TSMC: The Most Mission-Critical Company on Earth

You can listen to this Deep Dive here

On my Semiconductor Primer, I mentioned the following quote from the book “Chip War” to substantiate the pervasiveness of chips in modern world:

“Last year, the chip industry produced more transistors than the combined quantity of all goods produced by all other companies, in all other industries, in all human history.”

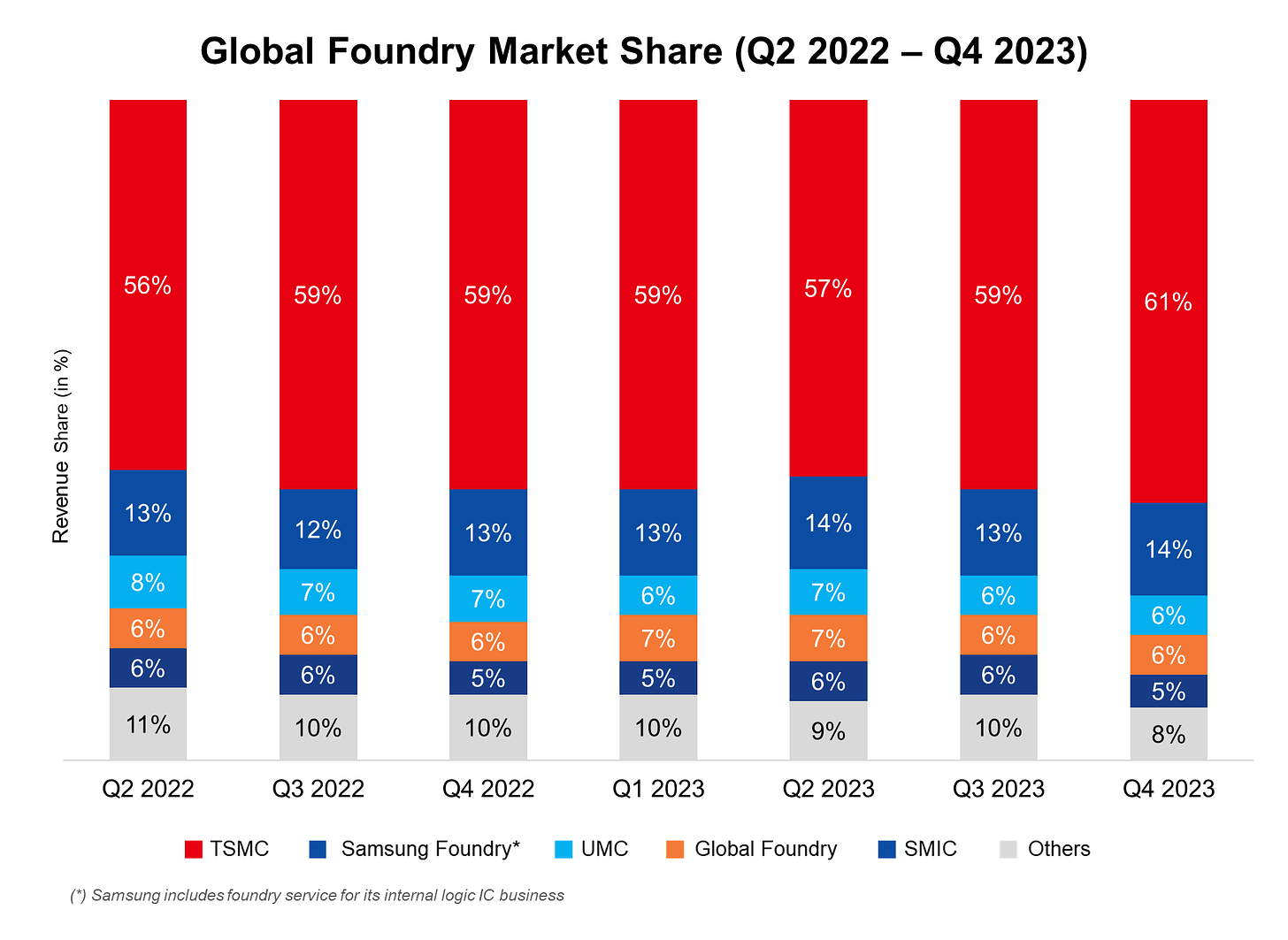

As you can imagine, chips are pervasive in our modern civilization. From washing machines to smartphones and fighter jets, chips are indeed indispensable. While in the early years of semiconductor industry almost every company used to own Fabs i.e. semiconductor manufacturing facilities, chip manufacturing has gradually been outsourced to Foundries i.e. pure-play semiconductor manufacturing facilities that produce chips for other companies (fabless firms). Today, foundries manufacture supermajority of the chips produced in the world, and Taiwan Semiconductor Manufacturing Company (TSMC) alone has ~60% market share in the global foundry market.

Perhaps more astonishingly, TSMC has a de-facto monopoly with ~90% market share in the leading edge nodes (manufacturing processes with the smallest transistor sizes and highest densities). Leading edge nodes are crucial for applications requiring the highest computing performance like supercomputers, advanced servers, high-end PCs/laptops, smartphones, AI/machine learning, and military/defense systems. As a result, the very basic tenet of modern life is essentially standing on the shoulders of one company based in Taiwan.

But how did a company in Taiwan end up being so mission-critical for nearly all leading technology companies today?

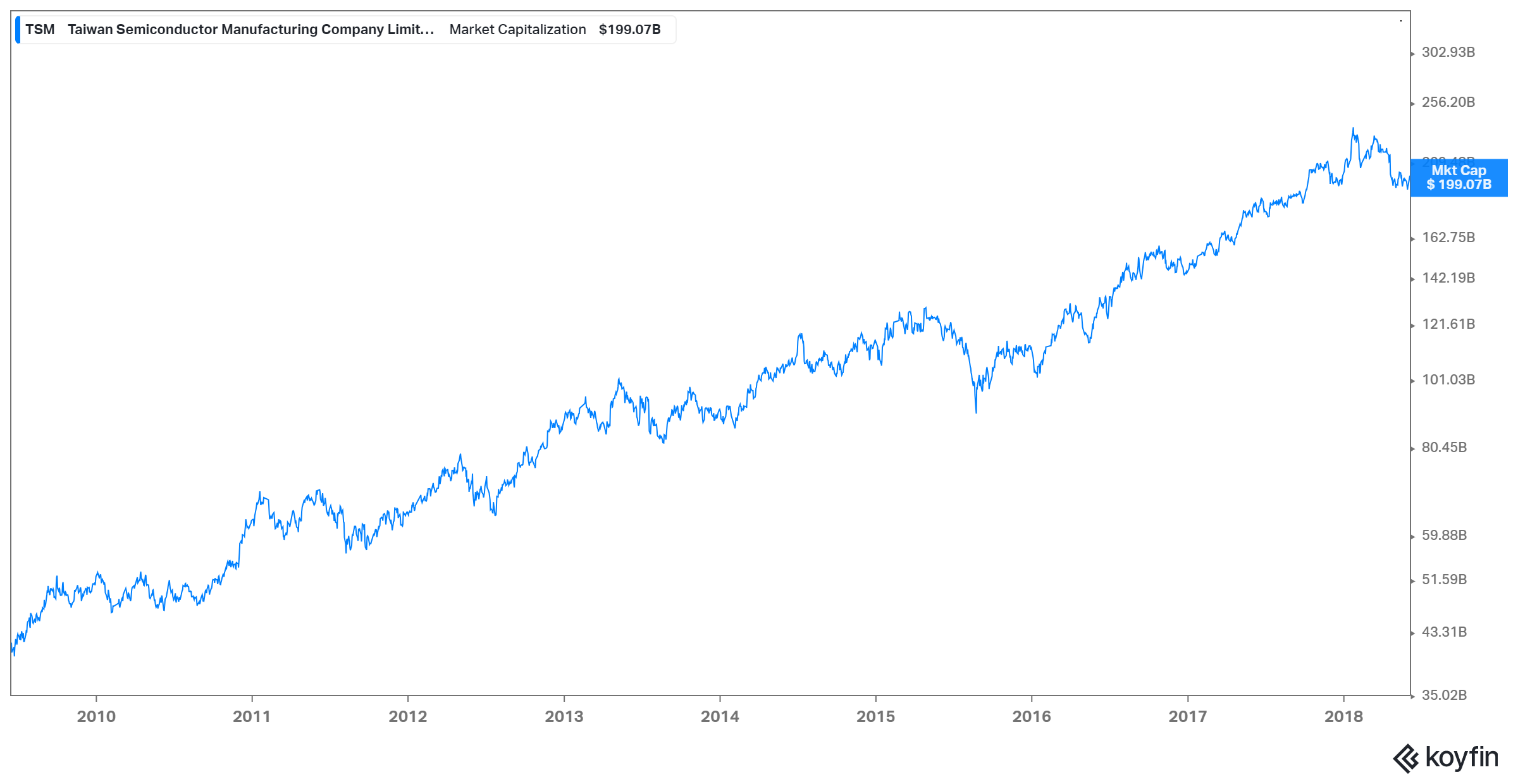

If Apple is Steve Jobs with ten thousand lives, Morris Chang almost feels like a similar figure for TSMC. Chang is perhaps the epitome of late bloomers as he founded TSMC at the ripe age of 55 and led the company for almost two decades before retiring at age 74. His retirement proved to be short lived as he came back again to lead TSMC in 2009. At the time of his return, TSMC was ~$40 Bn market cap company. By the time he finally retired from the board at age 87 in June 2018, TSMC became a ~$200 Bn company. Today, TSMC is valued ~$650 Bn.

Imagine starting a company at age 55 in a geopolitically fragile country with an unproven business model and then building it to be the most mission-critical company on earth! I am not erudite enough to capture my astonishment and admiration in words for Morris Chang, but it’s important to understand his story and TSMC’s early days to better appreciate what TSMC is today.

Chang was born in China. At age six, Chang, along with his mother, left for Hong Kong as the Second Sino-Japanese War (often regarded as the beginning of World War II in Asia) started. Then on December 7, 1941, the same day the attack on Pearl Harbor happened, Japan launched a coordinated offensive across the Pacific targeting several territories of the United States and British empires. One of the key targets was the British colony of Hong Kong. Chang quickly returned to Shanghai. That also proved to be a short stay as Chinese Communist Revolution started a few years later, and Chang once again came back to Hong Kong. By the time he was 18, he basically had to endure three major wars; given how his life transpired made me wonder whether Chang went through “Post-traumatic Growth” which is, as Taleb points out, much more common than PTSD.

Thankfully, Chang got accepted to Harvard and moved to the US at age 18. However, in his sophomore year, he transferred to MIT to study Mechanical Engineering. After finishing his undergrad and Masters in the next three years, he decided to pursue PhD at MIT but ended up failing the qualifying exam twice.

As Chang started looking for a job in 1955, he received two offers: one from Ford offering $479/month and the other one from Sylvania Electric Products offering allegedly just $1 more than Ford’s. Chang took the latter, and started working in Sylvania’s new Semiconductor division. Since he studied Mechanical Engineering, he decided to study some text books to get up to speed on electrical engineering. While studying Shockley’s book “Electrons and Holes in Semiconductors”, he started showing up with the text book at the bar and buying drinks for senior colleagues so that they would entertain his questions about the book.

Chang eventually moved on from Sylvania as he recalled one of the Senior managers musing the company’s predicament:

"We (at Sylvania) cannot make what we can sell and we cannot sell what we can make."

