Gartner may not be "AI loser"

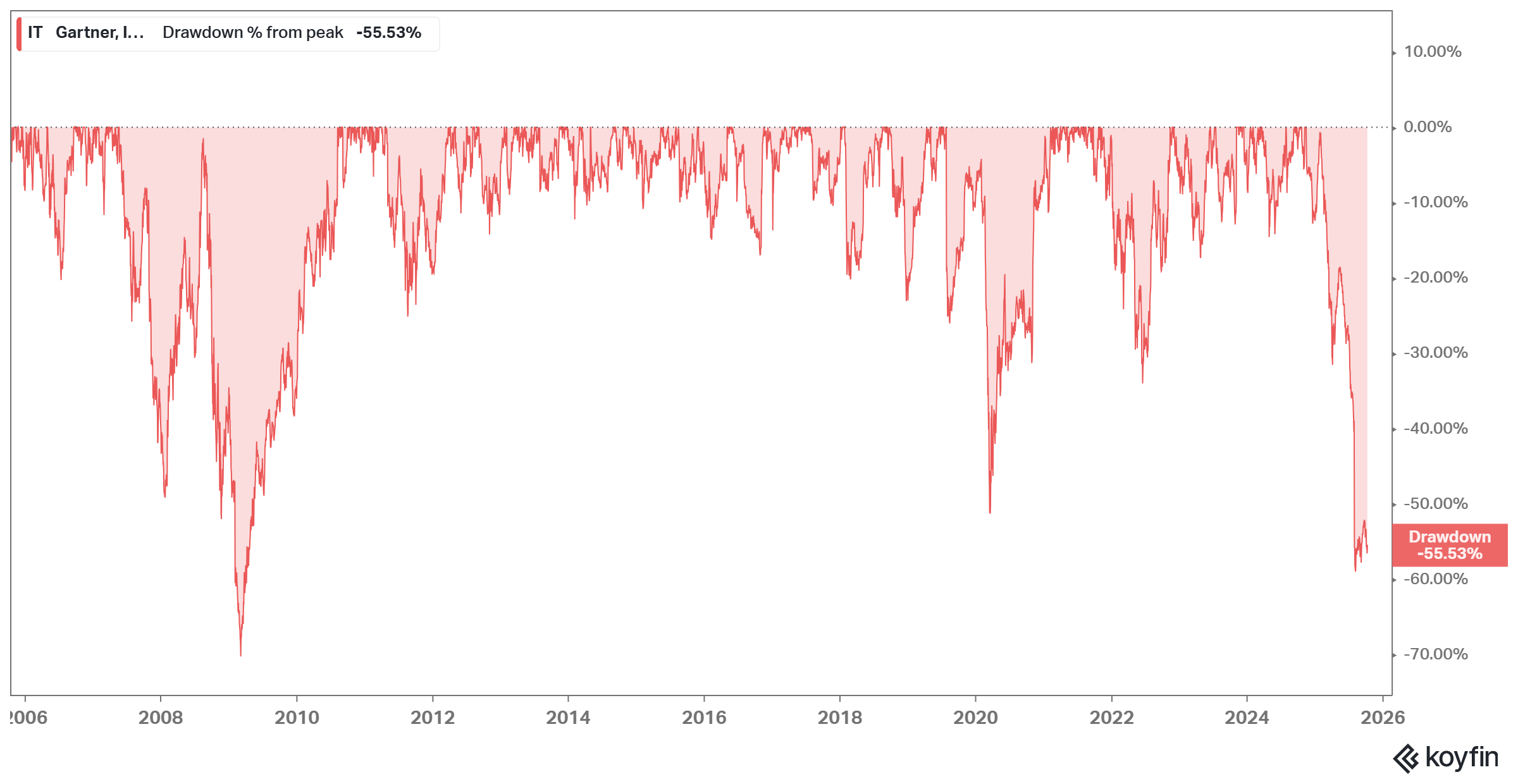

While the broad index makes all-time high almost every other day these days, Gartner shareholders are actually currently experiencing the worst drawdown since the GFC.

