Airbnb 4Q'25 Update

Programming Note: I will be traveling with my family for the next three days. Hence, I will take some time off, but will be back on Tuesday next week.

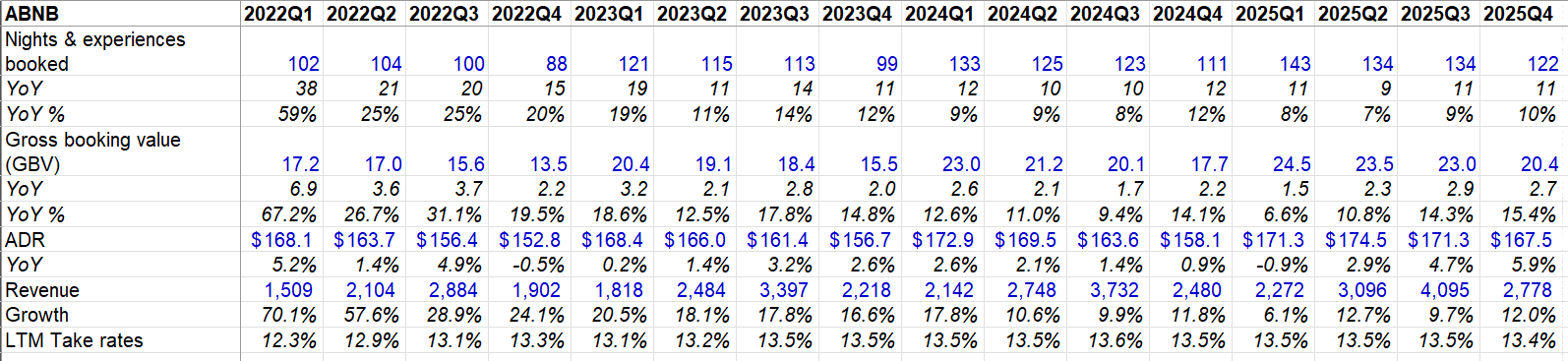

Earnings for most internet or SaaS stocks these days appear to be just another event for these stocks to go further down. Airbnb somehow managed to buck this trend. While consensus estimates for revenue were $2,711 Million and $2,528 Million respectively in 4Q’25 and 1'Q’26, Airbnb posted $2,778 Million revenue in 4Q’25 and guided $2,610 Million revenue (mid-point) for 1Q’26 which appears to be good enough for the stock to be up ~4% post-earnings (as of this writing).

Airbnb’s acceleration in Gross Booking Value (GBV) continued in 4Q’25 and posted its highest GBV growth in the last two years. “Reserve Now, Pay Later” is proving to be a strong tailwind for GBV as it not only lengthened the booking lead time but also incentivized people to gravitate towards higher ADR homes.

Airbnb also mentioned that guest travel insurance products (available in just 12 countries) grew by ~40% YoY. You will notice that despite such tailwind, Airbnb’s LTM take rate actually went down in 4Q’25. The most significant factor distorting the take rate in 2025 was the acceleration of booking lead times. Airbnb records GBV at the time of booking, but recognizes revenue only upon check-in. Management noted a “continued lengthening of lead times” and an acceleration in nights booked for future travel (particularly for major 2026 events like the World Cup and Winter Olympics). When users book further in advance, the denominator (GBV) swells immediately, but the numerator (Revenue) is delayed. This mathematically suppresses the implied take rate in the current period, even if the underlying monetization potential of those bookings remains unchanged. In fact, Airbnb mentioned they expect Q1 take rates to be modestly higher YoY.

I’ll dig into the quarter in more detail behind the paywall.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 66 Deep Dives here.

Regional mix shift