Alphabet 1Q'23 Earnings Update

Disclosure: I own shares, and Jan 2025 call options of Alphabet

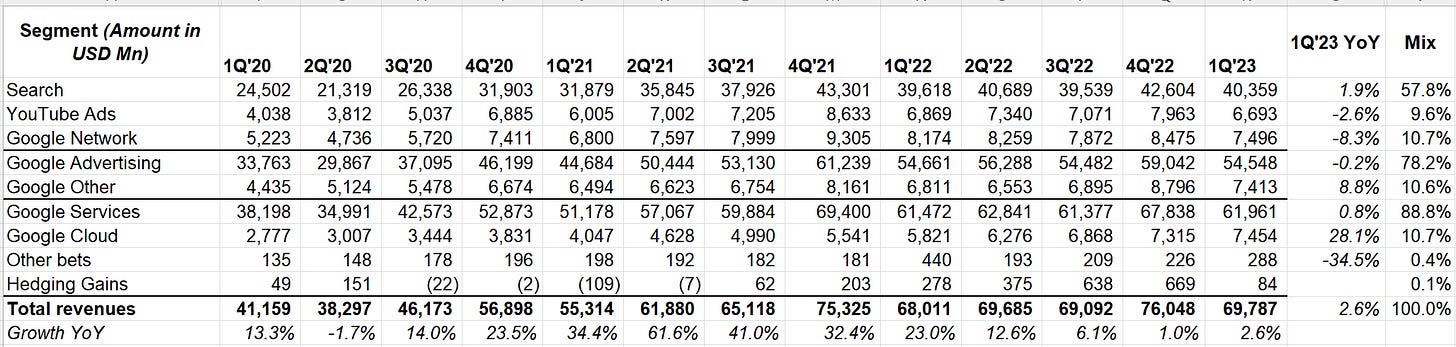

Google Search is still growing, but YouTube ads was down YoY for three consecutive quarters now.

Thankfully, Google Cloud maintained the momentum with +28% topline growth.

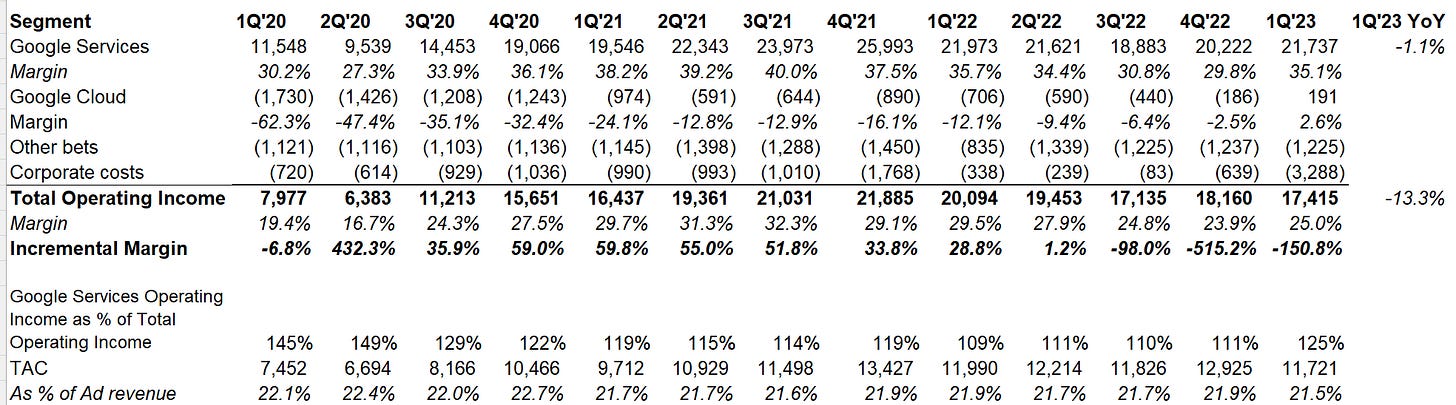

The big news in this quarter is Google Cloud became profitable for the first time. But there are some caveats.

This profitability came after some adjustment in internal cost allocation methodologies. Google recasted Google Cloud’s last four quarter’s EBIT (from 1Q’22).

They also changed estimates for useful life of servers and network equipment which was almost $1 Bn benefit some of which likely flows through Cloud segment.

Corporate costs included $2.6 Bn restructuring charges (severance+ office related) and costs related to DeepMind (used to be other bets before).

Google Services margin is likely to have a tailwind from 2Q’23 as Google Research related costs will move from Google Services to Google DeepMind within Alphabet's unallocated corporate costs.

It’s really bit of a shame that after acquiring DeepMind in 2014, it took them almost a decade to integrate and pool the intellectual horsepower together. In fact, DeepMind tried to seek an “independent legal structure” even after being acquired. If not for competition from OpenAI+ Microsoft, I wonder if this integration would ever happen.

Search

Since there has been media reports about Samsung potentially choosing Bing over Google for default search position on their phones, there was a question related to that:

we've always been in a competitive environment for these deals. And while I can't comment on the specifics of any of our partnership agreements, what has served us well is always, first of all, building the best product possible, focused on giving value to users. And when we work with our partners, we work hard to create a win-win experience, and ultimately, partners end up choosing us because that's what their users want. And that's always been what's helped Search be widely distributed. So I think it all starts with continuing to innovate and improve Search and making sure we are leading there. So I think we've always approached it very robustly over the many, many years, and I'm comfortable that we'll continue to be able to do so.

While Satya Nadella indicated gross margin for Search may have peaked for forever, Sundar Pichai sounds a little more optimistic that costs can be managed:

costs of compute has always been a consideration for us. And if anything, I think it's something we have developed extensive experience over many, many years. And so for us, it's a nature of habit to constantly drive efficiencies in hardware, software and models across our fleet. And so this is not new. If anything, the sharper the technology curve is, we get excited by it because I think we have built world-class capabilities in taking that and then driving down cost sequentially and then deploying it at scale across the world. So I think we'll take all that into account in terms of how we drive innovation here.

As expected, AI was frequently mentioned, but very little useful info was given in the call in terms of timeline and specifics of product rollout.

AI-driven tools, however, have been driving ad performance:

Advertisers who use PMax are, on average, achieving over 18% more conversions at a similar CPA. This is up 5 points in just 14 months, thanks to advances in the AI underlying bidding, creatives, search query matching and new formats like YouTube Shorts.

Google Cloud

Over the past 3 years, GCP's annual deal volume has grown nearly 500%, with large deals over $250 million growing more than 300%. Nearly 60% of the world's 1,000 largest companies are Google Cloud customers

Google Workspace now has 9 mn paying customers. The last time they disclosed paying customers number (6 mn) was back in 2020. While some seem to think Google Workspace as a threat to Microsoft 365, it doesn’t seem Google Workspace has much of a bite. It just kept growing ~1 mn paying customers per year since 2015. For context, Microsoft has ~400 mn Office 365 paid seats in commercial segment. While Alphabet never disclosed how many paid seats per paying customer Google Workspace has, it is hard to imagine Microsoft losing sleep over Google’s 1 mn/year incremental growth. It would definitely cause headache if Google Workspace started adding paying customers at an accelerating rate.

Some other interesting quotes on GCP:

We are the only cloud provider to announce availability of NVIDIA's new L4 Tensor Core GPU with the launch of our G2 VMs, which are purpose-built for large inference AI workloads, such as generative AI.

Growth in GCP remained strong across geographies, industries and products.

in Q1, we continued to see slower growth of consumption as customers optimized GCP costs reflecting the macro backdrop, which remains uncertain.

YouTube

The number of channels that uploaded to Shorts daily grew over 80% in 2022. No updated data on daily shorts watched per day, so I wonder whether Shorts may have peaked for the time being.

Some interesting quotes/data on YouTube:

our creator ecosystem and multi-format strategy will be key drivers of YouTube's long-term growth. And to support this growth, we're focused on, number one, Shorts; number two, engagement on CTV; number three, investing in our subscription offerings; and number four, a longer-term effort to make YouTube more shoppable.

…In one of our largest marketing mix modeling studies to date, YouTube ROI is 40% higher than linear TV and 34% higher than all other online video, according to a customer analysis from January 2020 to March 2022 of Nielsen Compass ROI benchmarks across 16 countries and 19 billion of total media spend measured. This proves YouTube's ability to drive effectiveness at scale.

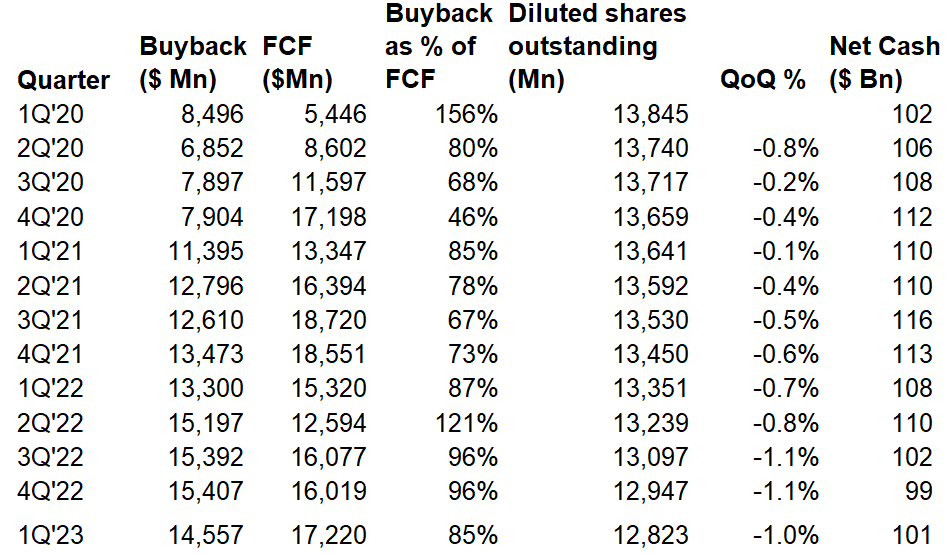

Capital Allocation

Alphabet continues to utilize almost all of their FCF in buying back shares which come out to be ~1% share per quarter. They also have ~$100 Bn net cash on balance sheet.

Headcount

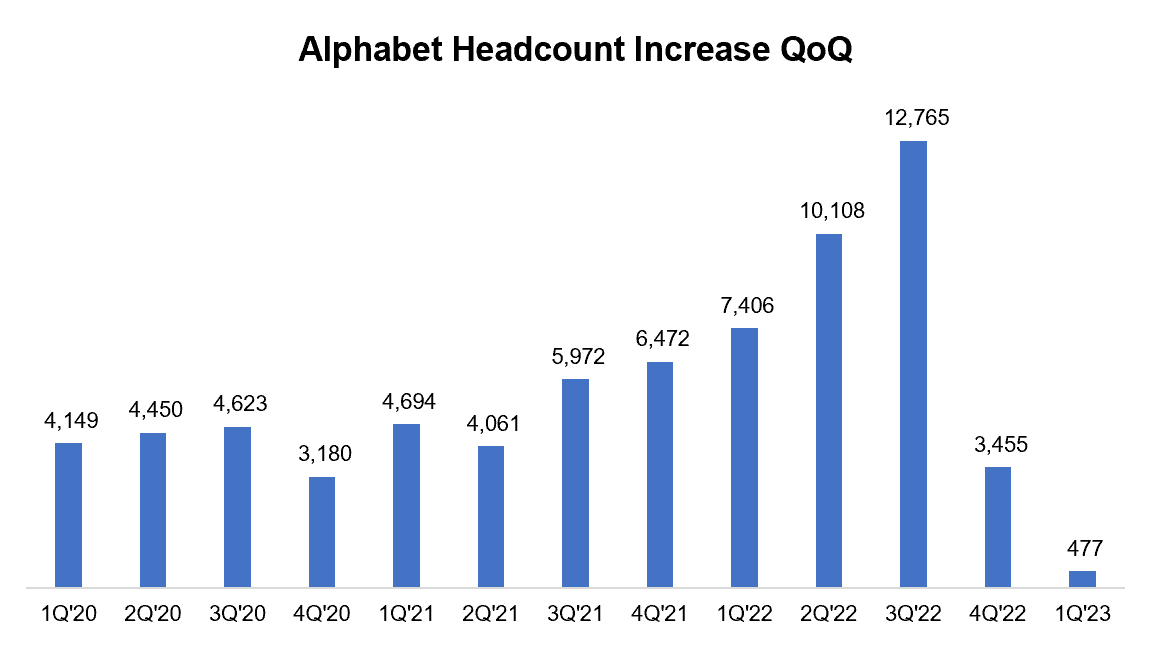

While headcount grew by 477 in 1Q’23, the recent layoff will be reflected from 2Q’23. Google talked about “durably reengineer our cost base” which likely means they would like to match topline and expense growth.

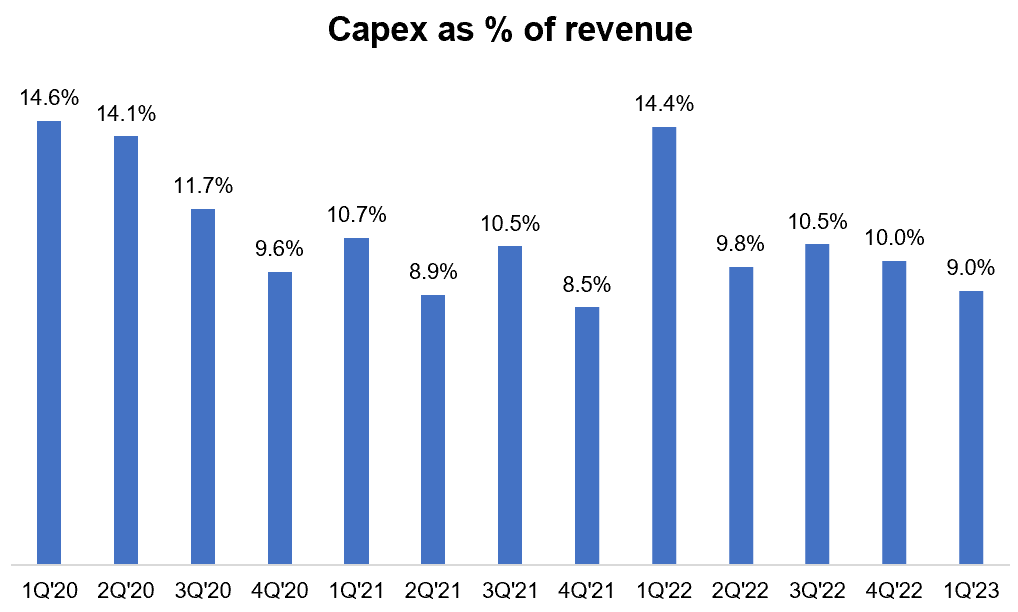

Capex

While street (including me) was expecting capex to be mostly flat YoY, CFO guided 2023 capex to “modestly higher than in 2022.”

CapEx this year will include a meaningful increase in technical infrastructure versus a decline in office facilities. We expect the pace of investment in both data center construction and servers to step up in the second quarter and continue to increase throughout the year.

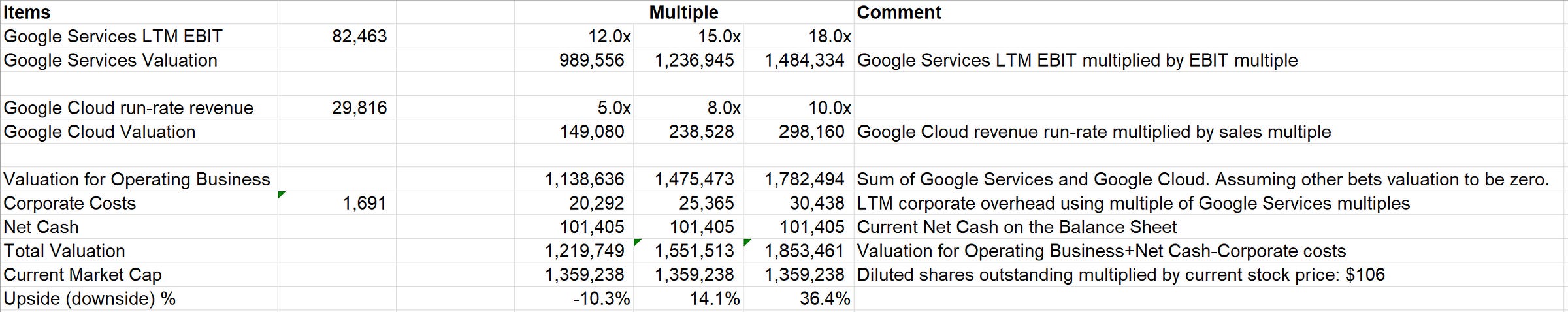

Valuation

While Alphabet’s valuation remains undemanding, the long-term questions related to Google Search and evolution of Search economics will decide whether it is mispriced stock or a potential value trap.

You can read my more detailed analysis (including valuation) on Alphabet here

I will cover Meta’s earnings tomorrow.