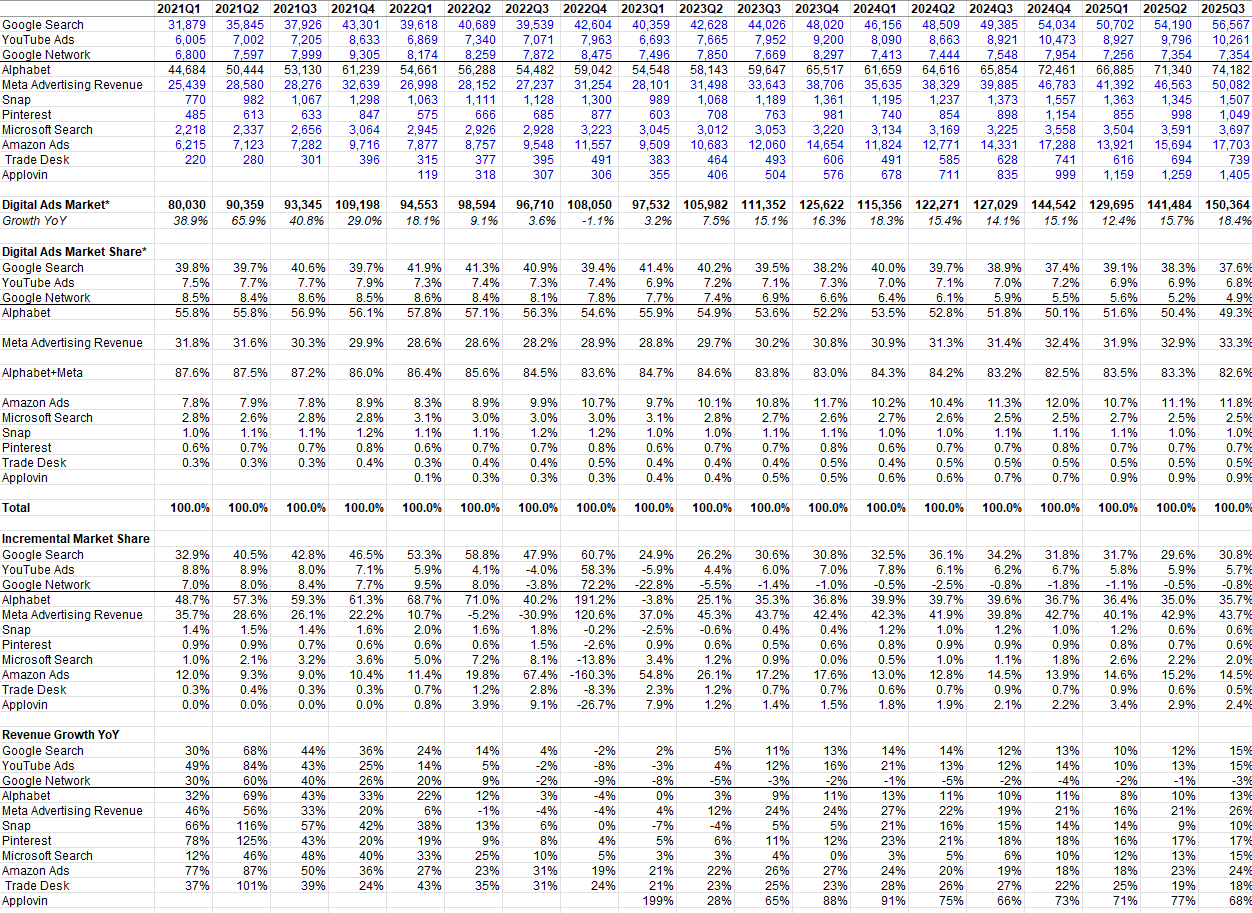

Digital Advertising Industry Snapshot, Portfolio Change

As is the tradition in every earnings season, I am sharing my digital advertising Snapshot after 3Q’25 earnings.

Digital ads market growth has accelerated to 18.4% in 3Q’25 (vs 15.7% in 2Q’25 and 14.1% in 3Q’24).

Meta continues to gain market share every quarter. For the first time, Google’s advertising market share was below 50%. From 3Q’21 to 3Q’25, Meta and Amazon gained ~300 bps and ~400 bps market share, largely at the expense of Google who lost ~760 bps market share during this period.

Almost half of Google’s market share loss actually came from its low margin network business which is perhaps going to be increasingly irrelevant over time as search is gradually graduating to “zero click answer machine”. YouTube also lost market share during this period, but it is difficult to infer anything definitive from this data point given YouTube’s subscriptions has accelerated during this time. As Alphabet mentioned during 3Q’25 call, YouTube Music and Premium subscriber generates a meaningful higher gross profit than ad-supported users which certainly implies Alphabet is very happy to “lose” this market share to other advertising players.

As a result, it seems likely that a huge chunk of Alphabet’s market share “loss” in the last 4-5 years is a intentional retreat from some advertising markets. In fact, a part of me wonders whether this planned retreat may eventually expand to Search as well if Gemini gains further momentum, especially after they launch Gemini 3.0 later this year. If that happens, it might make inferring the health of Google’s search business more challenging than it may appear at first glance. Let me explain more.

*Digital Ads Market is defined as Alphabet reported ad revenue+ Meta’s ad revenue+ Amazon Ads+ Microsoft Search+ Pinterest+ Snap+ Trade Desk+ Applovin revenue

In one of the Google’s recent anti-trust trials, there was an interesting disclosure about an internal meeting with Google’s top executives in October 2024, including Liz Reid (Head of Search), Vidhya Srinivasan (VP and General Manager of Ads and Commerce), and Nick Fox (SVP of Knowledge and Information). From the meeting summary, the following stood out to me:

“Nick’s main point: “we have 3 options: (1) Search doesn’t erode, (2) we lose Search traffic to Gemini, (3) we lose Search traffic to ChatGPT. (1) is preferred but the worst case is (3) so we should support (2)”

Vidhya essentially said that analysis keeps telling them we aren’t losing Search/Ads traffic yet, but she feels like this is inevitable, and we should prepare for Gemini’s success. She wants to accelerate monetizing Gemini with Ads ASAP ... “writing is on the wall”

Discussion on use cases in Gemini led to lots of questions around Gemini monetization strategy

Desire from Vidhya, Shashi, and others to more explicitly come up with a connected strategy, e.g. thinking about when Gemini should kick back to Search, build out Shopping solutions, etc

Maria mentioned and pinged after about exploring opportunities to build in Shopping experiences in the Gemini user experience more explicitly

It’s been a year since this meeting, but I suspect the main takeaways from the meeting still have validity. Gemini already has 650 million MAUs (vs 450 million in 2Q’25), and queries on Gemini increased 3x from 2Q’25. While many queries are certainly incremental today, it does seem likely that traditional core Google search will continue to bleed share to Gemini and ChatGPT. The more aggressive Google becomes to promote Gemini, the more uninspiring Search ad revenues may seem comparing and contrasting to other digital ads players. However, if users turn more into Gemini instead of Google and eventually become paying subscribers, I wonder it may eventually play out the same way as it did in YouTube: the average gross profit from paying subscribers may turn out to be higher than ad-supported search users. Admittedly, I am not super confident of this as it is hard to imagine an outcome better than current Google search.

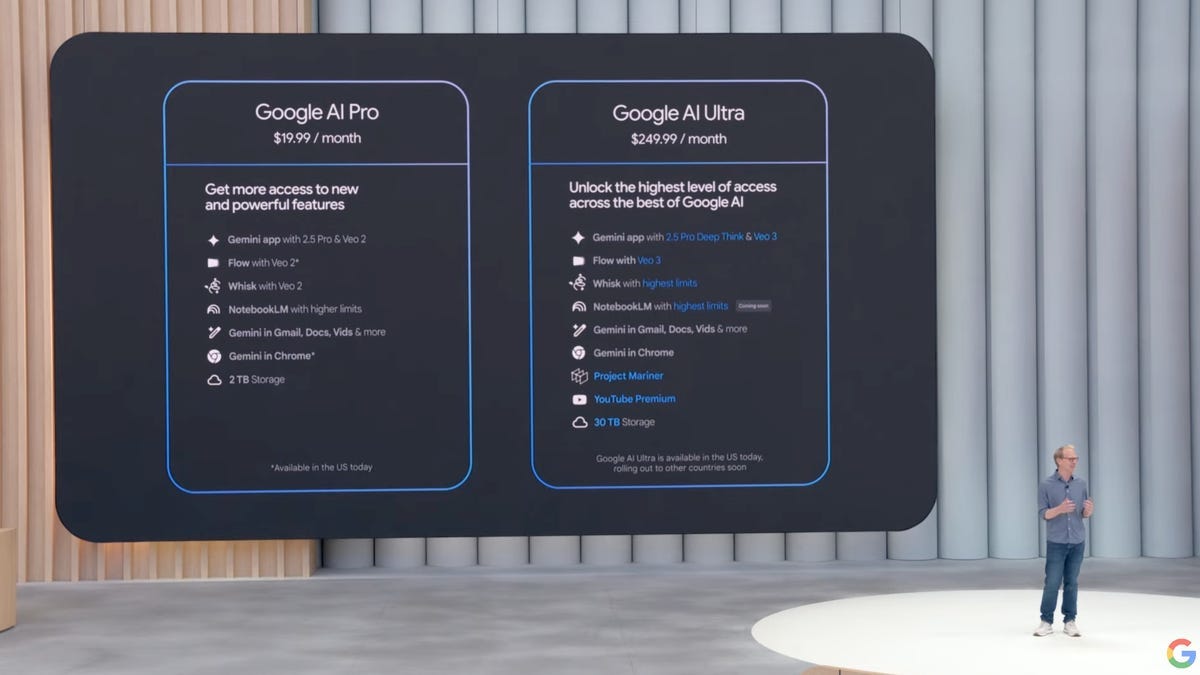

This is particularly intriguing because Google does have an opportunity to build the highest consumer surplus subscription product in the planet. They already have 300 million paying subscribers in Google One and YouTube premium. Imagine if Google eventually introduces a “custom” subscription plan that lets you add all the Google Services in one bundle and get a ~20-50% discount to the a la carte prices if you pick 2+ products/services from Google, I can imagine how Google may be able to get to 1 Billion+ subscribers in the next 5-7 years. Ads will still play an important role given ad-supported users will likely continue to be the majority of Google’s user base, but in this scenario, Google’s intrinsic value may continue to increase even if they lose ads market share to Meta and Amazon et al over time.

I also wonder what it means for the rest of the digital ad players if a behemoth such as Google very gradually retreats from ads. Given Meta and Amazon generates majority of their ad revenue primarily from direct response or performance ads, it’s not like direct response advertisers will just switch more to Meta and Amazon. Ultimately, these advertisers care about ROIs and once they cannot meet their ROI threshold, they won’t increase their spending on Meta. However, there is one interesting possibility; if the very nature of search queries change and transition more to Gemini/ChatGPT, we may see a revival of brand advertising. In a recent Stratechery interview, Michael Morton hinted at this possibility:

It’s funny how the world goes circular. Limited shelf, unlimited shelf, and now maybe back to a more constrained shelf, and then to where everything was brand and now everything was performance-based marketing. Well, now if you’re getting down to a world where there’s a couple of icons, and people are more trusting to the model and the model doing the due diligence for them, some ability for brand recall and spending money on brand advertising could rise in importance again.

It is also worth noting that measuring the performance of brand advertising can be more challenging than direct response ads. As a result, brand advertising can be more cyclical than performance advertising, but in a world of zero click search, companies may be increasingly under more pressure to spend on brand advertising than they were in the last 5-10 years. That might leave even less margins for brands overall, but that may lead to greater auction liquidity and higher ad prices on Meta, Amazon etc.

I will share the digital advertising industry snapshot spreadsheet and explain some portfolio changes that I made yesterday behind the paywall

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 64 Deep Dives here.