Meta's monetization game

Back in 2022, Meta was facing onslaught from multiple directions: a) Apple’s App Tracking Transparency (ATT), b) regulatory threats from Europe (and sometimes even the US), c) competition from TikTok, d) rising capex with uncertain pay-off, and e) persistently rising operating losses in Reality Labs with even more uncertain pay-off.

If you look closely, while the stock increased by 7-8 fold from the bottom, almost all of these concerns except ATT are still sort of simmering around.

Europe still has plenty of zeal for coming up with novel (and often nonsensical) regulations. TikTok is still around and while Reels is a very effective response so far, with OpenAI’s Sora, Meta’s clock may be ticktocking for another race. Meta’s recent capex guide (~$100 Billion for 2026) dwarf its 2023 capex outlook in 3Q’22 call ($34-39 Billion) which raised so many eyebrows back then. There is still plenty of debate around pay-off for such elevated capex. For reality labs, I suspect there is not even much of a debate. There is almost a consensus among investors that all these spending in reality labs won’t yield much return for the company in the future. I am yet to come across a Meta bull pounding the table how reality labs investments will contribute materially to Meta’s business even 5 years from now.

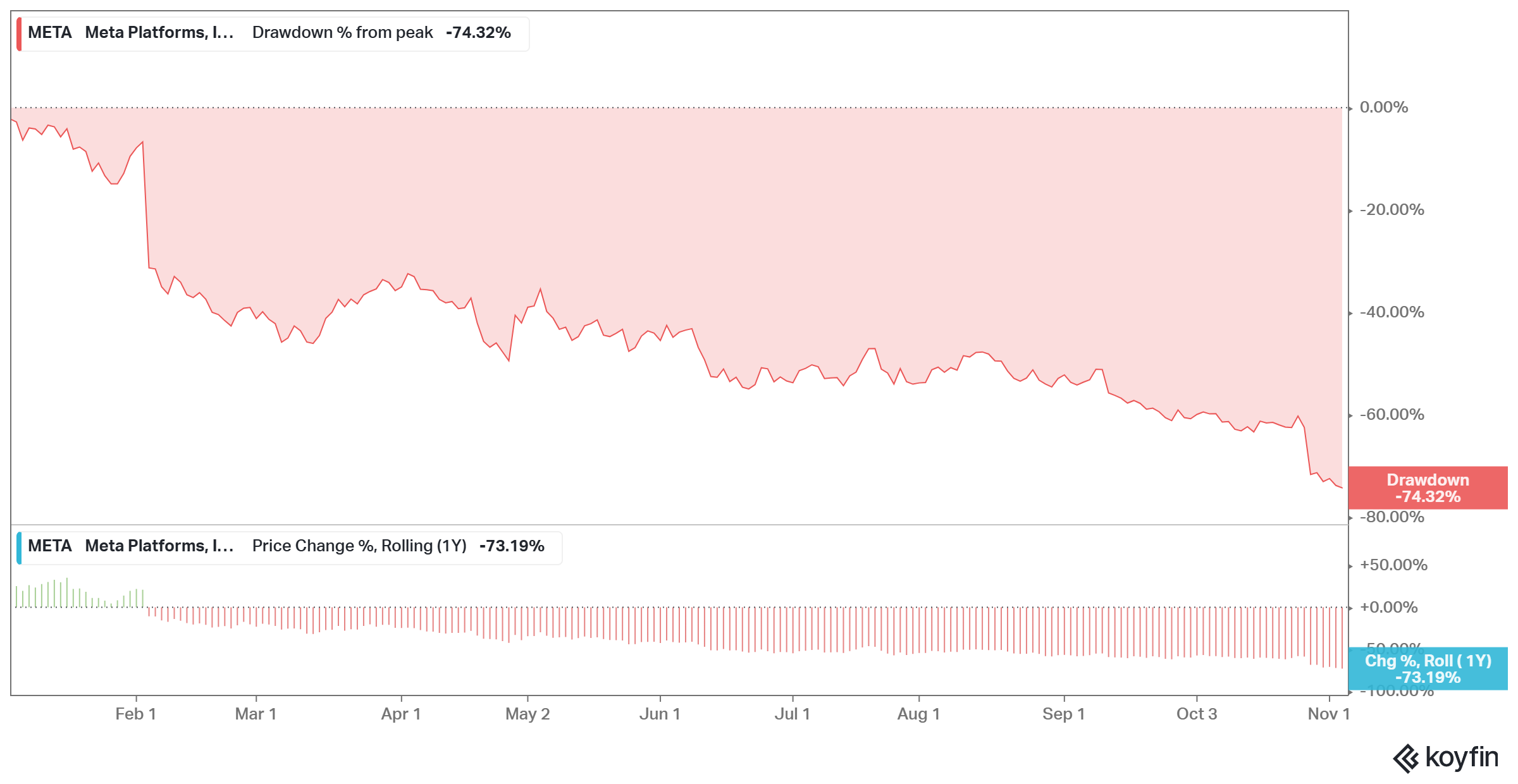

Even though it can be hard to pinpoint which of the aforementioned reasons primarily led to Meta’s ~75% drawdown in 2022, I would argue the vast majority of the decline could likely be explained by ATT. The rest of the concerns weren’t invalid, but I suspect the rest of the concerns would have harder time having a sustained relevance in investor psyche if Meta continued to post strong revenue growth in 2022. In reality, Meta actually posted negative revenue growth in 2022 for the first time in its history largely due to ATT, and all the concerns essentially fed each other to depict a draconian future for the company.

The reason I am repeating the history of investor concerns around Meta is to point out that much of the concerns in the near-term are almost always likely to be outweighed as long as the company’s monetization game remains strong. Of course, the stock can go down for variety of reasons but the company today is decidedly in a very advantageous position when it comes to monetization.

I have written about “golden age of digital advertising” before (see here, and here), and Meta’s recent initiative about “Business AI” is another step in the direction of deepening the effectiveness of its ad infrastructure. From Meta’s blog post:

“Meta is launching new Business AIs – a turnkey sales concierge and AI agent designed to help you engage, convert and build lasting relationships with your customers in the AI era. With just a few clicks, you can configure Business AI for your WhatsApp and Messenger chats, Facebook and Instagram ads, and now, also on your website.

Business AI extends to more than just Meta’s apps. Starting today, qualifying businesses in the U.S. can also add Business AI directly to your website to answer frequently asked questions, make product recommendations and help drive sales.”

In another blog post, Meta expanded on Business AI’s use cases:

Business AI from Meta is unique because it adds further value to your existing Meta business account and campaigns. You don’t need to know how to code or spend months configuring the agent: Business AI learns from your existing social posts, ad campaigns, and website to provide more immersive responses for customers. Business AI on ads will be free to use for eligible advertisers, and at a fraction of the cost of alternatives on website and messaging apps.

To give shoppers more ways to visualize a product and inspire confidence, we’ll begin testing the ability to see how clothing featured in an ad looks on them after they upload a photo of themselves.

As I mentioned before, the fact that UK CMA reported that Google’s search revenue in the last decade was largely driven by increasing click-through rate (CTR) and improving conversion rate (CVR) must be a very positive signal for Meta’s monetization runway. Since search users already have much higher intent than Meta’s users, improving CTR and CVR are likely harder for Google than Meta. With features such as Business AI, I can see how Meta can accelerate user journey from awareness to consideration to purchase.

Of course, capitalizing on this monetization runway is predicated on the assumption that Meta’s properties will continue to dominate the attention economy. However, this is likely a perennial concern. No matter how many times Meta squashes or largely mutes the threat to its dominance in attention economy, something new almost always emerges. At least so far, many of these threats eventually turned out to be a very good outsourced “R&D” for Meta to figure out how to make their scaled properties more compelling for its own users!

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 63 Deep Dives here.

Current Portfolio:

Please note that these are NOT my recommendation to buy/sell these securities, but just disclosure from my end so that you can assess potential biases that I may have because of my own personal portfolio holdings. Always consider my write-up my personal investing journal and never forget my objectives, risk tolerance, and constraints may have no resemblance to yours.

My current portfolio is disclosed below: