Airbnb 3Q'25 Update

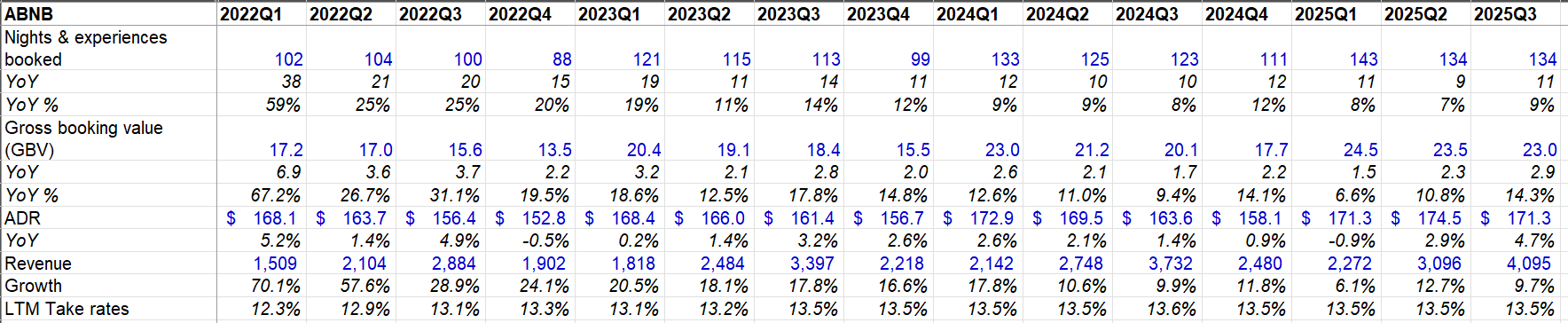

Airbnb had a notable acceleration in Gross Booking Value (GBV) growth as it increased from 10.8% in 2Q’25 to 14.3% in 3Q’25. This acceleration was driven by the twin acceleration of both the nights & experience or N&E (from 7% in 2Q’25 to 9% in 3Q’25), and Average Daily Revenue or ADR (which increased from 2.9% in 2Q’25 to 4.7% in 3Q’25).

While revenue growth was slower than GBV (~10% vs ~14%), GBV tends to be a leading indicator of future revenue growth since Airbnb records GBV when a guest makes a reservation but recognizes the associated revenue only when the guest actually checks in for their stay.

One of the reasons for such acceleration in GBV growth was Airbnb launched “Reserve Now Pay Later” in the US in Q3. This feature (which was only available for US domestic travel for homes that had flexible cancellation policies) encouraged customers to book their travel further in advance which led to strength in longer lead time bookings. Airbnb expects higher cancellation rates than usual for these bookings, but does anticipate net impact to be positive.

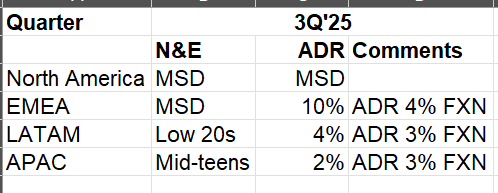

Nights & Experiences (N&E) and ADR by geography are shown below:

I have also shown the KPI trends below:

I’ll dig into the quarter in more detail behind the paywall.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 64 Deep Dives here.

Regional mix shift