Shopify's Surprise, XPEL 2Q'25

Shopify’s Surprise

I started buying Shopify in February 2022 in the $80s. I eventually averaged down which led to my average buy price to be ~$39/share, but the stock kept going down and found bottom in the mid-20s. I eventually sold my position in mid-$40s (sold at various prices between 30 and 50, but average was in the mid 40s) in February 2023. After just two and half years, the stock is now at ~$150. I’m sharing this history because I wanted to discuss a particular point.

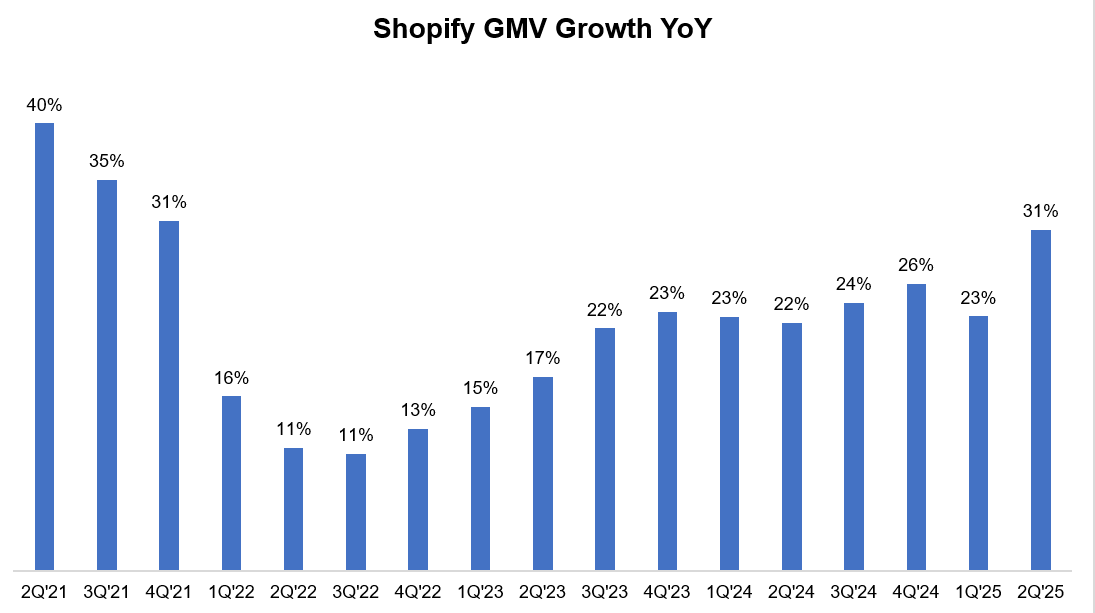

It’s quite common among investors to stare at a stock price chart and lament about missing the large gains. But more often than not, these frustrations are often quite misplaced. Of course, in hindsight I look a bit stupid to sell the stock at mid 40s, but take a look at what happened to GMV growth after I sold i.e. 1Q’23. Obviously, I never imagined the Shopify would grow at such an astonishing pace. Why couldn’t I imagine that? Whatever the reason, if someone modeled this growth trajectory I would probably think “You drank the Tobi Kool-Aid a bit too much. You need to calm down a bit.”

In fact, I was wondering that Shopify might be graduating from high-flying GMV growth stock to HSD to LDD GMV growth in the next few years which will put them under the scanner to improve their margins to drive earnings growth to sustain their lofty multiples.