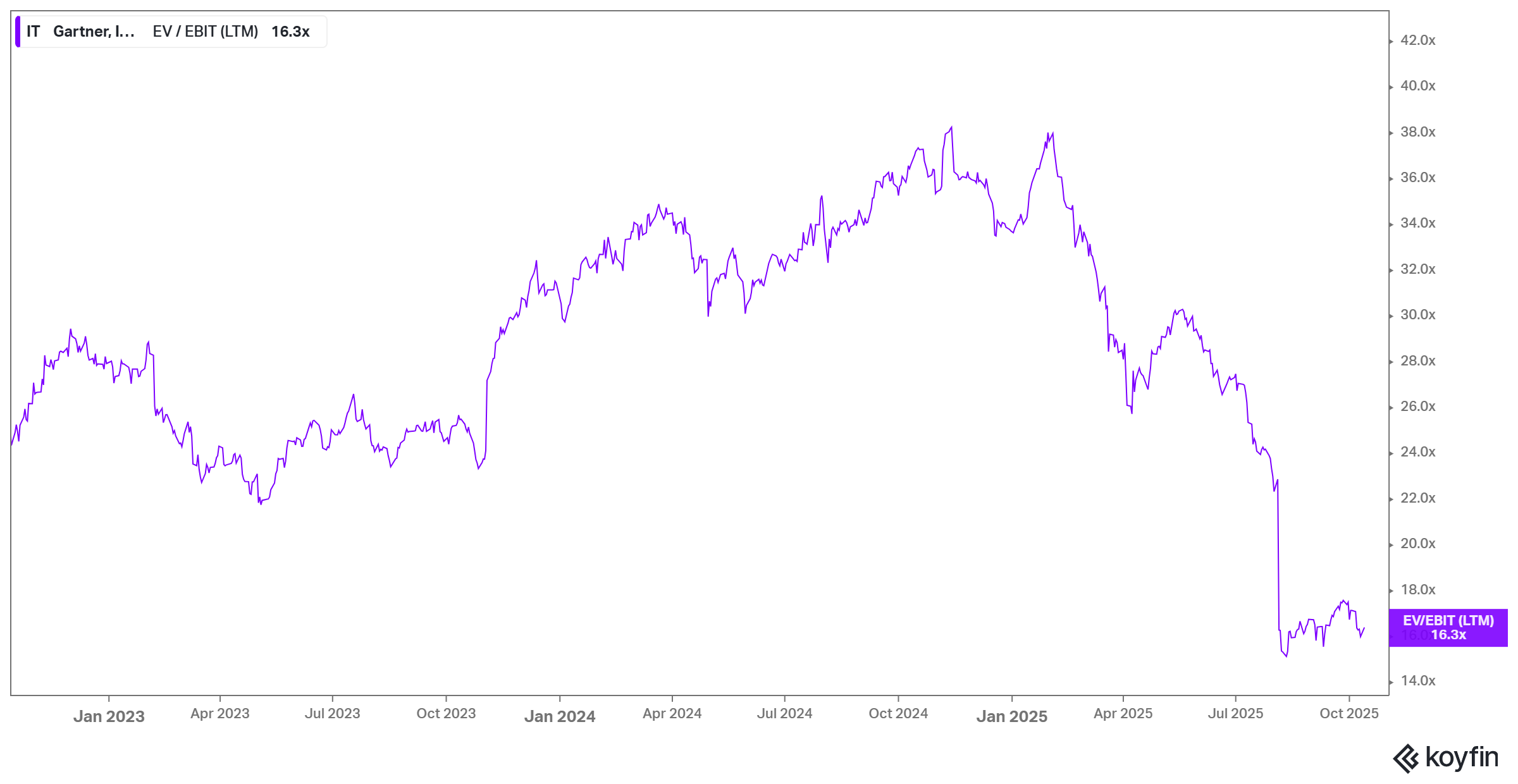

Gartner went from trading at almost ~40x LTM EBIT in late 2024 to just ~16x today. As you can imagine, there are all sorts of narrative flying around now to make the case that Gartner’s best days may not be ahead of them. A couple of weeks ago, my friend David Kim from Scuttleblurb wrote an interesting piece on Gartner which I think helped contextualize some of these concerns.

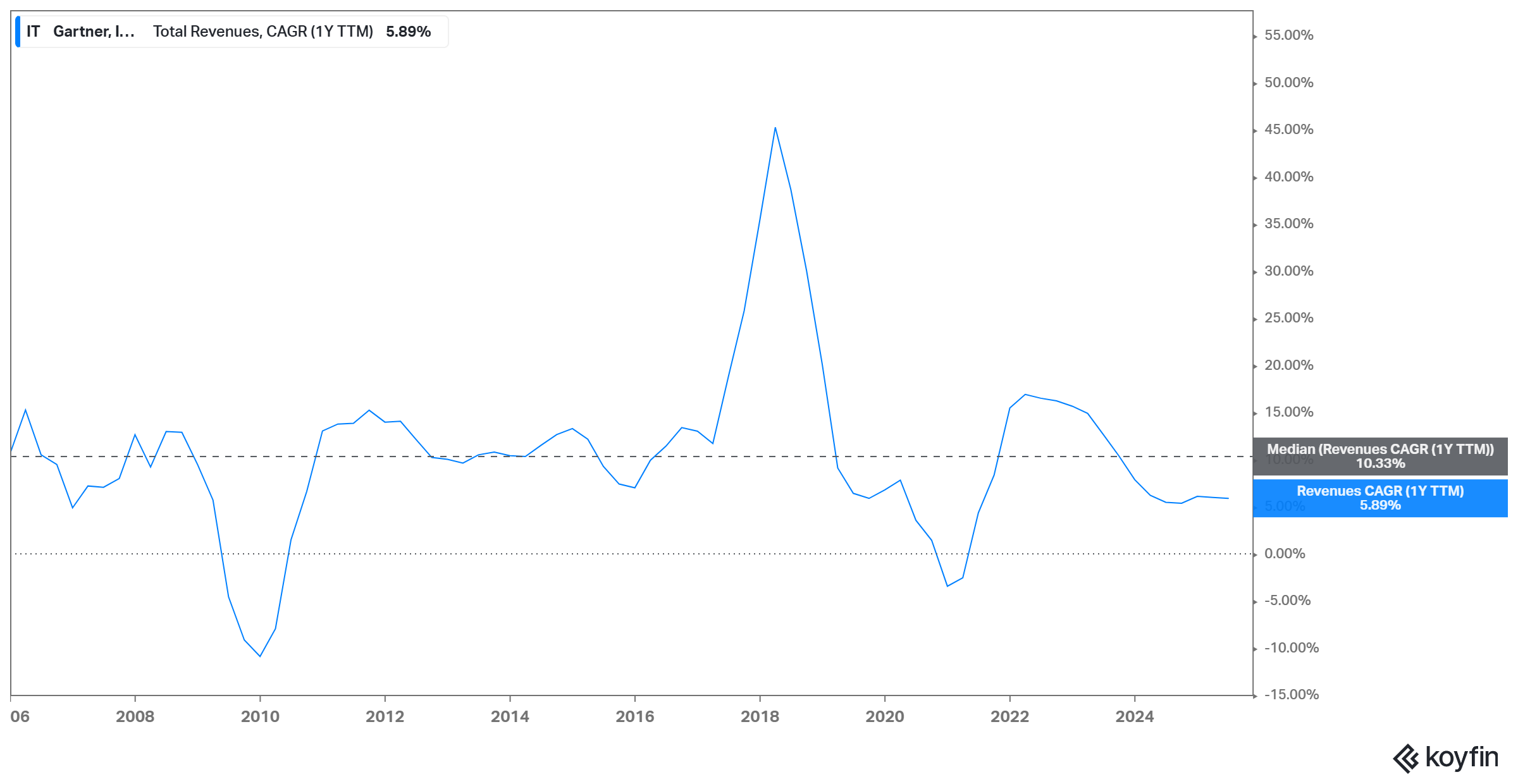

At first glance, it is quite understandable why investors are concerned. While Gartner’s median revenue growth was low double digit for the last 20 years, it has come down to just mid-single digit now.

For the uninitiated, Gartner’s core is subscription research sold to IT buyers (GTS or Global Technology Solutions) and to non‑IT leaders (Global Business Solutions); both GTS and GBS are part of their core “Insight” segment. Tiers range from a ~$20–25k “read‑only” seat to ~$80–100k for access that offers unlimited analyst calls and senior “executive partner” time; conferences and consulting are adjuncts with a much smaller profit contribution.

Is Garner’s research mission critical for its customers? I don’t have any compelling argument to doubt its usefulness for its customers, but Scuttleblurb points out the reality of any non-mission critical but merely useful subscription research services (including yours truly). Churn in this business is inevitable, especially when “ROI” of spending on any research can be often a bit squishy:

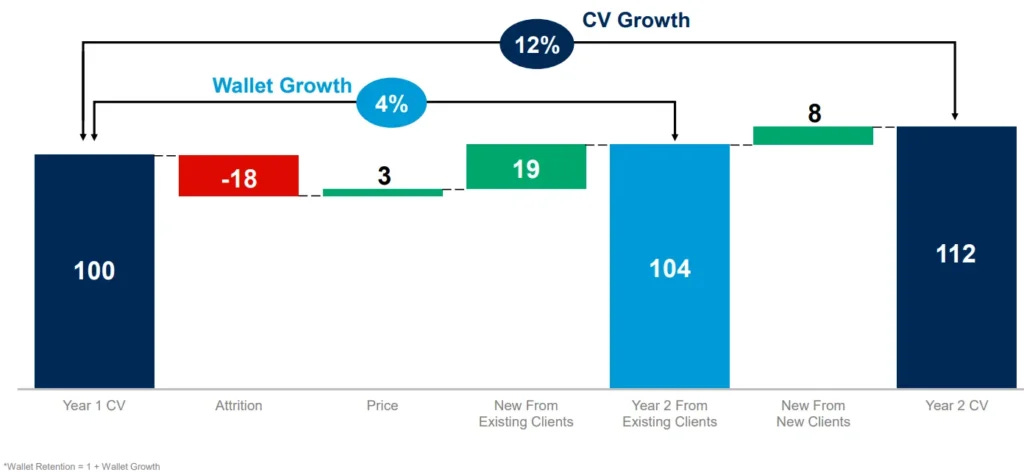

“that Gartner has managed to grow contract value by double-digits nearly every year over two decades while starting each CV anniversary ~18% in the hole is testament not to the inherent retentive properties of subscription research but to the effectiveness of its sales organization.

…that Gartner assists in mission critical spend doesn’t render Gartner itself mission critical. It is often just one of several sources, from competing research shops to consulting firms, that enterprise buyers rely on to compare vendors and craft strategy. Clients find it tough to quantify the ROI of Gartner’s services and, make no mistake, they do complain about Gartner’s pricing, often questioning whether they’re getting they’re money’s worth. Some of this may be a matter of perception. Subscribers don’t live in Gartner the way they do in a CRM or HR system and commonly access the company’s services an ad hoc basis, when procurement decisions or a big internal project comes to the fore. The lack of consistent, habitual use may lead some clients to think they get less value from Gartner’s services than they actually do. Also, gains to knowledge are notoriously hard to measure and often take the form of intangible benefits, like looking smart in front of one’s boss or a future interviewer, that go easily overlooked.”

Indeed, a friend (who is also a subscriber) recently was telling me that he was interviewing for a job, and he tried to steer the interview conversation to a direction so that he can deliver some of the insights he gathered from MBI Deep Dives. Even if he gets the job, it’s very difficult to assign any specific or objective value to MBI Deep Dives for his success other than some vague idea that it likely helped him during the interview process.

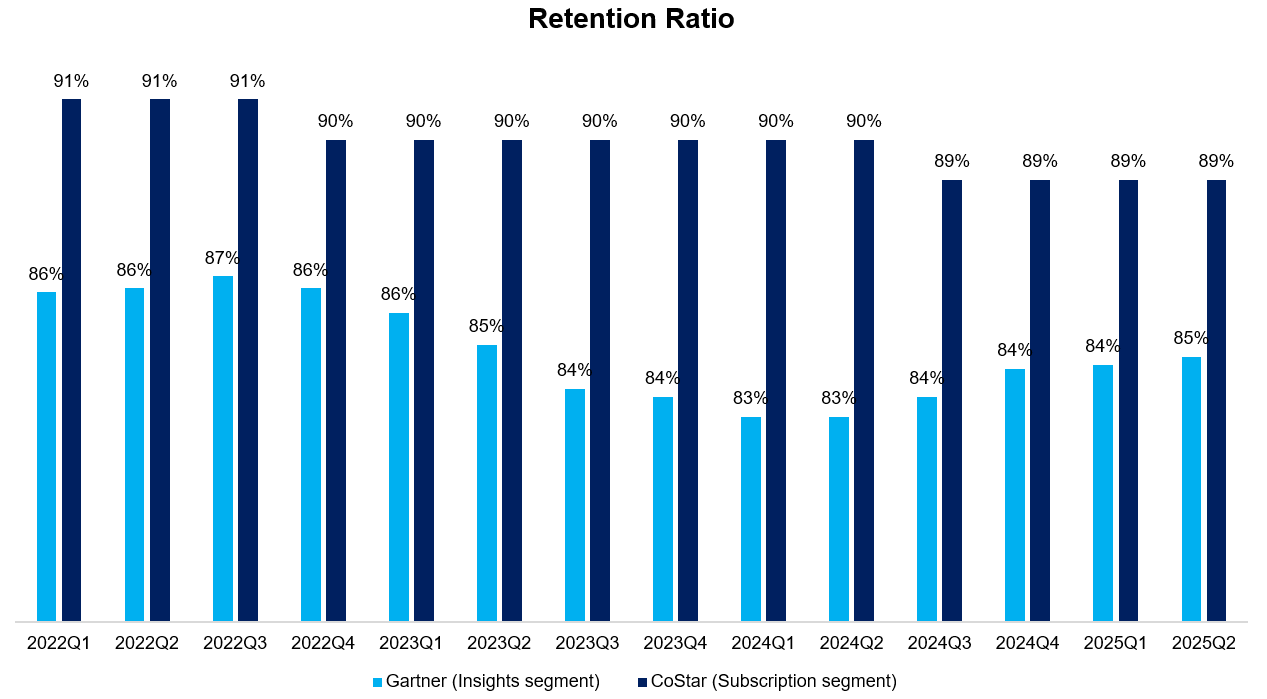

While Scuttleblurb sounded a bit underwhelmed about the quality of Gartner’s business due to the leaky bucket and hence the inherent treadmill nature for future growth, Gartner’s numbers is actually much closer to “mission critical” than it may appear. Let’s compare and contrast with CoStar, for example. CoStar is certainly mission critical for its customers; it’s difficult to scale a commercial real estate business without subscribing to CoStar. Nonetheless, its retention ratio hovers around 90% whereas Garner’s client retention ratio is usually around mid-80s. That’s pretty impressive?

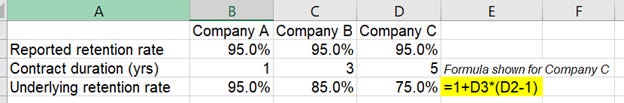

Of course, there are lot of nuances in comparing such different businesses. First of all, the benefits of being a mission critical is deeply understood during economic downturn. CoStar can likely go through a recession without much of a noticeable change in renewal rates whereas Gartner will almost certainly feel the vicissitude of economy much more. Moreover, the differences in definition of retention rate itself can mask a lot of differences. For example, imagine Company A, B, and C all report 95% retention rates for their subscription services, but customers only renew the contracts in every 1, 3, and 5 year respectively. Even though they will all report 95% retention rates, their underlying retention rate is actually 95%, 85%, and 75% respectively. Since company C has a 5-year contract, its reported retention can mask the inability of its customers to cancel their subscription.

Indeed, Gartner actually mentions ~75% of its contracts are multi-year in nature whereas CoStar’s subscriptions typically renew at one-year increment. Given the average duration of the contract is 1.7 years for Gartner, the underlying retention rate for its subscription services is likely a bit worse than reported retention compared to CoStar, but unlikely to be materially worse than reported retention.

Of course, these are just quirks of the nature of business model and services Gartner is selling, but the stock is selling off for not these reasons. The primary culprit is their contract value growth decelerated from ~17% to just 5% in three years.

Is Gartner getting “Chegg-ed” by ChatGPT? Scuttleblurb makes a convincing case that is quite unlikely:

Even if publicly available data were trustworthy and unbiased by vendor hype, information discovery alone has never been the chief reason for subscribing to Gartner. Were that the case, Google search would have decimated Gartner’s research business long ago. I think LLMs, in their current state of maturity, are akin to an advanced form of search, more useful for packaging publicly available data than for generating sound opinions.

it doesn’t fly for the domains that Gartner plays in, or for the kinds of questions its clients ask, questions that go well beyond simple prompts, like “give me the pros and cons of the top five endpoint security tools”. You will not find a reliable publicly available baseline for how the CFO of a $1bn revenue manufacturer should structure and budget an FP&A program or on how the CIO of a bank with $100bn of assets across Europe and North America should evaluate zero-trust network security vendors in an environment running on legacy technology.

Try telling the Board you used Google searches and ChatGPT to narrow down the list of ERP vendor finalists. See how that goes. It’s not just that Gartner is a more credible authority for evaluating IT decisions than ChatGPT; it’s perceived that way too, which is just as important for a CIO whose foremost concern is career preservation.

“ZissouCapital” also corroborated similar arguments about Gartner:

“It’s an expensive, discretionary service, but their sales force is an insane machine. I don’t think they’re really the “industry currency” they were once regarded as, but from calls I’ve done, MSFT, Amazon, etc. aren’t cutting spend as vendor clients. Talked to probably a dozen customers over the last couple of months trying to find someone who would tell me yeah we are substituting Gartner with ChatGPT et al and couldn’t find a single person. Closest I got was a guy at a federal health agency with a massive budget who had to cut $5bn in costs and slashed Gartner subs for all the people he fired. He was reflecting the AI-fear narrative in the stock price on the call, but when I pushed him he said if DOGE hadn’t cut his budget, he wouldn’t have fired those people and he wouldn’t have cut their Gartner subs for AI tools instead. He also said he personally upgraded his Gartner seat to the highest tier with all the CTO access etc and wouldn’t be cutting it”

The data Scuttleblurb shared also makes a pretty convincing case that the primary reason for Gartner’s recent soft operating performance is likely DOGE and tariffs, not AI:

The US Federal Government, influenced by by DOGE scrutiny, retained just 50% of its Gartner contracts by value, and was responsible for nearly 80% of the year-to-date contraction in GTS NCVI3. With nearly all US Federal contracts, ~4% of CV, coming up for renewal this year, spending weakness should not carry over into 2026.

Subscribers in industries heavily dependent on imports and exports, who made up 35% to 40% of Gartner’s total contract value (with GBS slightly more exposed than GTS), performed much worse than those in sectors not impacted by tariffs. Moreover, although deals are being delayed and escalated up the chain, the deal pipeline – a forward looking measure of demand – is up double-digits across both GTS and GBS, which one would not expect to see if AI were culprit.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 63 Deep Dives here.

Current Portfolio:

Please note that these are NOT my recommendation to buy/sell these securities, but just disclosure from my end so that you can assess potential biases that I may have because of my own personal portfolio holdings. Always consider my write-up my personal investing journal and never forget my objectives, risk tolerance, and constraints may have no resemblance to yours.

My current portfolio is disclosed below: