Adobe 1Q'23 Update

Disclosure: I am long shares of Adobe

In 2001 and 2002, Adobe's topline went down 3% and 5% respectively. In 2009, revenue went down by 18%!

Thanks to shift to subscription and a continued secular momentum in digital content, Adobe will perhaps prove to be a quite resilient business in the much anticipated slowdown of 2023. Not only they had an impressive Q1, they also raised guidance for 2023.

Here are my highlights from the quarter.

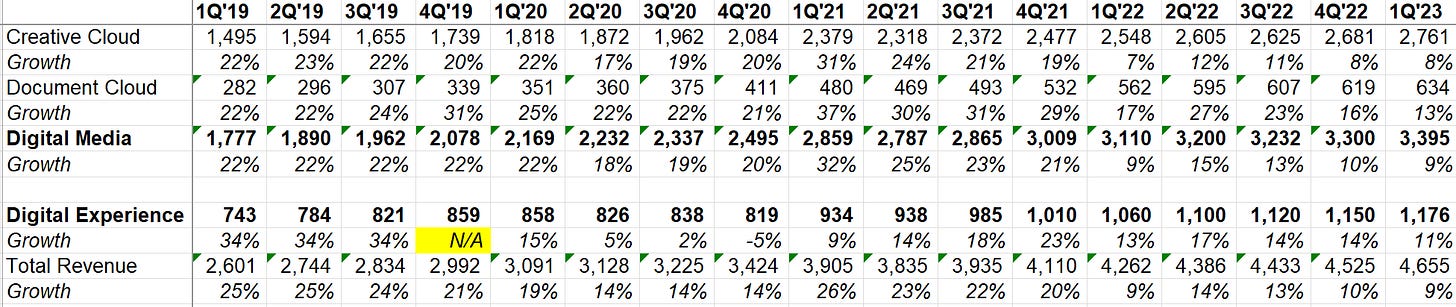

Revenue

Topline grew +9% or +13% FXN. Net New Creative Cloud and Document Cloud ARR were $307 Mn and $103 Mn respectively.

Overall, Digital Media net new ARR was $410 Mn (vs guidance of $375 Mn). 2Q guidance for Digital Media new new ARR is $420 Mn.

RPO exiting the quarter was $15.21 billion, which is +10% YoY or +13% FXN.

Analysts kept asking why Adobe’s business is proving to be very resilient. Here’s what Adobe said:

When I take a step back and I think about what is driving that differential performance in this environment, I think our products are mission-critical to our customers. We are on the critical path of them generating revenue. But as the world goes digital and those investments are prioritized, not only do we help companies drive top line growth, but we help them with the underlying productivity gains that go with that. It is why customers in this environment are prioritizing around things that we sell to enable their success. It addresses top line performance as well as underlying profitability of our customers. So being on the critical path, being mission critical to customers, we think this is the type of environment where the power of Adobe and the performance of the company gets to shine.

What’s driving Adobe’s growth?

In terms of primary growth driver, it is and always has been new user acquisition. It is by far the biggest contributor, and a lot of the PLG work that we've done over the last year or 1.5 years is contributing to not just top of funnel, but also conversion of that top of funnel.

In terms of upsell and migration, we've been investing for a decade or more in education, and we have a very efficient channel now where students that graduate effectively upgrade and migrate into full priced offerings. That drove a very strong Creative Cloud individual all apps quarter for us.

Retention, we've been doing a lot of work in retention through PLG, but we've also been driving a lot of utilization of Adobe Express as part of the Creative Cloud business. All of that combined makes for a very strong retention rate.

New businesses, we talked about Substance and Frame having outsized growth. And of course, the pricing and packaging work that we've been doing and all along continues to contribute to that, both for CC and Acrobat CCDC as a whole. So looking ahead, all of these drivers and these levers are intact, and we have lots of opportunities going forward as well.

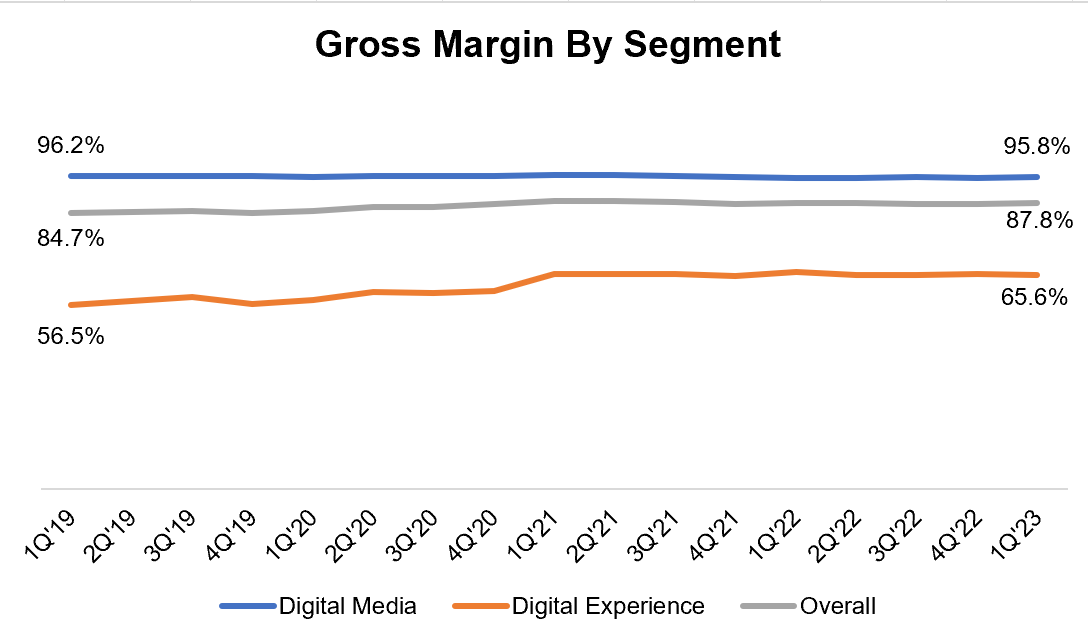

Gross Margin

Digital Media continues to post almost unparalleled gross margin i.e. >95%. Digital Experience’s gross margin seems stuck at mid-60s.

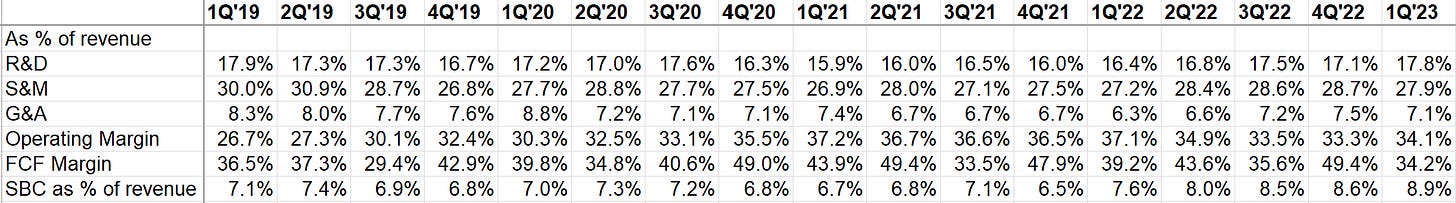

Cost Structure

Thanks to those sky high gross margin and strong market position, Adobe posted ~34% GAAP Operating Margin. SBC as % of revenue remains in the High Single Digit (HSD) level.

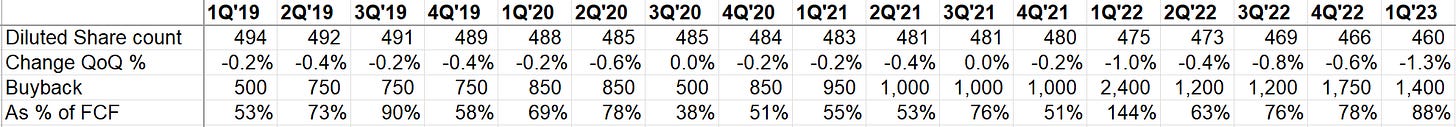

Capital Allocation

Adobe utilized 88% of its FCF in buying back shares, reducing share count by 1.3% QoQ (and -3.2% YoY).

Figma

Speaking of capital allocation, Adobe still sounds optimistic about Figma acquisition closing by 2023:

From the outset, we have been well prepared for all potential scenarios while realistic about the regulatory environment. We have completed the discovery phase of the U.S. DOJ second request and are prepared for next steps, whether that is an approval or a challenge. Adobe remains confident in the facts underlying the case. And based on current process timing, we believe the transaction continues to be on track for a close by the end of 2023.

Figma-Adobe Opportunities

Adobe is certainly paying an eye-popping price for Figma, so they reminded why they think Figma-Adobe integration makes sense for both companies:

we believe that we can just fundamentally accelerate what they're doing today in product design. We have a global footprint. We are working with a lot of our -- with enterprise customers across the globe, and the feedback that we're getting from these enterprise customers is a lot of excitement about the kind of things we can do by bringing these 2 companies together to just accelerate and make them more productive in terms of what they want to accomplish and just accelerate everything that they're doing.

The second thing is around taking workflows between Photoshop and Illustrator and Figma and really just operationalizing them in a way that we can bring real-time collaboration capabilities based on the Figma platform to these -- to the core disciplines like illustration and video editing and photography and 3D design and more.

And the third is really around the evolution with FigJam, bringing that into the core for productivity use cases. So taking FigJam and integrating it more deeply with things like Acrobat and starting to just recognize that creativity is starting to be the foundation of how new productivity applications need to present themselves. And that whole motion of enabling productivity workers to express themselves creatively is where the market is going with the rise of the creator economy. And so we see -- we just see a ton of opportunities to integrate the products.

Generative AI

A big question mark on the terminal value of Adobe is how Generative AI will affect the Creative Cloud business. Adobe makes the case that it is net positive:

Creating an image is just the start. It's not the end. And Adobe is the only player that has a full end-to-end workflow, not just within the products and the tools that we have in the digital media business, but also everything that Anil is doing around the content workflow and the content supply chain out to the point of distribution. And in fact, because of this, we're seeing other gentech companies wanting to partner with us more and more, and so we feel like we're in a really advantaged position where we're going to come out with our own model and we're going to be partnering with others to make sure that because of our distribution and the place we play in the market, we can bring a lot of this value to actual fruition.

…We think that, again, if you can start to imagine yourself as creative by using a text prompt, we can take you through that full journey and onboard you into other Adobe offerings. It's also great for retention. We've always seen the more value that gets used in our core offerings, the better the retention rates and the better the LTV. And we think there's upsell opportunity. We do think these are distinct new packages that we can bring to market and upsell people to.

Guidance

Digital Media net new ARR guidance for full year was increased from $1.65 Bn to $1.7 Bn. GAAP EPS guide was also raised from $10.75-$11.05 to $10.85-$11.15.

For a more in-depth analysis on Adobe’s business, see my Deep Dive on Adobe