Synopsys' Pricing Evolution in Design IP

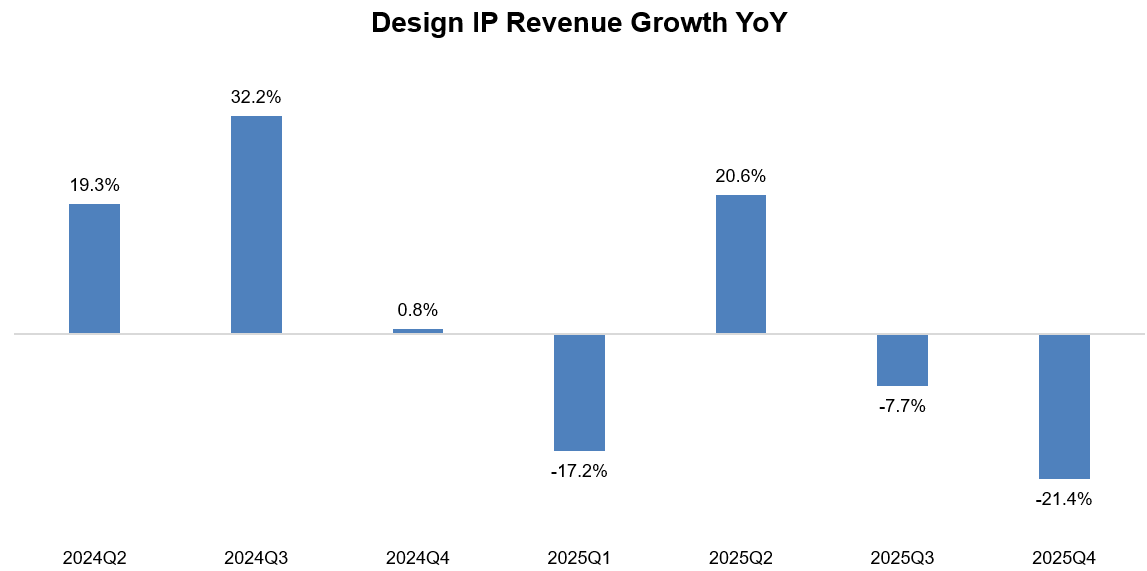

While design IP was as high as 39% of Synopsys total revenue back in 2022, it has come down to ~25% of revenue following Ansys acquisition. So, although this segment has somewhat declined in significance, the performance of this segment can still be needle mover for the company. It certainly doesn’t help that design IP revenue declined by more than 20% in FY 4Q’25 despite facing a pretty easy comp. To be clear, this was hardly a surprise for the investors. Management spoke at length about IP’s weakness in FY 3Q’25 call which drove the stock to be down 35% after that call which I covered earlier.

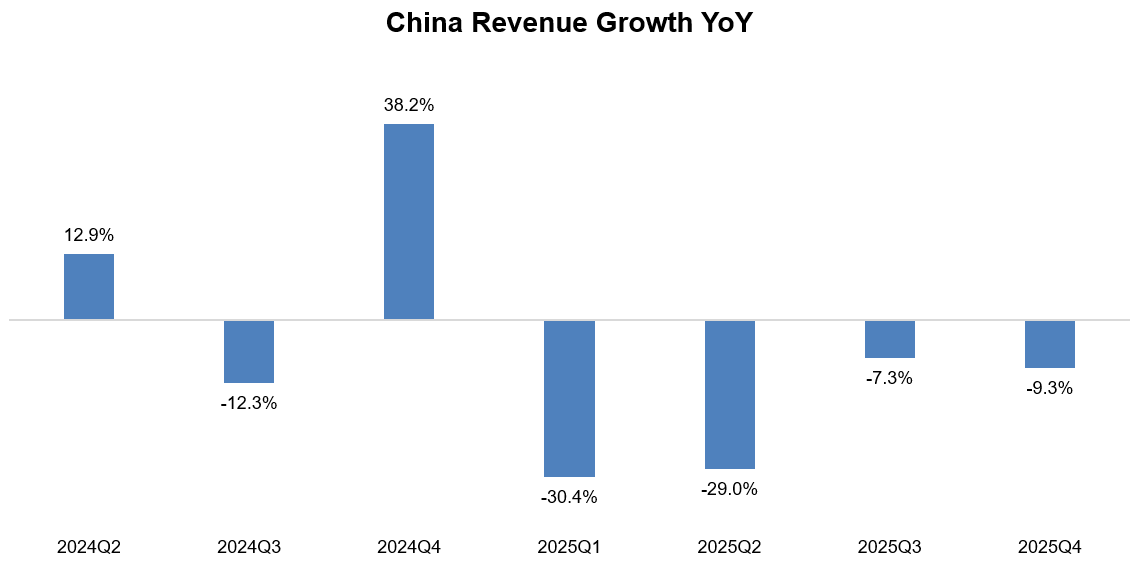

One of the primary culprits for IP’s weakness is China. For the four consecutive quarters, Synopsys China revenue was down. While it may seem China revenue was down 9.3% in 4Q’25, after excluding Ansys contribution, it was actually down 22%! As a result, China’s contribution in Synopsys revenue mix declined from 16.1% in FY’24 to 11.5% in FY’25 (including Ansys).

Synopsys management explained their predicament in China, especially for IP business:

“On the classic Synopsys side, what we’re facing in China is primarily our inability to sell to the market that needs the most advanced solution…From a Synopsys standpoint, where it impacts us the most is in IP, given the proportion of our business and our leadership in IP, not only in China broadly, but in China that has a fairly big impact on Synopsys.

From EDA in general…we’re not losing share to our standard or the peers that you think about. When we’re losing share in China are for customers our industry cannot sell to. And therefore, there’s an erosion that is happening on the EDA side on customers that we cannot deliver or support due to entity restriction or technology. So we believe we have derisked it in our guide for ‘26. And of course, when you pass ‘26 and assuming the environment is the same, meaning no additional restrictions, then the comps get easier in terms of comparing year-over-year.”

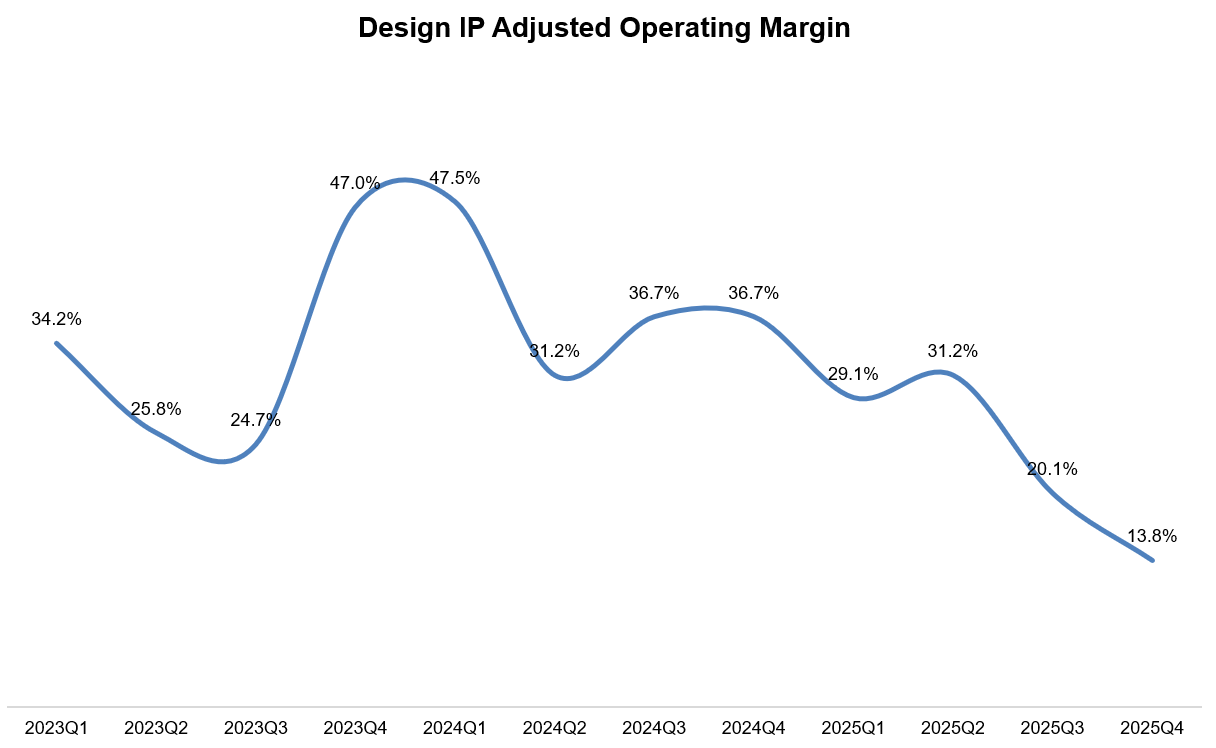

Design IP margins predictably took a nosedive given the declining revenue. Design IP’s adjusted operating margin was 47% in 4Q’23, but it came down to only 13.8% in 4Q’25. It’s actually even worse than that since these are adjusted numbers that add back SBC. Considering SBC as a percentage of overall revenue was 10.5% in 4Q’25, the real margin in design IP segment was likely barely breakeven.

Given this context, Synopsys likely feel increasing pressure to capture more value from their IP business. Back in 2024 Investor Day, Synopsys management explained their pricing structure in IP business:

…most of our contracts are a committed agreement with the customer. So we call them FSAs, flexible spending account, where the customer commits x millions of dollars for a duration of time, and they pull the IP when they need it. So they burn that flexible spending account.

So we provide them that flexibility. It gives us the ability to forecast our business because those agreements are committed. The reason we don’t move to a subscription base in terms of the time base where you sell them a USB for 3 years, and they can pretty much use it on any chip start, it will impact our monetization ability.

…The customer pays us even if the chip does not go in production…even if they design in the IP and the chip does not go into mass production, we get paid.

However, Synopsys appears to be willing to make some changes to capture further upside. I will discuss this evolution, as well as a slight change in my portfolio, behind the paywall.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 65 Deep Dives here.