Airbnb 2Q'25 Update

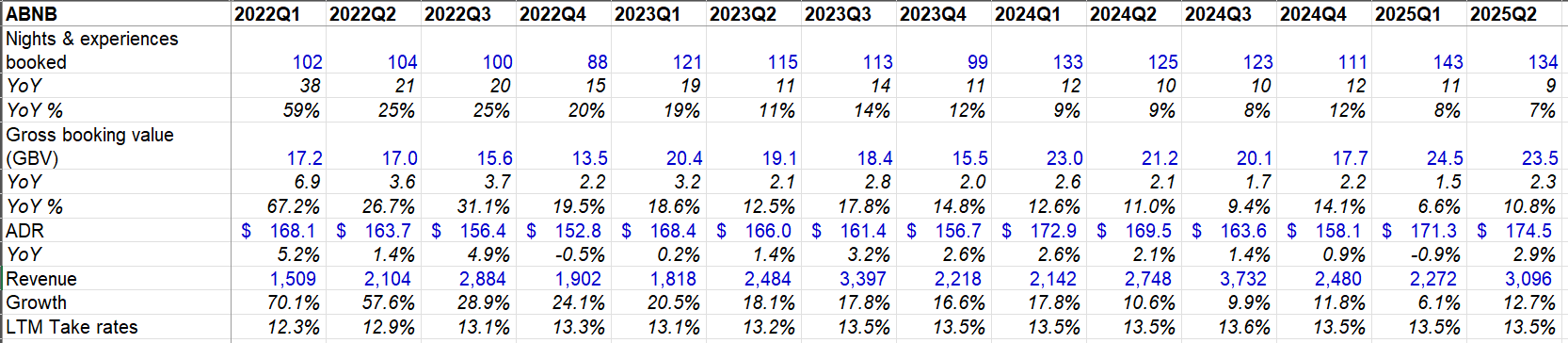

Airbnb had a decent quarter. While nights booked decelerated to 7%, both Gross Booking Value (GBV) and revenue increased by double digit rate. Q2 started with a lot of economic uncertainty from tariffs but demand on Airbnb accelerated from April to July. However, the company cited impending hard comps for Q3 and Q4 which soured the sentiment about outlook a bit. The stock went down ~8%, but I think it’s quite interesting time at Airbnb. I’ll explain more, but let’s first look at the Key Performance Indicator (KPIs) first.

Region

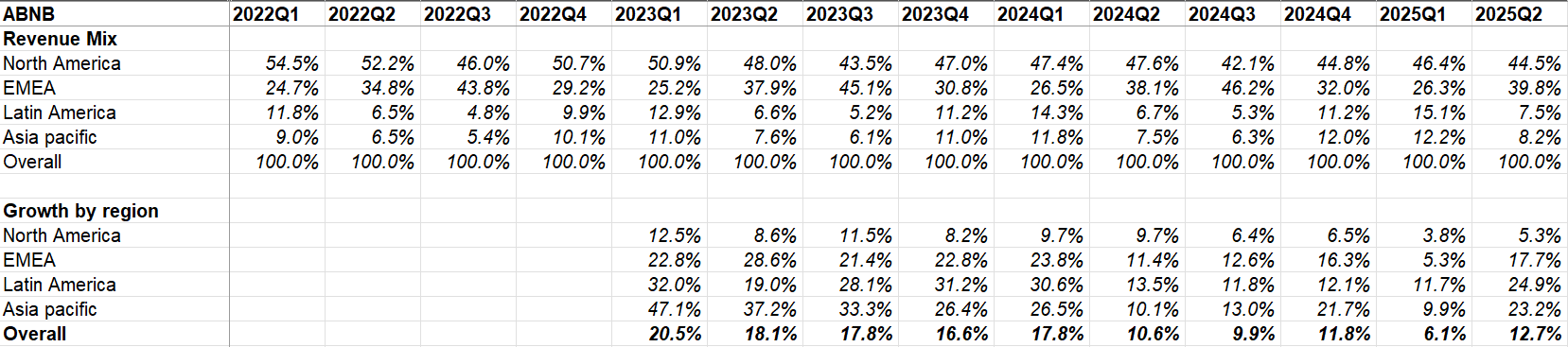

Although Airbnb doesn’t report specific segment details, Airbnb discusses its business in two broad segments: core, and expansion markets. They have only 5 Core markets: US, Canada, Australia, France, UK. And they identify the following countries as “Expansion” markets: Spain, Italy, Germany, Mexico, Brazil, China, India, Korea, Japan. They didn’t mention this in this call explicitly, but did mention in 1Q’25 call that ~70% of their business is still within the core markets.

For the last six consecutive quarters, nights booked on expansion markets has grown at twice the rate of core markets. That bodes well for the Airbnb bull case that Airbnb will become much more mainstream over time across many more countries beyond just five. Again, we don’t know exactly what the “core” market grew at, but if we just look at North America region, unfortunately it hasn’t grown at double digit rate for the last seven consecutive quarters. So, such growth rates in expansion markets may be slightly less impressive than it appears at first glance.

So, the big question is whether Airbnb has been “saturated” in the US?

Airbnb has upgraded its total price display, and pricing tips yet still needs more work to ensure strong value and broader demographic appeal in the United States. It is gaining traction with previously underpenetrated groups, especially Hispanics and consumers in Heartland states. Additional efforts to improve usability and expand payment choices are expected to lift US performance further. But when you don’t grow at double digits for seven consecutive quarters, the question of saturation will only get louder every quarter.

Europe is another important region for travel where Booking is much fiercer competitor than they are in the US. While homes are the soul of Airbnb, management seems to be leaning to boutique hotels as well, especially in Europe. From the call:

We've spent a lot of time looking at hotels as a business. We think it's really compelling, and we think that there's going to be a lot more to do with hotels on Airbnb. Our take rate is very, very competitive. We've spoken with hotels around the world, especially independent boutiques in bed and breakfast, a huge percent of hotels in Europe are independents. And one of the things they said is they really want incremental travelers. They know that they have another booking channel. They would love to have high-income American young travelers. We're probably the biggest travel brand in the United States. So I think we're really, really compelling. And when we have -- I think homes and accommodations homes will be the heart and soul of Airbnb. But that being said, in our top markets, top markets, especially during high season, people often don't find a home. We think hotels would be a great supplement.

Brian Chesky does seem to understand that the current trajectory isn’t good enough:

“We are looking to reaccelerate the growth of Airbnb. We are not satisfied with the company growing approximately 10% year-over-year. We want the company to reaccelerate.”

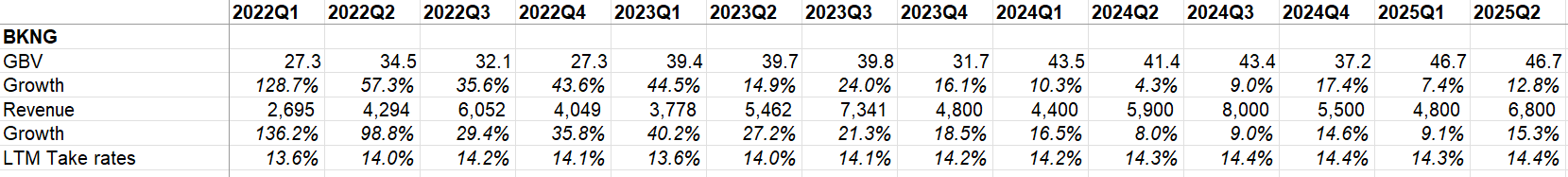

For someone who basically originated the “Founder Mode” saga, it is certainly less than ideal if your business is limping around ~10% growth rate and is actually being beaten by a metrics driven machine called Booking. Indeed, for the last three consecutive quarters, Booking has grown at a faster rate than Airbnb despite its revenue being more than double the size of Airbnb’s.

Margins

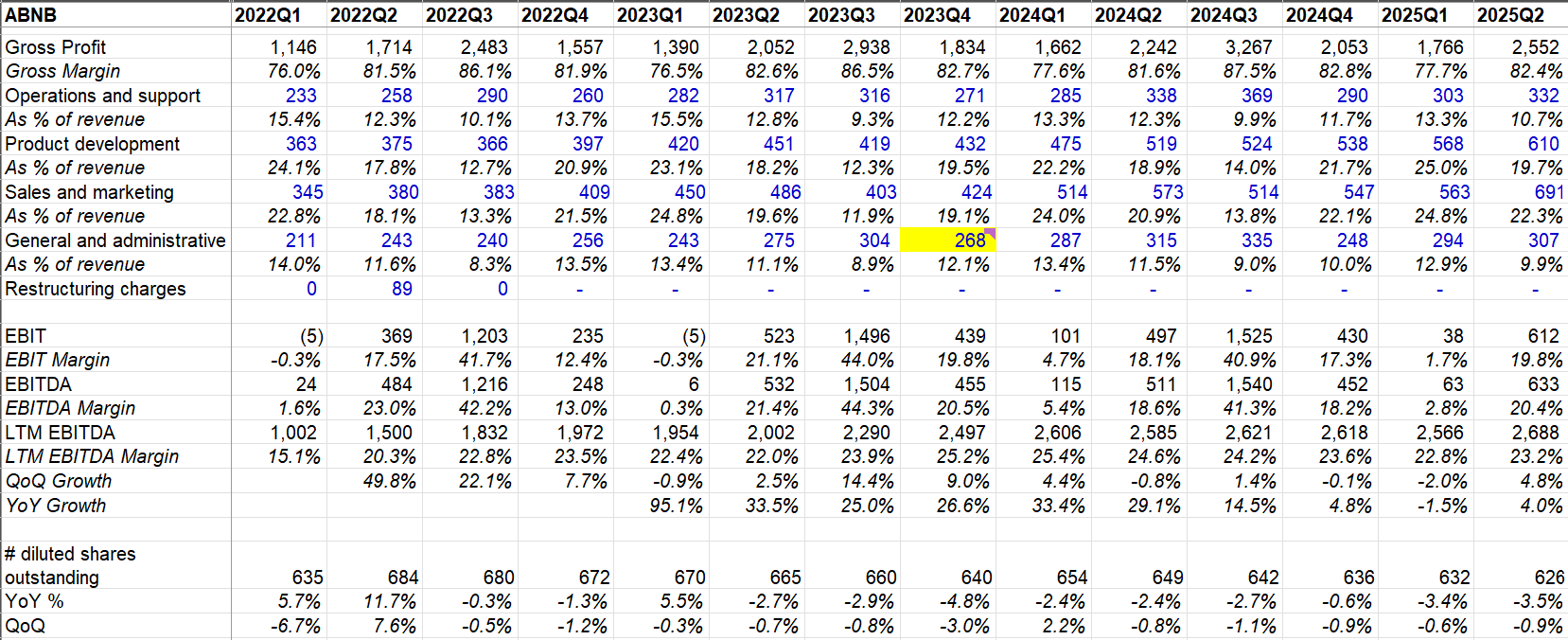

Airbnb is a very profitable business with low to mid-20s LTM EBITDA margin. Please note I do not add back SBC for this EBIDA calculation and it is a better metric than FCF given the structural working capital benefit. Moreover, considering their humongous cash balance, I wouldn’t want to capitalize interest income either.

Their LTM EBITDA margins peaked at 25.4% in Q1’24 and since then, margins have been under pressure. In recent quarters, they have been investing in their recent experiences and services launch which was a further headwind to their margins.

One particular cost line item that is worth highlighting is “Operations and Support” which used to be ~12-15% of revenue but came to only 10.7% of revenue in 2Q’25. Airbnb mentioned they’re using AI customer service agent which reduced the percentage of hosting guests who need to contact a human agent by 15%. I expect they will get further leverage here as they roll it out over other markets in coming years.

AI

Speaking of AI and customer service, Chesky has some interesting bits on how AI will impact travel. From the call:

We've chosen a very specific way to approach AI. A lot of companies have chosen what I would say is the lower stakes part of travel, which is travel planning and inspiration. For AI, we actually start with the hardest problem, which is customer service. Customer service is the hardest problem because the stakes are high, you need to answer this quickly and the risk of hallucination is very, very high, and you cannot have a high hallucination rate. And when people are locked out, they want to cancel reservation, they need help, you need to be accurate. And so what we've done is we built a custom model or we've built a custom agent built on 13 different models that have been tuned off of tens of thousands of conversations. We rolled this out throughout the United States in English. And this has reduced, as I mentioned in the opening remarks, 15% of people needing to contact a human agent when they interact instead with this AI agent. We're going to now, over the course of this year, bring this to more languages. And throughout next year, it's going to become more personalized and more agentic. So what this means is that when you reach out to an agent, the AI agent, it will not only tell you how to cancel your reservation, it will know which reservation you want to cancel, it cancel it for you, and it can be agentic as in it can start to search and help you plan and book your next trip.

Next year, we're going to bring AI into travel search. So all this brings us back to the question you asked about travel planning. Over the next couple of years, I think what you're going to see is Airbnb becoming an AI-first application. And this leads to the bigger question around AI. Over the last almost 3 years since ChatGPT spin out, if you look at the top 50 apps in the App Store, almost none of them are AI apps. The #1 app in the App Store, I think, as we speak, is ChatGPT. And if you go through 2 through 50, maybe only 1 or 2 others are AI native applications. So you've got basically AI apps and kind of non-AI native apps. And Airbnb would be a non-AI native application. Over the next couple of years, I believe that every one of those top 50 slots will be AI apps. either start-ups or incumbents that transform into being AI native apps. And I think at Airbnb, we are going through that process right now of transitioning from a pre-generative AI app to an AI native app. We're starting to customer service. We're bringing into travel planning. So it's really setting the stage.

I think that the key thing is going to be for us to lead and become the first place for people to book travel on Airbnb. As far as whether or not we integrate with AI agents, I think that's something that we're certainly open to. Remember that to book an Airbnb, you need to have an account, you need to have a verified identity. Almost everyone who books uses our messaging platform. So I don't think that we're going to be the kind of thing where you just have an agent or operator book your Airbnb for you because we're not a commodity. But I do think it could potentially be a very interesting lead generation for Airbnb.

Indeed, I don’t think Airbnb is commodity. I myself actually enjoy browsing Airbnb very much. It turns out I’m not the only one, and the implications can be profound over the long term. From the call:

We're seeing a giant uptick in the number of people that are booking a home from the homepage on Airbnb. So this has been a major behavioral change from basically the last 17 years of Airbnb's history. So if you go to most apps, especially OTAs, you open the app and every single person goes essentially to the search box. they type in something in the search box and they enter dates and then they get a bunch of search results. And this is how everyone search for travel over the last 20, 25 years. The holy grail is to get more and more people to be in browse and discovery mode, almost like on Netflix or say DoorDash. DoorDash was very search-driven. They're now more of a browse and discovery application. And it's been a really hard not to crack within travel, but we think we've done it because what we've seen is that increasingly more and more guests are engaging not just the service experience from a homepage, but with homes. Now this is very strategic. Why is this strategic for us? The reason why is if people can engage with our homepage rather than typing in a destination, then we can divert travel more broadly to where we have available supply, thereby increasing conversion rate of our traffic, if this makes sense.

Experiences and Services

Airbnb made a huge splash on their launch of experiences and services. They mentioned in the call that the average guest rating for service and experience since launch is 4.93 stars (vs 4.8 for homes during the same period). They received 60k applications to host a service or experiences. They shared a couple of interesting data points: a) ~40% of bookings for Airbnb Originals are from locals, and b) ~10% of bookings for services are from locals. While these are somewhat encouraging data points, neither of them moves the needle and frankly speaking, I remain skeptical, especially about services. Airbnb again talked about the potential of hiring chefs or masseuse through the app, but I’m not sure why I would want to keep hiring them through Airbnb once I found someone I like.

In any case, these are not huge headaches for me. Management does have a right approach here. They’re focusing on a handful of key cities (Paris, LA etc.) and trying to improve attach rates of experiences and services in these key cities. Whatever strategies prove to be successful, they will roll it out over other cities. But in case they cannot make it work, they will be forced to move on. They are spending only $200 million per year on these new launches, so it’s not material enough even if it doesn’t work. But if it does work and my skepticism proves to be unfounded, that’s all the better because as I will show later, I don’t think the stock price assigns much value to these bets anyway.

Ad dollars

Unlike Booking, Airbnb doesn’t spend much on customer acquisitions via Google since ~90% of their traffic is organic in nature. The way management explained how they’re thinking about spending ad dollars in the future can itself be thought as an ad for Meta (only half-kidding). From the call:

We think that probably going forward, the best way to market services and experiences is to actually market the entire offering of Airbnb. So immediately upon the launch, we did launch some Airbnb experiences, specific ads. But this fall, we're going to be launching ads that market home services and experiences, the bundled offering. And we think this is a really, really key principle that only Airbnb offers all of this in one app. And so we don't think that the marketing intensity per se has to increase because we think we get a lot more for our dollar by marketing all of our offerings.

If you book a home, you're very likely to want a service or experience, so we can market all 3. The second thing is channel. So that's just the strategy. We think that the channels for services experiences and homes is increasing in the shift to social. Now why is this going to be the case? Well, one of the things we're noticing, obviously, in the whole world seeing is that a lot of travel is switching from desktop to mobile and from Google search to social media.

And so increasingly, people are spending time on social media and social media is gradually taking over as the #1 place for travel search from Google and travel is becoming more of an inspiration base than a high-intent search-based destination platform. So Airbnb, we think, is really primed for social media. We are probably the most relevant brand for young American travelers that is the kind of heart and soul of kind of the social media audience. And I think that you're going to see a lot more of social media native advertising. So we're shifting a lot of our advertising from TV to social. And we are -- and the great thing about social is we can target. We know a lot more about the customers. We know if they're Airbnb customers. We can actually when they watch an ad, we can link it to inventory and get them to go directly to the app. So it's actually, we think, very, very performative. So this is what we're going to be doing with marketing.

Capital Allocation

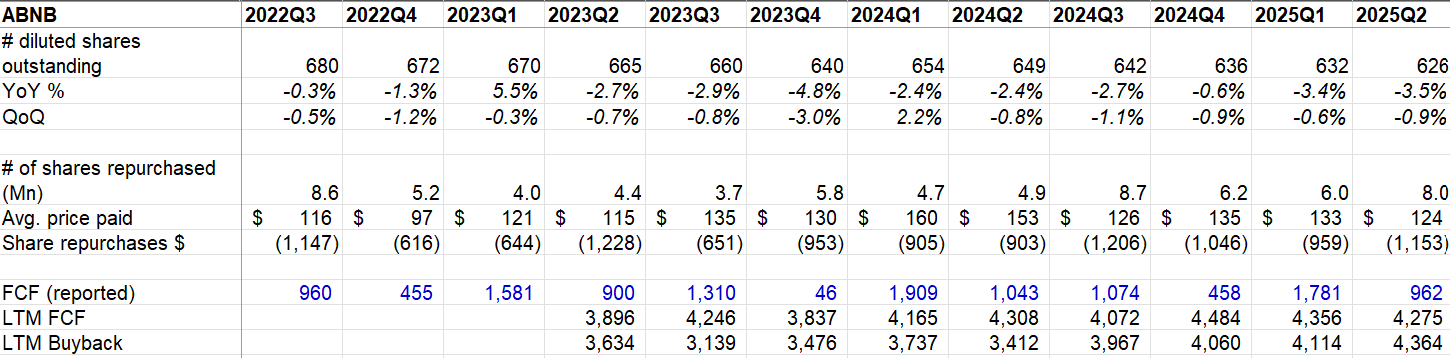

Since Airbnb started buying back stocks in 3Q’22, diluted shares outstanding declined by ~8%. Over the last four quarters, their LTM buyback is essentially more or less the same as their FCF. I do want to highlight that I’m taking FCF just as the company reports it (so I haven’t made any SBC or any other adjustments). However, for buybacks, apart from share repurchases, I have also included taxes paid related to net share settlement of equity awards. I used to not include this, but after a feedback from a subscriber, I decided to add it to buyback as well. The subscriber explained “it is effectively a share buyback since employees receive shares net of tax and the company pays the cash tax due to the tax authorities. It is equivalent to the company issuing the entire vesting amount of shares to employees, who then sell the number of shares required to settle their taxes back to the company and use those funds to pay their taxes.”

I agree; as a result, going forward, you will see me including this number for other companies as well.

While Airbnb hasn’t done many acquisitions, they seem more open to it now. From the call:

We've historically primarily focused on building organically, but we absolutely are open to acquisitions, and we are going to be looking at it. And I think that we are now in a better place to consider acquisitions now that we've rebuilt our tech platform from the ground up, and we have this new expanded strategy where we're focused not just on all aspects of traveling, but also living and so I think there's absolutely acquisitions on the table that we could be looking at. We always want to make sure that if we do an acquisition, it is one of the most perishable opportunities that the integration costs don't outweigh the benefit of the revenue that we get. But we are absolutely opportunistic when it comes to acquisitions.

Outlook

Airbnb guided revenue of $4.02-$4.1 Billion revenue in Q3, which implies ~8-10% revenue growth. As mentioned earlier, management also highlighted that their nights booked grew by 8% in 3Q’24 which then re-accelerated to ~12% in 4Q’24. As a result, they expect tougher comp for Q4. So, Airbnb will likely to remain confined within HSD to LDD growth for the rest of the year.

I will share some thoughts on valuation behind the paywall.

In addition to "Daily Dose" like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 61 Deep Dives here.