Sylvania was eventually merged with General Telephone in 1959. A year ago, Chang already moved to Texas Instruments (TI) in 1958. It was also the same year Integrated Circuit (IC) was invented at TI by Jack Kilby.

At TI, Chang’s initial project was a particularly challenging one. While IBM usually manufactures all of their products, they decided to outsource some of the chips manufacturing to TI as the demand was too high for them to do on their own. Moreover, IBM’s own plant had just ~10% yield i.e. for every 100 chips being manufactured, 90 of them had to be discarded. TI, on the other hand, had almost zero yield when Chang was assigned to the project. In just four months, Chang was able to increase the yield to 20%! Sensing Chang’s potential, TI offered to sponsor his PhD at Stanford; Chang finished his PhD this time within just two and half years.

After finishing his PhD and returning to TI, Chang became General Manager of one of the divisions within Semiconductor segment at TI. Then in just five years, he became Vice President at TI and was rumored to be the leading candidate to be the next CEO of TI.

Although Chang became US citizen in 1962, some allege that Chang might have been passed over for the TI’s CEO role because of his Chinese ethnicity. While that’s a popular theory, it’s far from the only explanation why Chang might have been looked over for the CEO role. After running TI’s semiconductor division for six years, Chang was given responsibility to turn around TI’s struggling consumer products division. Chang wasn’t successful in that role.

Then after nearly three decades of career at TI, Chang moved to General Instrument as their COO. He resigned from this role in just 18 months. Even his first marriage was falling apart. As Chang was grappling with both personal and professional challenges, K.T. Li, who became subsequently regarded as “Father of Taiwan's Economic Miracle”, invited Chang to come to Taiwan to lead Industrial Technology Research Institute (ITRI) which was supposed to be Bell Labs type research organization. Chang considered it to be essentially his retirement job.

That all changed when K.T. Li gave him a new assignment. Li asked Chang to start a new semiconductor company in Taiwan and make it a global leader. Taiwan, despite being underdeveloped country back then, wasn’t quite stranger to semiconductor industry. But the role their companies played was quite low value-add as indicated by their ~4-5% gross margin. As Chang mused to come up with a business plan, he realized the only viable path for his new company may be pure-play foundry! Here’s Chang’s thought process in his own words:

…one thread of thought as I paused and thought about the task that Mr. K.T. Li gave to me…he wanted me to present a business plan, he wanted me to start a semiconductor company.

And another thread was what I had already observed, closely observed, for three decades. I had been in the semiconductor business for three decades before I came to Taiwan. And I learned at close quarters how competitive the industry was, and how good some of the players were—companies like Intel, Texas Instruments. Even then the Japanese companies were very fierce also. I knew how competitive it was, and how difficult it would be to carve out a niche for a new Taiwan company. So that was the second thread of thought. The third thread of thought was I paused to try to examine what we have got in Taiwan. And my conclusion was that [we had] very little. What strengths have we got? The conclusion was very little. We had no strength in research and development, or very little anyway. We had no strength in circuit design, IC product design. We had little strength in sales and marketing, and we had almost no strength in intellectual property. The only possible strength that Taiwan had, and even that was a potential one, not an obvious one, was semiconductor manufacturing, wafer manufacturing. And so what kind of company would you create to fit that strength and avoid all the other weaknesses? The answer was pure-play foundry.

While Chang came to this conclusion, it was far from easy to execute on this conclusion. The conventional “wisdom” back then was “Real Men Have Fabs” i.e. any serious semiconductor company should manufacture their own chips instead of outsourcing it. But thanks to Moore’s law, demand for chips kept growing and the Integrated Device Manufacturers (IDMs), i.e. companies who both design and manufacture, were willing to outsource some of their manufacturing demand to pure-play foundries. Given it was mostly “leftover” demand, this business was far from stable.

Despite all the uncertainty around the business model, the Government of Taiwan decided to fund half of the $220 mn funding Chang decided to raise for his new company. ~28% of the fund came from a Dutch company named Philips, the same company that started ASML (a joint venture between ASM and Philips). The rest ~22% was raised from various business leaders in Taiwan who were essentially told by the government to invest in this new company. Taiwan Semiconductor Manufacturing Company (TSMC) was founded in 1987. While Morris Chang was going to lead TSMC, he initially didn’t have any equity.

In the initial years, TSMC was mostly just manufacturing the “leftover” orders from the IDMs, but it was the rise of fabless companies that truly turbocharged TSMC’s growth. Today’s behemoths such as Nvidia, Qualcomm, and Broadcom were all started right after TSMC was founded and given none of them had fabs to manufacture their own designed chips, they were looking to outsource their manufacturing to someone else. As the Fabless companies grew from just a handful to hundreds or even thousands of them over time, so did TSMC’s revenue. TSMC became publicly listed in Taiwan in 1994 at $4 Bn valuation. It later became listed in the US in 1997.

With the rise of Fabless companies, TSMC started to enjoy bit of a flywheel effect! As TSMC gets better and better in manufacturing chips with more and more advanced process nodes, their customers can address and capture higher market share which creates even more demand for TSMC’s chip manufacturing prowess. Even though TSMC started with significant technological disadvantage, it didn’t take them too long to get up to speed of their peers and then gradually surpass everyone else over the years!

With ~$8 Bn revenue and $2.8 Bn operating Profit, TSMC appeared to be at pretty solid ground in 2005. Chang was 74 years old then and decided to retire by handing over the leadership position to Rick Tsai. However, this retirement proved to be only a temporary one as he decided to return to the helm of TSMC at age 78 during the summer of 2009.

Even though the economy was still reeling through the ramifications of GFC, the late 2000s also introduced iPhone and smartphones to the world. When competitors were hesitant to make big investments in such macro backdrop, Chang decided to aggressively invest and create a distance from their competitors. While TSMC invested only ~$12 Bn cumulative capex during 2005-2009 period, they invested a whopping ~$40 Bn cumulative capex during 2010-14 period following Chang’s return to the company. It was also the time when they started to forge a close rapport with Apple, the largest customer of TSMC today which alone generated ~$18 Bn revenue for the company in 2023 (more on this later).

Chang relinquished TSMC’s CEO role in 2013 but remained Chairman of the board. After three decades with the company since its very beginning, Morris Chang finally left the TSMC board in 2018. It is remarkable to think that Chang had two 30-year careers with two different companies. I am a tad bit surprised that there hasn’t been a movie on his life yet! I have tried to condense as much as I could, but I strongly encourage readers to listen to Acquired podcast on TSMC which was my primary source to understand the founding story of TSMC.

During 2013 to 2018, TSMC was led by two co-CEOs: Mark Liu and C.C. Wei. Following Chang’s departure from the board, Liu became the Chairman and Wei became the sole CEO. Liu is set to retire as well in June 2024 and Wei will then take over both the CEO and chairman role at TSMC.

Here’s the outline for the rest of the Deep Dive:

Section 1 The Economics of TSMC: This section starts with a very brief discussion on the basics, followed by a more granular discussion of TSMC’s revenue, pricing power, partnership with Apple, and operating cost structure of the business.

Section 2 Competitive Dynamics: This section explores first why Taiwan was so successful in chip manufacturing, and the geopolitical implications on the chip manufacturing industry. This then leads to Intel and Samsung’s recent attempts to be competitive against TSMC at advanced chip manufacturing and what this may mean for pricing power of TSMC.

Section 3 Capital Allocation: I showed capital allocation of last couple of decades at TSMC in this section.

Section 4 Model Assumptions and Valuation: Model/implied expectations in the current stock price are analyzed here.

Section 5 Final Words: Concluding remarks on TSMC, disclosure/discussion of my overall portfolio.