Nvidia and OpenAI's Gambit

A programming note: I will publish my Deep Dive on ASML tomorrow. As a reminder, I only send one email per day; therefore, on the day I publish my Deep Dive on a company, I won’t publish anything else.

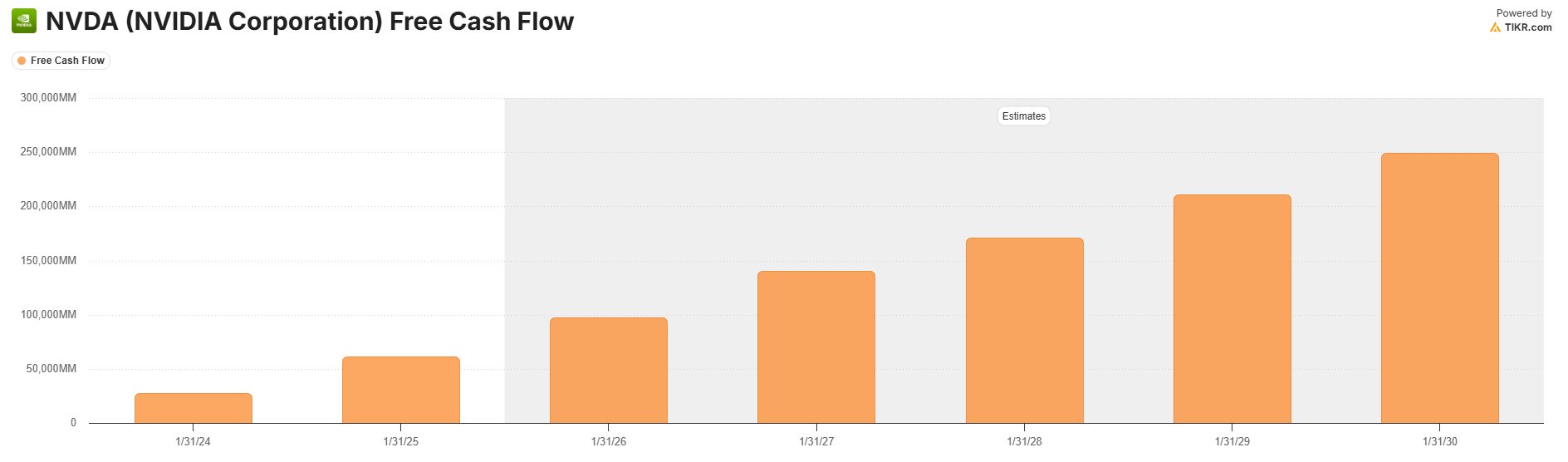

Early this year, I remember looking at Nvidia’s consensus FCF estimates for the next five years and wondered what exactly Nvidia will do with all these money.

To put this in perspective, from FY’26 to FY’30, Nvidia is expected to generate a cumulative $867 Billion of FCF in the next five years! Of course, these are just consensus estimates, so who knows what the actual numbers will be. But looking at the number made me wonder that what Nvidia will choose to do with all these FCF may have a profound impact on the big tech landscape. I was a bit skeptical that all they would do is buyback shares.

Indeed, we may have a slightly better idea now what Nvidia is going to do with the hyperscalers’ “recurring” gift to them. It appears Nvidia may be going to fund the most capital intensive private company the world has ever seen: OpenAI.

OpenAI and Nvidia entered into a “strategic partnership” to to build and deploy at least 10 gigawatts of AI data centers which will require millions of GPUs. Nvidia mentioned that it “intends to invest up to $100 billion in OpenAI progressively as each gigawatt is deployed”.

While Nvidia stock went up initially (which must mean market took the deal positively), I have seen plenty of negative reaction to the deal which is taken as a sign of bubble or froth in AI. The web of relationships and scratching each other’s back among several companies in the AI ecosystem is likely to raise eyebrows of even the most ardent AI believers!

There may be a lot of merit to such skepticism, but admittedly, if I were in Jensen’s shoes, I am not sure I would do anything differently. To say it differently, from Nvidia’s perspective, I think it makes much more sense to allocate capital in a way to try to design the AI ecosystem to maintain or bolster their competitive position.

