CoStar Multifamily vs Zillow Rentals

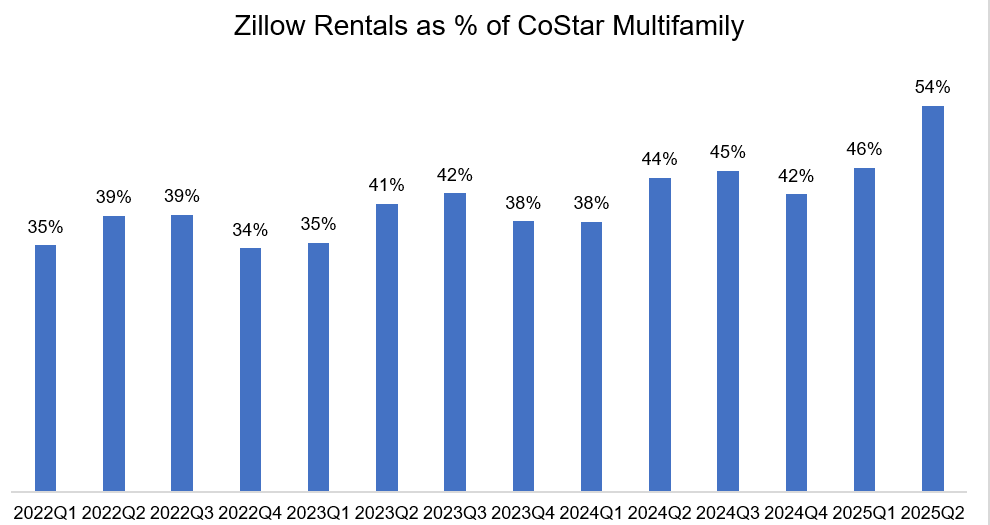

Each quarter, I closely track Zillow rentals revenue to gauge how the competitive dynamics between Zillow Rentals and CoStar multifamily segment (mainly Apartments.com) is evolving. At first glance, it may appear Zillow Rentals is really eating Apartments.com’s lunch for the last few years as Zillow Rentals revenue increased from ~39% of CoStar multifamily revenue in 2Q’22 to ~54% in 2Q’25.

However, there is a bit more nuance to this. On February 6, 2025, Zillow entered into a partnership with Redfin to become exclusive provider of multifamily rental listings on Redfin and its sites, including Rent.com and ApartmentGuide.com.

