Amazon 4Q'23 Update

Disclosure: I own Jan 2025 $55 Call Options of Amazon

While many investors remain obsessed with quarterly topline growth of AWS, the real story continues to be North America’s sustained margin recovery.

Here’s my highlights from yesterday’s earnings.

Revenue

1P revenue grew HSD and Amazon’s revenue ex 1P increased by high-teens last quarter.

Since I continue to rate Amazon retail to be relatively overlooked driver for Amazon, let me start with margin discussions on retail.

Amazon ex-AWS

North America’s operating margin bottomed at -2.3% 1Q’22 and has since then increased by more than 800 bps to reach 6.1% in 4Q’23, just shy of the pre-pandemic high of 6.4% in 1Q’19.

International margin bottomed at -8.9% in 3Q’22 and also experienced massive margin improvement to reach -1.0% in 4Q’23 although here margin deteriorated a bit QoQ. Amazon tried to reassure that things are on track in international segment:

The International segment represents more than 20 countries of varying degrees of growth. In our largest established countries like the U.K., Germany and Japan, relatively strong revenue growth contributed to the year-over-year improvement in profitability. Additionally, we saw good progress in our emerging countries as they continue to expand their customer offerings while seeking to invest wisely.

Fulfillment+ Shipping

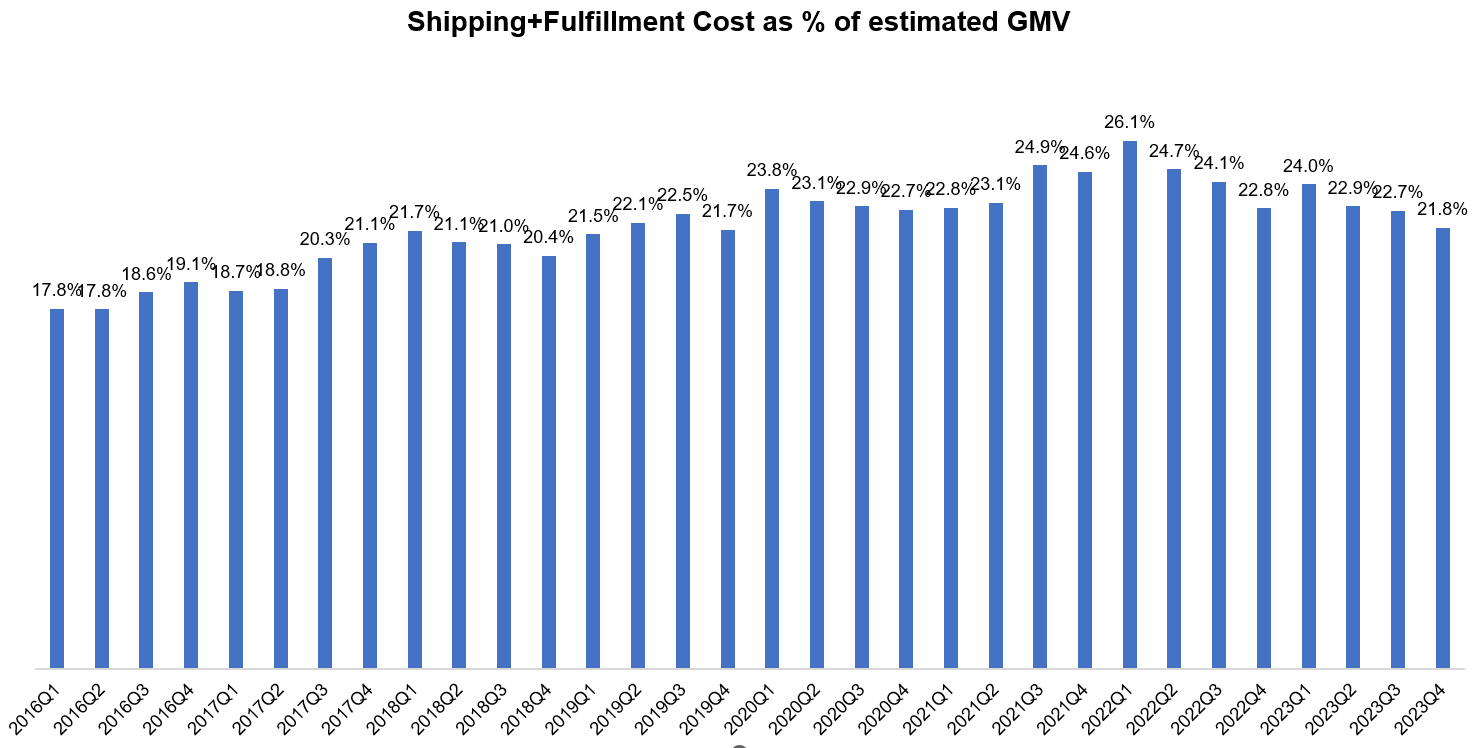

Shipping+ fulfillment costs, and paid units both increased by ~12% in 4Q’23.

Shipping+ fulfillment cost as % of GMV continued to go in right direction. As % of estimated GMV, shipping+ fulfillment costs were 21.8% in 4Q’23 (vs 26.1% in 1Q’22). We are now lot closer to pre-pandemic level, but Amazon may still have a plenty of runway left for further improvement if you eye at 2016 when this number used to be below 17%. Again, let me contextualize why this is a huge deal for Amazon and its shareholders.

I estimate Amazon’s GMV was ~$800 Bn in 2023 (defined as online sales+ (3P sales/25%). So every 100 bps improvement would add ~$8 Bn to Amazon’s bottom line. For the full-year, shipping+ fulfillment cost as % of GMV was 22.7%. If it were ~400 bps lower i.e. 18.7%, it would add ~$32 Bn to Amazon’s total operating profit which would almost double its actual reported profit of ~$37 Bn!!

Of course, we cannot expect it to magically happen by next couple of quarters or even years, but this is indeed the most important thesis for Amazon in my opinion that will likely play over multiple years.

To understand the valuation implications more clearly, I encourage you to play with my earlier shared Amazon model here.

During the call, management reiterated margin upside potential for retail in 2024:

we're seeing a reduction in some of the inflationary factors that hit us especially hard in 2021 and 2022, things like transportation services, fuel and others. So not totally out of the woods there but coming down, and we still see some more upside

Jassy also shared quite a few encouraging data points which also made it tangible how hard it will be to compete against Amazon’s logistics:

In 2023, Amazon delivered to Prime members at the fastest speeds ever, with more than 7 billion items arriving same or next day, including more than 4 billion in the U.S. and more than 2 billion in Europe. In the U.S., this result is the combination of two things. One is the benefit of regionalization where we rearchitected the network to store items closer to customers. The other is the expansion of same-day facilities where in the U.S. in the fourth quarter, we increased the number of items delivered the same day or overnight by more than 65% year-over-year.

…In 2023, for the first time since 2018, we reduced our cost to serve on a per unit basis globally. In the U.S. alone, cost to serve was down by more than $0.45 per unit compared to the prior year. Lowering cost to serve allows us not only to invest in speed improvements but also afford adding more selection at lower average selling prices, or ASPs, and profitably. We have a saying that it's not hard to lower prices, it's hard to be able to afford lowering prices. The same is true with adding selection. It's not hard to add lower ASP selection, it's hard to be able to afford offering lower ASP selection and still like the economics. Like improving speed, adding selection puts us in the consideration set for more purchases.

Shopping Assistant

Amazon launched “Rufus” which is their shopping assistant. It increasingly seems clear to me that query share will continued to be fragmented in GenAI dominated apps and almost every consumer tech company understands and smells this opportunity. It remains to be seen how well this opportunity will be capitalized, but the near certainty of fragmentation of query shares, and the uncertainty around how all these eventually settle is what unsettled me enough to sell Google shares. We’ll see how that ages over time.

Here’s more color from management what the assistant can do:

we launched Rufus, an expert shopping assistant trained on our product and customer data that represents a significant customer experience improvement for discovery. Rufus lets customers ask shopping journey questions, like what is the best golf ball to use for better spin control or which are the best cold weather rain jackets, and get thoughtful explanations for what matters and recommendations on products. You can carry on a conversation with Rufus on other related or unrelated questions and retains context coherently. You can sift through our rich product pages by asking Rufus questions on any product features and it will return answers quickly. We're at the start of what Rufus will do with further personalization and expansion coming, but we're excited about how it will make discovery even easier on Amazon.

AWS

AWS is now almost ~$100 Bn annualized revenue business.

After five quarters of hiatus, AWS again added more than a billion QoQ revenue which Amazon claimed to be higher than other hyperscalers:

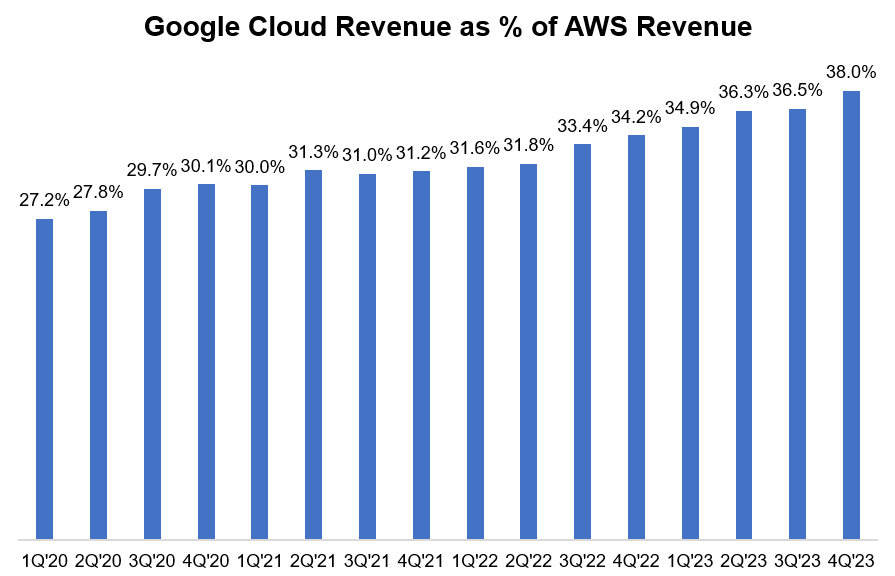

Azure vs Google Cloud vs AWS

Now that we have all the hyperscalers reports, here’s their revenue growth trajectory:

We knew GCP had a good quarter, but it does appear to be even better when you benchmark against AWS numbers.

Back to AWS.

AWS incremental operating margin continued to be >60% and overall operating margin hovers around ~30%. The incremental margins across the big tech I covered clearly exhibited a ton of efficiency last couple of quarters!

Some encouraging comments on AWS growth from the call:

Similar to what we shared last quarter, we continue to see the diminishing impact of cost optimizations. And as these optimizations slow down, we're seeing more companies turning their attention to newer initiatives and reaccelerating existing migrations.

…We expect accelerating trends to continue into 2024.

Opex+Capex

Looking at cost structure, it’s tempting to see a lot more headroom for further efficiency, especially in sales & marketing.

If 2023 was the “year of efficiency” in big tech land, 2024 may prove to be “year of capex”. Like Google and Meta, Amazon too indicated capex to increase due to their investments in AWS related infrastructure although they haven’t quantified the increase:

As we look forward to 2024, we anticipate CapEx to increase year-over-year primarily driven by increased infrastructure CapEx to support growth of our AWS business, including additional investments in generative AI and large language models.

Other Bets

We got an update on Kuiper:

In October, we had a major milestone in our journey to commercialize Project Kuiper, which is our low Earth orbit satellite initiative that aims to provide broadband connectivity to the 400 million to 500 million households who don't have it today.

…We're on track to launch our first production satellite in the first half of 2024 and started beta testing in the second half of the year.

Outlook

Amazon’s guidance for 1Q’24 is below (please note they increased useful life from 5 to 6 years):

Closing words

While there is a lot of positive you can take away from this report, I do want to reiterate that a lot of this is already priced into the stock. Amazon trades at ~35x NTM EV/EBIT multiple, so market clearly is paying dearly for the impending growth and margin expansion. We are, unfortunately, currently in a market in which we should perhaps lower our expected return.

Please feel free to share with your friends and network. I will cover Spotify's earnings next week. Thank you for reading.