Shopify's Miraculous Momentum

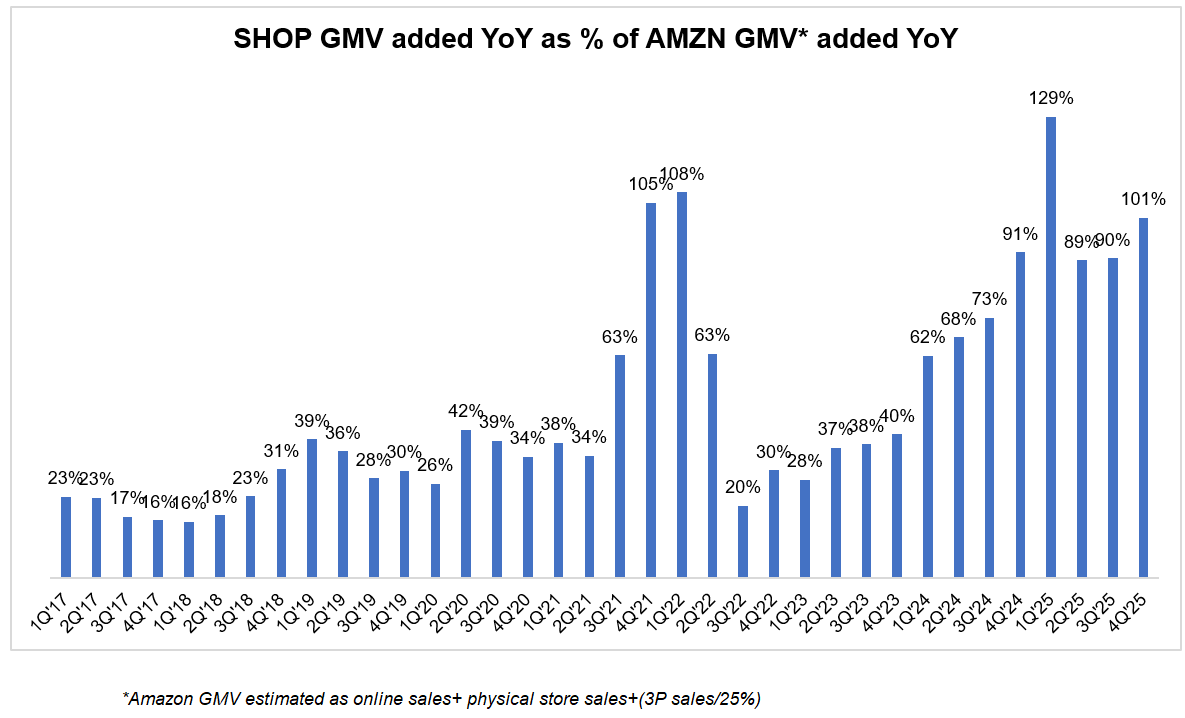

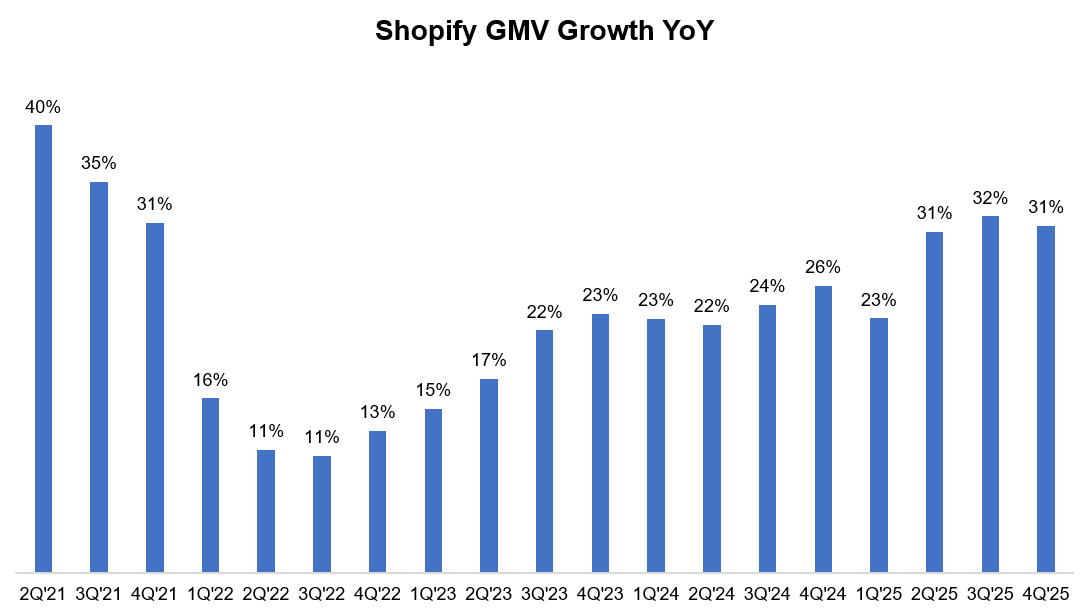

One of the most impressive things about Shopify is their ability to grow GMV in tandem with Amazon in recent quarters. Shopify was able to maintain such admirable momentum in 4Q’25.

One of the key reasons for Shopify to be able to match Amazon’s growth is that their business model is inherently much more scalable globally than Amazon’s. Even though ~14% of US e-commerce now goes through Shopify’s platform, international is increasingly a very important growth driver for Shopify which is hard for Amazon to match. Just like in 3Q’25, almost half of their incremental GMV dollars came from outside the North America. Their GMV from European merchants actually increased by 45% (35% in FXN) in 4Q’25. Their B2B GMV growth of 84% also was a tailwind. The new cohorts are actually performing even better than the earlier ones which is a terrific sign for the health of the platform. From the call:

In Q4, our growth was led by the 2024 and 2025 cohorts, which have proven to be larger and more productive than prior cohorts, outperforming older cohorts in GMV and revenue after similar periods of time on the platform.

Quite remarkably, 4Q’25 GMV alone was higher than Shopify’s GMV back in entire 2020, a year which was massively benefitted by pandemic! Shopify’s operating performance, no matter whether you’re a bull or bear, seems almost bit of a miracle in the last five years. The fact that the stock is still mostly flat during this period tells all you need to know what an embarrassing bubble 2021 was for SaaS stocks (to be clear, embarrassing for investors, not for the management or the companies).

This somewhat miraculous GMV growth in recent quarters was achieved while materially improving profitability. I will discuss more about their margins and key takeaways from the earnings call behind the paywall.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 66 Deep Dives here.