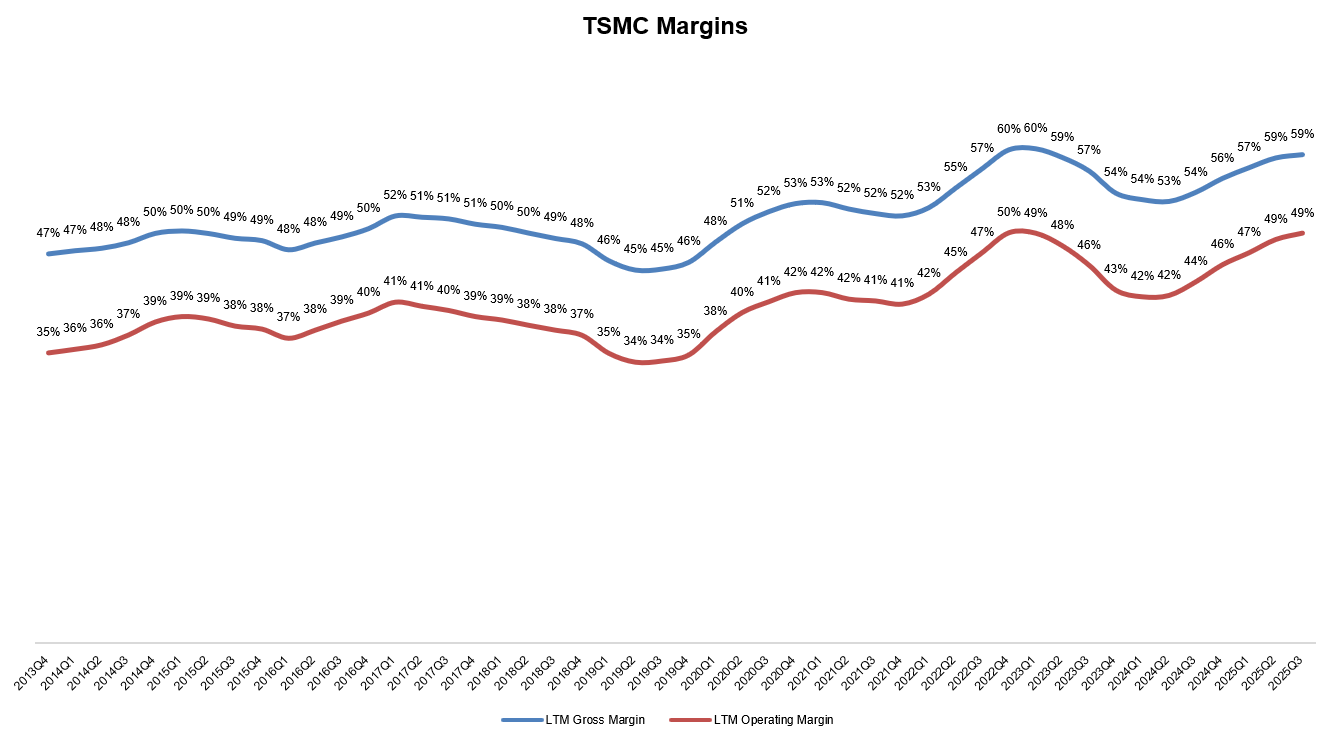

TSMC's Margins

It is kind of incredible to see TSMC’s margin trajectory over the last five years. Their current operating margin is now basically same as their gross margins pre-pandemic.

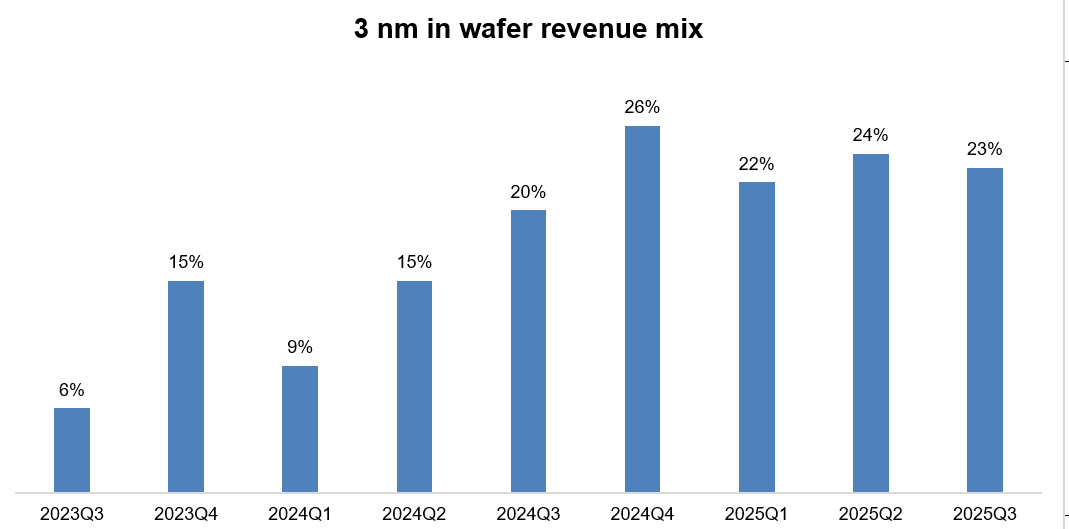

What is even more remarkable is how they were able to expand margins so much despite a persistent headwind from ramping up wafer revenue from 3 nanometer (nm). Back in 3Q’23 when TSMC first disclosed revenue coming from 3 nm, it was only 6%, Within a year or so, it shot up to quarter of their wafer revenue. To put this in context, in 3Q’23, their overall LTM gross margin was 54.5% and it has expanded by ~500 bps in the next two years despite the headwind from 3 nm.

Why was 3 nm wafer revenues a headwind for TSMC? TSMC management explained in 1Q’24 call:

it is true that N3 is taking a longer time to reach the corporate margin than the other nodes like N5 or N7. N5 or N7 before, it was like 8 to 10 quarters to reach the corporate. But for N3, we think it will take about 10 to 12 quarters. And this is probably because N3 process complexity has increased, and also our corporate average gross margin also increased during the period. But another reason is that we set the pricing of N3 very early, several years ahead of production. However, we experienced a lot of cost inflation pressures in the following years. So as a result, N3 will take a longer time than N5 and N7 to reach the corporate average gross margin.

In the recent earnings call, TSMC management mentioned N3 is finally going to match the overall corporate average margins in 2026. The fact that margins could have such expansion despite this headwind tells you how the overall numbers can mask the business’ much higher underlying profitability. Now that N2 is coming out, there will be a new source of margin headwind for TSMC just when N3 will reach overall corporate margins. However, TSMC has made sure N2’s structural profitability is higher than N3. From the 3Q’25 earnings call:

…as all the new node, when they just come out, the N2 will have dilution in our gross margin in 2026. But at the same time, the N3 dilution is gradually coming down, and we expect the N3 to catch up to the corporate average sometimes in 2026.

N2’s structural profitability is better than the N3…it’s less meaningful nowadays to talk about how long it will take for a new node to reach to a corporate average in terms of profitability. And that’s because the corporate profitability, the corporate gross margin moves and generally, it has been moving upwards. So less meaningful to talk about that

Beyond N2/N3 dynamics, TSMC will also continue to face some margin headwinds due to their overseas fab expansion which management quantified explicitly in the call:

While the cost of overseas fabs remain higher, thanks to the company’s overall larger scale, we now expect the gross margin dilution from the ramp-up of our overseas fabs to be closer to 2% in the second half of 2025. For the full year 2025, we now expect it to be between 1% to 2% as compared to 2% to 3% previously.

Looking ahead, we continue to forecast the gross margin dilution from the ramp-up of our overseas fabs in the next several years to be 2% to 3% in the early stages and widen to 3% to 4% in the latter stages. We will leverage our increasing size in Arizona and work on our operations to improve the cost structure. We will also continue to work closely with our customers and suppliers to manage the impact.

Typically, one might expect that as manufacturing operations mature and scale up, efficiency would improve, costs would decrease, and therefore the margin dilution would narrow. So it may seem a bit counterintuitive that the margin dilution will widen to 3-4% in latter stages.

In the initial phase, only the first few overseas fabs are ramping up (e.g. Arizona Fab 1). While these fabs are much more expensive to operate on a per-wafer basis, they represent a small percentage of TSMC’s total global output today. Their impact on the overall corporate average margin is therefore limited.

in the “latter stages” when multiple overseas fabs (e.g. Arizona Fabs 2 and potentially 3, Japan Fabs 1 and 2, Germany Fab 1) are expected to operate at high volume, a much larger proportion of TSMC’s total manufacturing will occur in these higher-cost regions. Even if the efficiency of the individual overseas fabs improves slightly over time, the sheer volume shifting away from the low-cost base in Taiwan mathematically drags the blended corporate gross margin down further.

Moreover, during the initial ramp-up, not all equipment may be installed, and the depreciation expenses have not yet reached their maximum level. Once the fabs are fully equipped and running at mass production volumes, the depreciation expense hits the P&L statement fully. As subsequent fabs come online, the cumulative weight of depreciation from multiple massive investments being recognized simultaneously is much higher, putting greater downward pressure on gross margins.

Besides, costs for specialized engineering labor, electricity, and water are fundamentally higher in the US and Europe than in Taiwan. In the early stages, staffing is focused on setup; in the latter stages, the fabs require full 24/7 staffing, magnifying the impact of higher labor costs.

Investors may not need to worry about minute details of such margin headwinds as long as TSMC’s absolute monopoly in leading edge chip manufacturing remains largely uncontested. Even if US cajoles (forces?) TSMC to build half of US demand locally, I guess as long as TSMC stays a monopoly in the leading edge, they can always just price the chips appropriately to protect their margins, and hence the burden of onshoring can be largely passed to its customers: mostly US big tech companies. Taiwan already rejected the idea of splitting chip production half to the US; the geopolitical tussle is a much larger consideration here than worrying about pesky margins. It is hard for me to imagine that US will ever be at ease with such a glaring vulnerability at place, so not only they may push for such “50-50” idea again but also in the meantime likely would like to try to find (and fund) for an alternative to TSMC.

As of today, there is essentially none.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 63 Deep Dives here.

Current Portfolio:

Please note that these are NOT my recommendation to buy/sell these securities, but just disclosure from my end so that you can assess potential biases that I may have because of my own personal portfolio holdings. Always consider my write-up my personal investing journal and never forget my objectives, risk tolerance, and constraints may have no resemblance to yours.

My current portfolio is disclosed below: