”. Instead, they are targeting the “thousands of different parts” in a server rack, including power management, thermal sensing, and signal chain components.

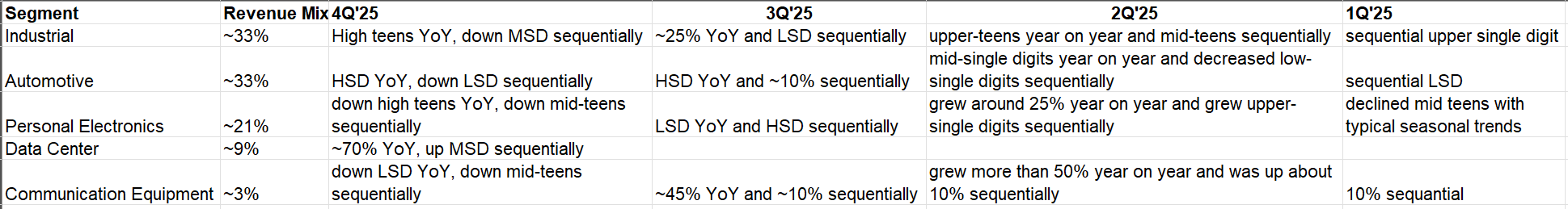

Beyond data centers, all the major segments were down sequentially: industrials down MSD sequentially, automotive down LSD sequentially, and personal electronics down mid-teens sequentially.

Management re-iterated that while they believe the recovery has legs in industrials, their visibility is limited beyond a quarter. From the call:

“…even if I go back to Q3, which was, I think, the highest industrial quarter for 2025, it was still about 25% from the previous peaks in year 2022, right? So I do believe that the secular growth continues in industrial. We are looking at end equipment and generation to generation, we see just more content growth per system. So I expect industrial to establish new highs in the future. This is why I talked in the last quarter about maybe a more moderate recovery, especially on the industrial side.

I do want to remind us all that earlier in 2025, I would say, the first half of ‘25, we saw a pickup of industrial and then it kind of came down. We want to see how sustainable this wake up in orders is.”

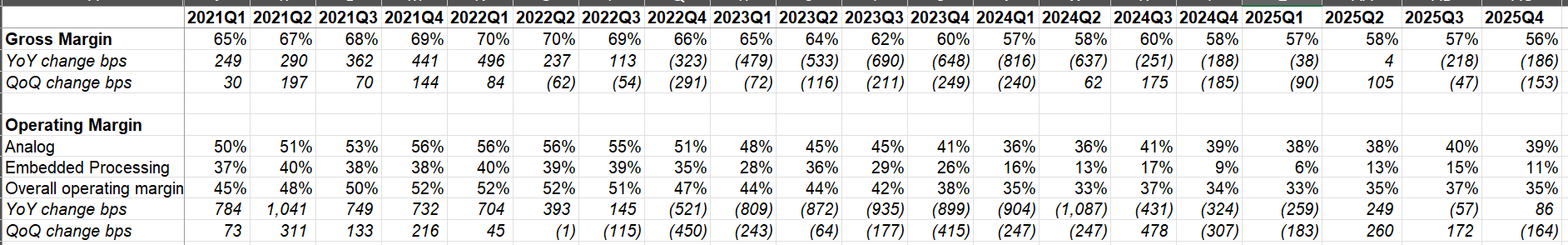

In terms of margin, gross margin was down both QoQ and YoY; however, operating margin improved by ~86 bps YoY in 4Q’25. As you can see below, operating margins of mid-30s in 4Q’25 are still closer to trough margins of this cycle last year, and still materially lower than peak margins of ~50% in 2021-22 period. Even if you consider the average of peak and trough as more “normalized” margins, there should be decent margin expansion over the course of the cyclical recovery.

While TI’s guide for Q1 tends to go down sequentially due to seasonal factors, they guided for $4.32 billion to $4.68 billion revenue in 1Q’26. If they meet the high end of the guide, TI’s revenue will grow at +5.8% QoQ. More importantly, while some analysts speculated whether such unusual QoQ growth is pricing related, TI dispelled it during the call. From the call:

“we have 80,000 products. Prices always go up and down. But for the company, the overall price effect like-for-like in ‘25, we expected it to be low single digits down. Now we finished ‘25, it was exactly there. When you say low single digits, think about 2% or 3% down.

That’s my assumption for 2026. That’s what we expect the market conditions to be. If anything changes with pricing, as you know, we’ll see -- of course, TI will respond. But right now, that’s our assumption moving forward. That’s why I was so convinced that the Q1, I think we have a little sequential growth there. It’s not due to pricing.

Actually, usually, Q1 pricing usually goes down a little bit because of yearly negotiations. That’s usually what we see in Q1.

we are just seeing growing orders, and it behaved the same through the quarter. I can’t speculate on what, but I do know the industrial market, there needs to be a correction. And the second point is data center is now a bigger part of our business, so it starts to move the numbers for us, right? This is a market that is now growing every quarter, and it’s not insignificant. So I think that also helps to change the guide compared to previous years.”

While TI received some flak for building too much inventory in the last couple of years, this cyclical recovery can now turn into a boon for them, especially if the pace of recovery surprises their competitors. So far, that’s not been the case given the weak recovery. From the call:

Our lead times are very competitive, unchanged, I think, on average, below 13 weeks, many of our parts at 6 weeks. Part of our ambition and objective as we prepare to the next cycle, was to be -- to be able to maintain very competitive lead times across the cycle. So far this cycle has not been very tough to meet, right, as I said, been a slow recovery, but our lead times continue to stay very, very competitive, probably the lowest in the industry, and our inventory position allows us to support customers.

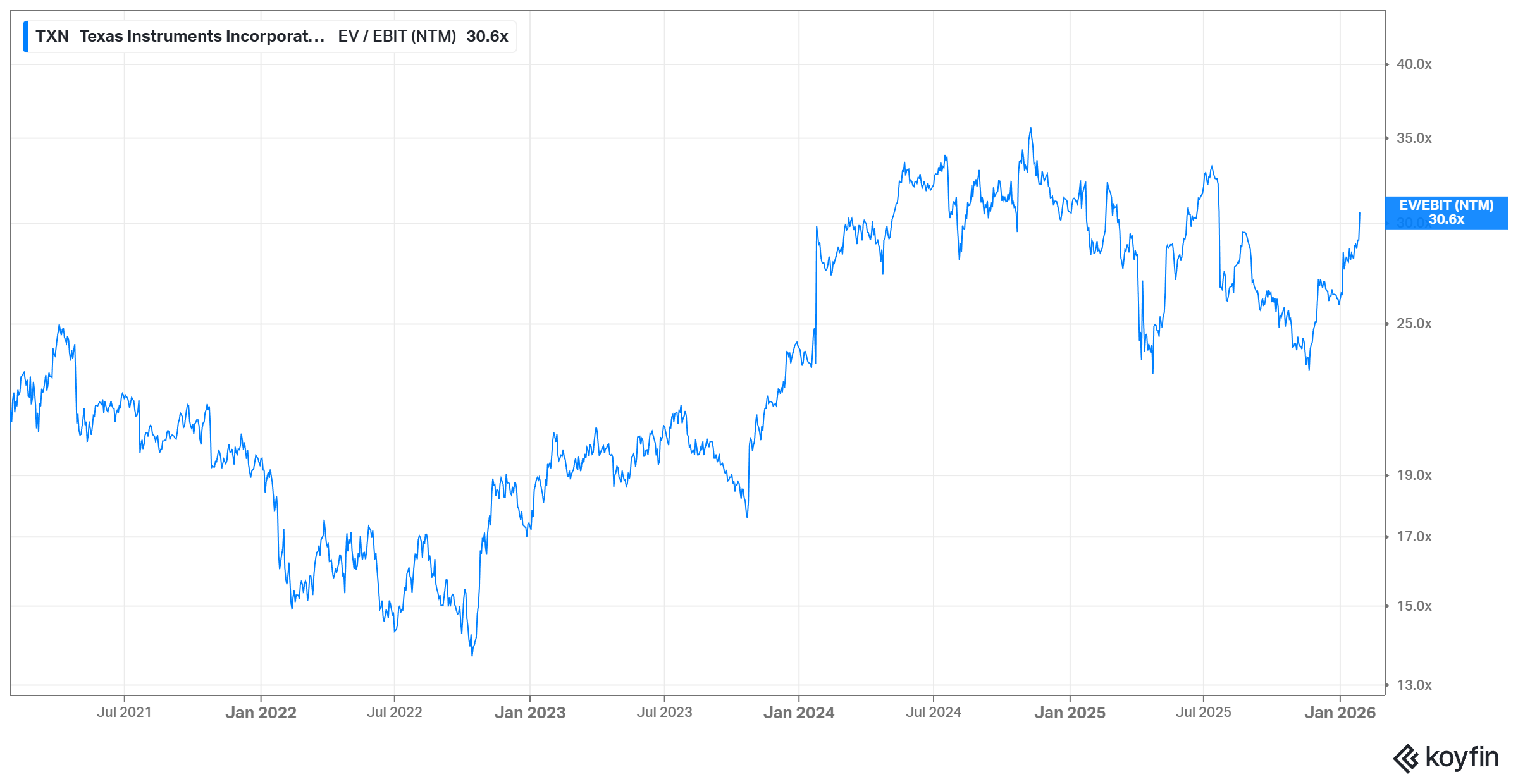

Overall, the tone in the call was quite positive even though I don’t think a whole lot has changed in the last three months. The stock currently trades at ~31x NTM EBIT. Given the cyclical recovery and margin expansion opportunity, I can see why the stock would trade at optically elevated multiple. Nonetheless, even if you adjust for normalized margins, the stock trades around mid-20s NTM EBIT multiple which is fine, but not quite exciting.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 66 Deep Dives here

Current Portfolio:

Please note that these are NOT my recommendation to buy/sell these securities, but just disclosure from my end so that you can assess potential biases that I may have because of my own personal portfolio holdings. Always consider my write-up my personal investing journal and never forget my objectives, risk tolerance, and constraints may have no resemblance to yours.

My current portfolio is disclosed below: