Texas Instruments 2Q'25 Update

You hardly ever see sell-side analysts being livid to management in an earnings call, but TXN’s 2Q’25 call was a bit spicy. After the prepared remarks, Q&A started with a combative tone from an analyst probing management about “change of tone” compared to last quarter. Then couple other analysts also pressed on “tone”.

Just read this interaction between BofA Analyst Vivek Arya and TXN CEO Haviv Ilan:

Vivek Arya: Haviv, sorry to go back to this tone change because it's not just from the last earnings call. It's at the end of a conference at the end of May, I think you had suggested that every remaining quarter of '25 will accelerate from the first half up 13%, but your Q3 sales guide is up only 11%. So my question is that versus that reference point, which end market has softened? Is it that the industrial normalization is done? Is it that auto, right, was a little weaker? Or is that just extra conservatism on TI's part? Because the tone change is, as I mentioned, not just from earnings, but from the end of May.

Haviv Ilan: Yes. And again, I don't control probably tone level, but that's you guys are hearing...

Vivek Arya: But you quantified it, Haviv. You quantified; it wasn't just tone.

TXN management actually attended BofA conference in early June, so I went back to see what exactly management said. I gotta say the analyst comes across a little too eager to interpret things management didn’t exactly mention:

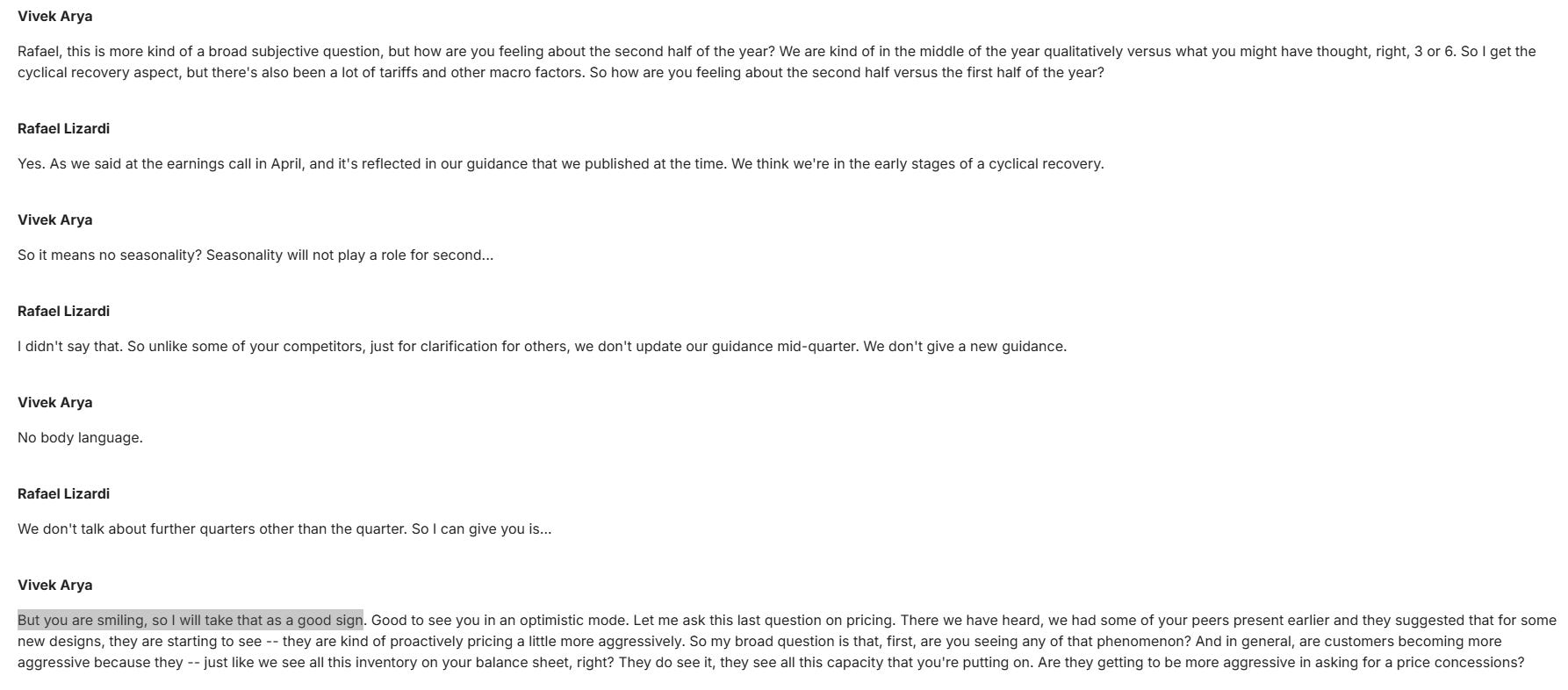

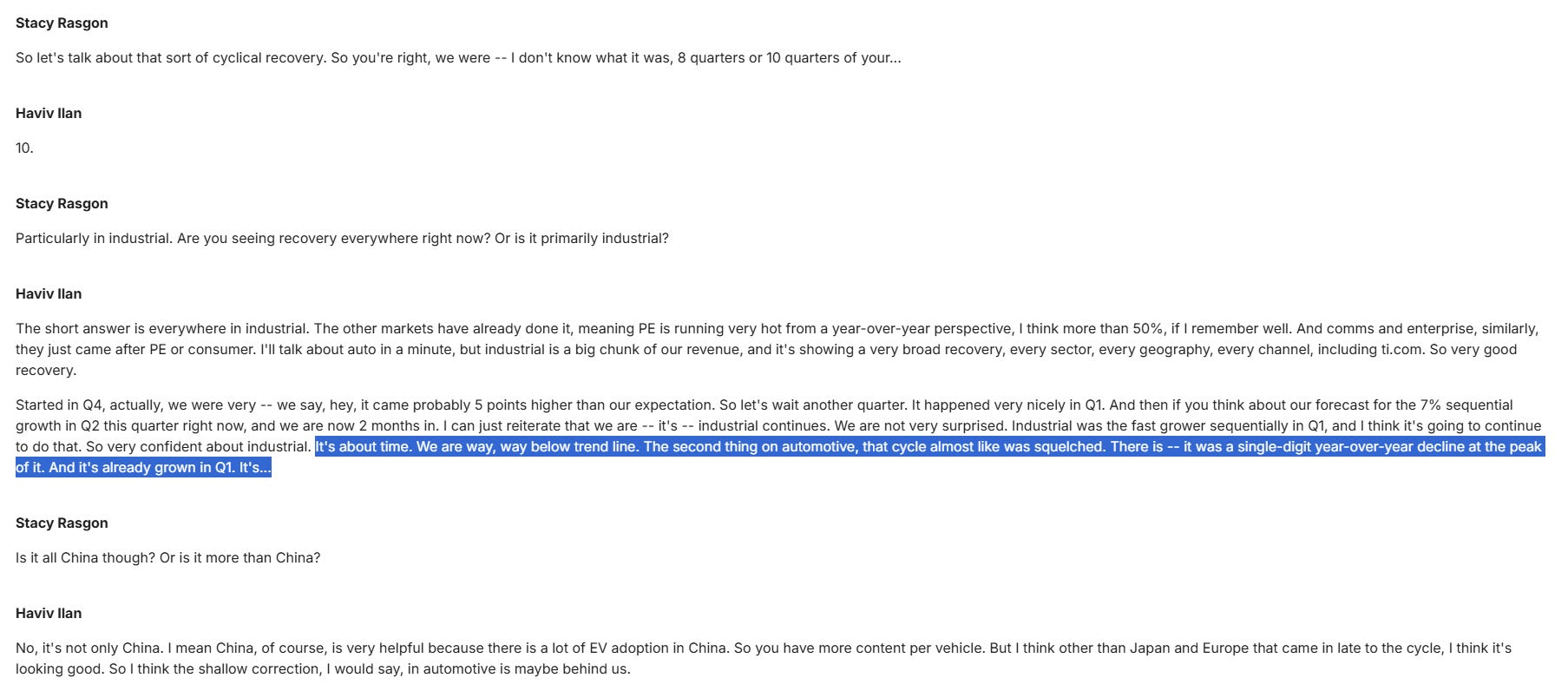

Nonetheless, I do admit I too got the the impression of a much better tone in Bernstein conference TXN management attended in May. See the below interaction from May:

Given this context, it’s perhaps not a surprise that the stock is down ~15% since reporting earnings a couple of days ago.

Here’s my highlights from the earnings.

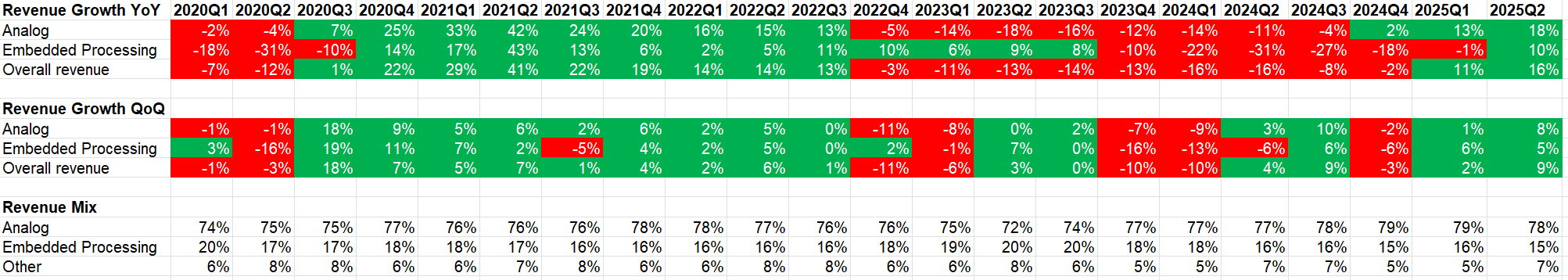

Revenue

I have shown below revenue growth by segment from both YoY and QoQ perspective. As you can see, the cycle has clearly turned. Analog revenue, which is ~80% of overall revenue, accelerated from ~13% YoY in 1Q’25 to ~18% in 2Q’25. Similarly, sequential revenue accelerated from ~1% in 1Q’25 to ~8% in 2Q’25.

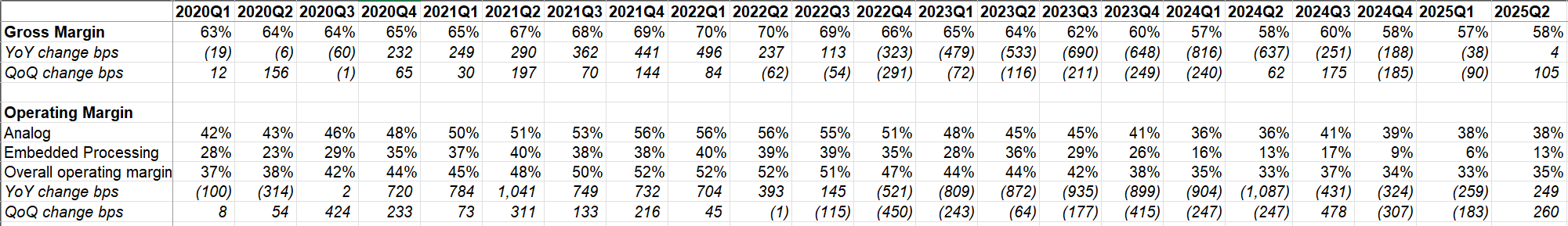

Margins

This is a cyclical business, so margins go up and down along the cycle too. Both gross and operating margin improved both from YoY and QoQ perspective.

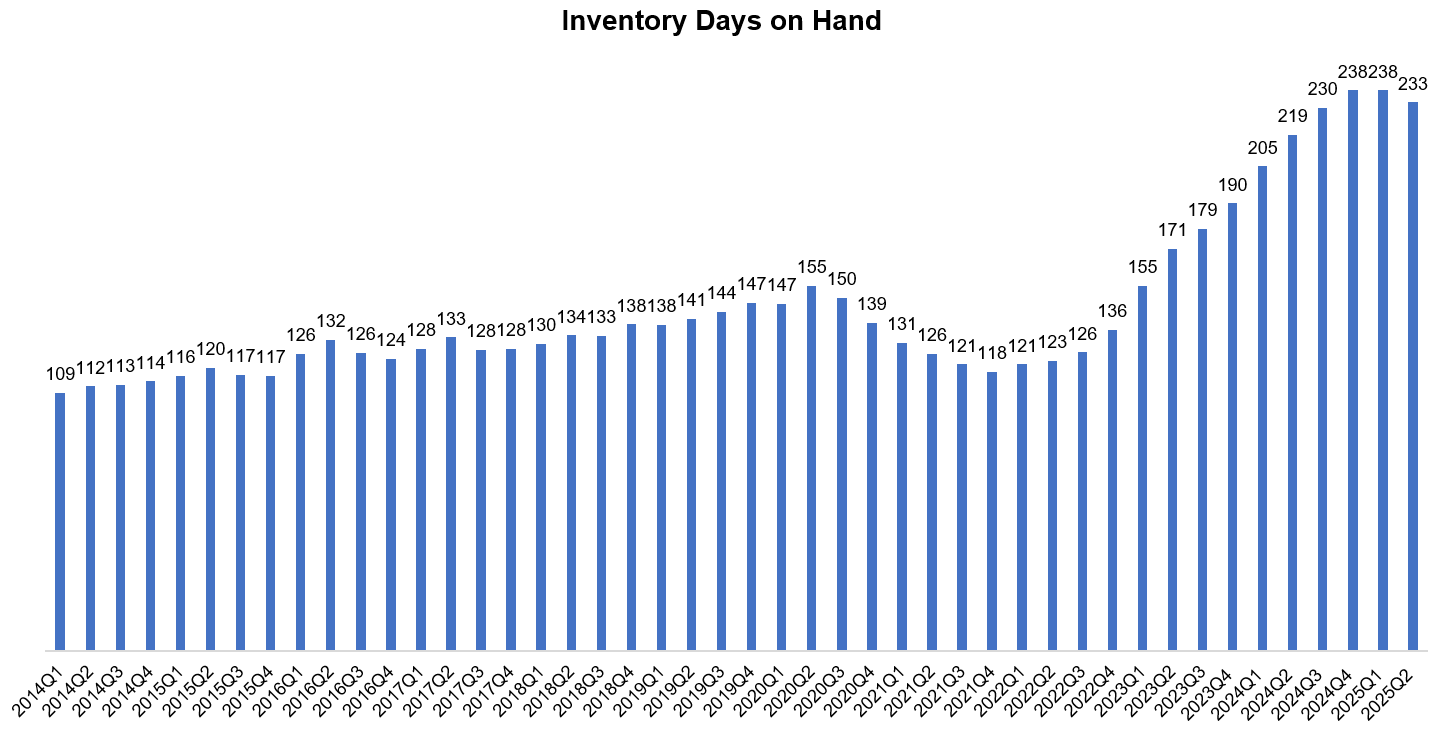

Inventory Days on hand also fell a bit last quarter. Given that there’s not much of an obsolescence risk for TXN’s inventory and will gradually come down through the cycle over time, it’s not a huge headache for me, but it’s good to see inventory days starting to trend in the right direction.

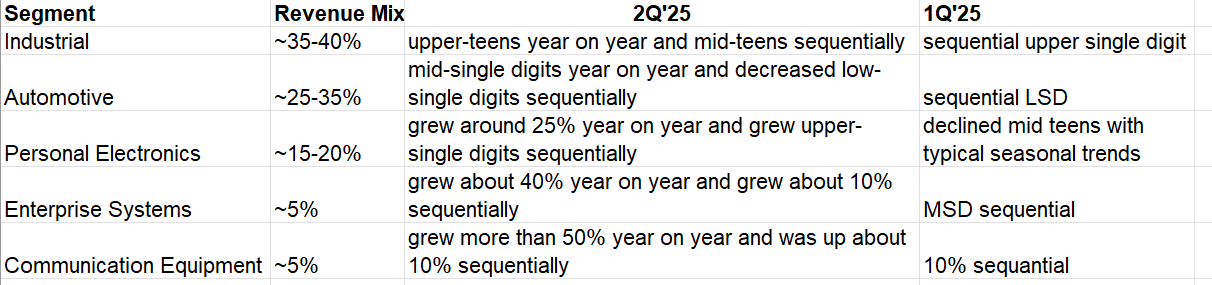

In terms of end markets, I have gathered management’s commentary in both 2Q’25 and 1Q’25. Apart from automotive which declined by LSD sequentially (but was +MSD YoY), every other end market grew both sequentially and YoY. Industrial, which is the largest segment, accelerated from HSD sequential growth in 1H’25 to mid-teens sequentially.

Here’s what management said about automotive lagging the rest of the end markets:

“…automotive, let's just remember that it's kind of a year delayed versus industrial, right? Industrial peaked for us at least in the third quarter of 2022. Automotive picked 1 year later in the third quarter of 2023. So one could expect automotive to be joining last. The automotive recovery has been shallow, meaning we are running single digits versus the peak, we are running year-over-year. We are actually having some growth in the second quarter from a year-over-year perspective, but at a very low level. So I will say that automotive has not recovered yet. But because of content growth, I think the cycle here is going to be less pronounced and more shallow.”

It’s hard to blame management too much for their optimistic tone last quarter as Q2 was indeed pretty good; however, this is not an easy business to forecast with high precision couple of quarters out, especially given the massive volatility around tariff and trade policies which are above their paygrade. Again, from the call:

…what we saw in Q2 is probably a combination of customers wanting to have a little bit more inventory because of tariff and also the cyclical recovery. When customers make orders, they don't tell us why they want more parts. And I would assume that some of it was for building a little bit of inventory on their shelves to protect themselves from tariffs, if you will. So that is my assumption. Again, I don't know how the third quarter will play out, but that's part of the way we are forecasting Q3.

Outlook

Given the uncertainty, TXN provided a wide range in their revenue and earnings outlook. For 3Q’25, their revenue guide is $4.45 billion to $4.80 billion and EPS range is $1.36 to $1.60.

Management also reminded that the upcycle may have lot more room to run than earlier ones once (if) we get past the tariff related uncertainties:

This recovery is very, very different from any previous one. You can see it also at the slope of the recovery when you look at the overall WSTS without memory trend, you can see a not very sharp return to trend line. We are still running 12% or 13%, I believe, below trend line. And there is a lot of -- usually, when a cycle establishes itself, you first have to get a trend line, and then you have to establish the next peak. We are still running double digits percentage-wise on units below trend line.

They also highlighted recent changes in US tax legislation which would increase tax rates in 3Q’25 but will decrease cash taxes for the “next several years”.

I will share some thoughts below the paywall what I intend to do with my TXN position.

In addition to "Daily Dose" like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 61 Deep Dives here.

Prices for new subscribers will increase to $30/month or $250/year from August 01, 2025. Anyone who joins on or before July 31, 2025 will keep today’s pricing of $20/month or $200/year.