I do want to note that I feel a little uncomfortable writing anything about OpenAI. The company seems to throw some really eye-popping numbers and partnerships to shock everyone even though they just have a low double digit billions of revenue today. Just yesterday, WSJ reported that OpenAI is planning to build $1 trillion of computing infrastructure. I may never see another company in my lifetime throwing trillion dollar numbers with so little revenue!

Having said that, I do want to update my opinion a bit post-Nvidia deal. OpenAI can sign $300 Billion of RPO with Oracle but since neither of them has the cash or debt capacity to fund it, you could be genuinely skeptical about some of OpenAI’s audacious proclamations. Given the size of funding requirement, I was also not quite a believer that VCs can continue to fund it, especially considering they also need to find checks to fund Anthropic, xAI etc. But now that Nvidia appears to be willing to fund OpenAI’s ambitions, OpenAI may have found their most credible partner ever for their funding needs. Given that hyperscalers seem to compete against each other who can give money to Nvidia faster, OpenAI may not have to worry for a while about funding as long as they stay at the frontier in AI.

However, this partnership may cast a long shadow over the rest of Big Tech. An unconstrained OpenAI is a far more formidable competitor.

The impact on hyperscalers (AWS, Azure, GCP, and Meta) is particularly acute from a supply chain perspective. In a market already characterized by severe GPU scarcity, a 10-gigawatt commitment will inevitably cannibalize available supply. With Nvidia heavily prioritizing this massive allocation to OpenAI, the GPU supply for other major cloud providers will remain squeezed, potentially stifling their own AI infrastructure buildouts and making it harder to serve their customers.

This development makes one thing abundantly clear: Application-Specific Integrated Circuits (ASICs) are no longer a “fun little project” or a mere negotiating tactic; they may be an absolute necessity. Hyperscalers cannot afford to have their largest capex dictated by a single supplier, especially one that is now heavily backing a key competitor in various niches. The motivation to develop viable in-house silicon has never been stronger.

I, however, don’t want to romanticize ASICs too much. Custom silicon shines once the model architecture and software stack settle; until then, general‑purpose GPUs and Nvidia’s end‑to‑end tooling can keep winning. When might the model architecture and software stack stabilize enough for ASICs to shine? Unfortunately, that question is above my paygrade.

However, over the long-term, ASICs feel increasingly essential about gaining bargaining power, ensuring supply chain diversity, and maintaining control over each of hyperscalers’ technological destiny. Relying solely on Nvidia is too great a strategic risk, regardless of GPU price.

Google, of course, occupies a somewhat unique position. They were the earliest to invest in custom silicon and possess arguably the best talent pool to execute on it. Internally, Google is largely insulated thanks to their robust TPU infrastructure. Yet, their cloud business (GCP) remains exposed because enterprise customers overwhelmingly prefer the familiarity and established ecosystem of Nvidia’s GPUs. I wonder if Nvidia-OpenAI partnership further incentivizes Google to make their TPUs a more compelling external offering in other neoclouds. If there is too much demand-supply mismatch in GPUs, more and more customers may be willing to give TPUs a shot.

Given Microsoft’s own massive investment in OpenAI, I am a tad bit surprised that the market hasn’t reacted more negatively to Microsoft after this partnership. OpenAI seems to be cultivating a very “promiscuous” relationship strategy, taking significant capital from multiple strategic partners whose long-term goals may not perfectly align. The deal with Nvidia potentially dilutes Microsoft’s influence over OpenAI’s strategic direction. We will have to wait for more details about Microsoft-OpenAI’s latest negotiations as their joint statement said they are “actively working to finalize contractual terms in a definitive agreement”. I was confused about such a joint statement (why not just wait to finalize the agreement and then issue a press release), and my confusion only compounded after reading Nvidia’s press release about OpenAI partnership which mentioned “NVIDIA and OpenAI look forward to finalizing the details of this new phase of strategic partnership in the coming weeks.” If the deal hasn’t been finalized yet, why is there any hurry for issuing a press release?

In addition to "Daily Dose" (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 62 Deep Dives here.

Current Portfolio:

Please note that these are NOT my recommendation to buy/sell these securities, but just disclosure from my end so that you can assess potential biases that I may have because of my own personal portfolio holdings. Always consider my write-up my personal investing journal and never forget my objectives, risk tolerance, and constraints may have no resemblance to yours.