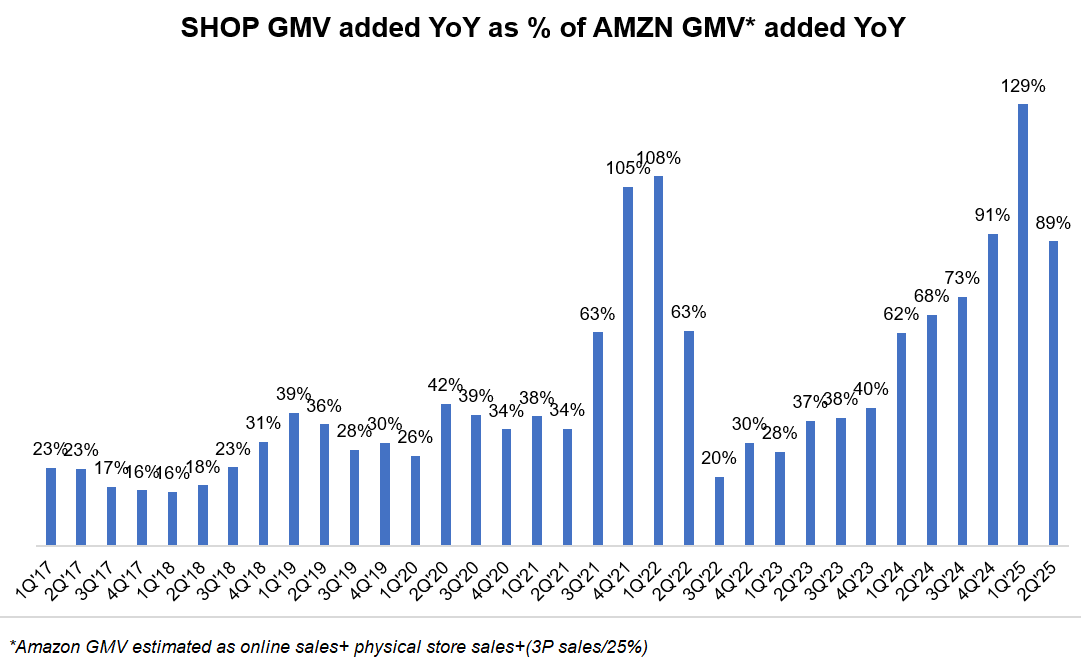

Again, look at the below chart that I very closely track: Shopify GMV added YoY as a percentage of Amazon GMV added YoY. Shopify truly punched above its weight during the pandemic and came down to more historical level of “market share” relative to Amazon. To my utter astonishment, they have now gone back to their heyday of “market share” gains relative to Amazon.

Perhaps a lot of it was always just the ATT impact. Once Meta recovered the signal, Shopify coasted through it (and then some) and the slowdown in 2022-23 proved to be a false signal.

Looking at these two charts makes me feel there is something fundamental about Shopify that I have never quite appreciated enough and it is perhaps only “fair” that I didn’t get to enjoy those large gains without such insight and appreciation.

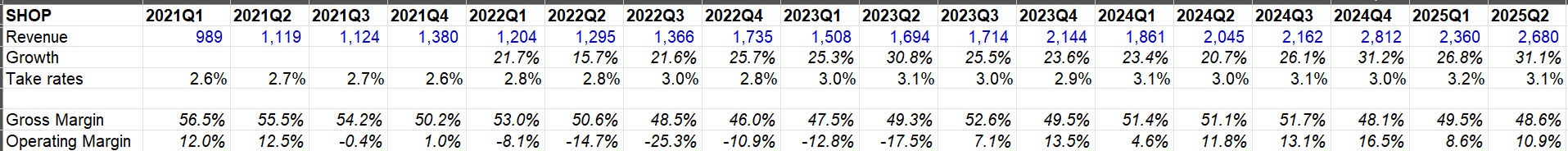

It wasn’t just GMV growth acceleration, Shopify achieved this by largely maintaining their take rates and improving their operating margins substantially since I sold the stock. Their gross margin remains stuck around ~50% and you may not need to drink too much Tobi Kool-Aid to think ~20% operating margin is possible at scale.

Of course, let’s not forget the stock currently trades at ~120x LTM EBIT. But I don’t want to give an impression that’s the real story behind my missed profits. The real reason is I am utterly astonished by the company’s operating performance in the last couple of years. My hats off to Shopify management! 🫡

In addition to "Daily Dose" like this (yes, DAILY), MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 61 Deep Dives here.

XPEL 2Q’25

I will share my earnings recap of XPEL behind the paywall.