Danaher 2Q'25 Update

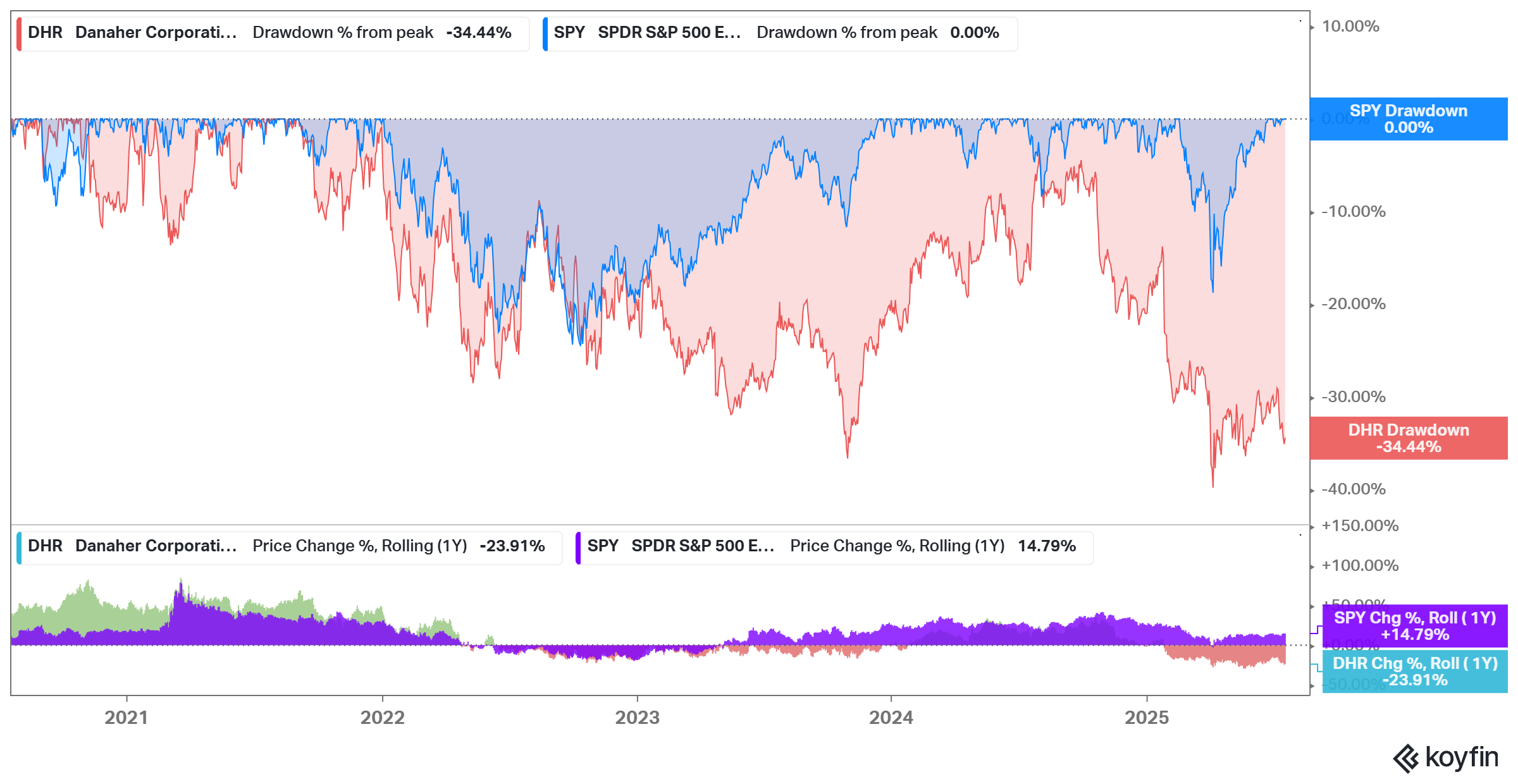

While S&P 500 is at its all-time high, Danaher is still ~34% below its peak from late 2021. The company was beleaguered with pandemic hangover and destocking trends for much of 2022-24 period. While the worst seem to behind them, the business isn’t quite humming enough to get investors excited yet.

Yesterday’s earnings report also wouldn’t probably excite anyone, but neither would it cause a shareholder to lose much sleep.

Let me recap the business performance of 2Q’25.

Overall Danaher

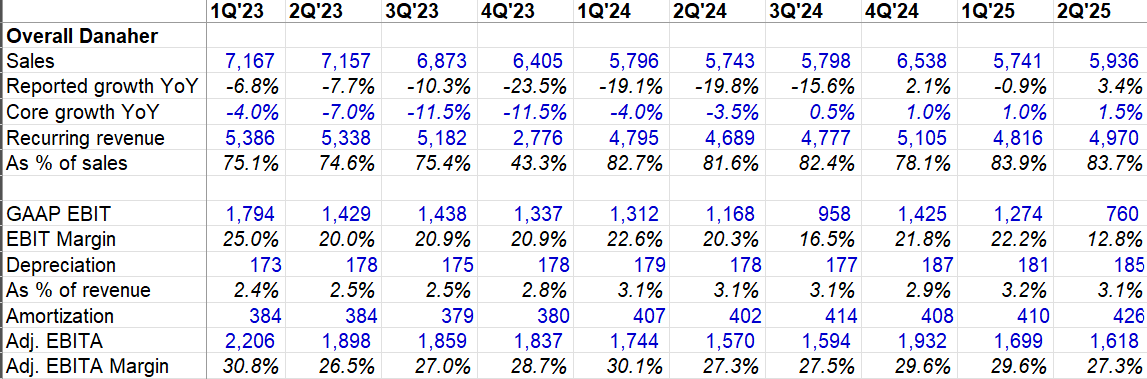

Danaher’s revenue grew at Low Single Digit (LSD) rate last quarter. Geographically, reported revenue in North America and “high-growth” markets was basically flat. China declined by Mid Single Digit (MSD). Western Europe was the shining light in the last quarter. In fact, Danaher’s overall reported revenue increased by $193 million YoY in 2Q’25, but revenue from Western Europe alone grew by $186 million.

Danaher reports its business in three broad segments: a) Biotechnology, b) Life Sciences, and c) Diagnostics. Majority of revenue in all three segments come from recurring revenue through consumables that are spec’d into regulated process or the specific equipment Danaher sells to the customers. This recurring portion of revenue gradually increased by almost 10 percentage point from 74.6% in 2Q’23 to 83.7% in 2Q’25.

Danaher took a non-cash impairment charge of $432 million pretax ($328 million after-tax) on a genomics consumables business which led to a noticeable drop of GAAP EBIT margin. If you adjust that and given past acquisitions and resultant amortizations, it’s better to look at adjusted EBITA to gauge the underlying economics here. Overall adj. EBITA margin was flat yoy at 27.3% in 2Q’25.

Let’s look at Danaher now in segment by segment.

Biotechnology

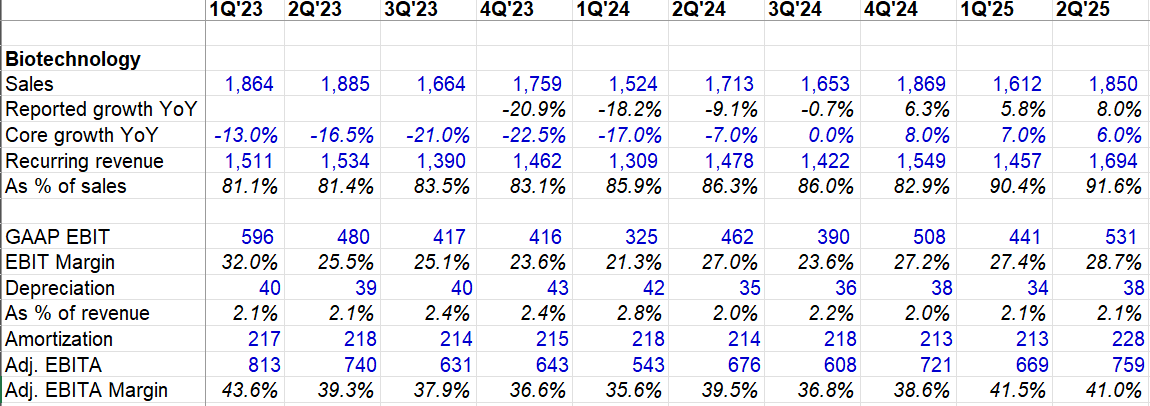

Danaher’s biotechnology segment has two businesses: a) bioprocessing which is ~85% of the revenue in this segment, and b) the rest 15% is Discovery & Medical (D&M) which is more like the life sciences tool business.

Bioprocessing revenue was up High Single Digit (HSD), but D&M down LSD. Danaher enjoyed Low Double Digit (LDD) growth in consumables, mostly driven by commercial demand and large pharma CDMO customers. Smaller customers are still below historical trends but they’re stabilizing a bit now.

Danaher mentioned monoclonal antibodies, which is ~75% of bioprocessing revenues, remain the largest investment area for their customers who have a healthy pipeline of new molecules in development. They continue to expect bioprocessing revenue to grow HSD in 2025.

Equipment sales declined as customers continue to absorb capacity added over the past several years, and global trade uncertainty apparently delayed in some larger capital investment decisions.

Adj. EBITA margins improved a bit YoY and was 40%+ for second consecutive quarters. ~92% of the revenue in this segment was recurring in nature in last quarter which tends to be higher margin business. If you notice, Danaher’s revenue actually declined by $35 Million in 2Q’25 vs 2Q’23, but their adj. EBITA still grew by $19 Million, primarily because the recurring mix of the revenue increased from ~81% to ~92% over that period.

Life Sciences

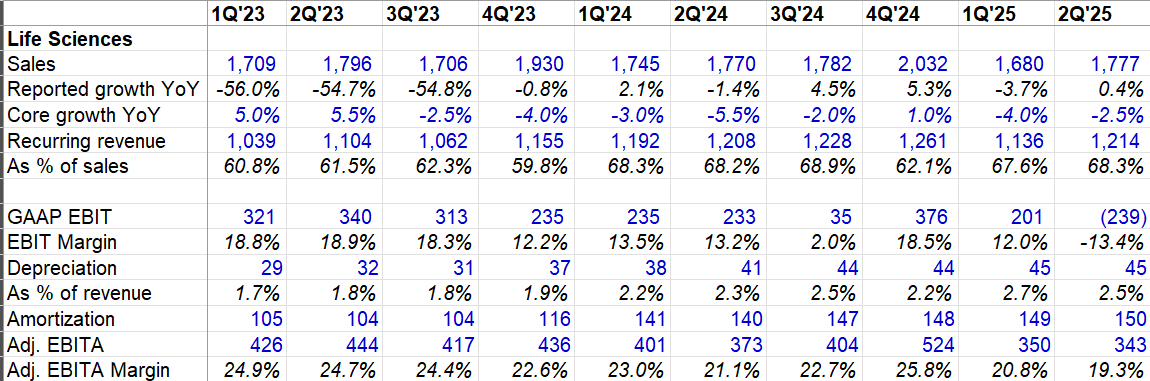

Revenue was flat last quarter. Although 1H revenue is down LSD in this segment, Danaher still expects full-year to be flat. What will drive incremental improvement to finish the year flat? From the call:

“I would say that genomics, again, remember the first half, we had those two large customers really fall off. I think that's probably 1/3 of it.

I would say that we are assuming China -- especially China, the tools with some comps -- easier comps and a better funding environment. There's another 1/3 of it. And then lastly, new products and kind of other things is the final 1/3. So 1/3, 1/3, 1/3 between China, genomics, new products, other; that's sort of what we're assuming and are baked into the model from step-up from 1H to 2H of roughly $150 million”

Danaher mentioned clinical and applied markets held up well globally, while demand from academic and government customers remained weak.

Danaher took the impairment charge mentioned earlier in this segment which led to this segment reporting operating loss in 2Q’25. However, adj. EBITA was 19.3% in 2Q’25, slightly down from 21.1% in 2Q’24.

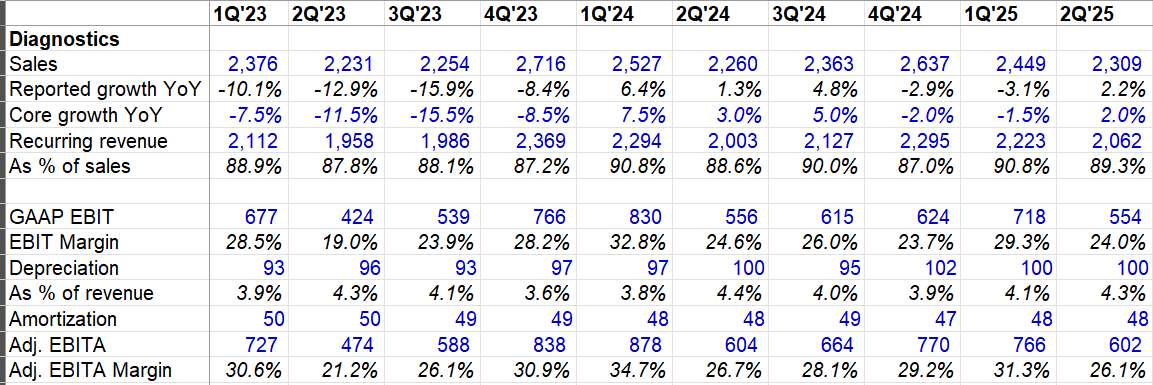

Diagnostics

Diagnostics revenue was up LSD, but it was actually up MSD outside of China.

Beckman Coulter Diagnostics revenue increased by HSD outside of China which was their fourth consecutive quarters of MSD+ growth outside China.

Cepheid global installed base was again mentioned to be 60,000 instruments which seems to be flat since that’s the same number mentioned in 2Q’24 call. During Covid, Cepheid’s installed base doubled and reached 50k by 1Q’23. Since then, installed base growth has slowed materially (basically they mentioned ~60k in each of the last five earnings calls).

Given the anemic revenue growth, margin contracted a bit.

Danaher management was asked whether AI is a headwind for biotech funding. Management thinks AI is likely a tailwind for them:

“…as it relates to AI, we really see that ultimately as a tailwind because we see then less money being spent on getting to compound ideas, if you will, and more money being spent taking great ideas, which have been validated in silico as they say, through the development pipeline, ultimately driving more manufactured and commercialized therapies.

And of course, that's where our business is, where we have the most volume, of course, the most share. And so we view this really positively. But we have to say that we're at a low activity level currently in the discovery phase of the biotech market.

I have highlighted an interesting piece recently which also corroborated to the idea that AI can really help in drug development process. A world of therapeutic abundance should be very positive for Danaher.

Guidance

Revenue growth guidance for 2025 remains unchanged at 3%. But they did raise full year adjusted diluted net EPS guidance to a range of $7.70 to $7.80 vs previous range of $7.60 to $7.75.

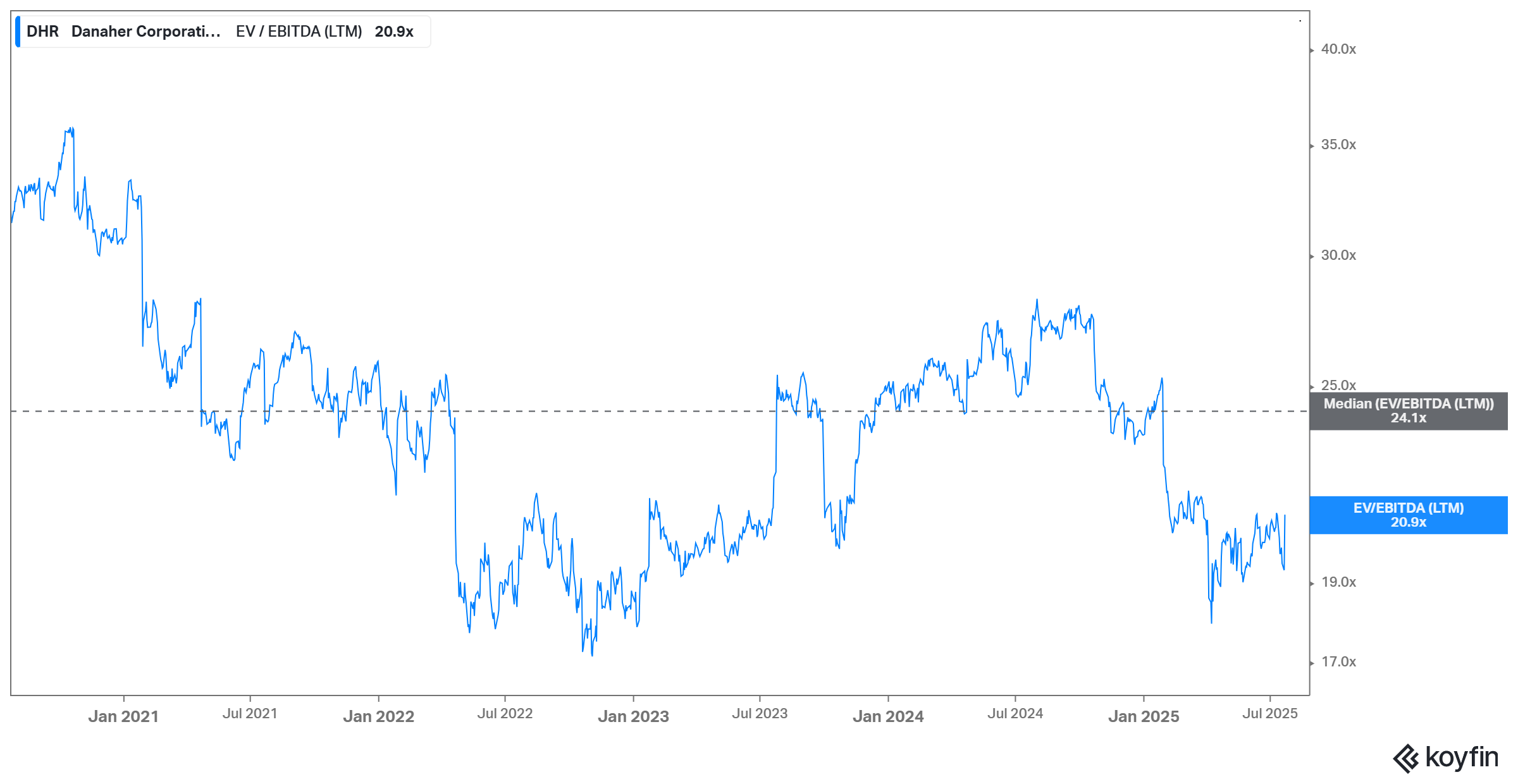

Valuation

Compared to the past few years, Danaher’s multiples have noticeably come down. However, it is hard for a stock to go up if revenue growth hovers around LSD level. After a very extended hangover of Covid and inventory destocking by its customers, I thought 2025 would be the year of modest recovery with at least MSD growth. Of course, the trade tensions and difficult funding environment in broader healthcare delayed that to hopefully next year.

It’s interesting to note that they bought back no share at all despite the stock being down over the last quarter. I suspect Danaher is likely preparing to do an acquisition sometime this year. Frankly speaking, I prefer that Danaher does a deal than buying back stocks. The whole sector has been reeling with challenges and there got to be some compelling opportunities which can have more compelling IRR than Danaher’s stock itself. Much of the life science stocks used to trade at nose bleeding multiples; now that they have all come down to a more tolerable level, it probably makes sense for Danaher to take that opportunity.

I don’t have any plan to further add to my position, but given that this remains a very high quality recurring revenue with lofty profitability business, I remain comfortable owning a piece of this business.

In addition to "Daily Dose" like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 61 Deep Dives here.

Prices for new subscribers will increase to $30/month or $250/year from August 01, 2025. Anyone who joins on or before July 31, 2025 will keep today’s pricing of $20/month or $200/year.

Current Portfolio:

Please note that these are NOT my recommendation to buy/sell these securities, but just disclosure from my end so that you can assess potential biases that I may have because of my own personal portfolio holdings. Always consider my write-up my personal investing journal and never forget my objectives, risk tolerance, and constraints may have no resemblance to yours.