Cognex: Agents of Automation

You can listen to this Deep Dive here

In 1981, Robert Shillman, a young lecturer in human-visual perception at MIT, resigned his faculty post, and teamed up with two of his top graduate students, Bill Silver and Marilyn Matz, to found a little startup in Massachusetts called Cognex. The name “Cognex” itself was a nod to their ambition, short for “Cognition Expert”.

The very next year after the company’s founding, Cognex unveiled DataMan, the world’s first industrial-strength Optical Character Recognition (OCR) system. It was a computer that could read letters, numbers, and symbols printed or etched directly on products even where no ink was used. Imagine a silicon wafer or a car tire with identification codes laser-etched into its surface which is invisible to the naked eye yet crucial for tracking. DataMan could instantly decipher those codes.

Cognex got some traction, and one of the first to notice was IBM. IBM became Cognex’s one of the first major customers, buying a DataMan system to read serial numbers on semiconductor wafers in its factories. That first installation read a humble 15 characters per second, but it proved the concept. In an era when factory automation was still in its infancy, Dataman could read what humans couldn’t, an early indication of machine’s superiority over human eyes. It was the start of a new way to ensure quality and traceability in manufacturing, free from human error or fatigue.

Shillman or as commonly known inside Cognex as “Doctor Bob”, and his team understood that as products like computer chips and circuit boards got smaller, faster, and more complex, human inspectors would struggle to keep up. By the mid-1980s, Cognex had begun targeting high-tech sectors, especially semiconductors and electronics where automation was no longer a luxury but increasingly a requirement.

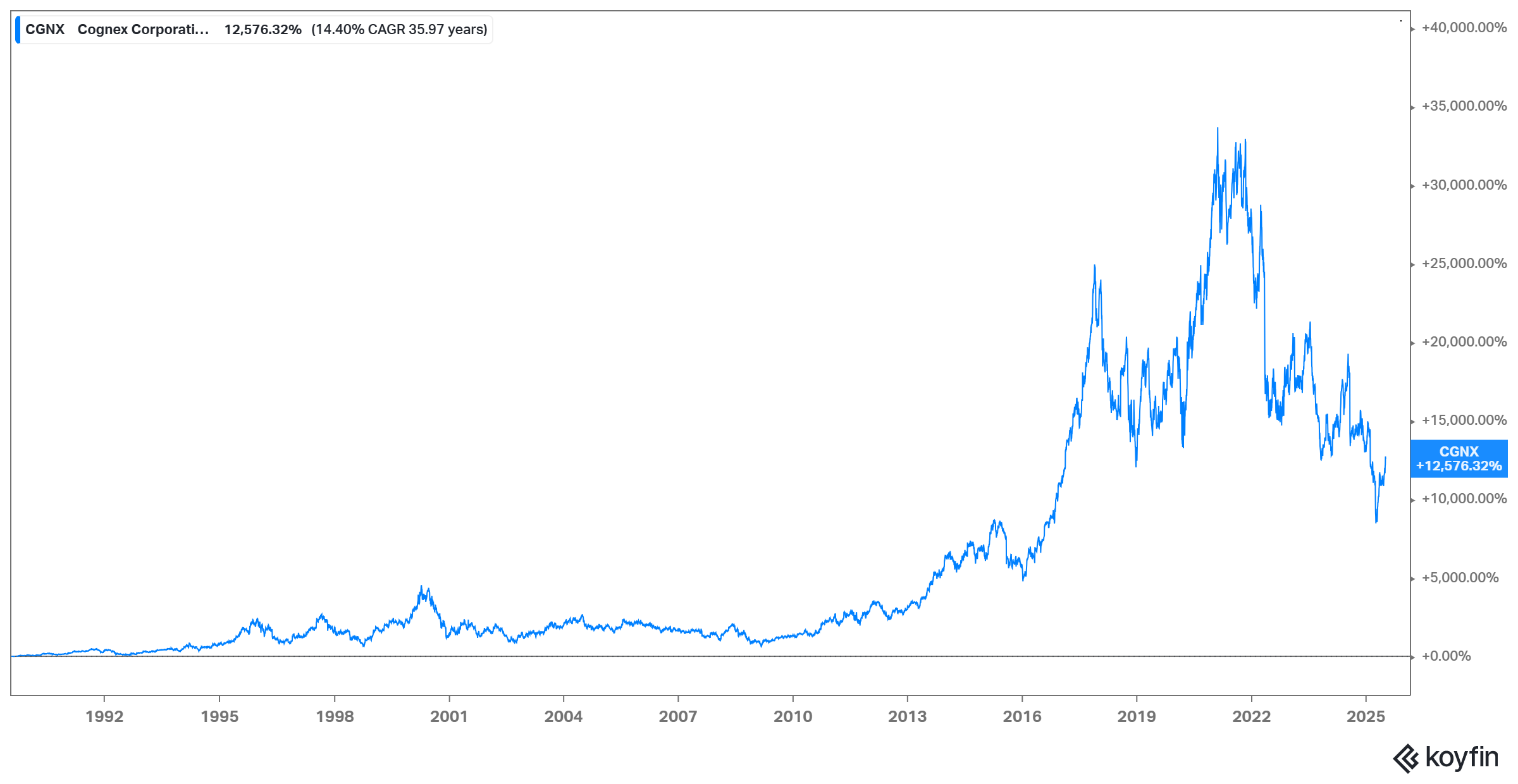

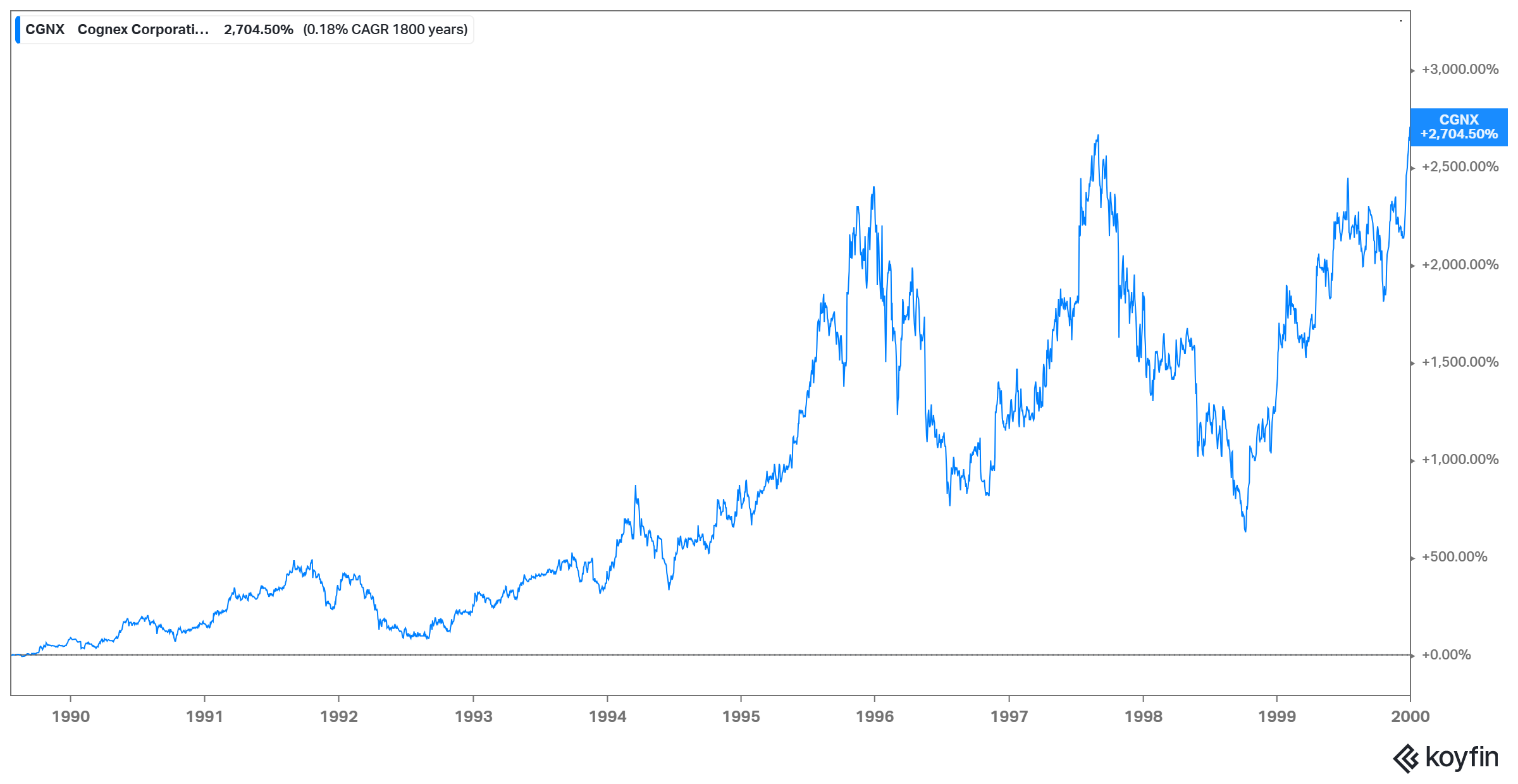

Cognex went public in 1989 at a split-adjusted 34 cents a share. Despite the current ~60%+ drawdown, the stock has still been a 125-bagger in the public market over the last three and half decades.

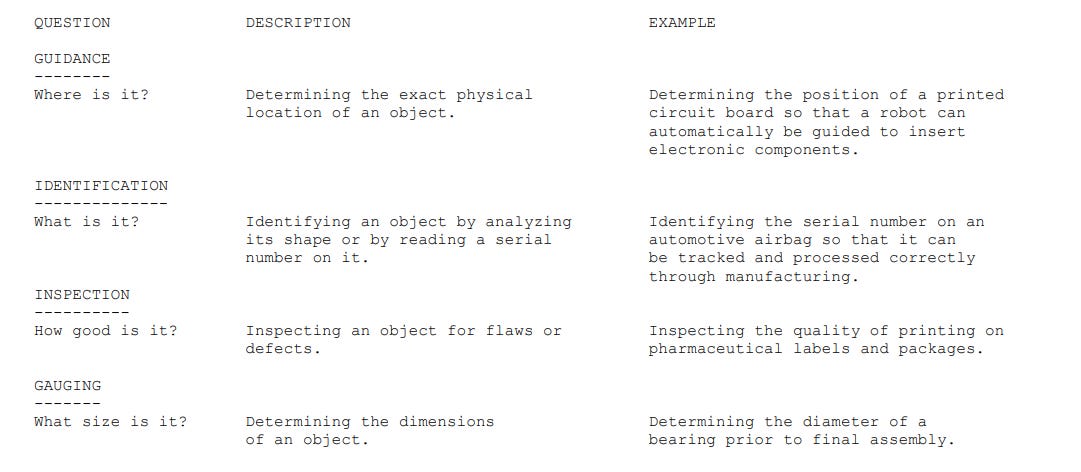

By the mid-1990s Cognex had morphed from a custom-projects boutique into a catalog company. The vast capabilities of machine vision can be distilled into four primary functions, which Cognex and the industry often remember with the mnemonic "GIGI": Guidance, Inspection, Gauging, and Identification.

Machine-vision systems in manufacturing revolve around these four fundamental tasks: guidance to locate parts, identification to recognize or read them, inspection to detect defects, and gauging to measure dimensions. Mastering these capabilities lets automation equipment reliably position components, track and route items, verify quality, and confirm precise sizing on production lines.

A notable development was the introduction of In-Sight in 2000, Cognex’s first compact, “smart” vision system that integrated camera, processor, and software into a single rugged unit. In-Sight was designed to be so user-friendly that a line technician could set it up without writing code, a radical departure from earlier systems that practically required a PhD to program. This move opened up a much wider market of potential customers who needed vision but lacked specialized expertise. By bringing vision to the masses (or at least to the average factory engineer), Cognex primed itself for the next phase of growth.

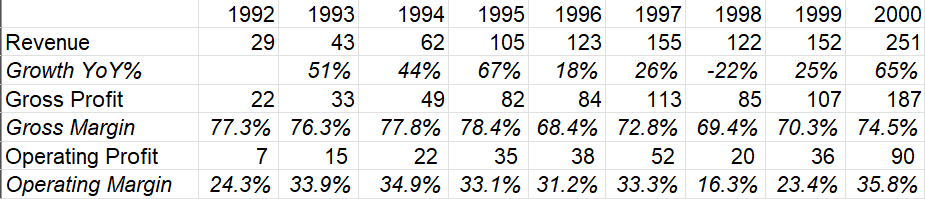

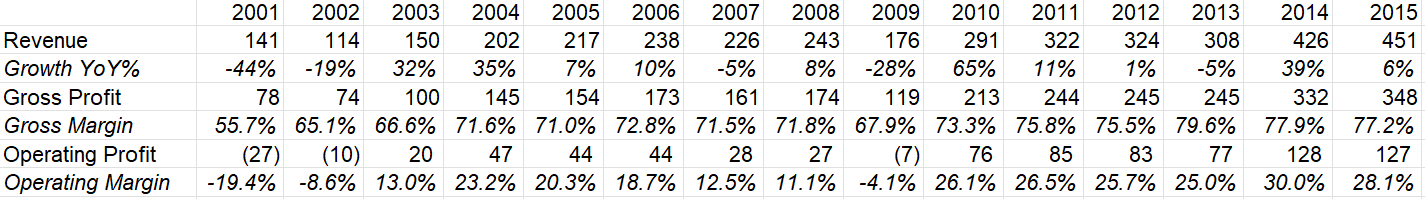

Cognex tapped the wider factory-automation market while the dot-com frenzy pushed semiconductor capacity orders to records. From 1992 to 2000, revenue leapt by almost ~9x to reach $251 million, operating income to $90 million, and operating margins to 36%.

As a result, the stock was ~27x in the first 10 years in public market!

Then gravity returned. When the tech bubble burst, chipmakers froze capital budgets and cancelled tooling projects. Cognex’s top line fell whopping 44% in 2001 and slid another ~20% in 2002. The collapse exposed a strategic vulnerability: almost ~80% of revenue still traced back to semiconductor and electronics industries whose fortunes rose and fell with memory prices and handset cycles.

A revived electronics cycle, the popularity of In-Sight, and the 2004 relaunch of handheld DataMan scanners lifted revenue past its old record in 2010, when Cognex booked $291 million revenue. Profitability took longer. The dam finally broke in 2014, helped by a revenue surge from Apple, propelling operating income to $128 million, well clear of the 2000 watermark.

Why did it take fourteen years to eclipse those millennium-era peaks? First, Cognex had to replace its semiconductor dependency with a broader set of growth engines, from barcode readers that could survive the punishing world of logistics to 3-D sensors that measured tire treads and glue beads. Second, the shift from high-ticket OEM boards to lower-priced, high-volume smart cameras meant climbing the same mountain with smaller steps; unit volumes rose even as average selling prices fell. Finally, every expansion required new domain expertise, channel partners, and, critically, the patience to deliver the cost-per-pixel economics that made vision attractive to mass-market factories.

Nonetheless, there is no denying the fact that this remains a cyclical business. Cognex’s fortune still rises and falls with the capex cycle of its customers. Historically, investors haven’ quite looked through such cyclicality and the stock went through repeatedly steep drawdowns.

As you can see, Cognex’s origin story was filled with vision (literally), rapid growth, and a hard-earned lesson in cyclicality. But what does the business look like today? That’s what I will detail in section 1.

In section 2, I will discuss the competitive dynamics in this industry, especially against Keyence and Chinese competitors. I’ll also touch on the relevance of Cognex’s products in the age of AI.

In Section 3, I will elaborate on Cognex’s capital allocation history, current philosophy, and management incentive structure.

In section 4, I will show what is likely currently embedded into the stock price. Finally, in section 5, I will offer some concluding thoughts and disclose my overall portfolio. Subscribe to keep reading!