MBI Daily Dose (July 13, 2025)

Companies or topics mentioned in today's Daily Dose: Future of logistics, Rise of Dupes, Meta vs EU, follow-up on Wealth Ladder

Austin Vernon argues that AI-driven autonomy and battery electrification may profoundly transform the labor-plus-fuel cost stack that makes trucking and last-mile delivery so expensive, putting almost a third of US GDP in play. Removing the driver lets fleets switch to much smaller, ultra-low-maintenance “pallet hauler” EVs, making even single-pallet point-to-point moves competitive and slashing less-than-truckload prices by 80-90%. Cheap aerial and ground drones push the last-mile price floor toward $1, giving most parcels air-freight transit times at a fraction of today’s ground-shipping costs.

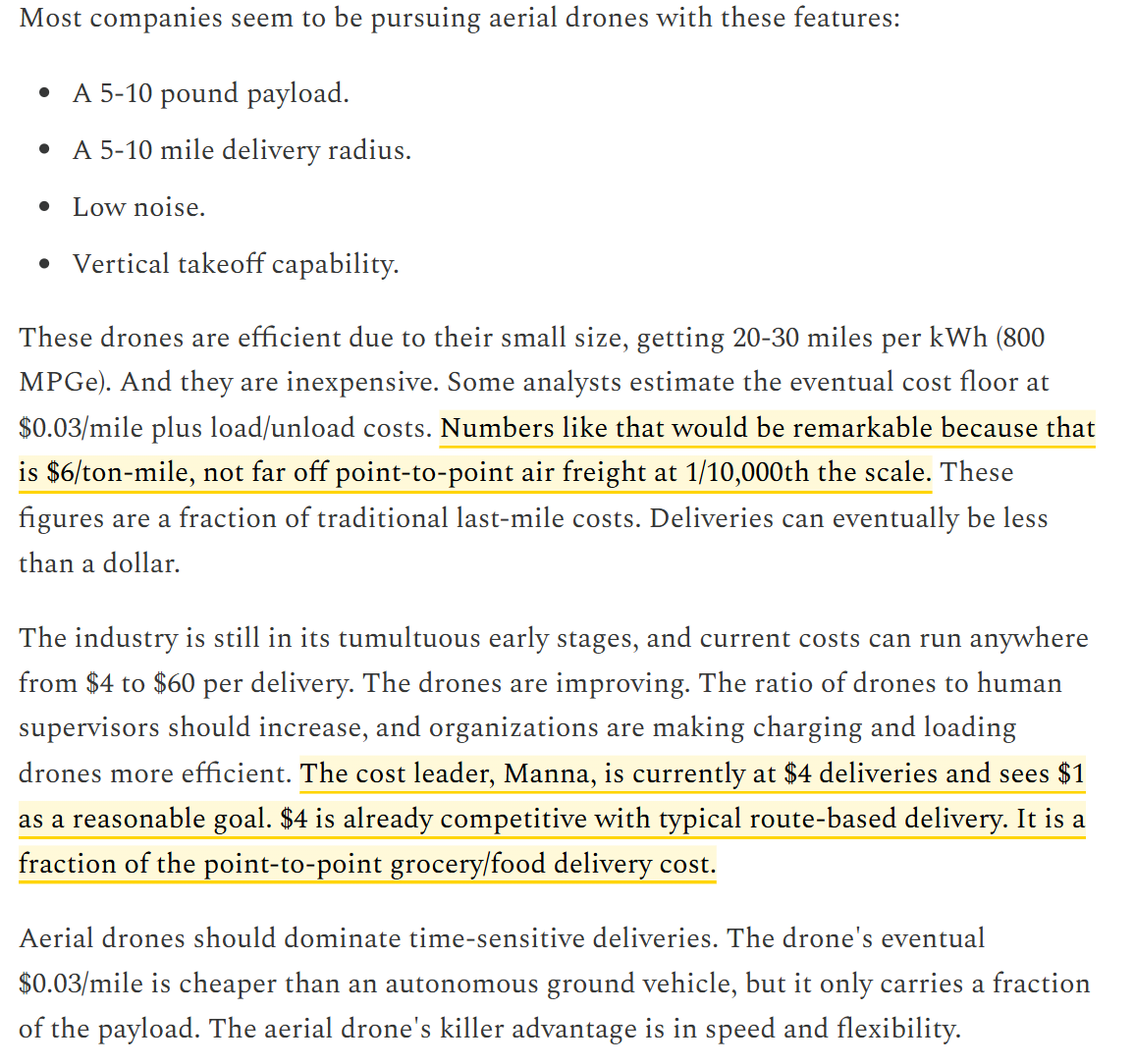

He does acknowledge that these things of course won’t happen overnight but it’s a thought provoking piece how much logistics may be transformed in the next couple of decades; here’s an excerpt on the economics of aerial drone delivery:

I was wondering about the impact on Amazon if such future eventually unfolds over time. Logistics is one of the key tenets of Amazon’s current moats in retail. If point-to-point shipping really lets a mid-Atlantic phone-case factory deliver nationwide for 75 cents and in 12–13 hours, the 35–40% take-rate sellers currently swallow for FBA, ads and commissions may prove challenging to sustain. Amazon may double-down on its scale advantages (proprietary drone corridors, exclusive micro-hubs, even licensing its logistics stack), but such massive potential transformation in logistics always runs the risk of offering some opening to new entrants to disrupt its logistics moat.

I have mentioned before that Lululemon sued Costco for alleged dupes. The Streisand-effect risk is real as yesterday WSJ published a piece which can almost be deemed as an ad for Costco’s Kirkland brand:

The store brand now accounts for roughly a third of Costco’s revenue—and it’s growing faster than the company as a whole. Costco’s total sales have almost doubled since 2017. Kirkland’s have almost tripled.

At this point, it’s bigger than many of the world’s biggest companies. . Kirkland alone brought in $86 billion last year—more than all of Procter & Gamble. In fact, this brand known for no-frills affordability generated roughly the same annual revenue as luxury giant LVMH.

It all started when Sinegal noticed something curious about his business: Even when the cost of raw materials went down, the price of brand-name products kept going up. That inefficiency became his opportunity.

Costco launched a private label in 1995 and called it Kirkland Signature, a nod to the company’s headquarters in Kirkland, Wash.

But the Lululemon lawsuit might just turn out to be free advertising for Costco, which is the company’s preferred form of advertising.

After all, press coverage of the suit is how many shoppers who would never spend $128 on pants found out their favorite company was selling a look-alike product at a fraction of the price.

I don’t think it was stupid for Lulu to sue Costco, but I’m not sure they expected mostly positive coverage Costco ended up enjoying. Lulu dupes were always there, but they were never quite considered as good as the real thing. But I have heard the dupes have gotten better and the quality gap between dupes and the real products is shrinking.

These dupes are not just a concern for Lulu; WSJ also ran another piece covering the rise of superfakes in luxury handbag industry. This particular bit stood out from the piece:

Luxury resale website Fashionphile has a counterfeit Louis Vuitton handbag on display alongside a real one at its New York flagship store—an “authenticity challenge” to see if shoppers can spot the real from the fake. The company’s founder Sarah Davis says people who work as sales assistants for top luxury brands haven’t been able to tell the bags apart.”

In addition to "Daily Dose" like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 60 Deep Dives here. I would greatly appreciate if you share MBI content with anyone who might find it useful!

Meta might be heading towards potentially a high-stakes standoff against EU regulators. From Reuters:

Meta platforms is very unlikely to offer more changes to its pay-or-consent model, meaning it is almost certain to be hit by fresh EU antitrust charges and hefty daily fines, people with direct knowledge of the matter said on Friday.

The Facebook owner was hit with a 200-million-euro ($234 million) fine in April after the EU antitrust enforcer said its pay-or-consent model breached the DMA from when it was introduced in November 2023 to November 2024.

Meta had tweaked the model in November 2024 to use less personal data for targeted advertising, which prompted additional EU scrutiny and the subsequent Commission comments in June.

That in turn will likely result in fresh EU antitrust charges in the coming weeks and daily fines following shortly, of as much as 5% of Meta's average daily worldwide turnover starting from June 27, one of the sources said, although a final decision has yet to be made.

This has been an ongoing saga for a while. The Substack “How EU Law Influences Tech” has a pretty good background reading on this whole saga. Meta already implemented some revisions and currently offer three choices to EU users. From the substack:

“Since November 2024, Meta has implemented a significantly revised model:

- Reduced subscription prices by 40% (€5.99/month on web, €7.99 on mobile).

- Introduced a third option: "less personalized ads" with non-skippable ad breaks.

- Created a two-step choice flow where users first choose between paid and free, then can opt for less personalization.”

It is par for the course that EU regulators take absurd approach in regulating US big tech. But this probably takes the cake: “Their core thesis is striking: if Meta chooses to offer its primary service for free, any equivalent alternative must also be free of monetary charge to have equivalent access conditions.”

I think it makes a lot of strategic sense for Meta to play hardball here. If they continue to give in, I don’t think EU will ever run out of increasingly outlandish demands. This doesn’t only affect Meta; it affects all the other gatekeepers too (Google, TikTok et al). Moreover, giving into EU’s demands consistently also can invite equally outlandish demands from governments of other countries (see Canada for example).

If EU really dares to fine Meta 5-10% of their global revenue for non-compliance, that will almost certainly attract attention from the current US administration. I doubt EU will do it; even if they do, Meta can legitimately threaten to leave the region as complying with such anti-business regulations may be counterproductive and create terrible precedents for the long-term health of the business. It is important to note that EU only drives ~10% of Meta’s revenue today, so EU doesn’t quite have as much negotiating leverage than one may perceive.

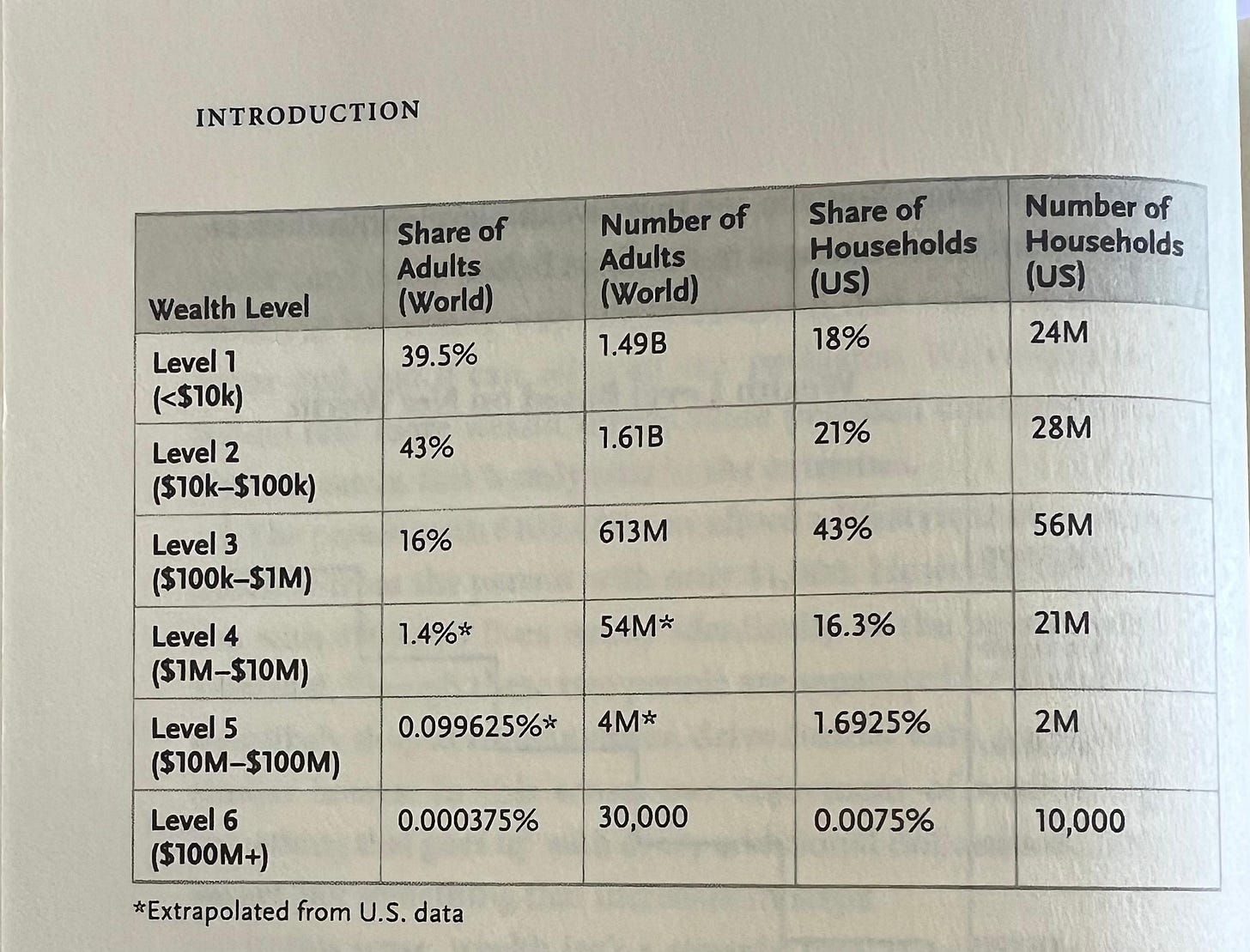

I mentioned about the book “The Wealth Ladder” yesterday. The book had this table segmenting wealth in six levels.

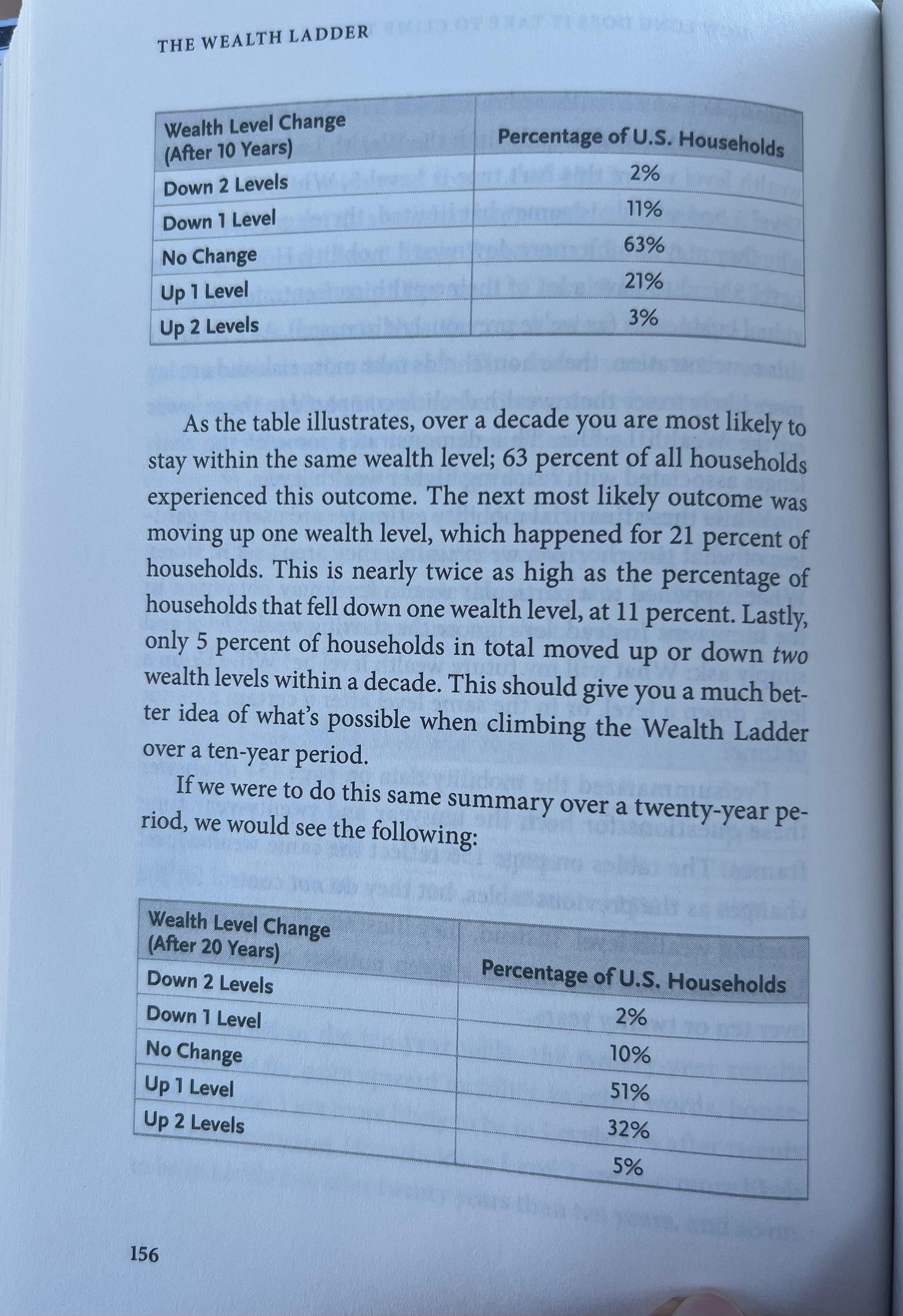

Later in the book, I came across this interesting data. It turns out you are more likely than not to stay at your wealth level even after 10 or 20 years. Social mobility is more sluggish than I thought at all levels. If you have moved two levels up the ladder over 10 or 20 years, it is quite an anomaly and not as common experience than you may think.

Current Portfolio:

Please note that these are NOT my recommendation to buy/sell these securities, but just disclosure from my end so that you can assess potential biases that I may have because of my own personal portfolio holdings. Always consider my write-up my personal investing journal and never forget my objectives, risk tolerance, and constraints may have no resemblance to yours.