Meta 1Q'25 Update

Disclosure: I own shares of Meta Platforms

Our goal is to make it that any business can basically tell us what objective they're trying to achieve, like selling something or getting a new customer and how much they're willing to pay for each result and then we just do the rest…if we deliver on this vision, then over the coming years, I think that the increased productivity from AI will make advertising a meaningfully larger share of global GDP than it is today.

-Mark Zuckerberg (1Q’25 Earnings Call)

Digital advertising has surpassed the days of “Mad Men” a while ago and thanks to AI, it seems even better positioned to unlock new markets and more opportunities. Meta is, of course, one of the companies leading this march.

Here are my highlights from today’s call.

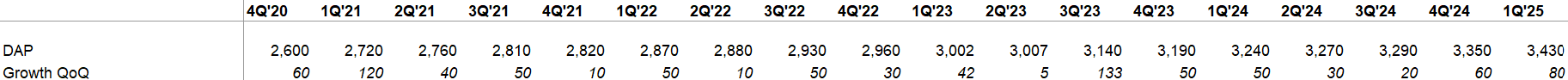

Users

Daily Active People (DAP) across its Family of Apps (FOA) accelerated to 80 mn QoQ in 1Q’25. I wonder when Zuckerberg starts to get concerned about the fertility crisis as well since Meta may run out of people to sign up for their products in a few years! (only half-kidding)

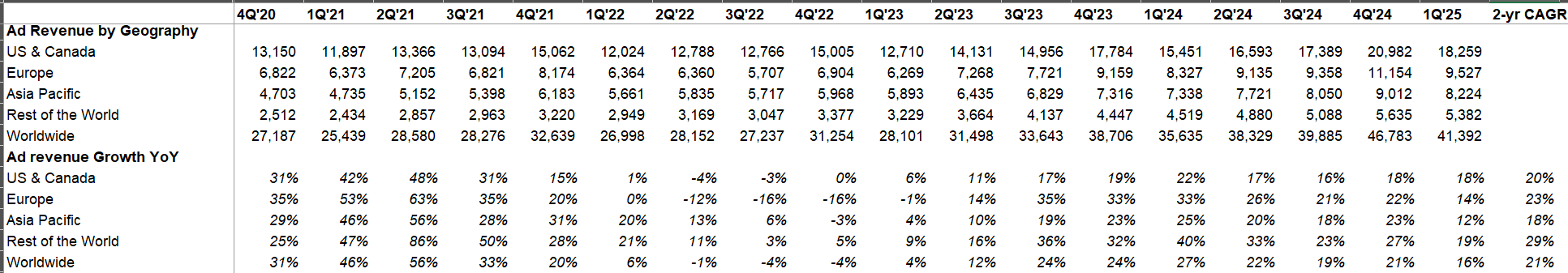

Ad revenue by Geography

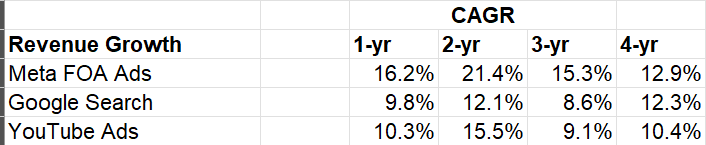

You can take a look at the table below and tell these numbers are quite impressive, but let me contextualize how impressive they are, especially in light of Google’s numbers.

Google advertising’s incremental revenue was $5.2 Bn in 1Q’25 YoY (of which Google Search added $4.5 Bn). Meta’s Family of Apps (FOA) ad business generated $5.8 Bn incremental revenue!

FOA’s growth has now surpassed Google’s even from pre-ATT days. Imagine facing an existential crisis and then come out stronger than ever before…a true sign of antifragility!

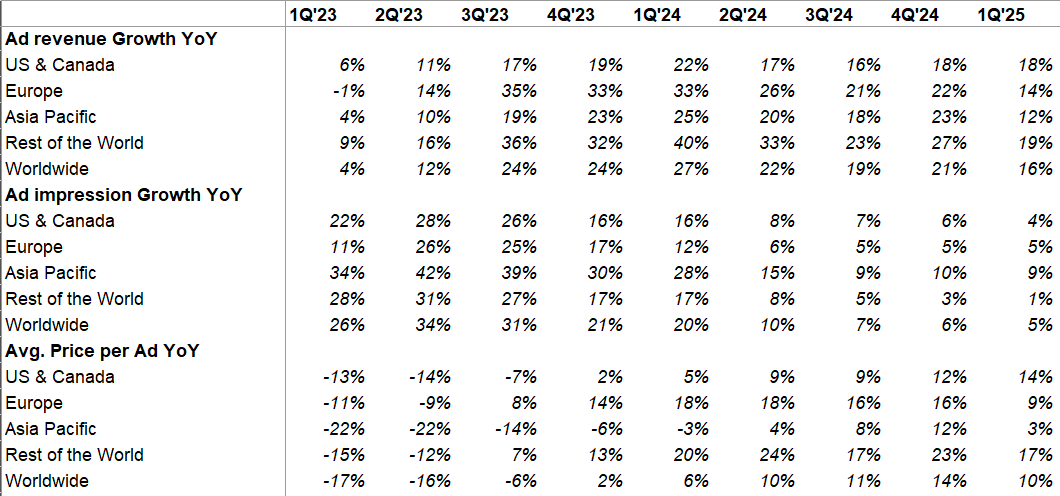

Ad Impression and Avg. Price Per Ad

I know a lot has been said about Google’s paid click growth of just 2% in 1Q’25. Meta’s ad impression growth was 5% YoY. On one hand, I think it makes Google’s number look more okay than many might think. On the other hand, Meta just seems to have more unmonetized impressions they can unleash if they ever feel too saturated. For example, Threads is just starting to monetize with 350 Mn MAUs. In the call, they also mentioned “tens of billions of views of status posts on WhatsApp each day”. I know they don’t monetize these via ads, but never say never. I wouldn’t be surprised if they eventually decide to monetize these; I’m obviously not suggesting anything in the near term but think long term i.e. 5-10 years and I sense it gives us more margin of safety in growth runway at Meta (vs Google).

This call also again drove the point home how AI is such a big deal in digital advertising and why even if impression growth stalls, we may have decent runway just by improving monetization of current impressions:

In just the last quarter, we are testing a new ads recommendation model for reels, which has already increased conversion rates by 5%. And we're seeing 30% more advertisers are using AI creative tools in the last quarter as well.

we continue to see conversions grow at a faster rate than ad impressions in Q1, so reflecting increased conversion rates and ads ranking and modeling improvements are a big driver of overall performance gains.

we continue to evolve our ads platform to drive results that are optimized for each business' objectives and the way they measure value. One example of this is our incremental attribution feature, which enables advertisers to optimize for driving incremental conversions or conversions we believe would not have occurred without an ad being shown. We're seeing strong results in testing so far, with advertisers using incremental attribution in tests, seeing an average 46% lift in incremental conversions compared to their business as usual approach. We expect to make this available to all advertisers in the coming weeks.

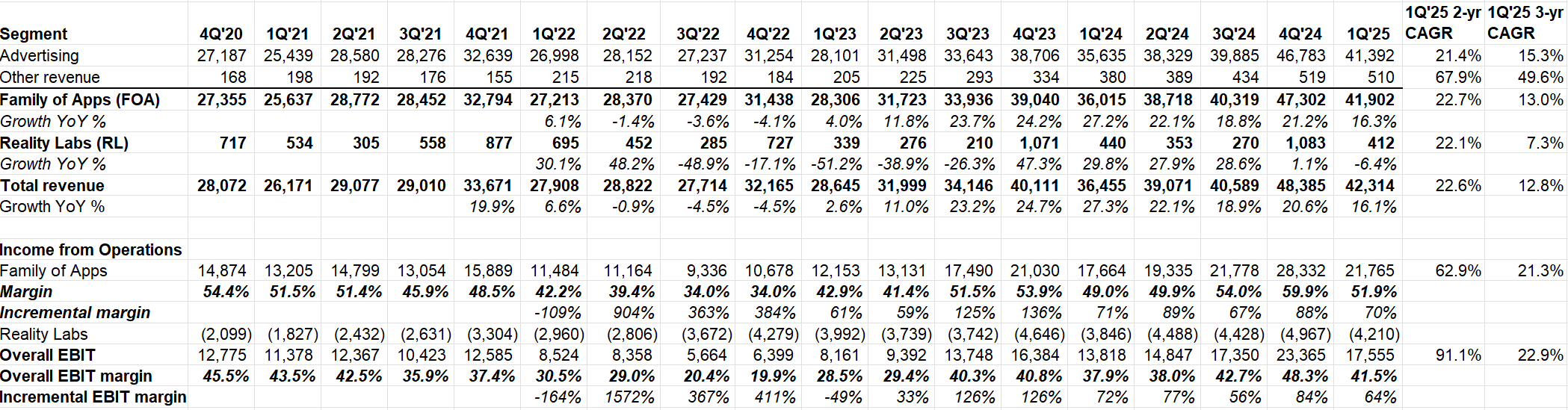

Segment Reporting

Overall 1Q’25 revenue was +16.3% YoY (~19% on constant currency).

FOA’s “other revenue” was +34% YoY which was driven by business messaging and Meta verified subscriptions (I don’t think Meta called out “verified subscriptions” as growth driver until this quarter. Of course, it’s probably meaningless given the scale of ads business)

FOA continued to post >50% operating margins.

For Reality Labs, another quarter of $4 Billion losses! More embarrassingly, revenue declined YoY! I know Meta is re-allocating a lot of expenses to AR glasses. I wonder if Meta is very close to admitting “defeat” in VR and scaling down their investments substantially by the end of 2026 if AI advancements don’t lead to sustained acceleration in VR in the next few quarters. AR likely deserves continued investments, so I don’t expect the Reality Losses to reverse course anytime soon even if they scale down investments in VR.

AI

Some quotes from the call all of which are good evidence for ROI on Meta’s AI investments:

In the last 6 months, improvements to our recommendation systems have led to a 7% increase in time spent on Facebook, a 6% increase on Instagram and 35% on Threads.

Over the long term, as AI unlocks more productivity in the economy, I also expect that people will spend more of their time on entertainment and culture, which will create an even larger opportunity to create more engaging experiences across all of these apps.

We began testing using Llama in Threads recommendation systems at the end of last year given the app's text-based content and have already seen a 4% lift in time spent from the first launch. It remains early here, but a big focus this year will be on exploring how we can deploy this for other content types, including photos and videos

we shared on the Q3 2024 call that improvements to our AI-driven feed and video recommendations drove a roughly 8% lift in time spent on Facebook and and a 6% lift on Instagram over the first 9 months of last year. Since then, we've been able to deliver similar gains in just 6 months' time, with improvements to our AI recommendations, delivering 7% and 6% time spent gains on Facebook and Instagram, respectively.

Meta AI

Meta AI monthly actives reached 1Billion (vs 700 million in 4Q’24 and 500 million in 3Q’24). While by this metric Meta AI looks better than even ChatGPT, I wouldn’t be surprised if number of conversations on Meta AI is not even 20% of ChatGPT gets today.

What are the top use cases?

The top use case right now for Meta AI from a query perspective is really around information gathering as people are using it to search for and understand and analyze information followed by social interactions from, ranging from casual chatting to more in-depth discussion or debate. We also see people use it for writing assistance, interacting with visual content, seeking help. And we see Meta -- people engage with Meta AI from several different entry points. WhatsApp continues to see the strongest Meta AI usage across our Family of Apps. Most of that, WhatsApp engagement is in one-on-one threads, followed by Facebook, which is the second largest driver of Meta AI engagement, where we're seeing strong engagement from our feed deep dives integration that lets people ask Meta AI questions about the content that's recommended to them.

How is Meta AI different from all the other chat bots out there?

I'm not sure that people are going to use multiple agents for the same exact things, but I'd imagine that something that is more focused on kind of enterprise productivity might be different from something that is somewhat more optimized for personal productivity and that might be somewhat different from something that is optimized for entertainment and social connectivity. So then there were different experiences. One of the trends that I think we're starting to see now is personalization across these. Right now if the experience is unpersonalized then you can kind of just go to different apps and get reasonably similar answers to different questions.

But once an AI starts getting to know you and what you care about in context and can build up memory from the conversations that you've had with it over time, I think that will start to become somewhat more of a differentiator.

While ChatGPT is certainly a productivity amplifier, it also very much satisfies a lot consumer use cases as well. And like Zuck said, it can definitely know me well and personalize the responses over time. I’m not super convinced yet that I will use different chat bots based on different query types.

Given OpenAI is still figuring out how to monetize free users and doesn’t have as prodigious cash flows as Google/Meta does, I wonder if the fight for the next 500 million users will be more closely fought than the first 500 million users was.

In this call, Meta did indicate that they will lean to their usual playbook of ad based model to monetize Meta AI:

Our focus for this year is deepening the experience in making AI the leading personal AI with an emphasis on personalization, voice conversations and entertainment. I think that we're all going to have an AI that we talk to throughout the day, while we're browsing content on our phones, and eventually, as we're going through our days with glasses. And I think that this is going to be one of the most important and valuable services that has ever been created. In addition to building Meta AI into our apps, we just released our first Meta AI stand-alone app. It is personalized. So you can talk to it about interests that you've shown, while browsing reels or different content across our apps. And we built a social feed into it. So you can discover entertaining ways that others are using Meta AI. And initial feedback on the app has been good so far…I think that there will be a large opportunity to show product recommendations or ads as well as a premium service for people who want to unlock more compute for additional functionality or intelligence. But I expect that we're going to be largely focused on scaling and deepening engagement for at least the next year before we'll really be ready to start building out the business here.

Facebook, and Instagram

In the first quarter, we saw strong growth in video consumption across both Facebook and Instagram, particularly in the U.S., where video time spent grew double digits year-over-year.

Messaging

Some good color on messaging opportunity:

…there are now as many messages sent each day on Instagram as they are on Messenger

…business messaging should be the next pillar of our business. In countries like Thailand and Vietnam, where there is a low cost of labor, we see many businesses conduct commerce through our messaging apps. There's actually so much business through messaging that those countries are both in our top 10 or 11 by revenue, even though they're ranked in the 30s in global GDP. This phenomenon hasn't yet spread to developed countries because the cost of labor is too high to make this a profitable model before AI, but AI should solve this.

Threads

Threads Monthly Active Users (MAU) over time:

3Q’23: 100 Million

4Q’23: 130 Million

1Q’24: 150 Million

2Q’24: 200 Million

3Q’24: 275 Million

4Q’24: 320 Million

1Q’25: 350 Million

MAU growth has decelerated a bit here.

AR

Ray-Ban Meta AI glasses have tripled in sales in the last year.

We're seeing very strong traction with Ray-Ban Meta AI glasses, with over 4x as many monthly actives as a year ago, and the number of people using voice commands is growing even faster as people use it to answer questions and control their glasses.

Capital Allocation

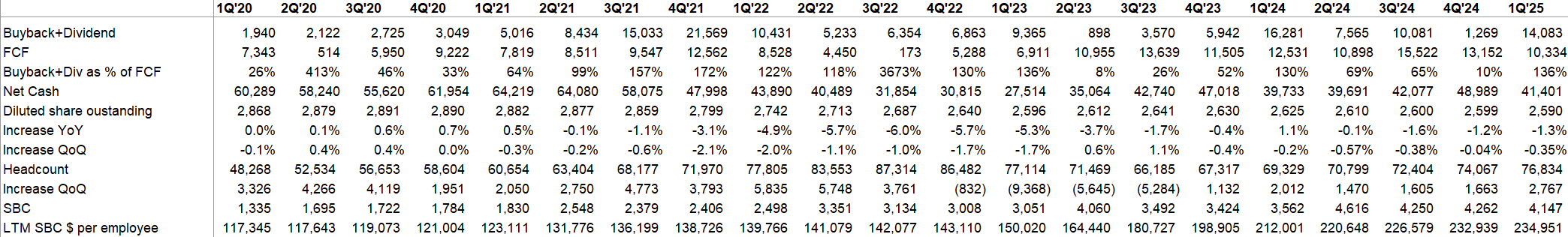

Interesting to see Meta was much more aggressive in 1Q’25 in buying back shares (vs last quarter). They haven’t filed 10-Q yet, but I will be curious to see the prices at which they bought back these shares given both the upside and downside volatility the stock experienced in the quarter.

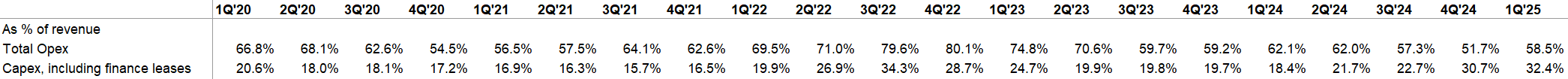

Capex and Opex

Looking at this table below, I wondered in which year Meta’s (and other big tech) depreciation expense may surpass their employee compensation expense! At the pace big tech is spending on capex, maybe it’s not as nonsensical as it may seem at first glance.

Regulation

The European Commission recently announced its decision that our subscription for no ads model is not compliant with the DMA. Based on feedback from the European Commission in connection with the DMA, we expect we will need to make some modifications to our model, which could result in a materially worse user experience for European users, and a significant impact to our European business and revenue as early as the third quarter of 2025. We will appeal the commission's DMA decision, but any modifications to our model may be imposed before or during the appeal process.

Meta later clarified that it would affect 16% of their overall revenue. There is not much merit to EU’s logic and it is clearly hostile to US tech companies as many EU companies do exactly what Meta has done. I would expect current US admin to not look the other way if US big tech is treated such a way by EU or anyone else in the world.

Outlook

Meta guided 2Q’25 revenue $42.5 Bn to $45.5 Bn (1% FX tailwind). Consensus is $43.8 Bn.

They also guided opex range down a bit from $114-119 Bn to $113-118 Bn.

However, capex guide was increased:

We anticipate our full year 2025 capital expenditures, including principal payments on finance leases will be in the range of $64 billion to $72 billion, increased from our prior outlook of $60 billion to $65 billion. This updated outlook reflects additional data center investments to support our AI efforts as well as an increase in the expected cost of infrastructure hardware. The majority of our CapEx in 2025 will continue to be directed to our core business.

Closing Words

Overall, this was a super impressive quarter and the guidance is reassuring even in the volatile tariff environment. The takeaway is pretty clear: Meta is very well positioned in navigating and riding along the secular theme of AI. It’s not just Meta of course; when I looked at Microsoft’s numbers tonight, perhaps the real surprise to me is the volatility that the big tech stocks routinely experience every now and then despite having such rock solid underlying business, growth, profitability, and balance sheets. Meta trades at below 25x NTM P/E even after ~5% AH rally, so the valuation is quite reasonable as well. I intend to stay invested.

Having said that, I am somewhat disappointed at Meta’s recent missteps in Llama and Zuck’s somewhat disingenuous explanation later. I don’t think Meta necessarily needs to have the best model for the stock to do well for long-term shareholders, but it does make me think whether the company may be losing their usual execution muscle a bit.

I will cover Amazon’s earnings tomorrow. Thank you for reading.

If you are not a subscriber yet, please consider subscribing and sharing it with your friends.

Disclaimer: All posts on “MBI Deep Dives” are for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.