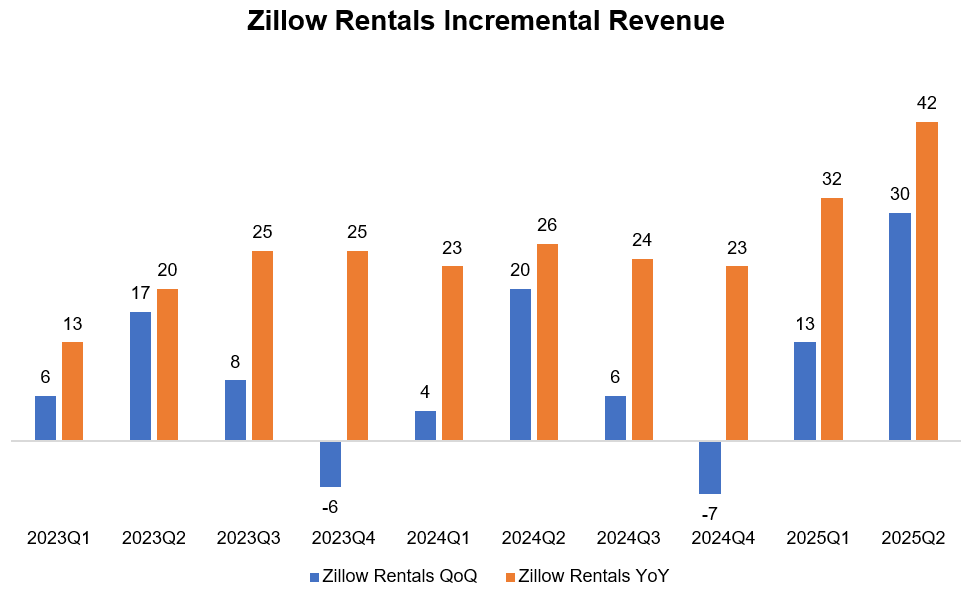

While we don’t know exactly how much incremental revenue came from this new partnership, I would venture a guess of ~$10 million looking at incremental revenue trajectory history of Zillow rentals.

Zillow’s Rentals revenue was $159M in 2Q’25, up 36% year over year. Multifamily led the charge: revenue up 56% and advertised properties up 45% to ~64k. That gap implies revenue per multifamily property rising roughly 7–8% year over year. Management says growth is coming from both more properties and upgrades to higher-priced packages. During the call, they did mention “We're also gaining wallet share with large property managers”

Andy Florance at CoStar likely knew that his shareholders may fret over these numbers, so he addressed this during the recent earnings call:

“I think we're conflating 2 different things here. Obviously, the product is extremely strong with very high NPS, renewal rates, growing bookings, robust sales bookings, growing ASP. And that's been conflated a little bit with looking at a lot of purchasing clients by our competitor paying top dollar to buy share from Redfin and from Realtor. That's relatively low quality advertisers coming in.”

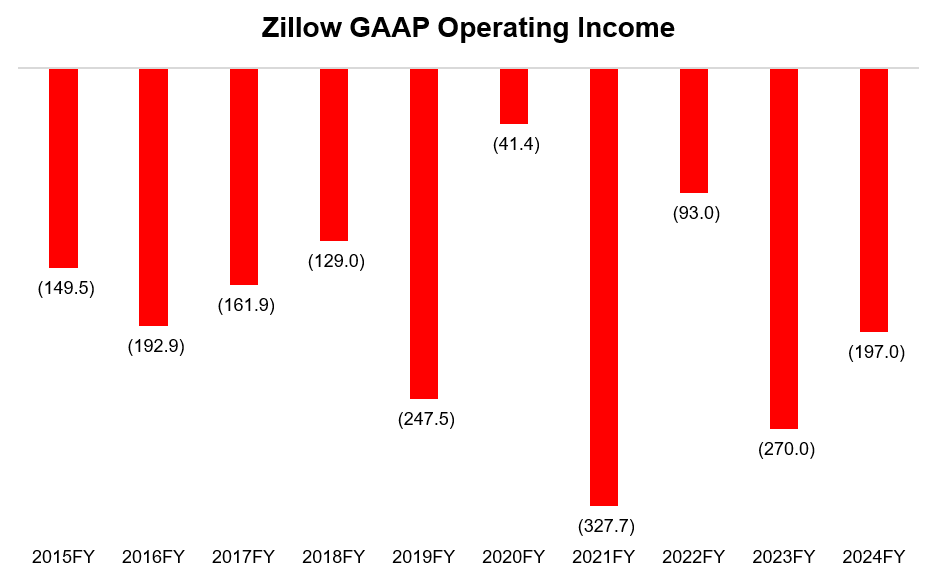

Indeed, historically Zillow never had much problems with generating revenue. Their only persistent issue was making actual profit (or even defining what actual profits is).

If you look closely to this Redfin deal, it’s fair to wonder about the quality of this revenue stream. Zillow paid Redfin $100 Million up front for the partnership which is amortized over nine years. This is, of course, a very real expense but conveniently added back to Zillow’s adjusted EBITDA calculation. Moreover, Zillow needs to make ongoing payments to Redfin for leads for an initial five-year term (with two optional two-year extensions). Practically, that means unit economics include a fixed amortization drip and a variable (not disclosed) cost-per-lead layer against each dollar of multifamily revenue.

