Figma 4Q'25 Update

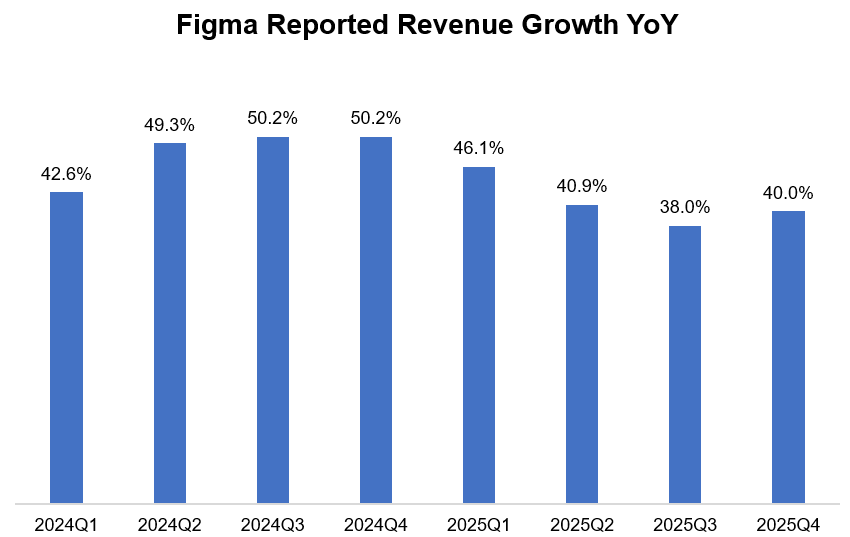

While Figma’s stock reacted positively to its 4Q’25 earnings, the stock is still down ~33% YTD. Considering the SaaS-ocalypse backdrop, Figma posted pretty strong numbers. Its revenue growth accelerated from 38% YoY in 3Q’25 to 40% in 4Q’25.

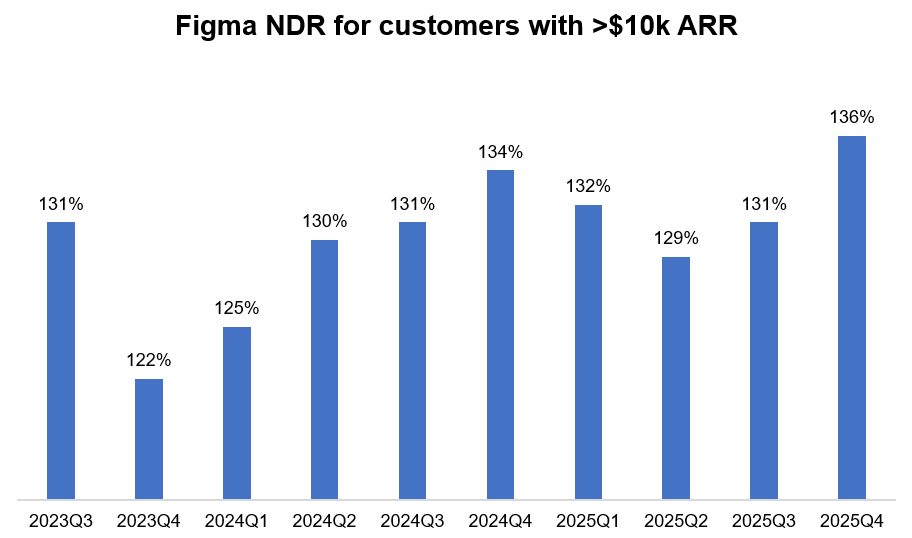

Figma’s Net Dollar Retention (NDR) for customers who spent at least $10k ARR was its highest ever in the last 10 quarters: 136%! Its Gross Retention Ratio was 97%, so clearly customers are not leaving Figma to “vibe design” yet.

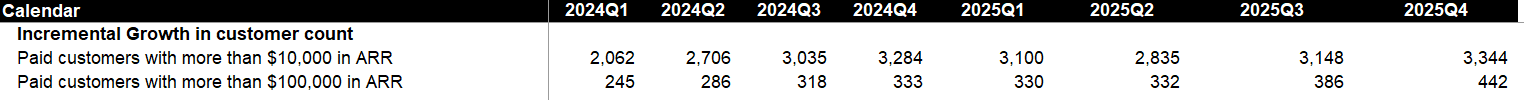

Figma’s incremental customer count with $10k and $100k ARR were also its highest ever in 4Q’25. Even the customers with more than $1 million ARR reached 67, growing by 68% YoY.

It’s not just 4Q’25, Figma’s revenue outlook also exuded plenty of confidence in their business model. Their 1Q’26 revenue outlook implied 38% growth YoY and FY’26 guidance at the mid-point implied 30% growth. For context, sell-side estimates only implied ~24% growth in 2026 although I do suspect buy-side estimates was higher than that. In fact, Figma’s commentary suggests that their guide is likely conservative and it won’t surprise me at all if their actual revenue growth in 2026 turns out to be close to mid-30s. I will discuss more about that as well as some key takeaways from the call behind the paywall.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 66 Deep Dives here.