Insurance Brokers 4Q'25 Update

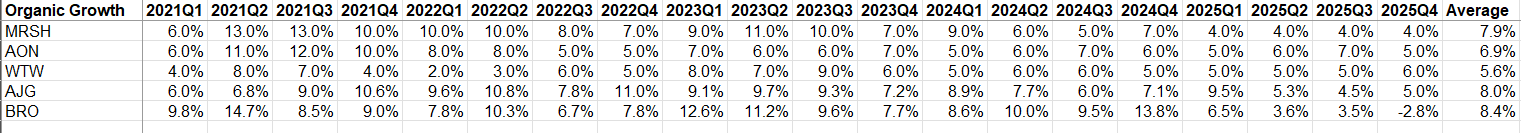

After years of steep increases, property insurance rates, especially in E&S (Excess & Surplus) and Reinsurance are falling due to a quiet hurricane season and an influx of capital. The insurance brokers, however, noted a split pricing environment. While property rates are softening (a headwind for organic growth), Casualty rates remain "hard" and still increasing. Overall, the brokers more or less grew their organic revenue around Mid Single Digit (MSD) rate with the exception of Brown & Brown (BRO) who had a difficult comparison from flood claims processing revenue in 4Q’25. I would also highlight that AJG earlier disclosed in their Investor Day that they would change the way they calculate their organic growth. As per their earlier definition, 4Q’25 organic growth would be ~2%. Although I didn’t go through MRSH or AON’s transcripts in detail, they do seem to have done better than the mid-sized players such as AJG and BRO.

Even though you will notice current organic growth rate is well below these companies’ last 5 years average, the last 5-year average is influenced heavily by the hard rates market seen in 2021-23 period which makes this average somewhat unrepresentative of the long-term normalized organic growth rate.

More importantly, now that valuations has come down in insurance brokerage industry, this is creating an excellent reinvestment opportunity for these brokers to deploy capital. For much of the last three years, these brokers used to trade at mid to high teens. Today, multiples have come down to low teens. Arthur J. Gallagher (AJG) management mentioned during their call that they cannot remember the last time a seller asked 16x multiple for their assets. They further mentioned that for tuck-in acquisitions, multiples have come down to ~10x, and ~12-13x for larger deals. Nonetheless, AJG thinks there is a slight slowdown in deals. From AJG call:

“I also believe there's maybe a little systemic slowdown here as sellers come to the realization that maybe valuations are coming down, and it takes a while for people to realize there's a new norm in that.”

With ~60k insurance brokers around the world, there is ample reinvestment runway for the public insurance brokers. Of course, serial acquirers with MSD organic growth profile with lots of tuck-in acquisitions every year and occasional large deals have been a bit out of favor in this current market. One key difference between companies such as Constellation Software (CSU) and insurance brokers is there is likely less existential concerns around the core business due to AI.

Having said that, investors are increasingly trying to be “creative” in finding AI risks everywhere, so don’t be surprised of a renewed disintermediation concern for brokers. In fact, AJG management was asked about AI risks in the call. This is what AJG management said in response:

“I think that we stand to benefit from that because if there is a product that can be sold with AI, we will likely be the ones that can put it out there and then -- and put it out there, have AI, get it to the point of sale and then have a producer do the final piece of it. The second thing is, remember, onboarding a customer is different than servicing a customer too. So it might tell you what the best product to buy is. Let’s just say that works. But then you got to service that policy.

And then you’ve got to handle the claims on it. And then you’ve got to interface with the carrier. I doubt that there’s an AI tool that will sell a policy to somebody who will have a serious issue in their bar or restaurant and then AI is going to tell AIG to pay the claim. It just doesn’t work that way. There’s going to have to be an adjuster there. There’s going to have to be a counselor called the producer that helps them understand how -- claims a bit.

Maybe they can put some policies on the books, but the service load that will come along with that. Now on the other hand, we see AI as being a terrific benefit for us to get better, faster at lower cost. We have spent 20 years working on standardizing our processes, centralizing them in our low-cost centers of excellence, driving the quality very high. AI is going to help us automate a lot of that. So the service layer, I think that we’re going to be able to deliver a better, faster and less expensive service offering.”

There are couple of things I would highlight here. Since everyone else will also have AI, I think all the benefits that AJG management is highlighting will mostly be competed away and will likely just accrue to their customers. However, the primary barrier for AI to do brokers’ job may be around how intensely regulated the industry is and the undertaking of re-architecting the entire system for AI to service the entire lifecycle of the insurance policy is indeed likely to be order of magnitude more difficult than building an analytics tool for tech-savvy developers.

One interesting incident that I would highlight from the insurance brokers’ calls is Howden’s alleged talent raid in some of these public insurance brokers. BRO was particularly affected by this. From BRO’s call:

“As of today, approximately 275 of our former teammates have joined this start-up, taking with them customers currently representing known annual revenues of $23 million. As we've done in the past, we will defend our rights in court and already have obtained an injunction.”

There were some colorful details in BRO’s lawsuit against Howden (you can read the filing here). I am not a lawyer, but some evidence seems quite damning for these employees who seem to have deliberately siphoned customers away from BRO to Howden. Nonetheless, it doesn’t reflect great on BRO’s culture that a couple hundred employees chose to do such deliberate attempt to hurt the company. While it’s certainly not ideal, one slightly comforting thing is Howden appeared to have used similar tactic to hire people from Marsh, and Willis Towers Watson.

Despite these idiosyncrasies, the broader thesis around insurance broker remains more or less the same. These companies will likely keep growing organically at MSD level and deploy earnings into acquiring dozens of tuck-in acquisitions every year while doing a large deal every once in a while.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 66 Deep Dives here.

Current Portfolio:

Please note that these are NOT my recommendation to buy/sell these securities, but just disclosure from my end so that you can assess potential biases that I may have because of my own personal portfolio holdings. Always consider my write-up my personal investing journal and never forget my objectives, risk tolerance, and constraints may have no resemblance to yours.

I made some slight changes in the portfolio yesterday which I will discuss behind the paywall.