Meta 3Q'23 Update

Disclosure: I own shares and 2025 January $50 Call Options of Meta

Meta had a terrific third quarter which makes the after-hours reaction (down ~3%) tad bit surprising, but perhaps understandable given the wider range of scenarios for advertising going forward.

Here are my highlights from tonight’s call.

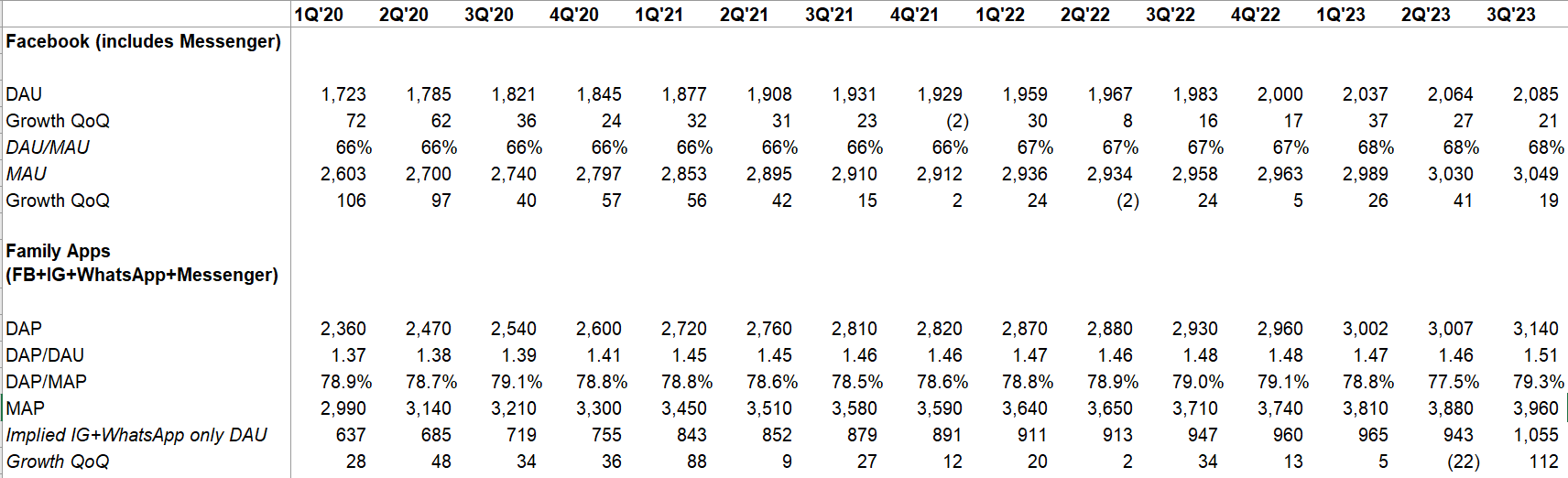

Users

Since 4Q’19, Meta added 880 Mn Daily Active Users/People (DAU/DAP) to its Family of Apps (FOA) properties. Given Snap currently has 406 mn DAU, this means Meta added two “Snap” (and then some) in less than four years!!

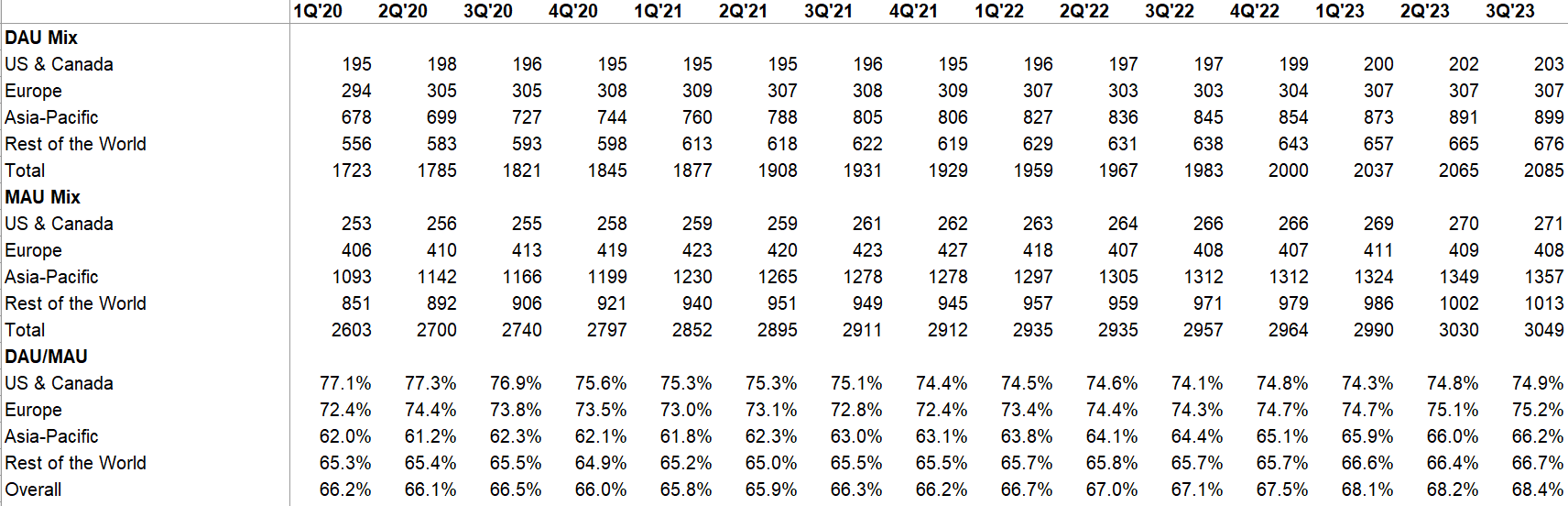

Engagement

DAU/MAU engagement looks steady across all regions. Overall DAU/MAU ratio has been inching up for the last seven consecutive quarters.

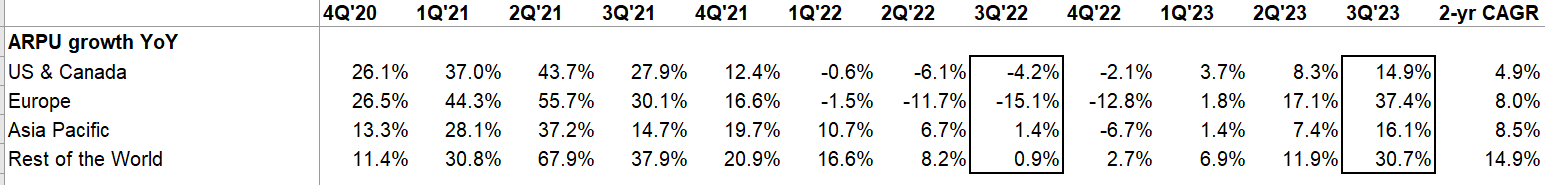

ARPU

While ARPU exhibited considerable strength, please note the material weakness in YoY comparison and hence, 2-yr CAGR is likely better reflective of long-term trend.

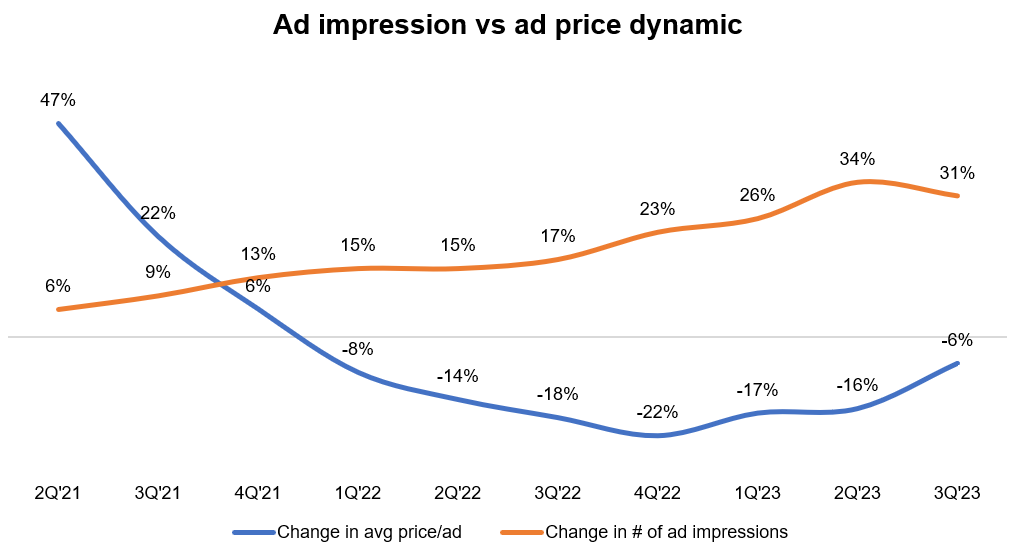

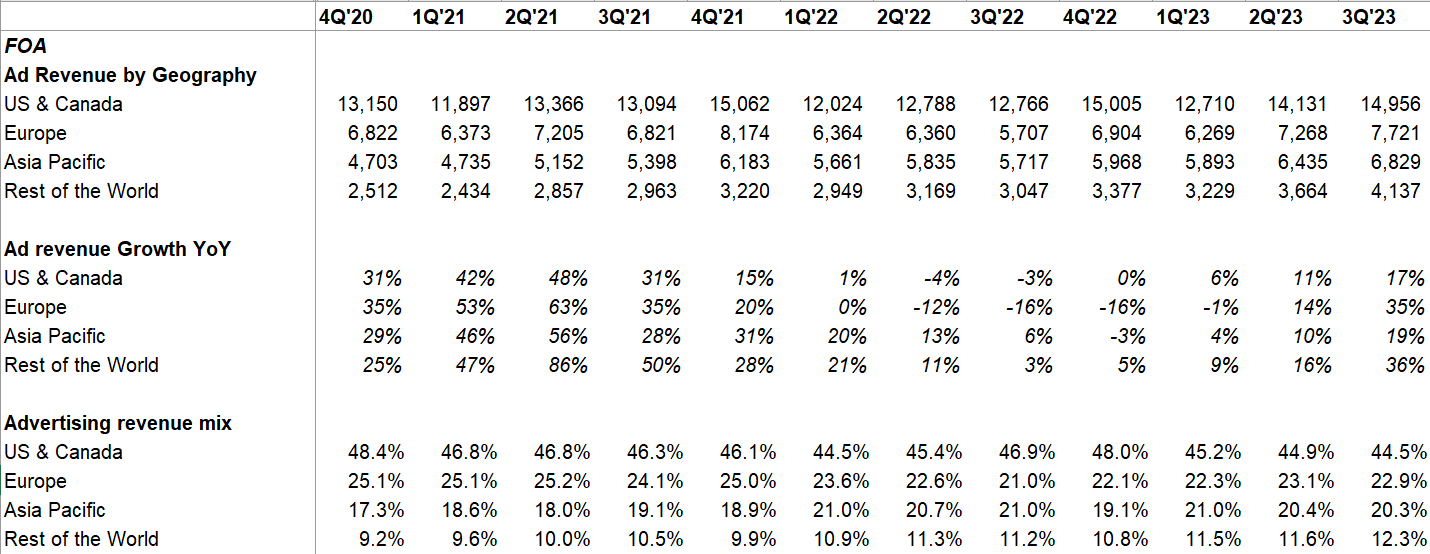

Ad revenue

Number of ad impression grew by 31% YoY whereas average price per ad declined by 6% YoY, driven by higher impression growth in APAC and RoW as well as lower monetizing surfaces (i.e. Reels).

Largest contributor to YoY growth: online commerce, CPG, and gaming respectively. Again, Meta highlighted strong demand Chinese advertisers:

spend from Chinese advertisers further accelerated for us in Q3. We have benefited from strong investments from a few of our larger clients. We've also seen generally broader-based strength from other China advertisers, and we believe factors such as lower shipping costs and easing regulations on the gaming industry have served as tailwinds here. But I think there has been a broader story of improved growth across all advertiser regions in Q3, and even excluding China, advertisers revenue growth has accelerated nicely.

But is the strong demand from Chinese advertisers sustainable? Meta mentioned even though they enjoyed long-term robust demand from these advertisers, they can be a bit volatile:

you kind of alluded to whether there's – the sustainability of the China advertising revenue. And even though we've seen particularly strong growth this year, I would say that there has been a longer-term trend of overall growth with this segment dating back to past years and also periods of volatility in the past, like in the last 2 years, we've seen periods with higher shipping costs with lockdowns, with regulation weighing on demand. So we recognize there's the potential for volatility in the future as well and especially given that there are so many macro factors at play that are quite hard to predict

I also wanted to highlight the growing contribution from APAC and RoW region. During 2019-20, these two regions used to contribute ~26-28% of Meta’s ad revenue; in each of the last three quarters, these regions were >32% of total ad revenue.

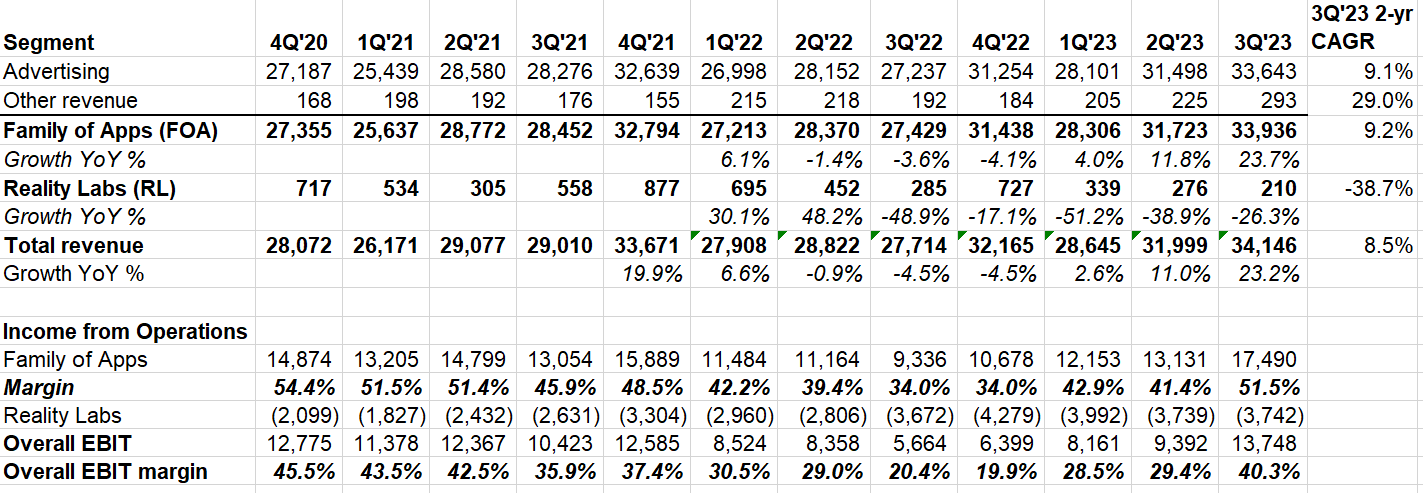

Segment Reporting

Overall revenue was +23% YoY(+21% FXN)

Total expenses -7% YoY, FOA expense -9% YoY

While easy comp can be thought of as one of the rationales for such growth, I think Meta’s resilience can be understood in comparison with Google. On a 2-yr CAGR basis, Google Search revenue grew by 7.7% and Google advertising increased by 6% whereas Meta’s advertising business grew by 9.1% CAGR.

Considering ATT and all the things that happened over the last two years, this has been an incredible turnaround for Zuck and Co. Even more impressive is FOA’s ~81% (no typo) incremental operating margin in 3Q’23 vs 3Q’21. After eight quarters, FOA returned to >50% operating margin. Admittedly, I myself started thinking in 2022 that we may never see >50% operating margin in FOA again. Glad to be proved wrong.

Reality Labs (RL) continue to hemorrhage losses, but losses are almost flat QoQ.

Reels

Reels has been a massive success: +40% increase in time spent on IG since launch; Monetization milestone reached earlier than expected as it is now net neutral to revenue.

Reels is expected to be modest tailwind to revenue in 2024.

Business Messaging

600 mn conversations happen everyday between people and businesses on Meta’s platforms.

>60% of people on WhatsApp in India message a business app account. Click-to-messaging ads doubled YoY in India.

Business messaging revenue is included in FOA’s “other revenue” which was +53% YoY largely driven by Business Messaging growth on WhatsApp.

We're seeing sustained momentum with click-to-message ads. Click-to-WhatsApp ad revenue continues to grow very quickly in particular and is already at a multibillion-dollar annual run rate. We're progressing on our work to enable further down-the-funnel conversions. And longer term, we're excited about the potential of AI to help businesses message with customers more efficiently at scale.

Threads

Threads now has 100 Mn MAU.

Chat Bots

Meta thinks chat bots engagement should be incremental:

this is a new use case that doesn't take away from people interacting with people. If anything, it should – we're designing these to make it so that they can help facilitate and encourage interactions between people and make things more fun by making it so you can drop in some of these AIs into group chats and things like that just to make the experiences more engaging. So this should be incremental and create additional engagement.

AI

Recommendation system increased time spent on FB and IG by 7% and 6% respectively in 2023. AI tools for advertisers are also driving results with Advantage+ shopping campaigns with a $10 billion run rate.

If you assume similar monetization for this incremental engagement, you can start to see that all those capex may be worthwhile. Perhaps that’s why Meta wants to lean onto hiring for more AI-related projects:

AI will be our biggest investment area in 2024, both in engineering and compute resources. But I want to avoid allocating a lot of new headcount. So we're going to continue deprioritizing a number of non-AI projects across the company to shift people towards working on AI instead.

we have a sizable hiring backlog right now since part of our layoffs earlier this year included teams swapping out certain skill sets for being able to hire others. And we're still going to be hiring those roles into 2024. So that means that even though we're planning to grow headcount at a much slower rate going forward, the actual rate next year may temporarily be faster as we work through this hiring backlog.

Meta believes what they’re doing on AI is quite unique:

here's some analogy (note: chat bots) is like what OpenAI is doing with ChatGPT, but that's pretty different from what we're trying to do. Maybe the Meta AI part of what we're doing overlaps with the type of work that they're doing, but the AI characters piece, there's a consumer part of that, there's a business part, there's a creators part. I'm just not sure that anyone else is doing this.

I think for the Feed apps, I think that over time, more of the content that people consume is going to be either generated or edited by AI. Some of it will be creators will now have all these tools to make content more easily and more fun. And I think over time, maybe we'll even get to the point where we can just generate content directly for people based on what they might be interested in. I think that, that could be really compelling.

Llama and Open Source

Llama 2 was downloaded more than 30 mn times last month.

What’s the point of making all these work open source?

our CapEx expenses are a big driver of our costs, so any aid in innovating on efficiency is sort of a big thing there.

While at the same time, a lot of the secret sauce that goes into our product has specific product logic on top of the model, and we're also able to further train the models with data that we have internally. So I think it's a good balance of improving the quality of what we do and improving the economics around it and improving recruiting while still enabling us to build a leading product.

Metaverse

Can FOA ever be benefitted through RL’s work?

Reality Labs is working to build the future of online interactions. And we do expect you'll see some interesting ways that translate into work with the Family of Apps in the near term.

…Longer term, obviously, we think there's a lot of value from operating our Family of Apps experiences on top of a new computing platform that we helped develop, for example, having glasses on that enable you to have our Meta AI assistant with you at all times. And as glasses scale, they'll make it increasingly easy to capture compelling content from a first person point of view while you're staying in the moment or the activity that you're doing and sharing that content should enrich our content ecosystems even further.

the smart glasses that we just rolled out, we sort of thought were a precursor to eventually getting to displays and holograms for augmented reality, and I think we will eventually get there still. It's not that far off. But I think that now the ability to deliver AI through smart glasses may end up being a killer use case for that even before you get to the kind of augmented reality type of use cases.

Meta sounded pleased with Quest 3 and Smart Glasses initial reception from people, but didn’t disclose any numbers.

Efficiency

As part of our 2024 budget, we plan to selectively allocate incremental headcount toward 4 key company priorities: AI, infrastructure, Reality Labs and monetization as well as toward our regulatory and compliance needs. Of those areas, we expect AI to be the largest area of increased investment as we further invest in generative AI across our core products, internal tooling and research efforts. We aim to offset some of this growth by continuing our efficiency focus and reducing planned hiring in other areas across the company in 2024.

The net effect of our efforts to close out our 2023 hiring underruns and our efficiency-focused 2024 budgeting process is that we expect to end next year with reported in-seat headcount meaningfully higher than our current headcount but to grow at a slower rate beyond that.

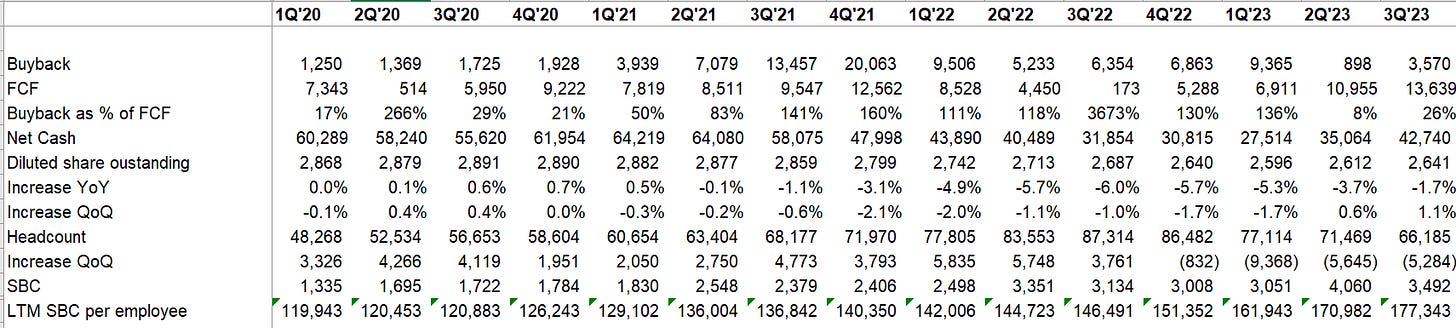

Capital Allocation

Like Google, Meta too was quite reticent in buying back stocks last quarter. For the second consecutive quarters, shares outstanding actually increased.

Why is Meta not buying back shares? Google alluded to pending tax payments. Meta hinted the same but while Google’s amount was $10 Bn, Meta didn’t specify any amount but my guess is tax is playing a role here.

In 1Q’20, Meta’s LTM SBC per employee was ~$120k (vs Google at $100k). Now Google is at ~$120k but Meta is at ~$177k! I wonder whether last few years poor stock price performance forced Meta to be a bit generous (among other things, likely not the only reason).

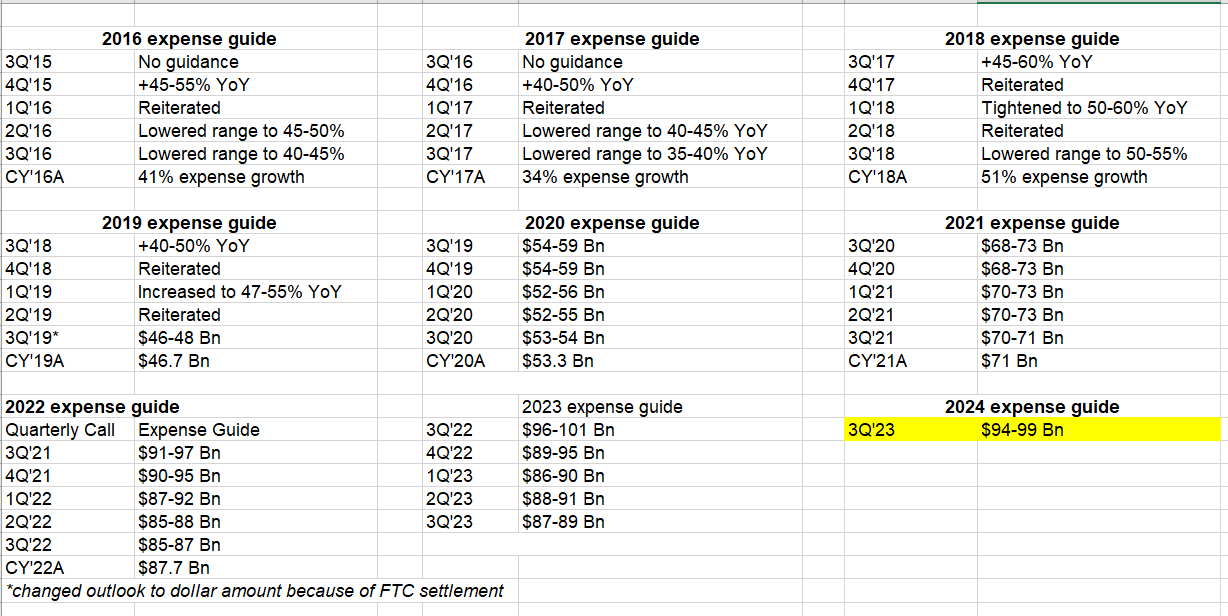

Opex Guide

Meta narrowed their opex guide range from $88-91 Bn to $87-89 Bn for 2023. They also provided 2024 expense guide: $94-99 Bn (street was more or less expecting $96-102 Bn, so this guide was better than expected).

FOA “will be a larger source of payroll expense growth than Reality Labs in 2024”.

Even though Meta is guiding 2024 expense, it seems some of it will depend on what they see in topline:

How the expense and revenue outlook come together? Obviously, that's -- as we get more information on the revenue outlook for next year, that will influence that.

Going forward, Meta will provide next year’s opex and capex guide in 4Q call instead of 3Q call.

Capex

Speaking of capex, 2023 capex range was narrowed: $27-30 Bn to $27-28 Bn (initial capex guide was $30-33 Bn)

2024 capex guide is $30-35 Bn which was also largely lower than what most people were expecting.

Regulation

Regulation, while ironically a moat for Meta, also remains a key worry for me as a shareholder. Meta touched on these concerns and it sounds like we may get an update on EU soon:

…we continue to monitor the active regulatory landscape, including the increasing legal and regulatory headwinds in the EU and the U.S. that could significantly impact our business and our financial results. Of note, the FTC is seeking to substantially modify our existing consent order and impose additional restrictions on our ability to operate. We are contesting this matter, but if we are unsuccessful, it would have an adverse impact on our business.

We're continuing to engage with the DPC and other regulatory authorities on our proposed consent model, but we're committed to making this move as soon as possible, and we will provide an update when we have it.

Outlook

4Q’23 topline guide is $36.5-40 Bn (+2% FX tailwind). The range is wider than usual for following reasons:

coming into Q4, we've been seeing continued strong advertiser demand in key segments, including online commerce and gaming. But having said that, we are also seeing more volatility at the start of the quarter. That's in part why we widened our guidance range to capture that uncertainty. And so for instance, while we don't have material direct revenue exposure to Israel and the Middle East, we have observed softer ad spend in the beginning of the fourth quarter, correlating with the start of the conflict, which is captured in our Q4 revenue outlook.

Closing Words

I will perhaps always vividly remember Meta’s 3Q’22 earnings, a period that truly instilled in my heart, mind, and brain that anything is possible in the market (see below tweet by Alex). As it looks like we are amidst another period of volatility in the market, it is good to remember that.

More commentary on follow-up call and 10-Q is here

For more in-depth analysis on Meta Platforms, you can read my analysis here (March, 2023).

I will cover Amazon earnings tomorrow. Thank you for reading.

If you are not a subscriber yet, please consider subscribing and sharing it with your friends.