Some notes from Big Tech 10-Qs

I went through Meta, Amazon, and Alphabet’s 10-Qs during this weekend, so just wanted to highlight some interesting points from their 10-Qs.

Meta 2Q’25 10-Q

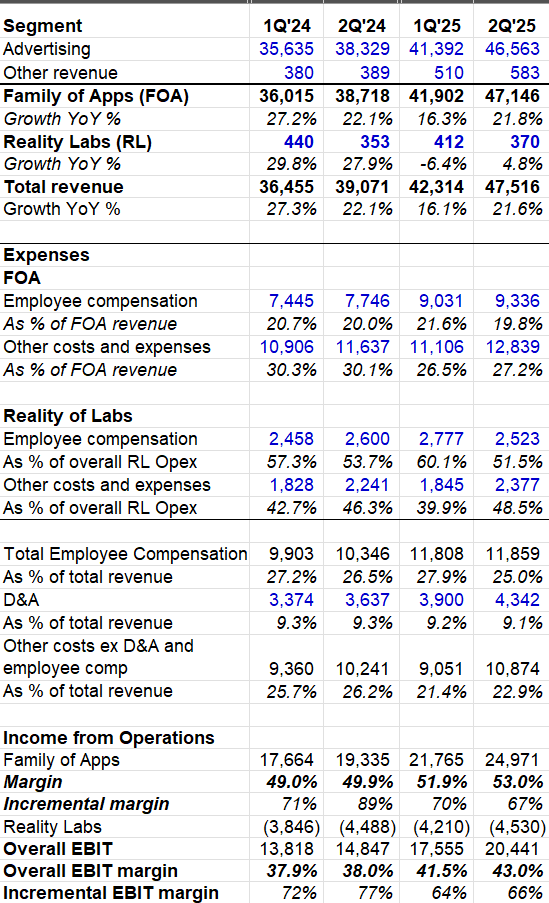

Both Alphabet and Meta now disclose total employee compensation expenses. One of the surprising data points for me was that almost half of the operating expenses of Reality Labs was non-employee compensation related in 2Q’25. If I had to guess, I would probably have said ~20-30%. Of course, Reality Labs sell hardware products (Glasses and VR headsets) which in aggregate likely have negative gross margin, but even then Meta likely spent ~$2 Billion in expenses ex hardware, and employee comp. That’s not a small amount if you annualize it, but we don’t quite know what exactly Meta spends this ~$8 Billion on.

Meta doesn’t disclose Depreciation &Amortization (D&A) expenses by segment, but now that we have employee compensation, we can see the overall company spent ~$12 Billion in employee comp last quarter, ~$4.5 Billion in D&A, and ~$11 Billion in “other costs and expenses ex D&A and employee comp” which would be ~$45 Billion if you annualize the number. Of course, D&A is certainly going to be a growing number for years given the skyrocketing capex, and employee comp is somewhat variable (Meta can hire or layoff depending on business context, but only to a certain extent). But it’s quite interesting to see Meta spends $40-45 Billion in opex that is outside the employee comp and D&A expenses and a significant part of this can be more discretionary than employee comp and D&A expenses. Looking at this breakdown of opex, I actually feel more comfortable that Meta can maintain its operating margin just fine even though capital intensity is rising. I expect the more discretionary expense buckets will grow much slower than overall revenue growth which will help them maintain their operating margins. Of course, there will be fluctuations in random quarter or year, but the point should stand over the course of 3-5 years.

I will share some thoughts from Amazon and Alphabet 10-Q and what I find the most interesting point across these three companies behind the paywall.