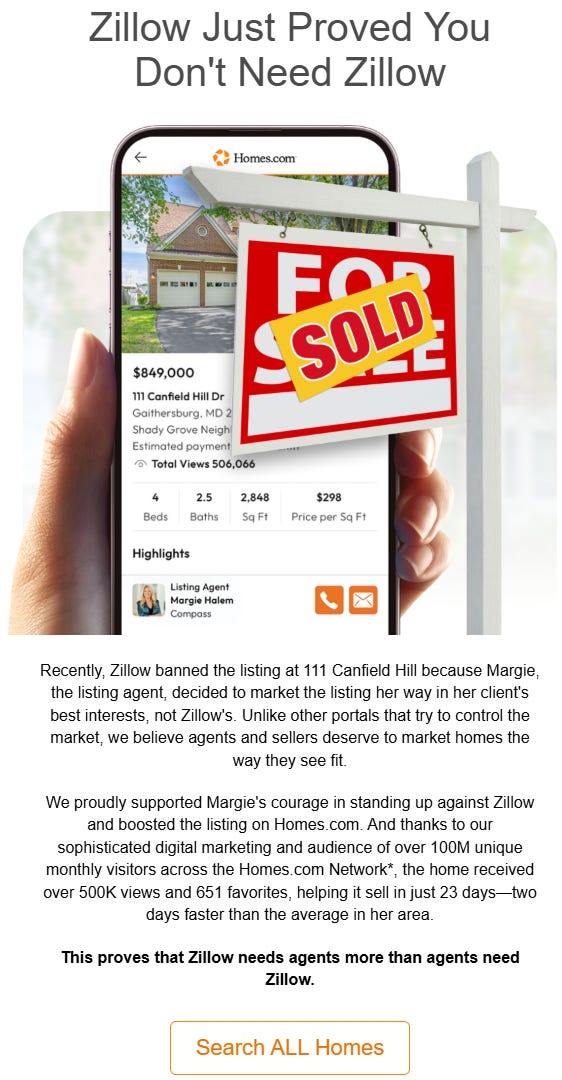

Some CoStar bears/Zillow bulls argue that Florance knows Zillow is becoming a much fiercer competitor in multifamily rentals, so he felt forced to go after Zillow’s core business. As a result, the eye-watering investments in Homes.com is not necessarily an opportunistic or offensive investments, rather a defensive strategy to protect its attractive profit pool in Apartments.com.

It’s hard to know exactly what prompted Florance to go after residential segment, but put yourself in Florance’s shoes. Imagine opening Zillow’s financial statements in one fine morning and discover that this must be world’s worst run “monopolies” as they generated losses after losses every single year in the last decade.

In case you think GAAP EBIT is not depicting a fair picture, let me point out that in the last 10 years, Zillow’s cumulative operating cash flow was $2.2 Billion. However, during this period, their cumulative SBC itself was $2.5 Billion. So, basically they generated no real cash at all.

Zuckerberg had a terrific quote more than a decade ago to encapsulate the state of Twitter: “Twitter is such a mess, it’s as if they drove a clown car into a gold mine and fell in." You could perhaps say the same about Zillow.

So, I find it more convincing to think a founder such as Florance would think he may have an opening to really go after Zillow, especially during a regulatory upheaval to see if he can get a piece of the goldmine and then run the business much more profitably than Zillow management ever could. He does seem quite willing to make life difficult for Zillow (see the recent lawsuit). I do find the rivalry at times quite funny; just see the email I received from Homes.com yesterday:

In addition to "Daily Dose" (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 61 Deep Dives here.

Current Portfolio:

Please note that these are NOT my recommendation to buy/sell these securities, but just disclosure from my end so that you can assess potential biases that I may have because of my own personal portfolio holdings. Always consider my write-up my personal investing journal and never forget my objectives, risk tolerance, and constraints may have no resemblance to yours.

My current portfolio is disclosed below: